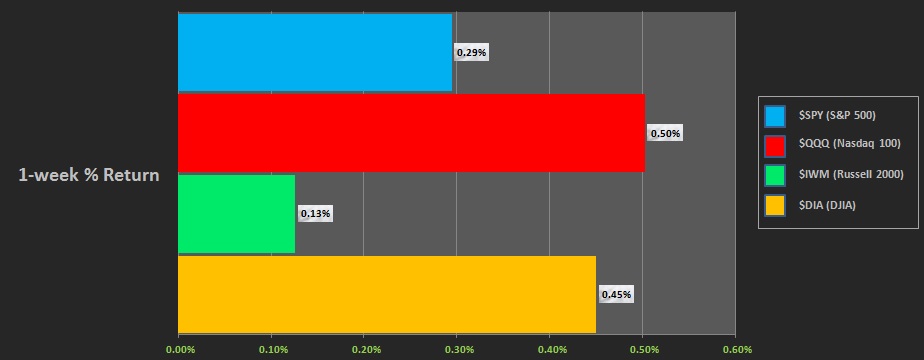

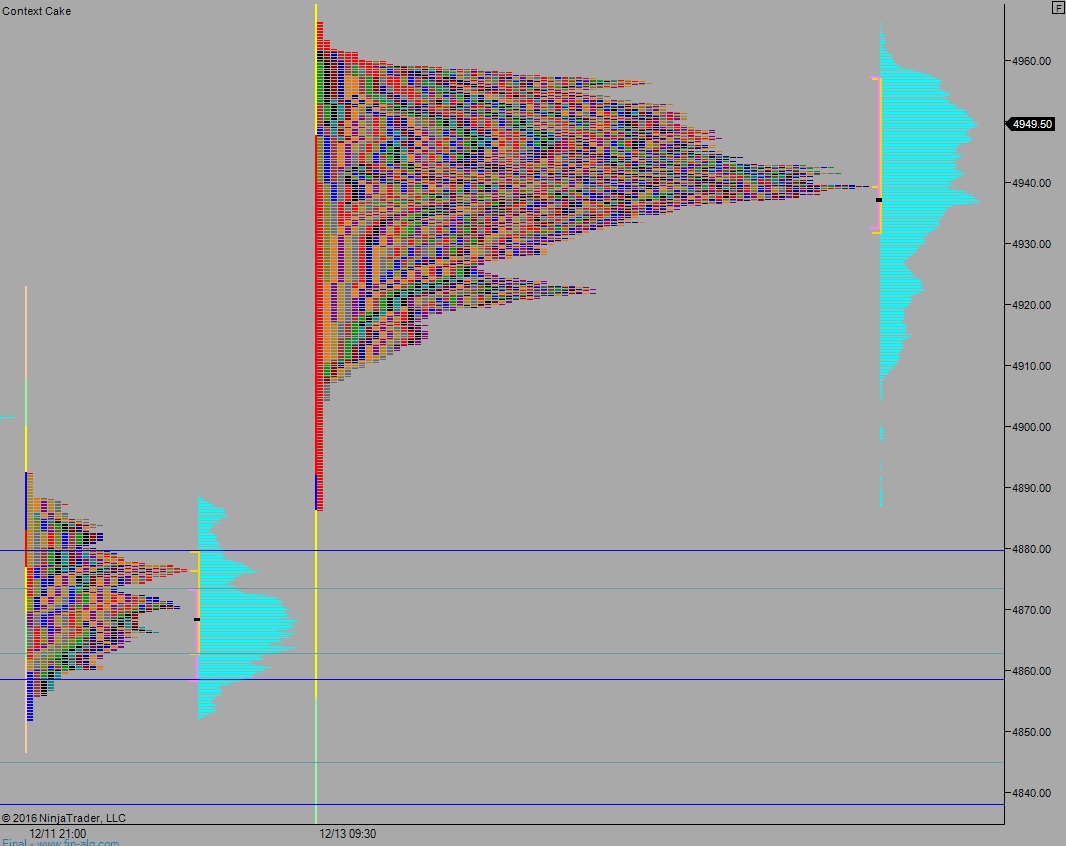

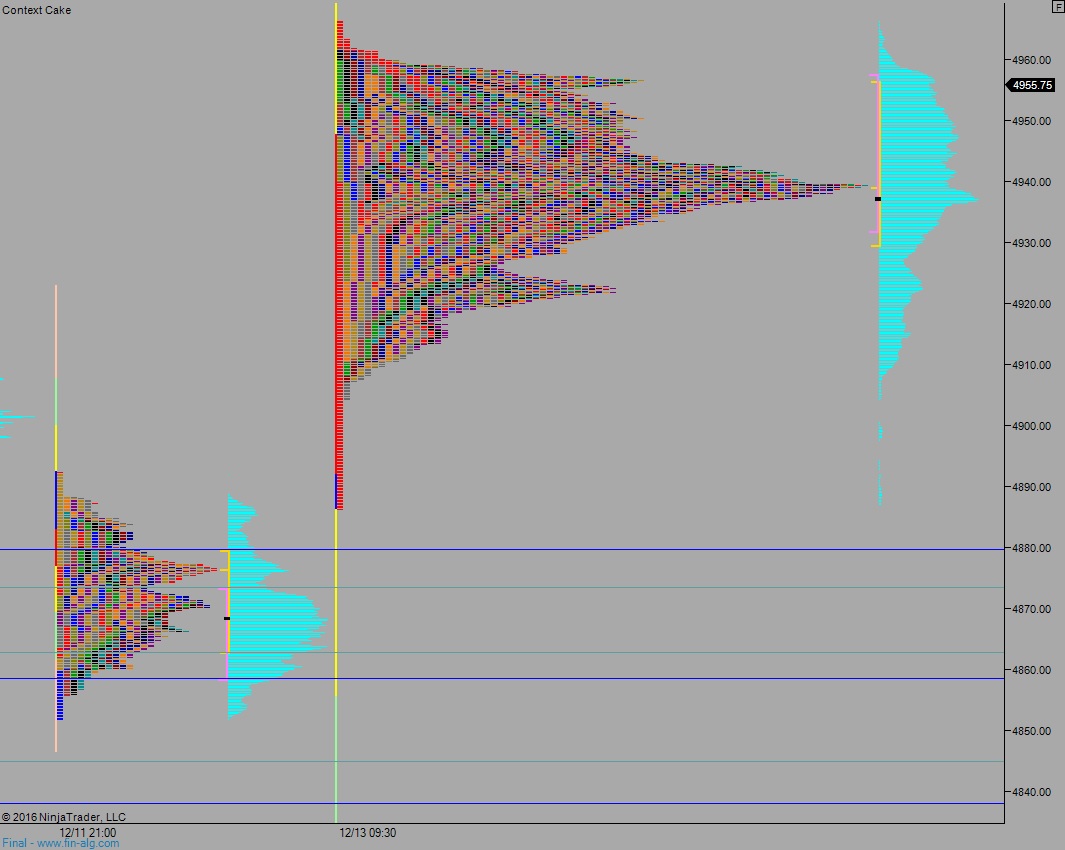

NASDAQ futures are coming into Friday with a slight gap up after an overnight session featuring normal range and volume. Price worked higher overnight, moving up beyond the Thursday high after a Non-farm payroll data came in better-than-expected:

Non-farm Payrolls for Dec 156.0K vs 178.0K Est; Prior 178.0K

Unemployment Rate for Dec 4.70% vs 4.70% Est; Prior 4.60%

The economic calendar is otherwise light today. The Factory and Durable Goods orders data is out at 10am and Baker Hughes rig count is out at 1pm.

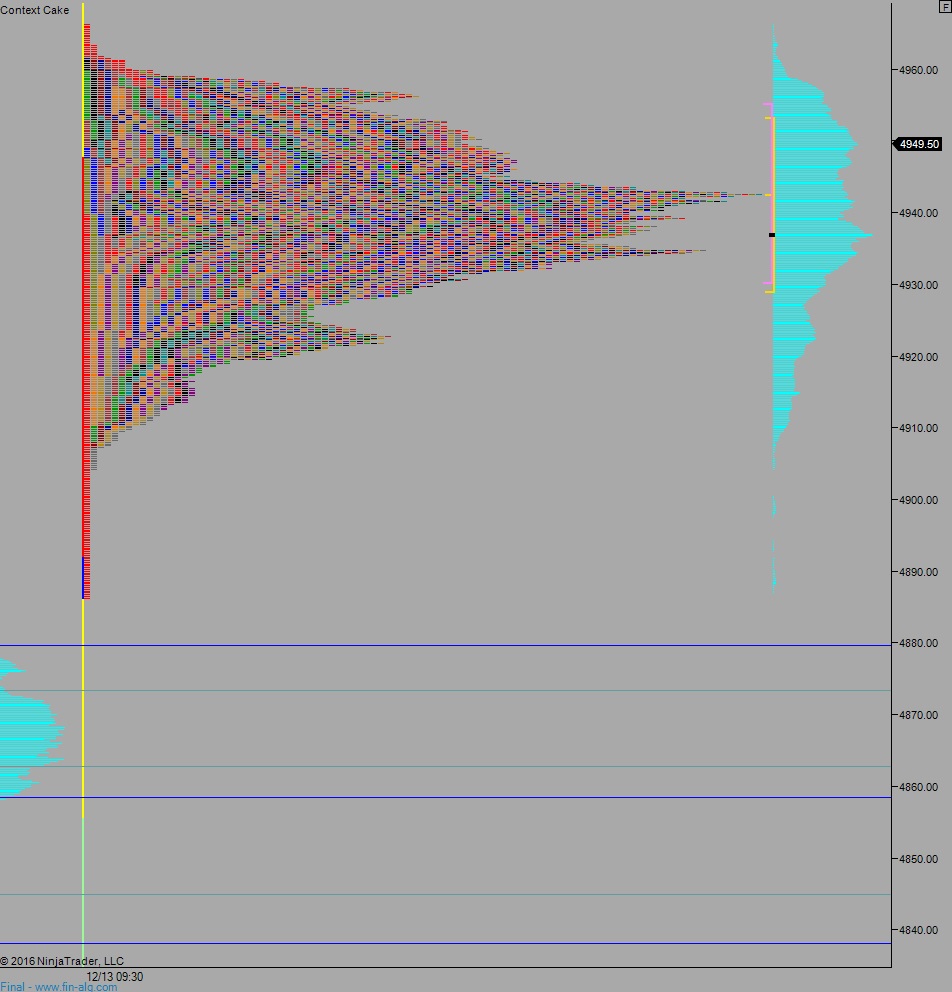

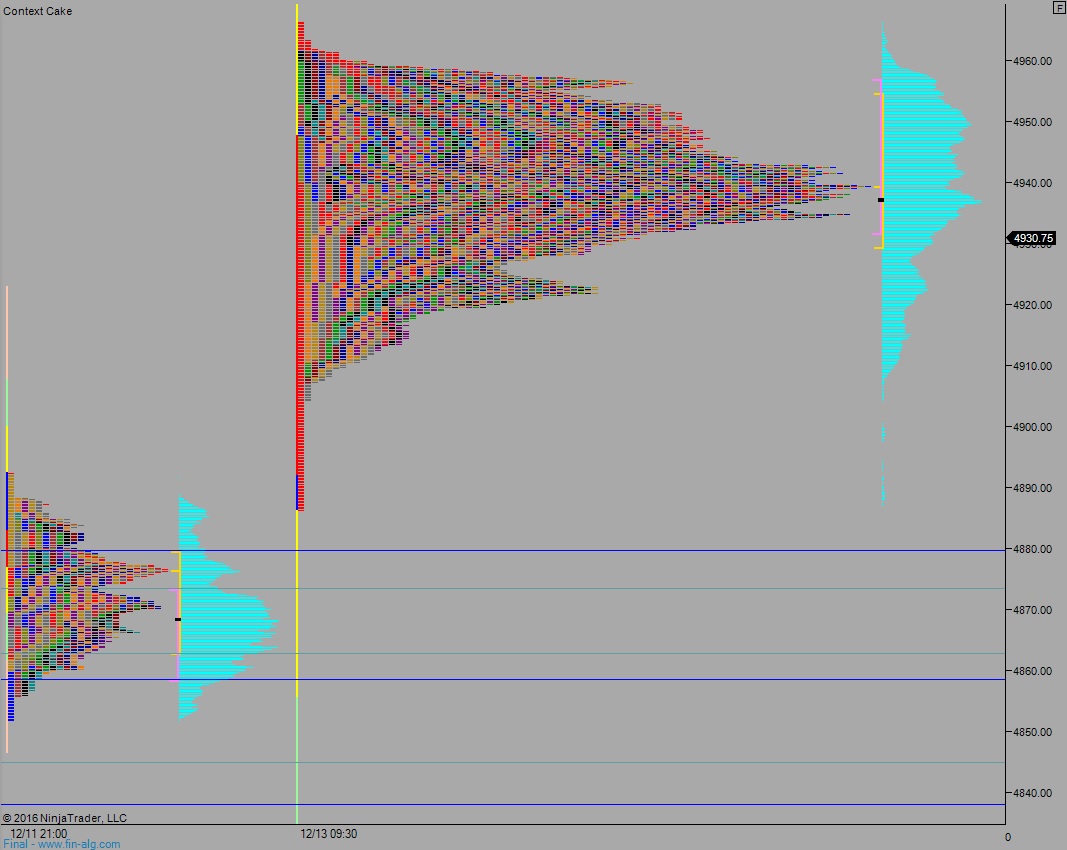

Yesterday we printed a normal variation up. After opening flat, a strong drive higher began the day and buyers became initiative during the afternoon, extending price higher and closing near session high.

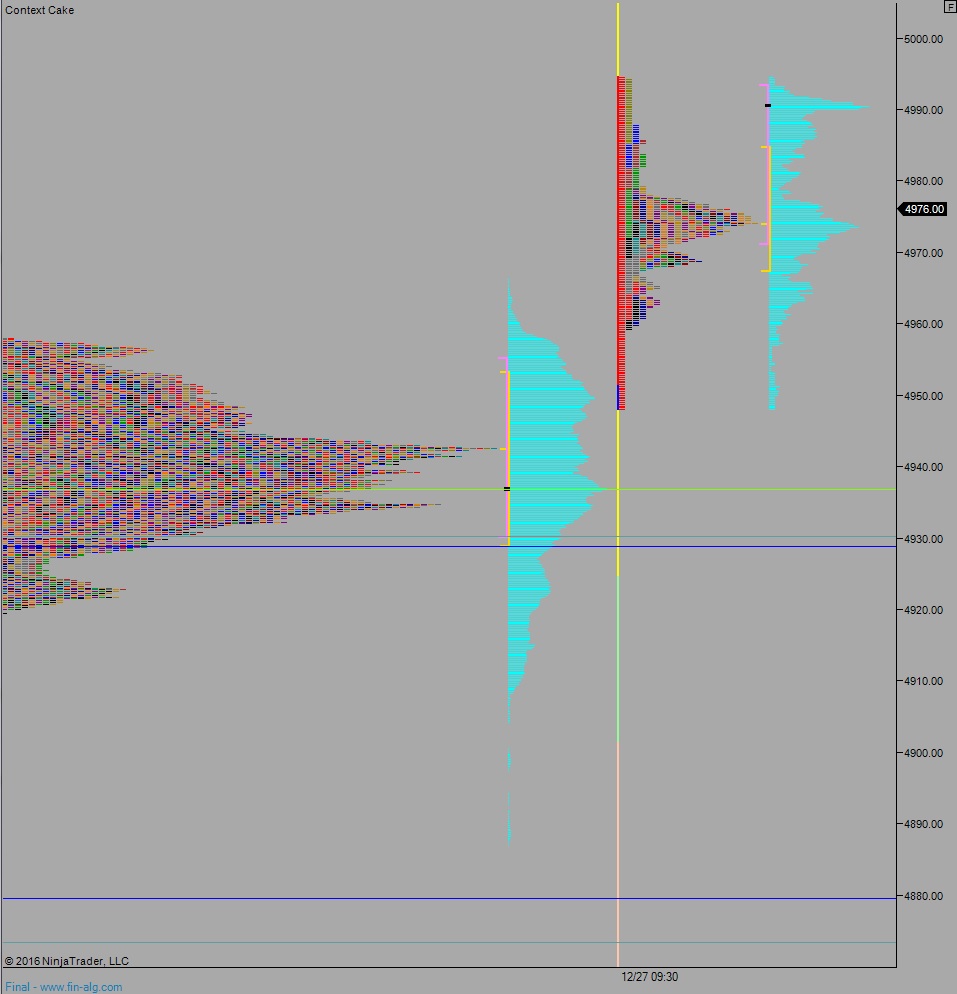

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 4961.25. From there, buyers step in and press through overnight high 4970 and continue higher, up to 4984 before two way trade ensues.

Hypo 2 sellers press down through overnight low 44958.25. Look for buyers down at 4957 and two way trade to ensue.

Hypo 3 stronger sellers work down to 4944.25 before two way trade ensues.

Levels:

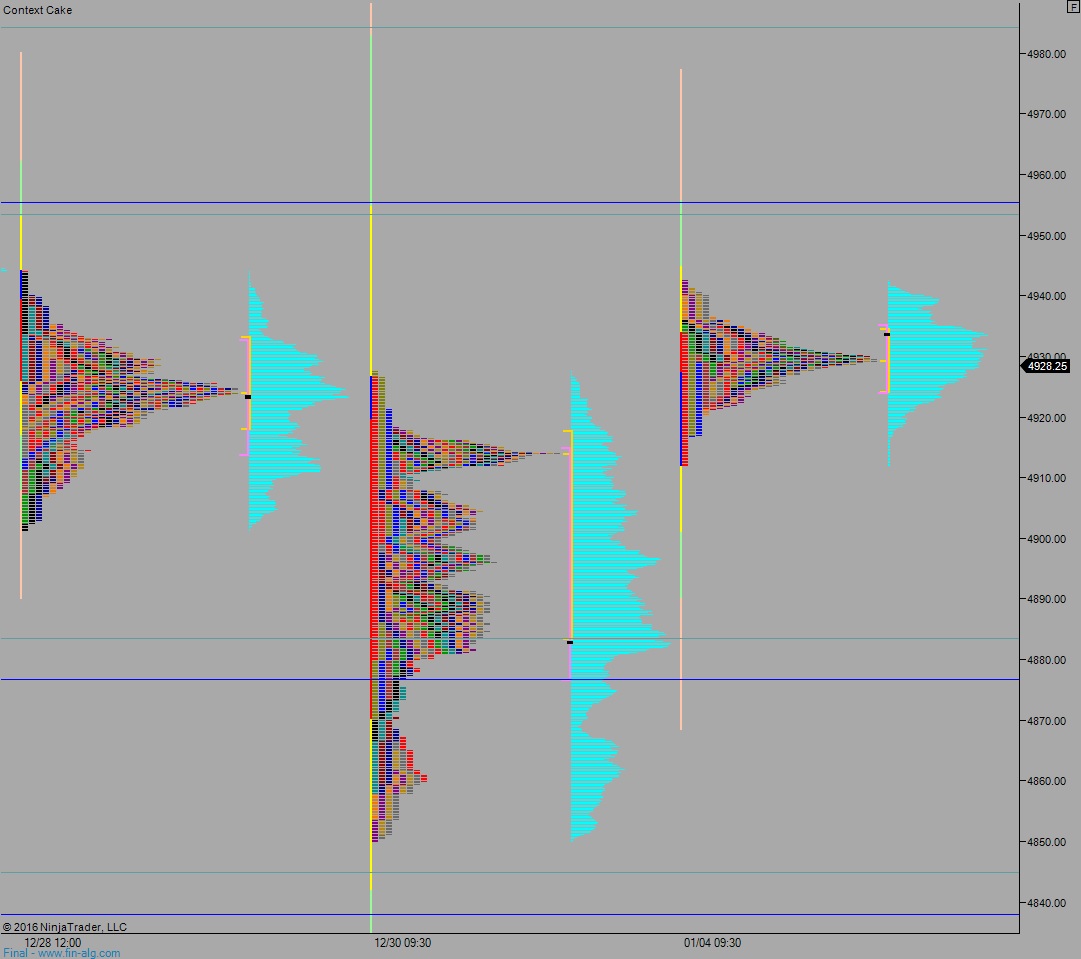

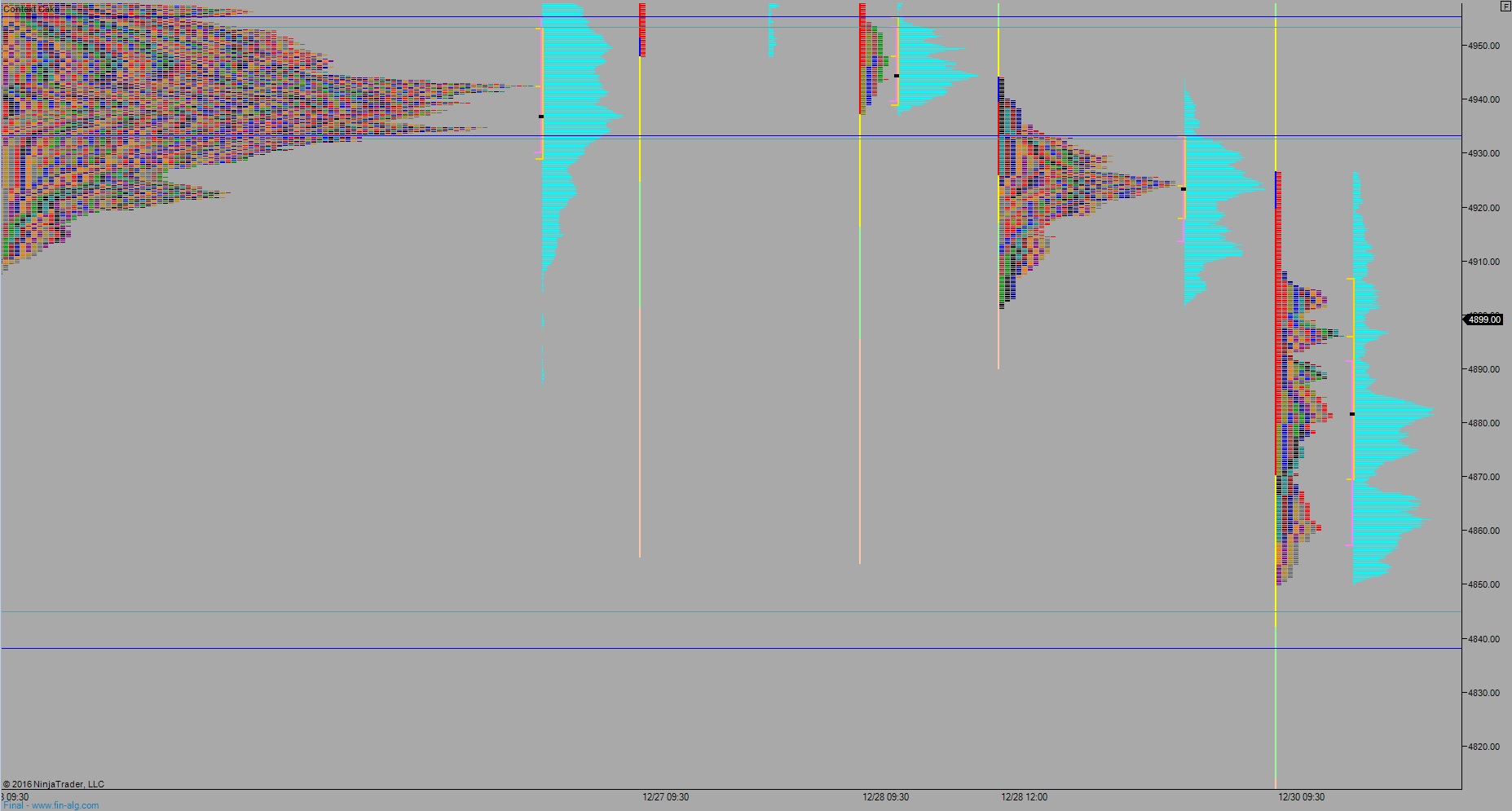

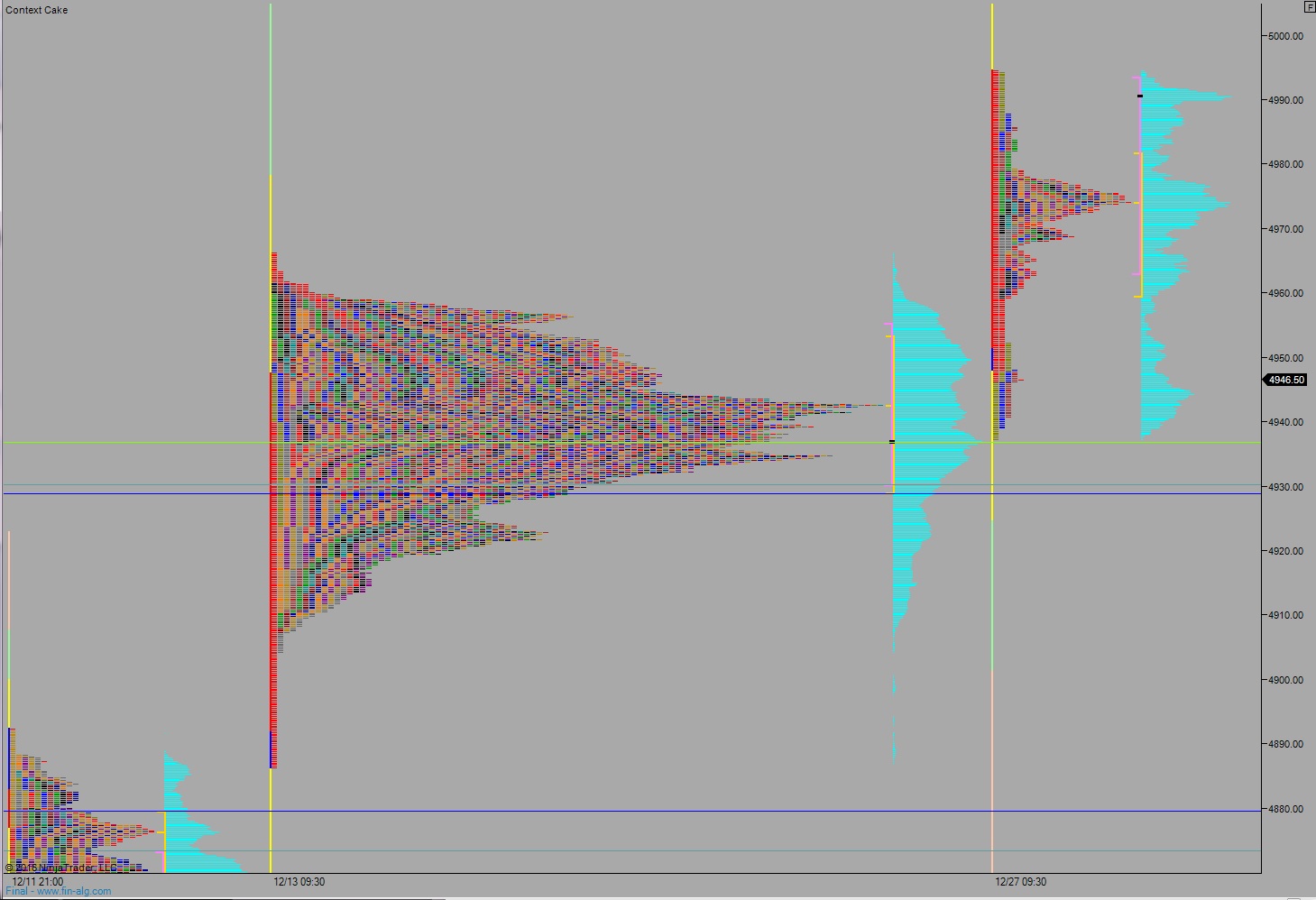

Volume profiles, gaps, and measured moves: