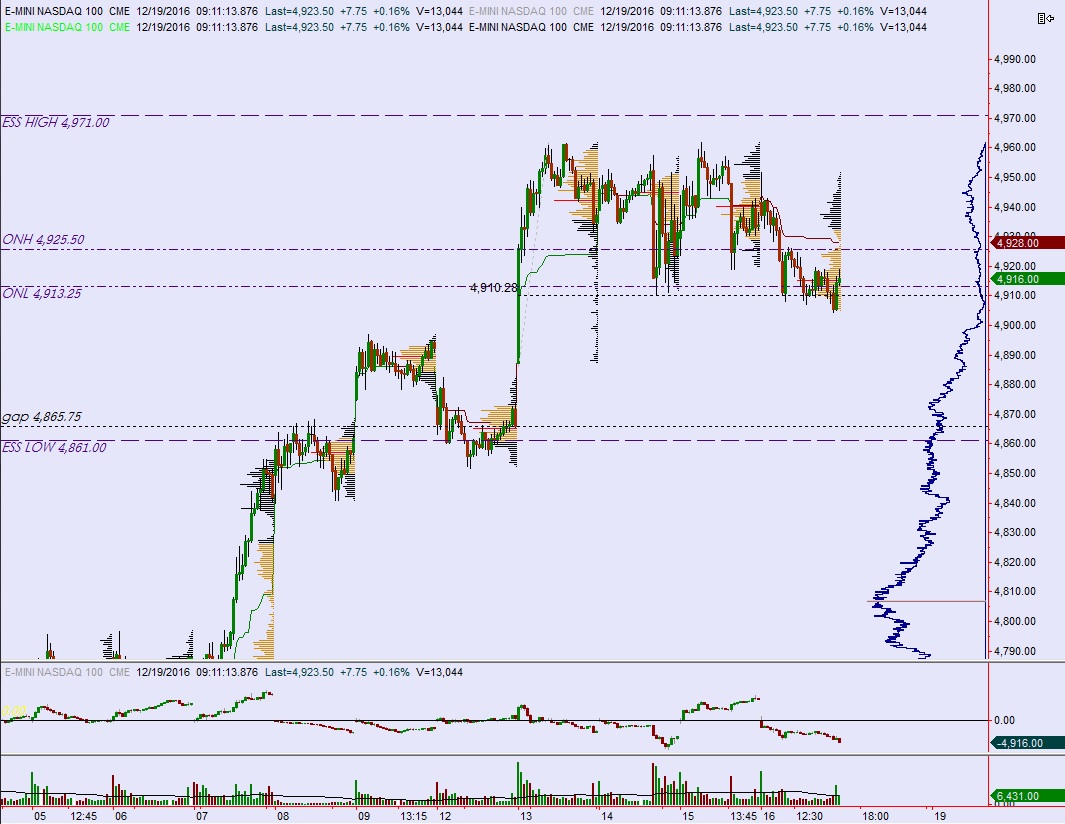

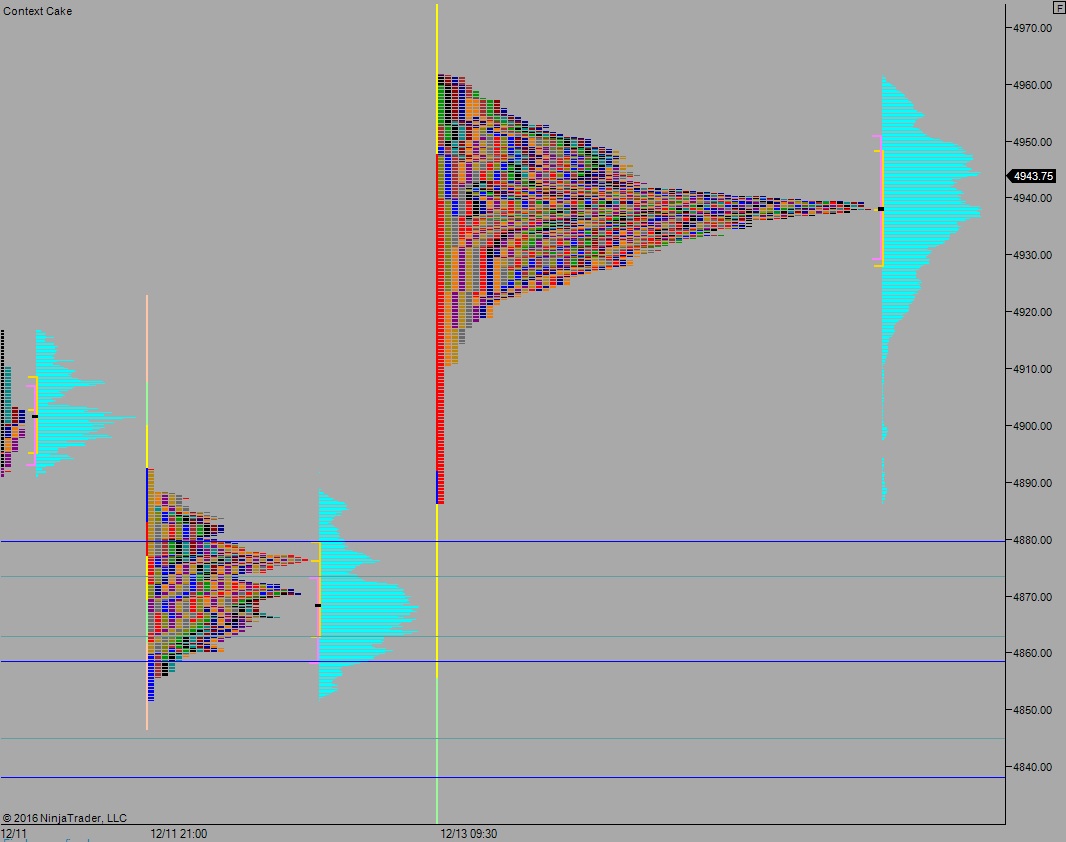

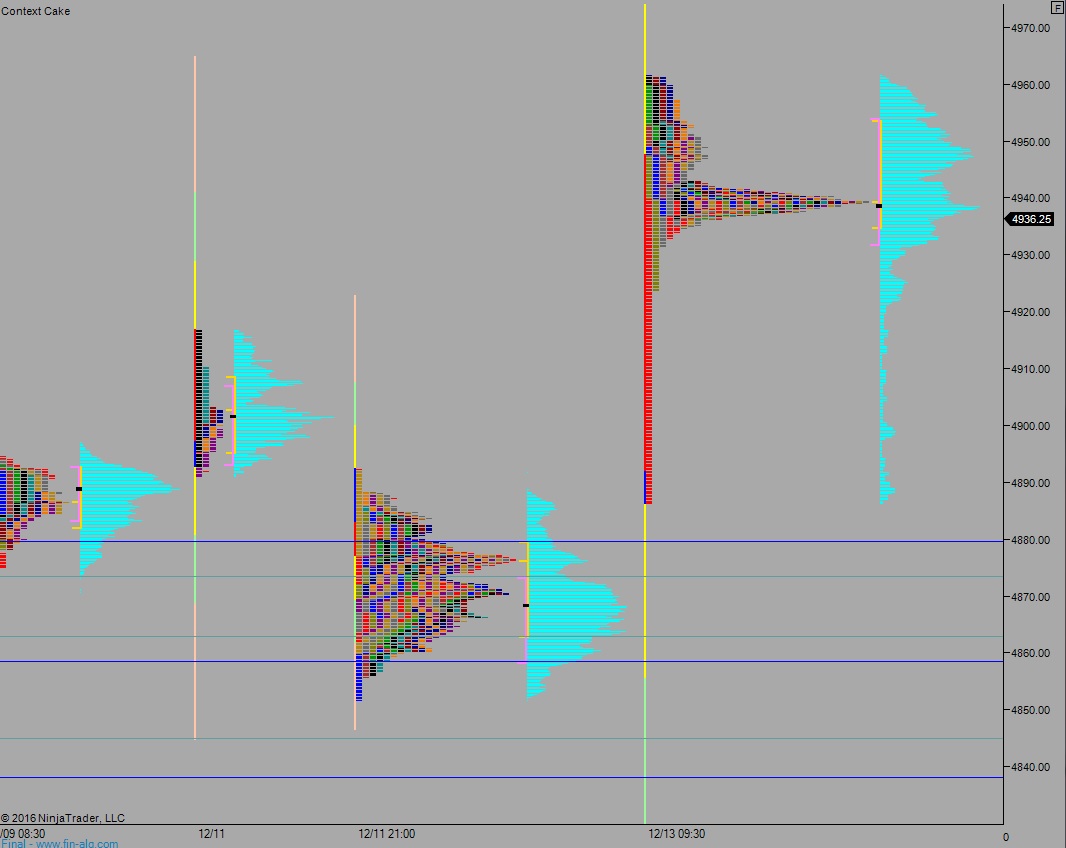

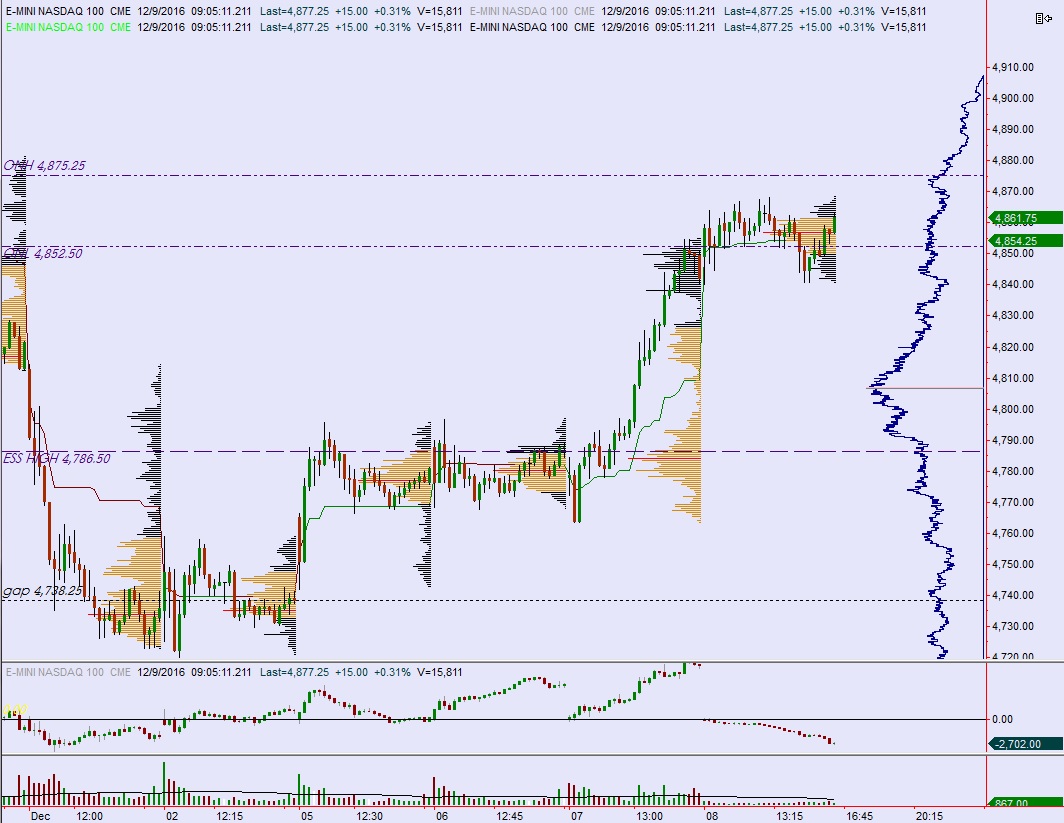

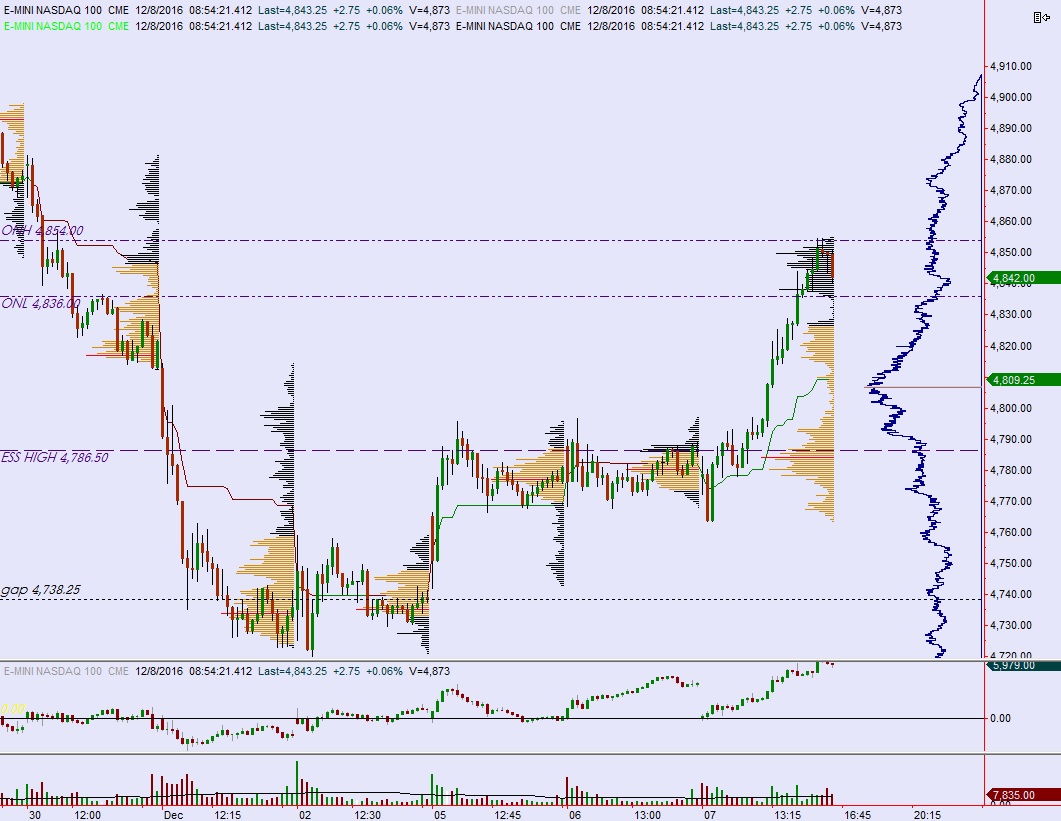

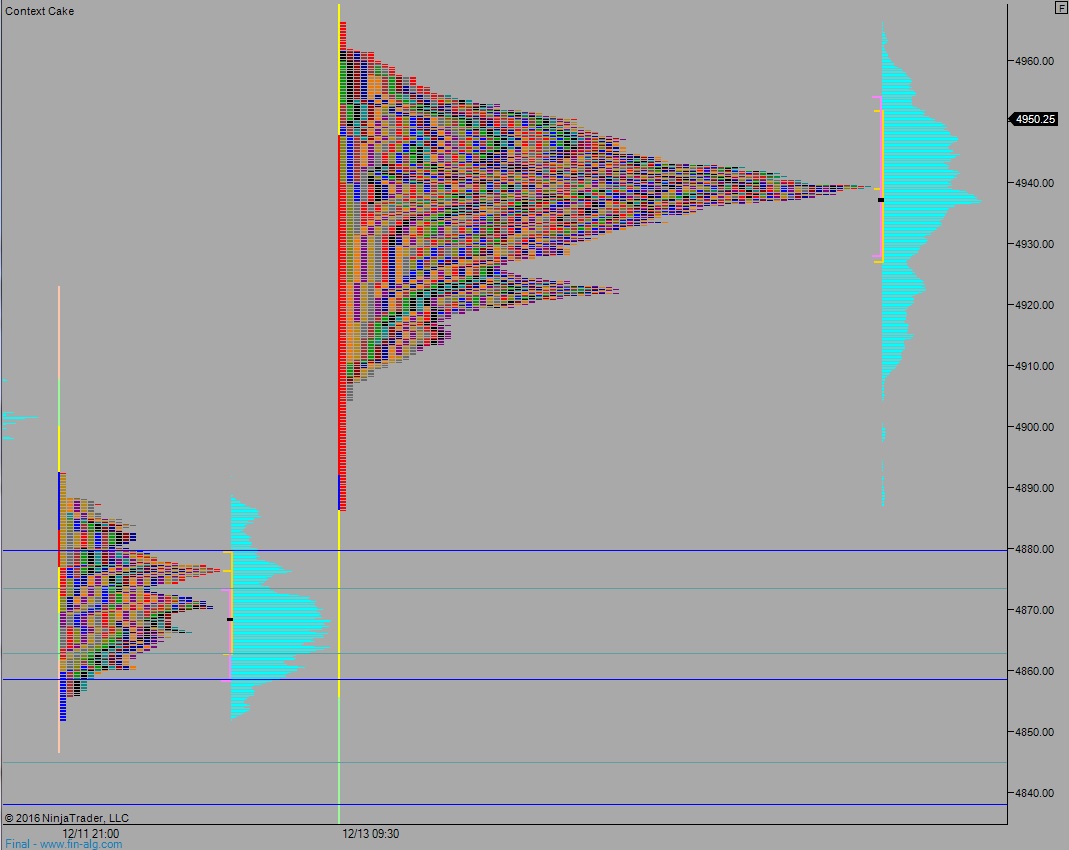

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked up to the value area high overnight and is holding high value as we head into cash open.

The economic calendar is light today—only a 4-week T-bill auction at 11:30am.

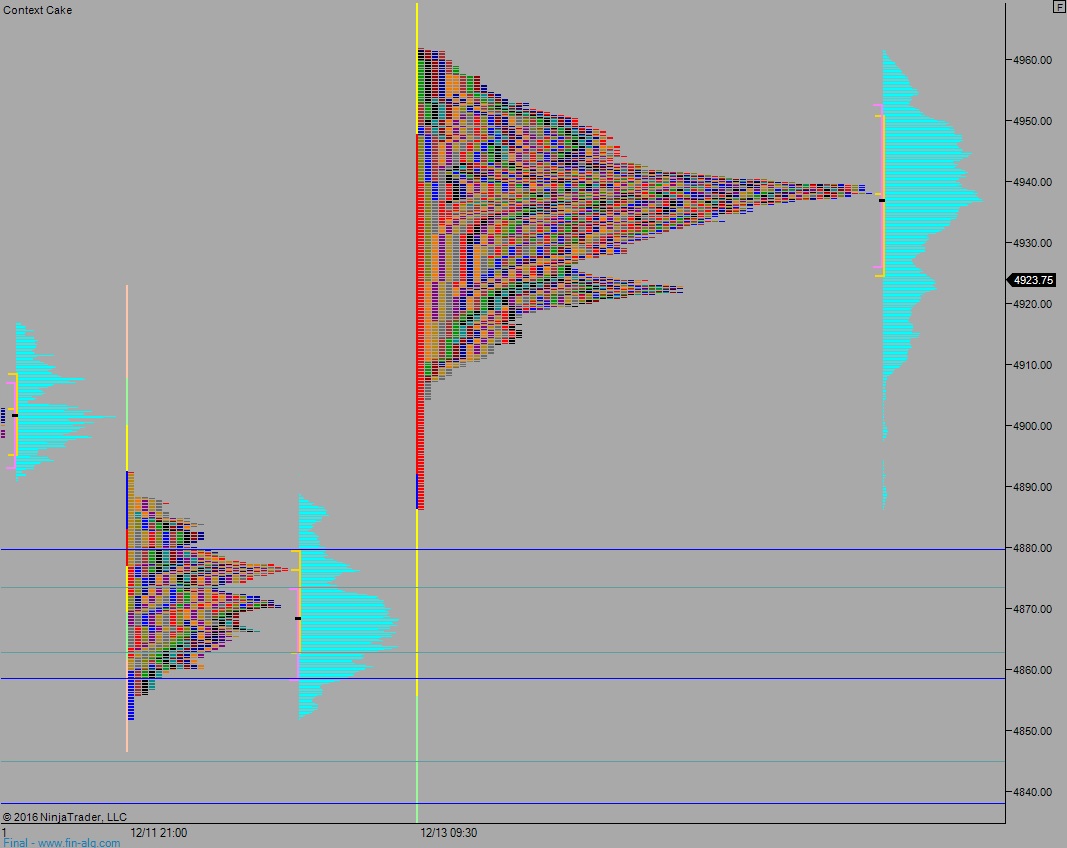

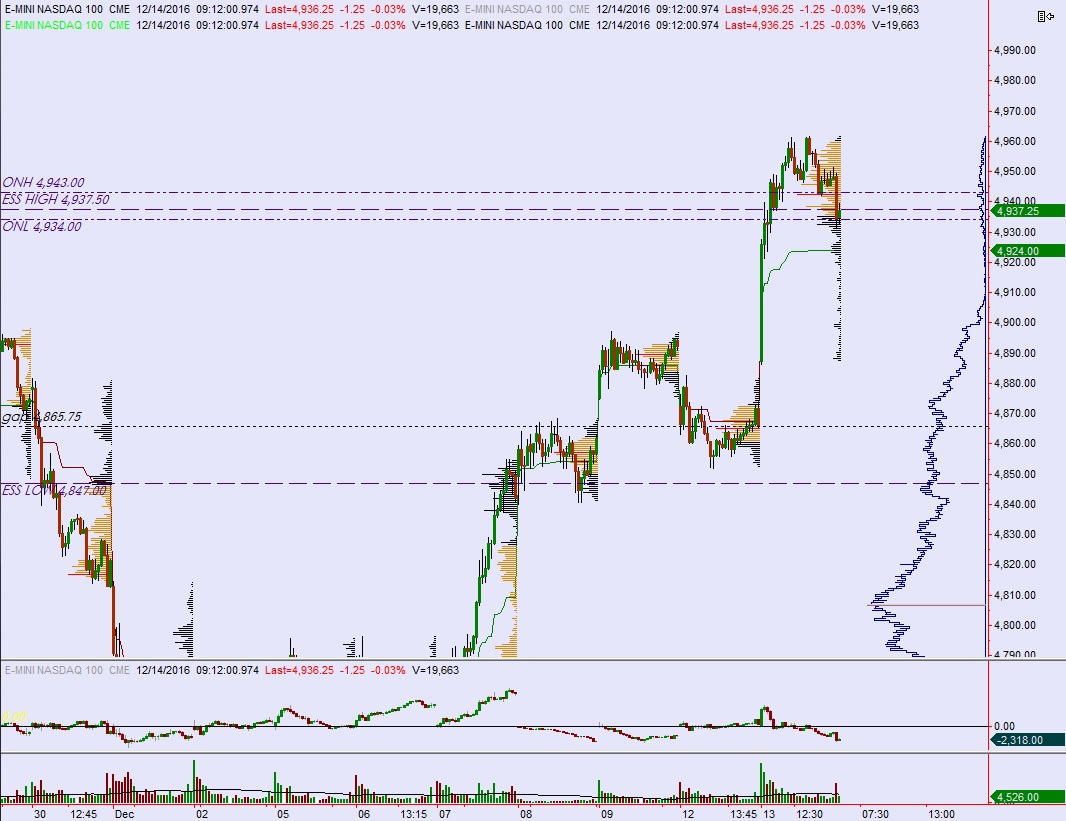

Yesterday we printed an elongated normal variation up. The more powerful rotations came to the upside, especially in the morning when a strong bid pressed the market higher for the first hour and a half. Sellers were found just above all-time high, and after some indecisive action near value high, a second, initiative wave of selling pushed through. It was, however, faded back higher by end of session.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4939. From here we continue lower, down through overnight low 4938.50 setting up a move to test value low down around 4920 before two way trade ensues.

Hypo 2 buyers work up through overnight high 4953 setting up a breakout to new highs. Look for sellers up at 4971 then again at 4977.50.

Hypo 3 strong buyers press to new highs, then sustain trade above 4977.50 setting up a potent, open-air trend higher.

Levels:

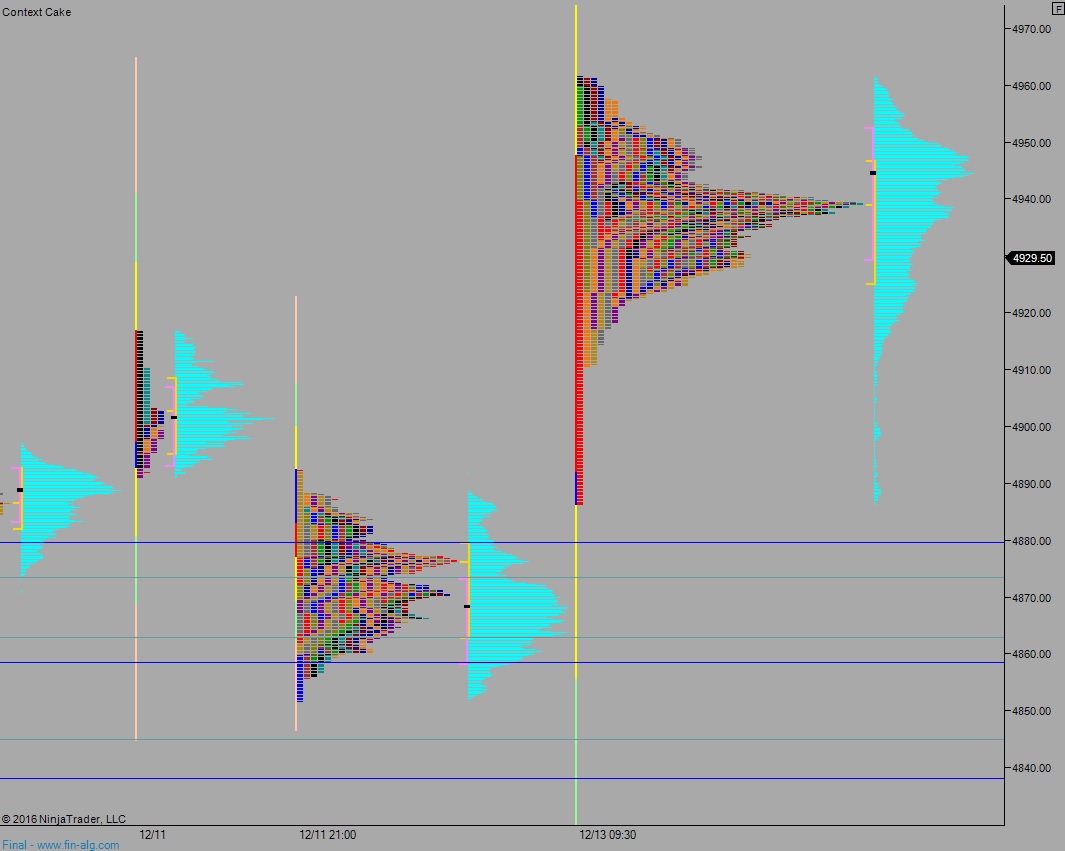

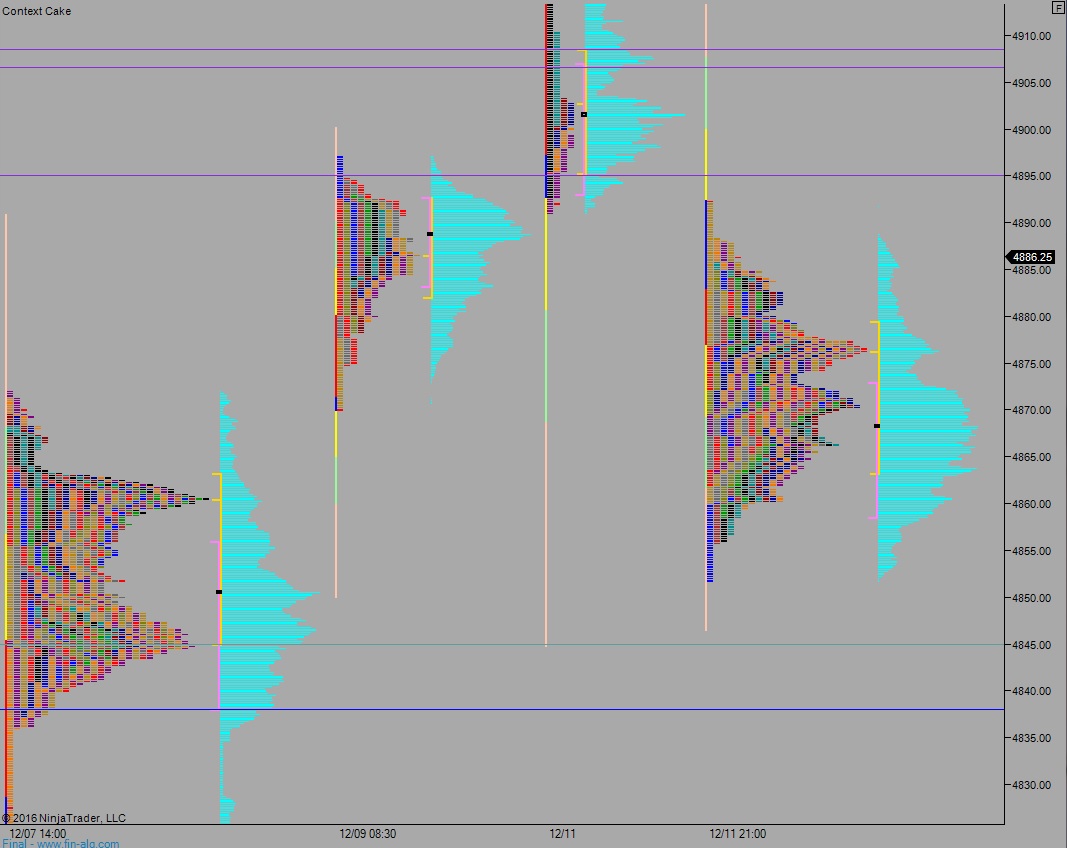

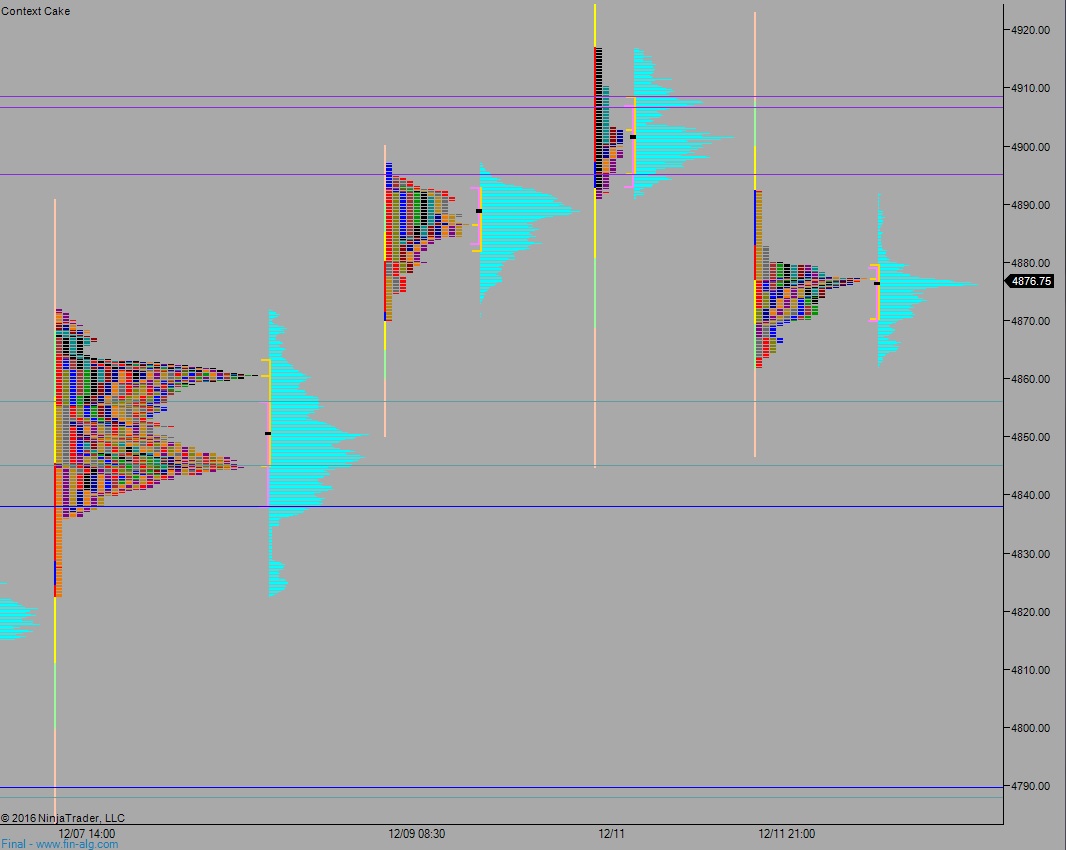

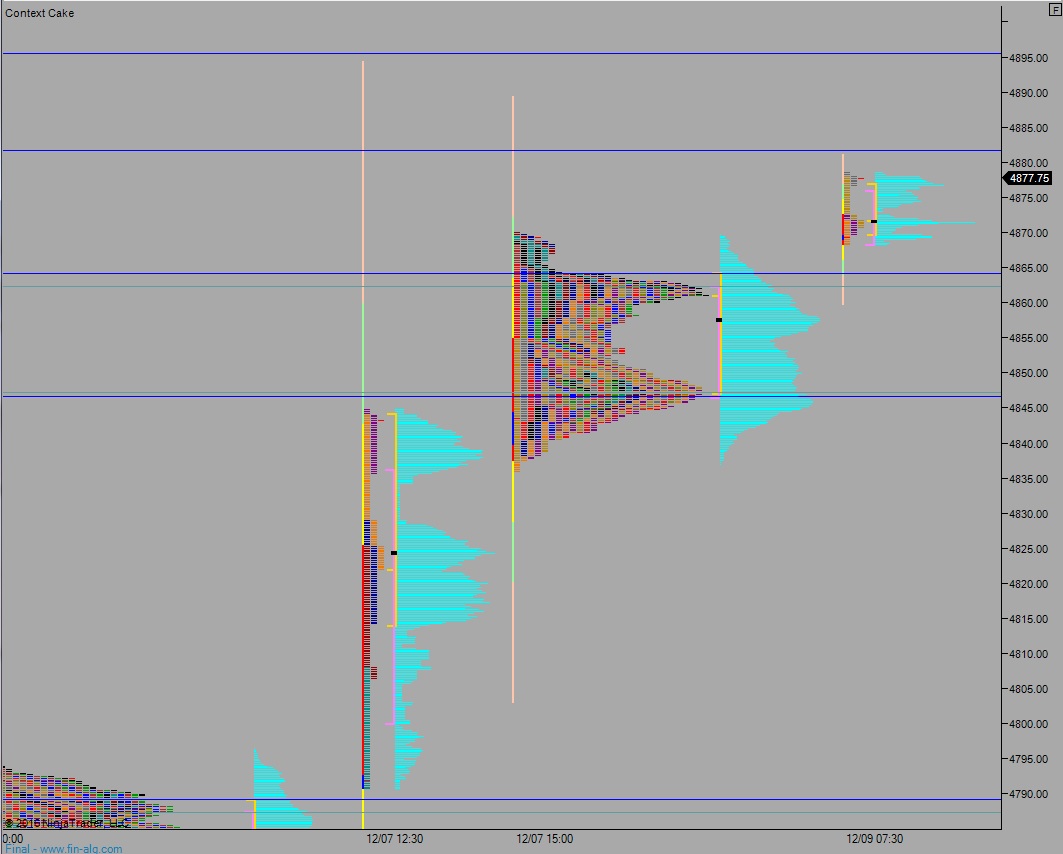

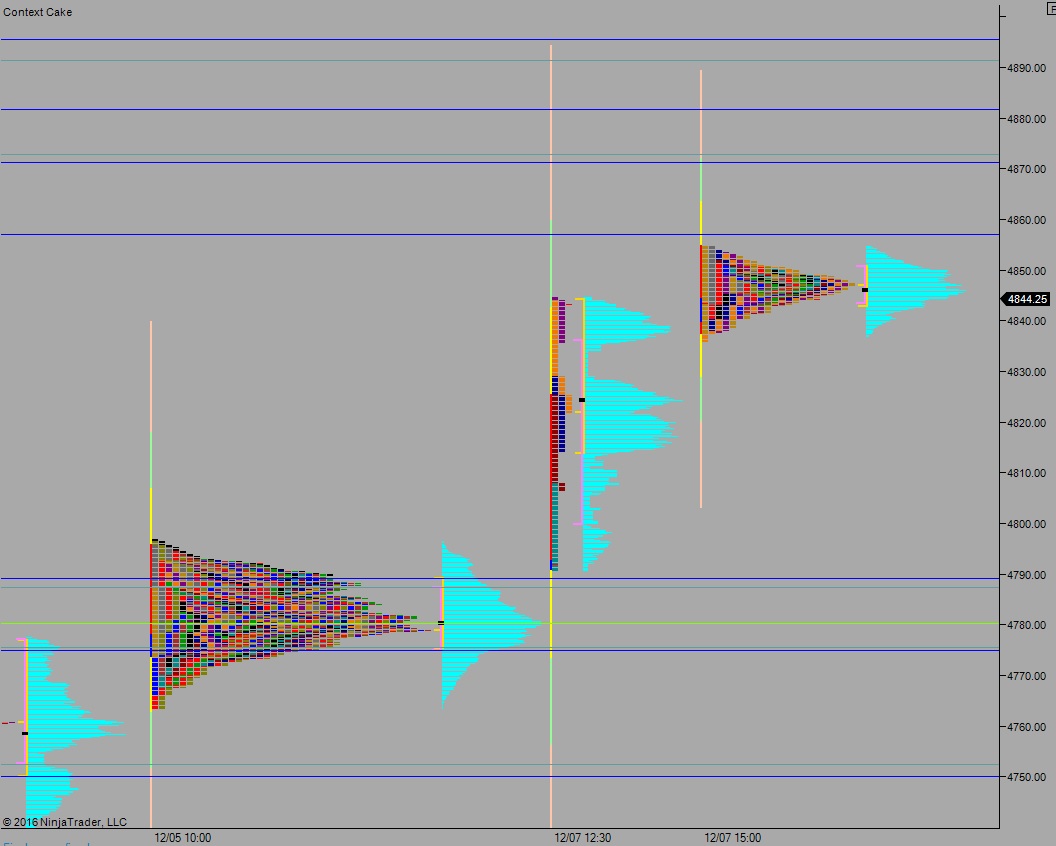

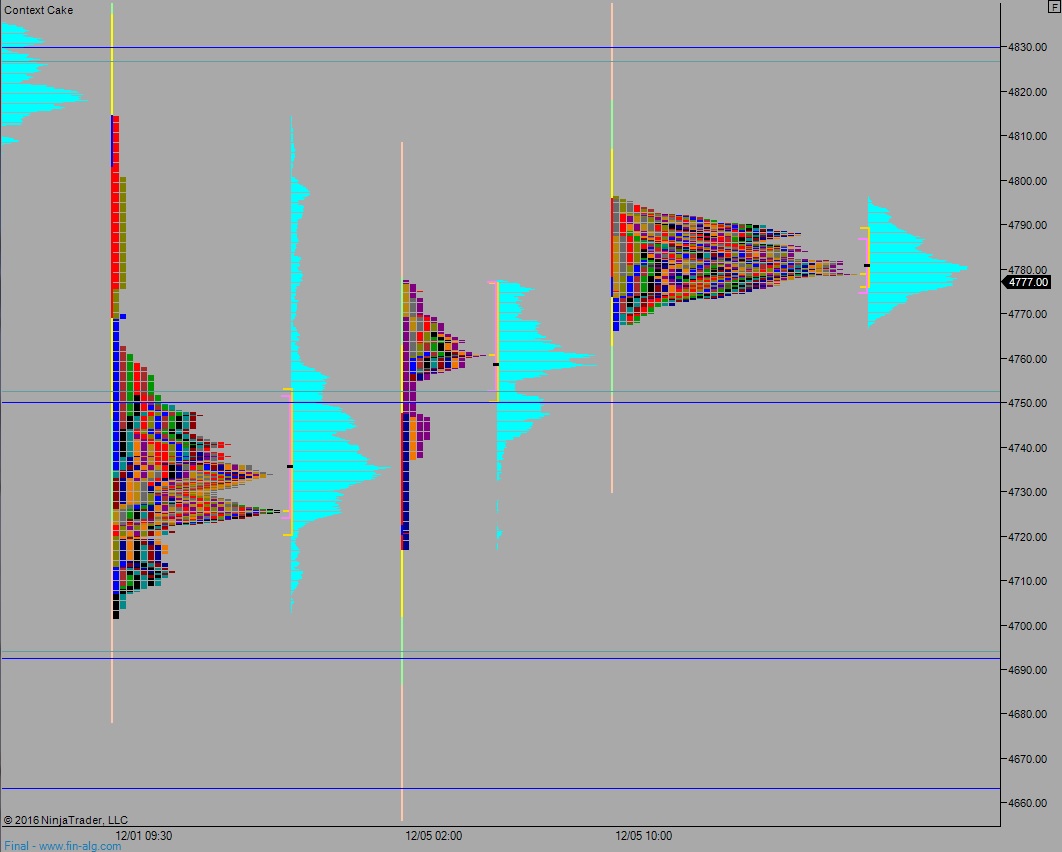

Volume profiles, gaps, and measured moves: