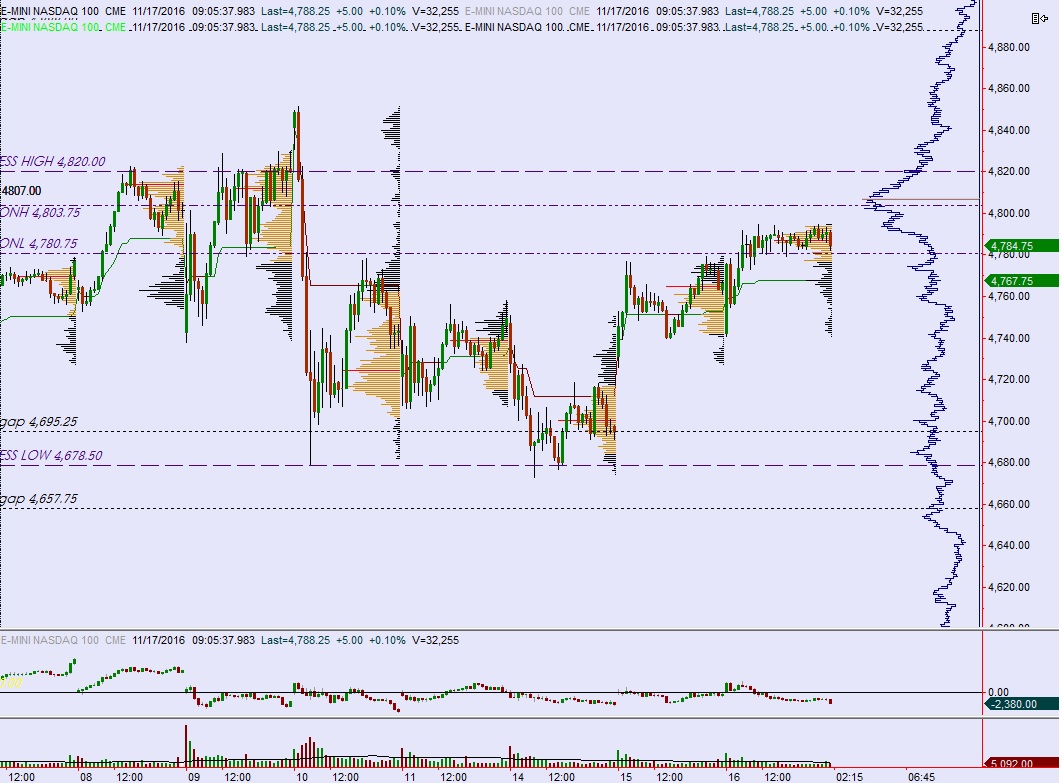

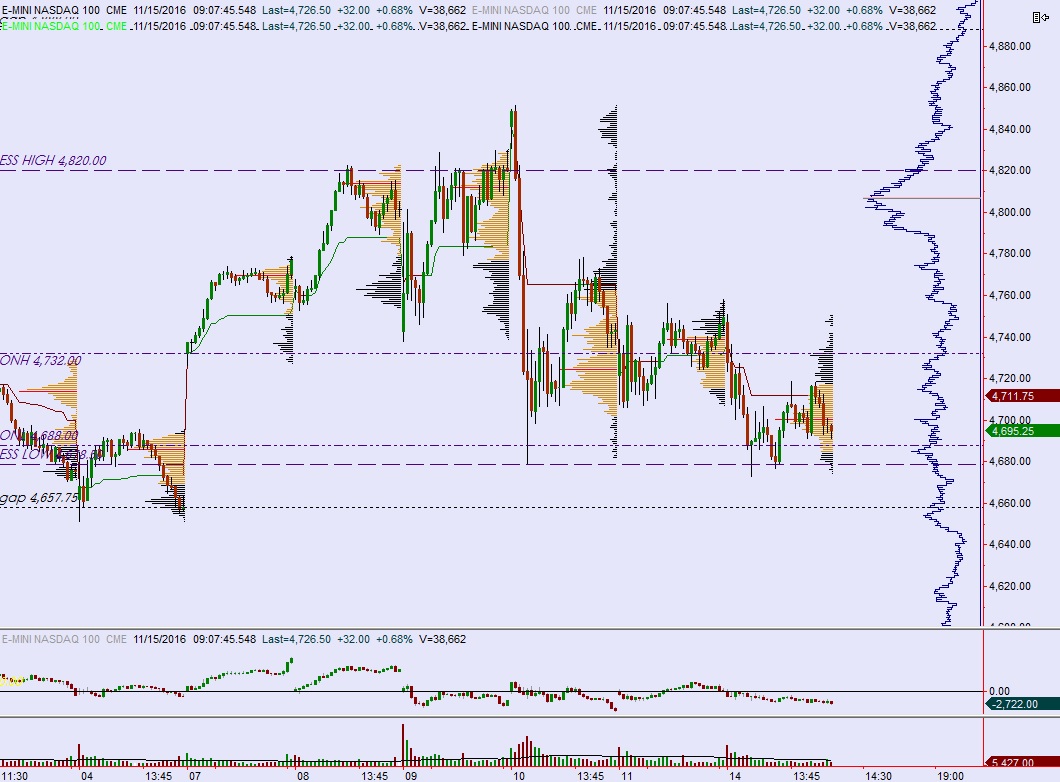

NASDAQ futures are coming into Monday gap up after an overnight session featuring normal range and volume. Price held the Friday range in balanced trade which is giving way to buying as we approach USA cash open.

The economic calendar is light today with only 3- and 6-month T-bill auctions at 11:30am and a 2-year Note auction at 1pm.

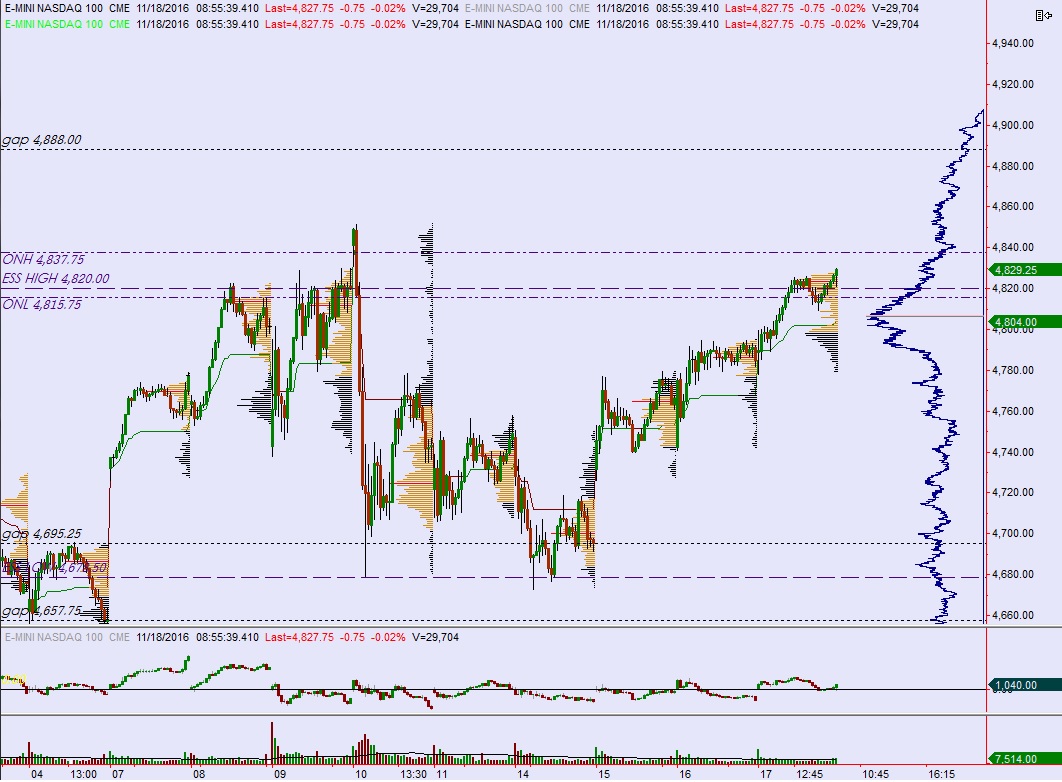

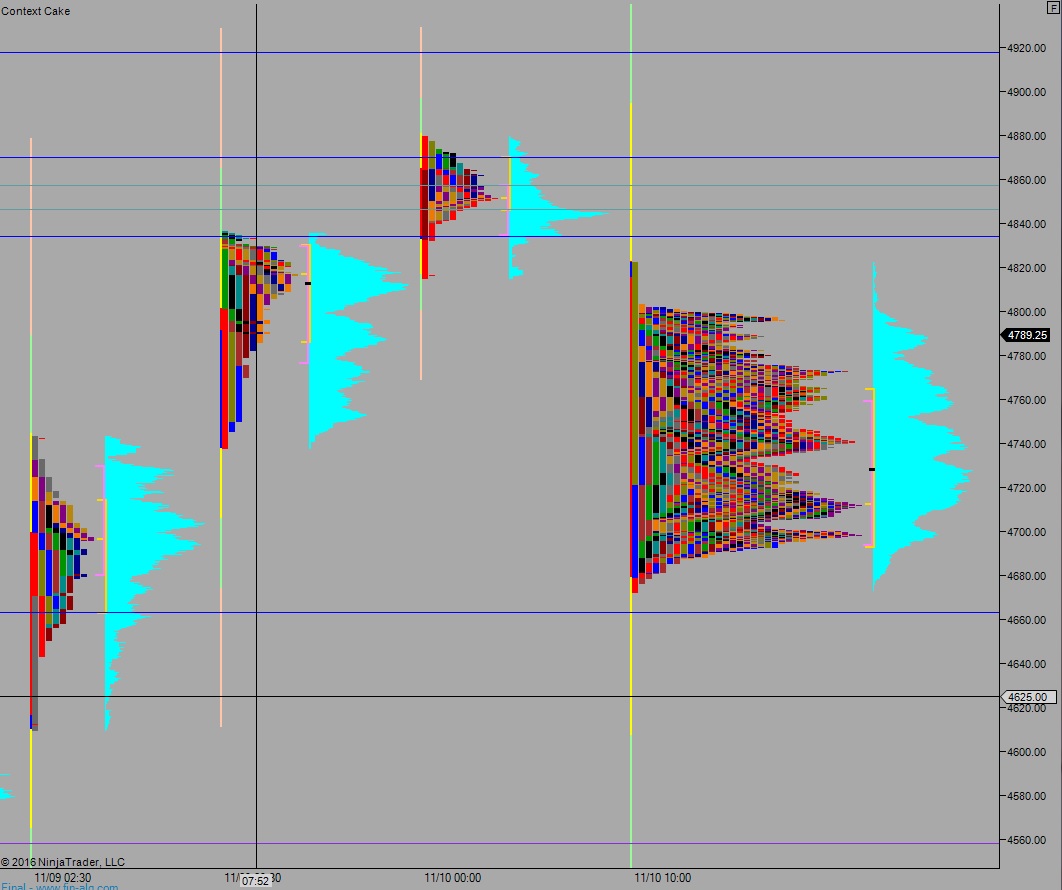

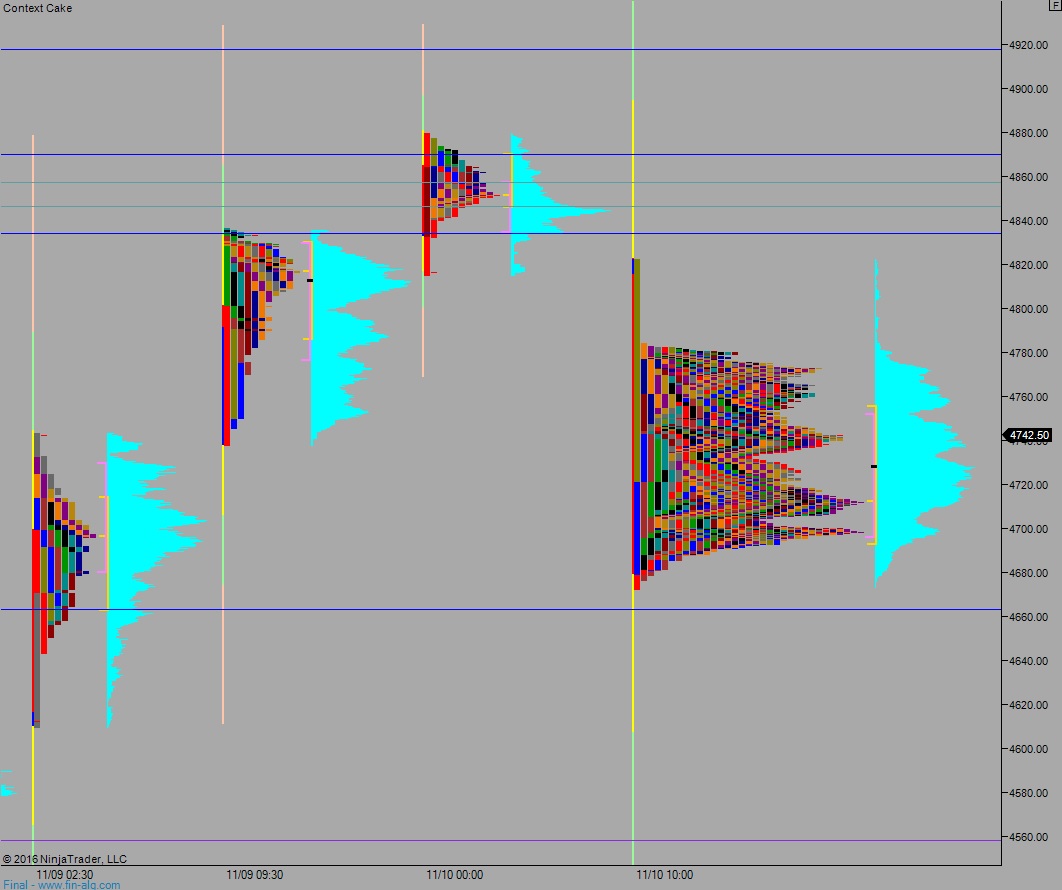

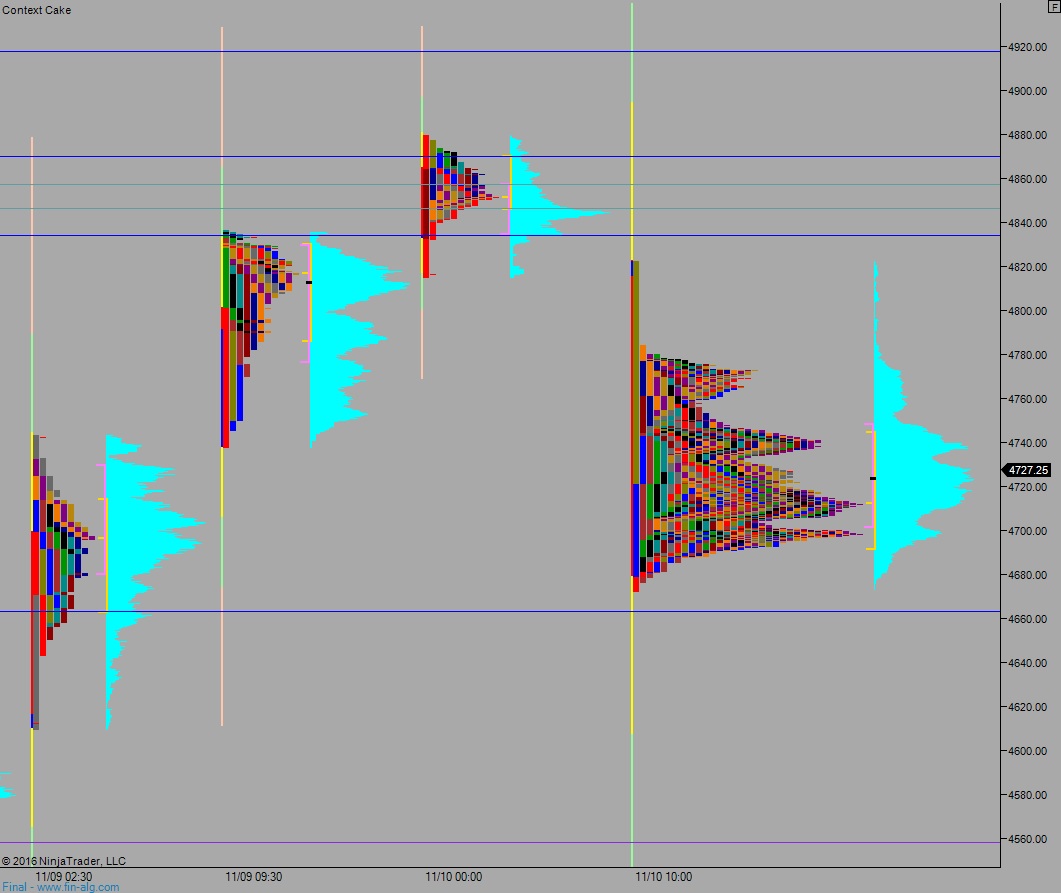

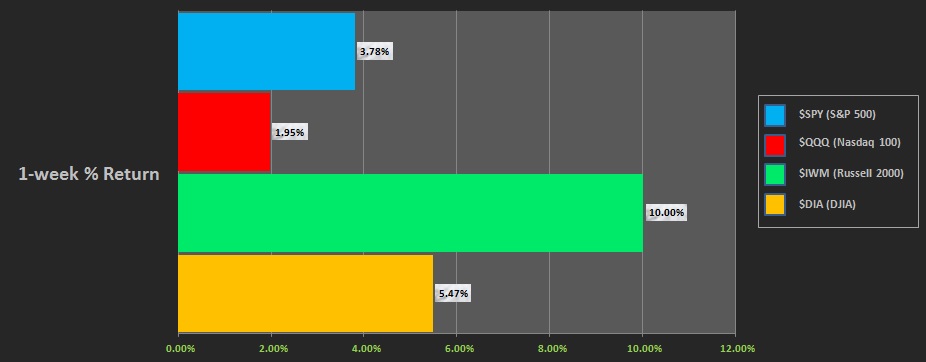

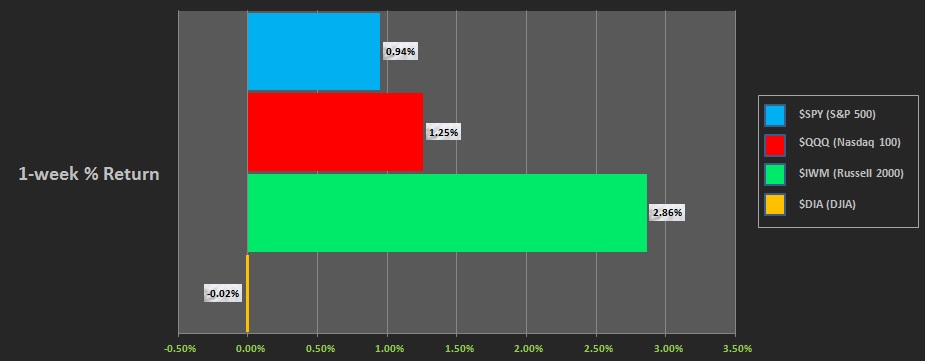

Last week featured a Monday of selling followed by a rally for the remainder of the week. The Dow lagged behind and the Russell lead. Here is the performance of each major USA index last week:

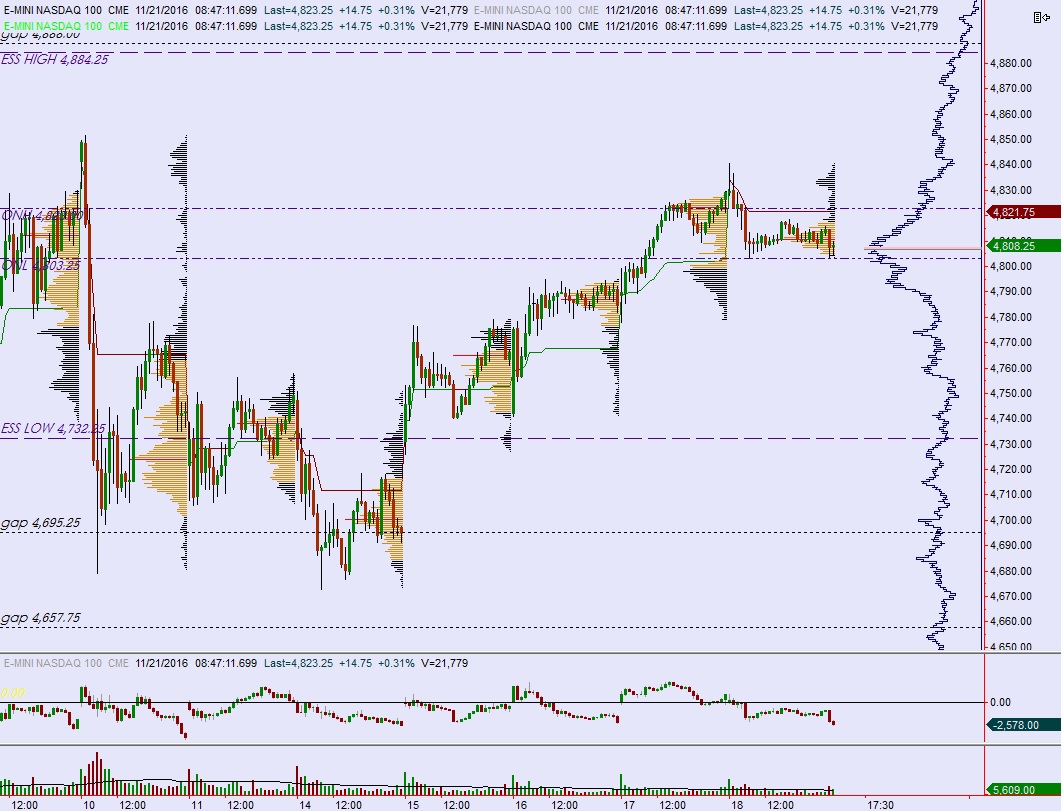

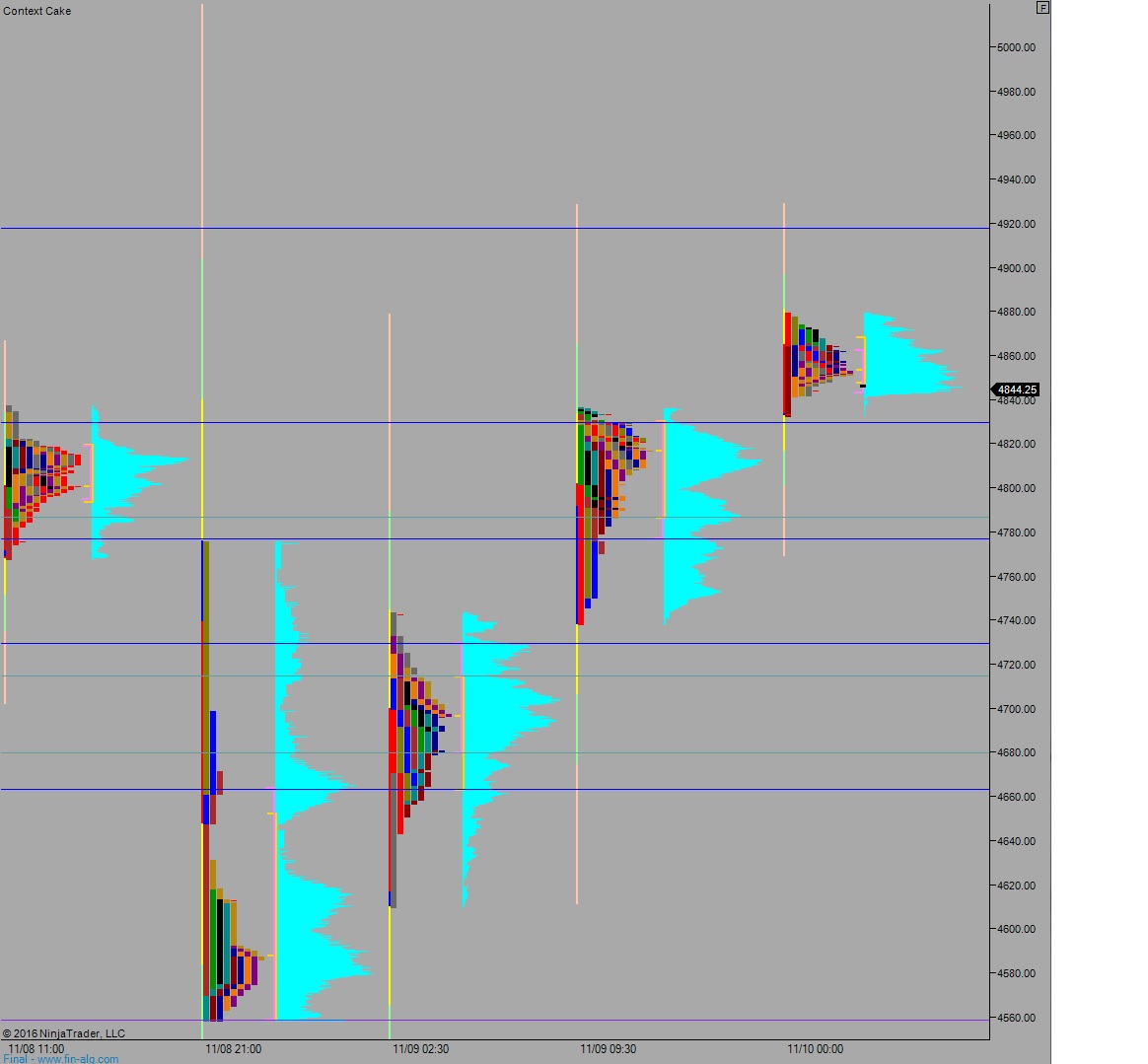

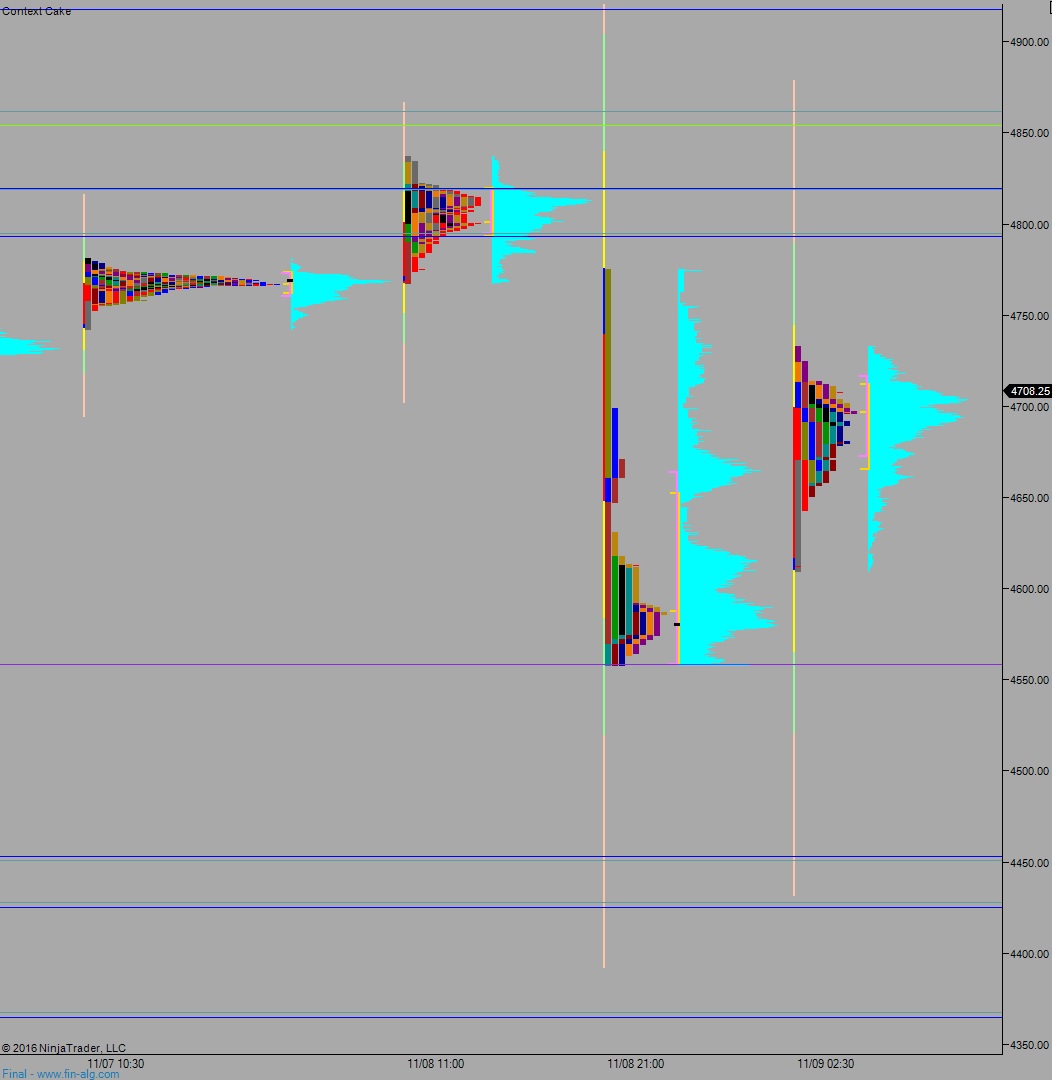

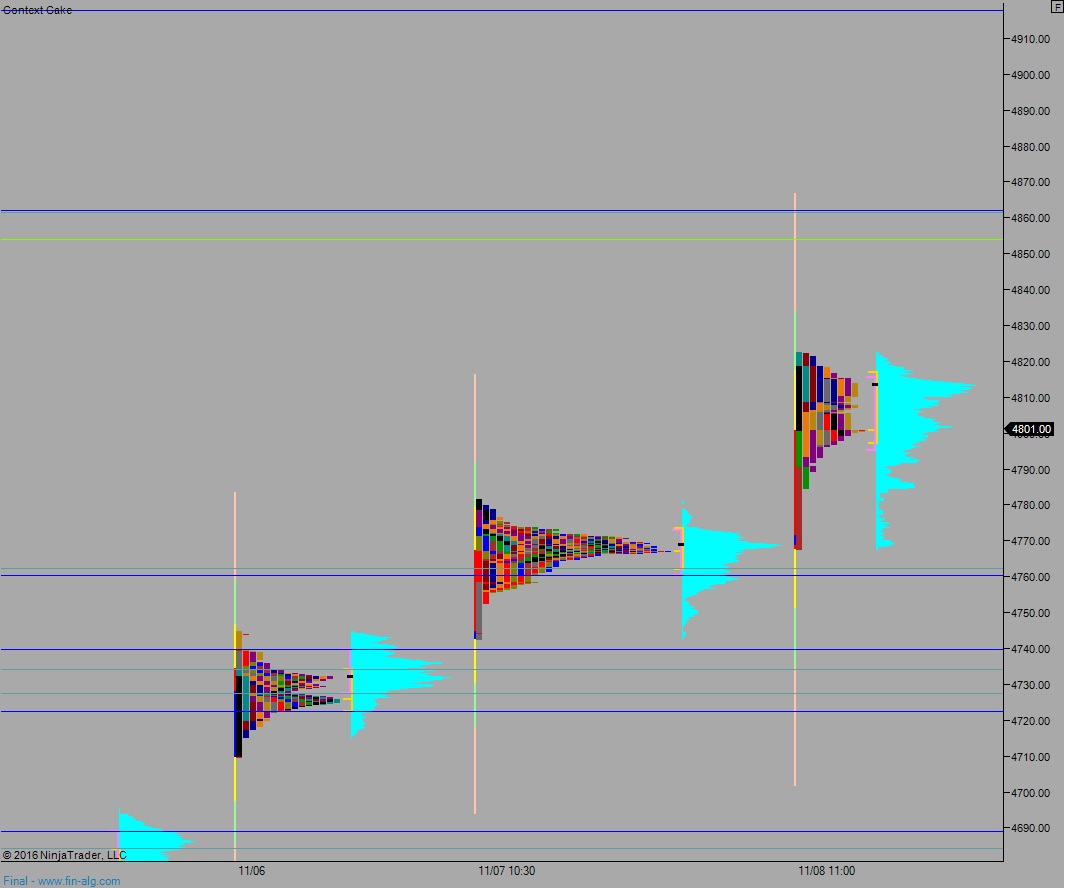

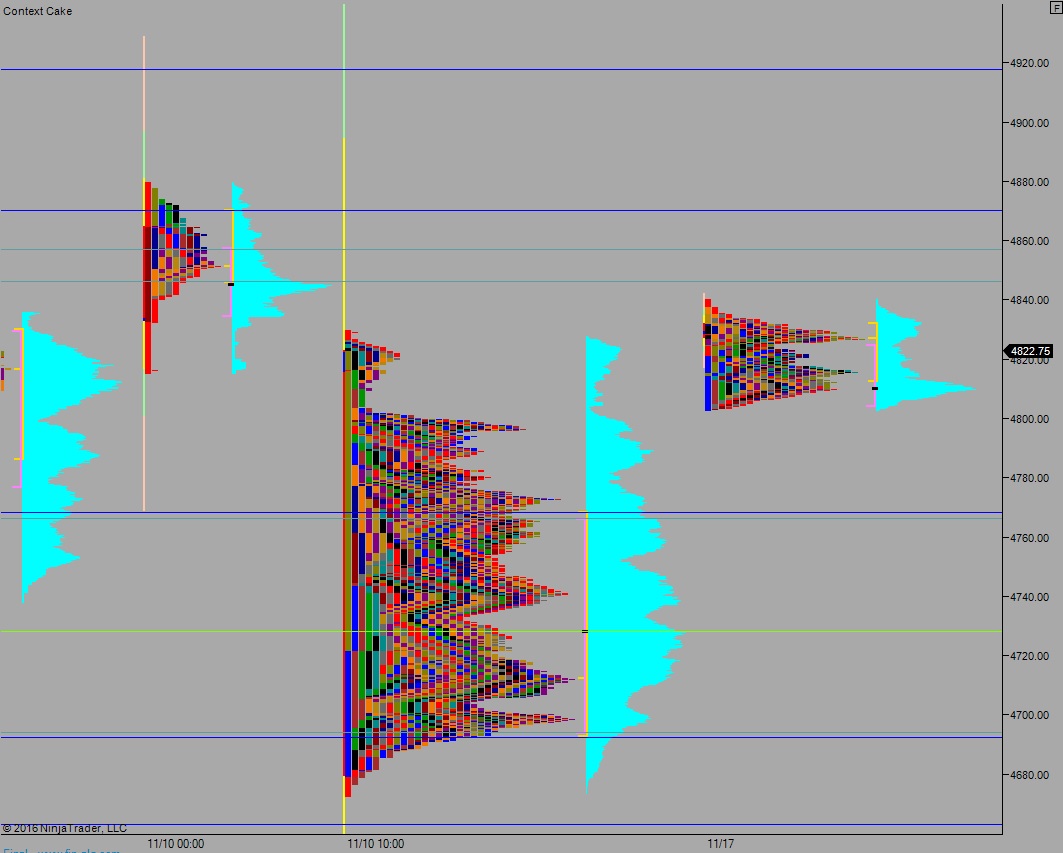

On Friday, an early probe higher discovered responsive sellers on the NASDAQ and once it pushed down to its CVPOC at 4808 it spent the rest of the day in a churn around those prices.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4804.25. A probe below last Friday’s low 4803 reveals responsive buyers and two way trade ensues around the value at 4809.

Hypo 2 buyers gap and go, make a push above Friday high 4840.50 and target 4846.25 before two way trade ensues.

Hypo 3 stronger buyers push up to 4870.25 before two way trade ensues.

Hypo 4 strong sellers fill overnight gap 4808.25, breach overnight/Friday lows 4803 and trigger a liquidation down to 4768 before two way trade ensues.

Levels:

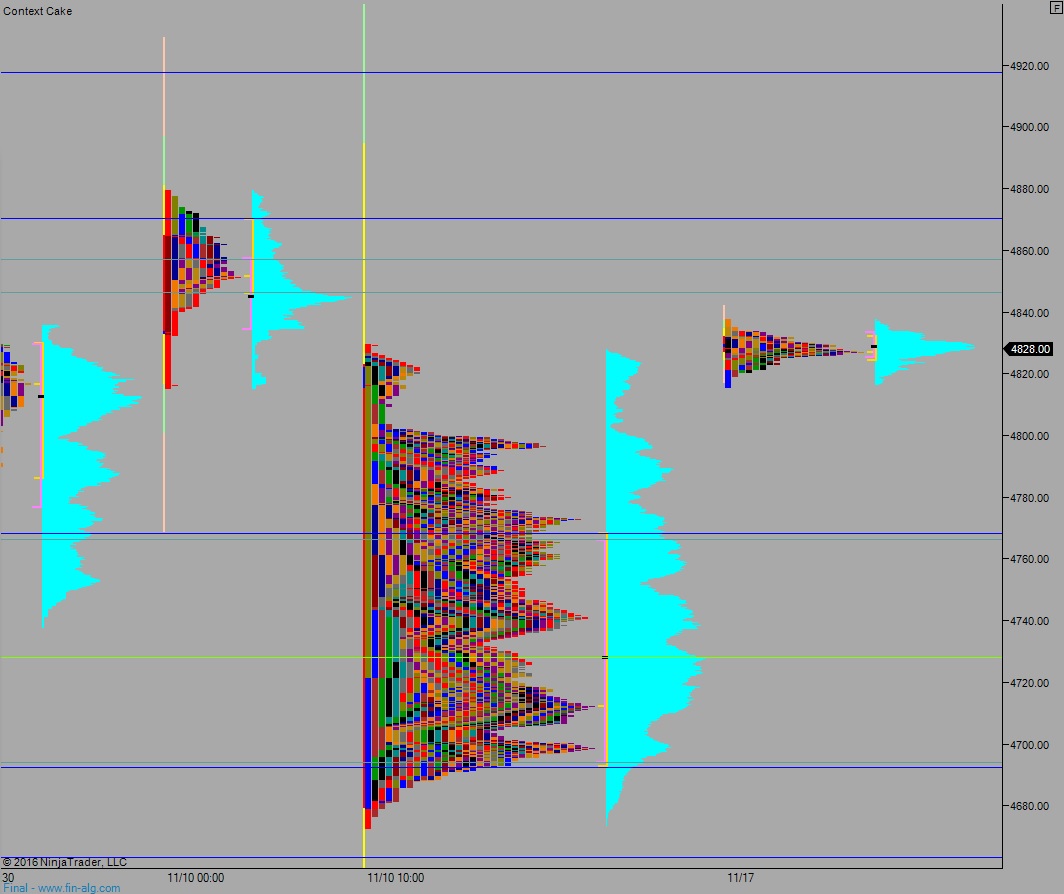

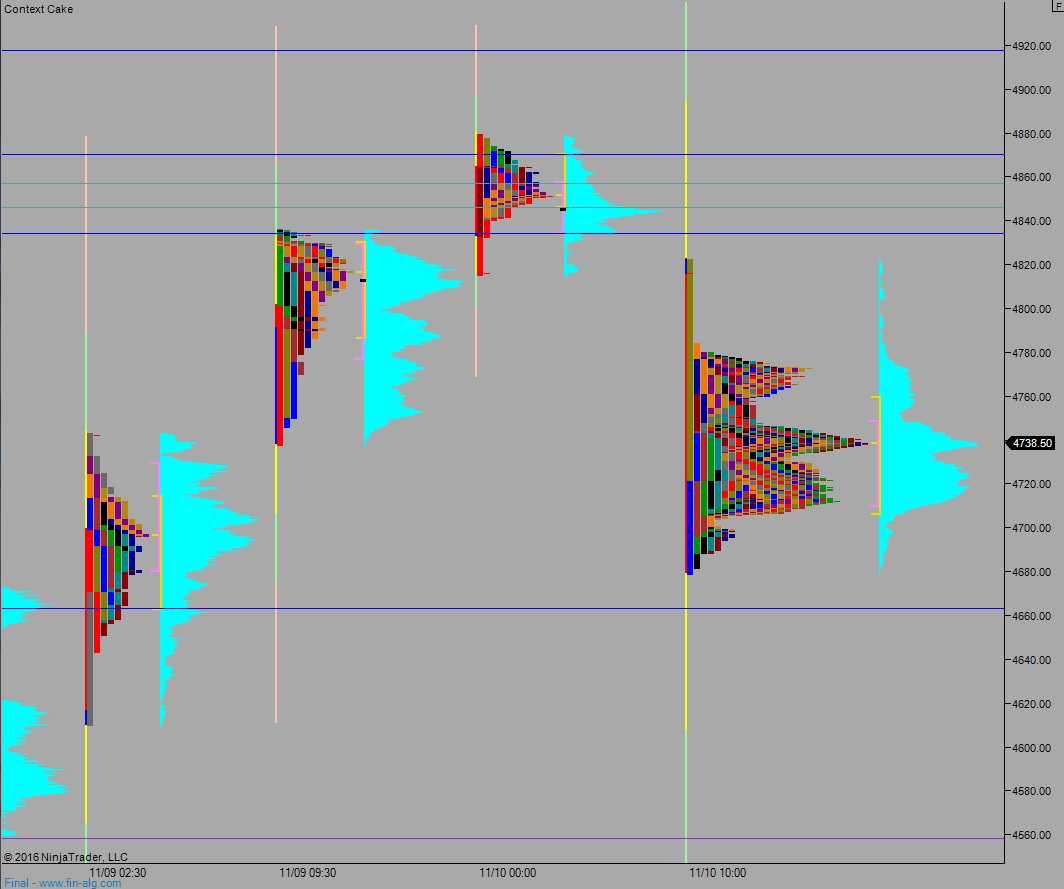

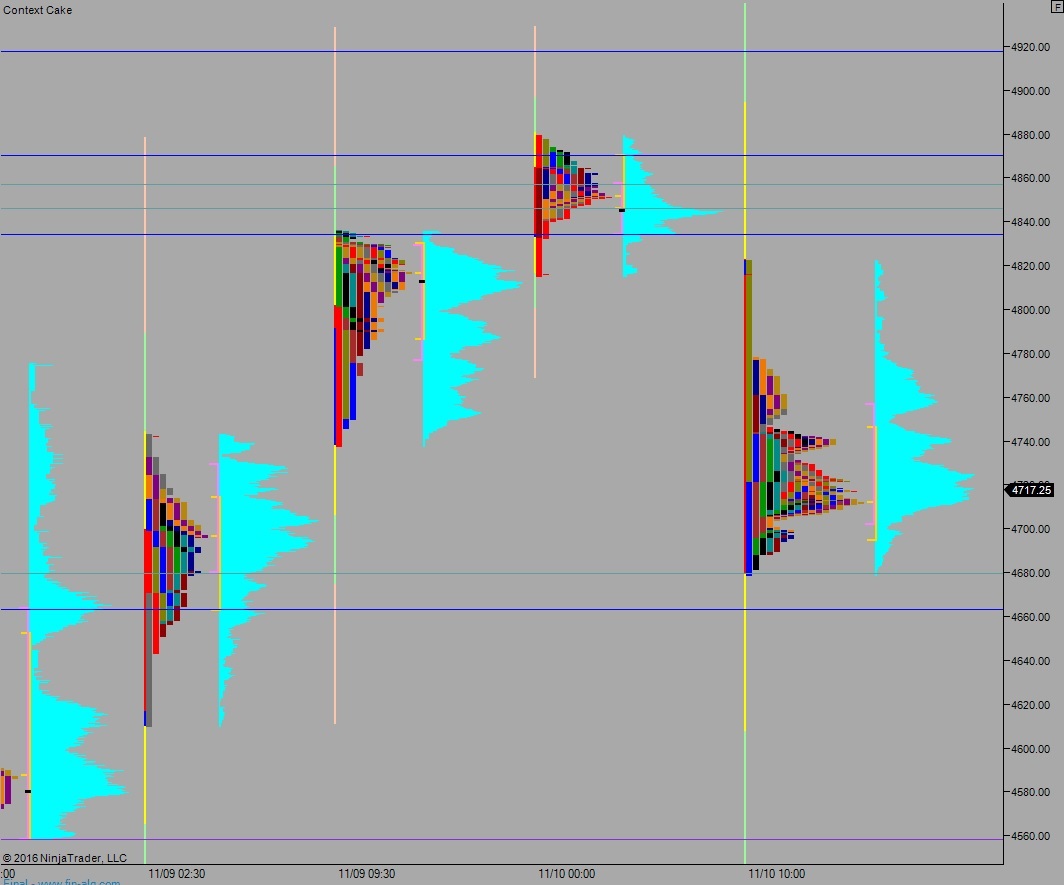

Volume profiles, gaps, and measured moves: