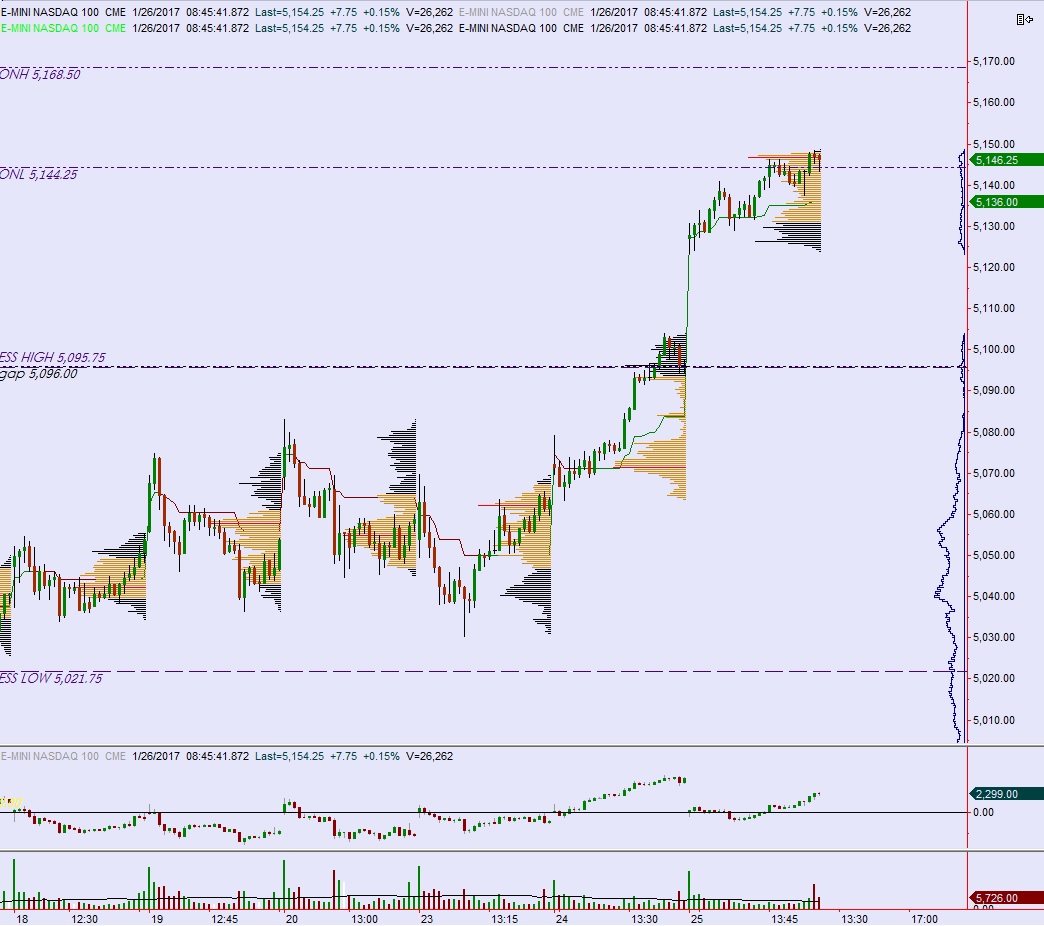

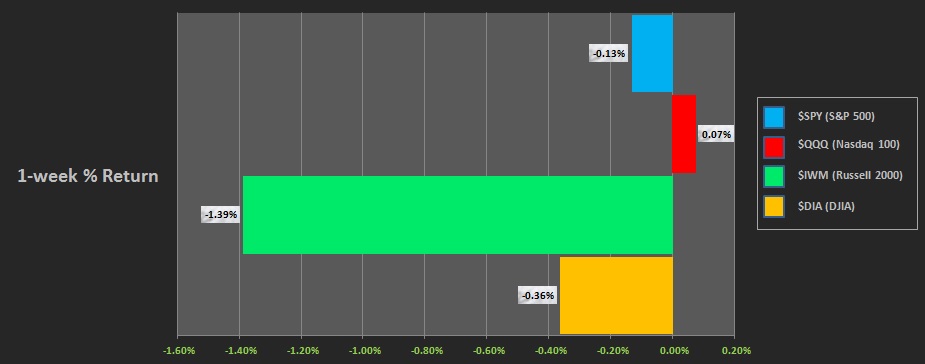

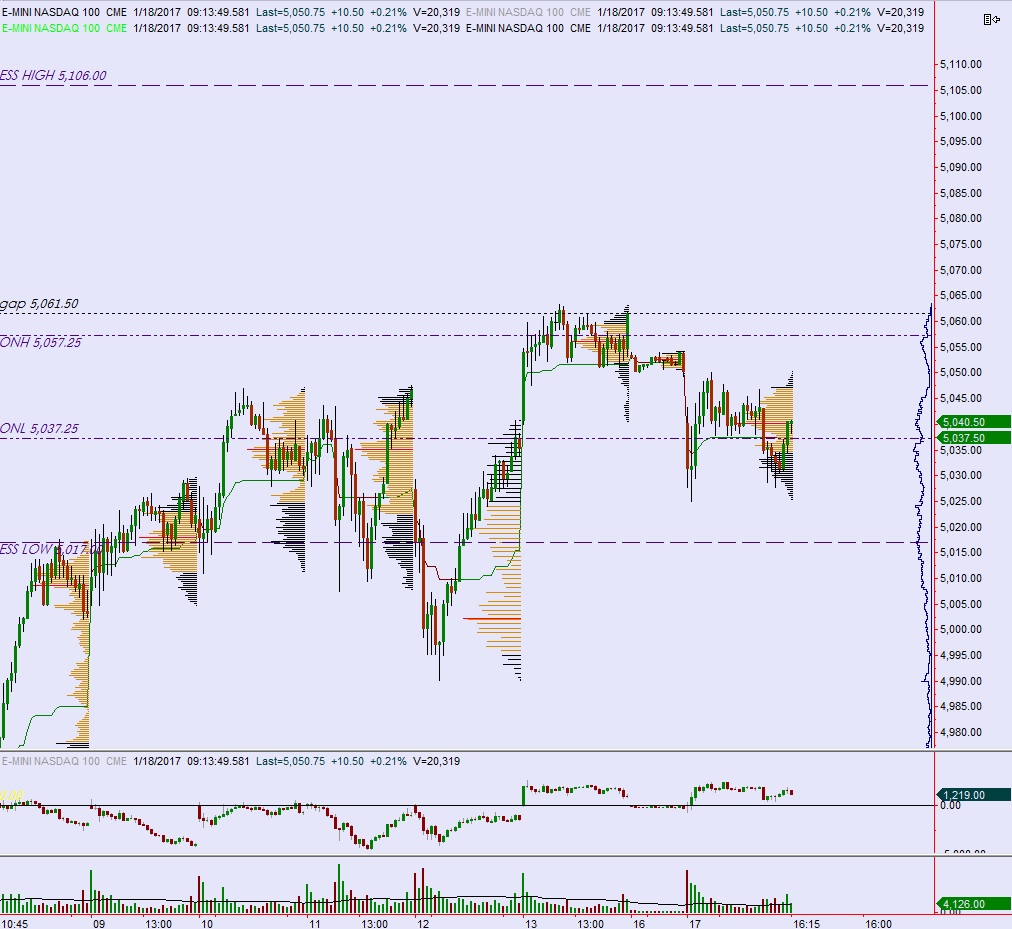

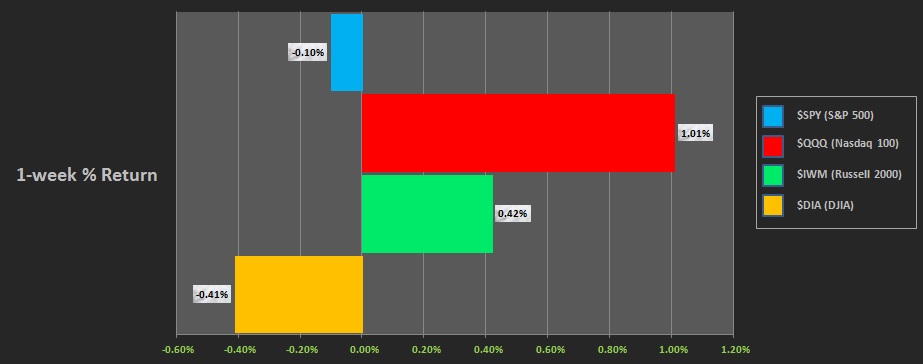

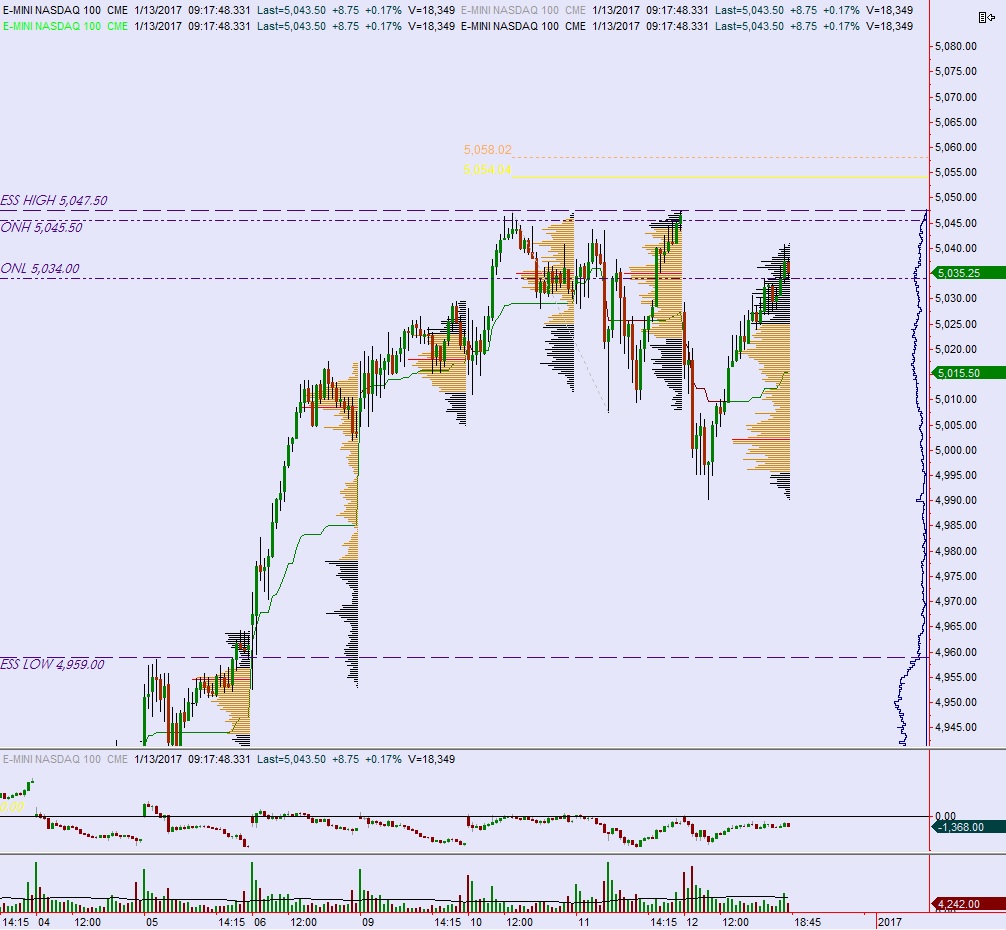

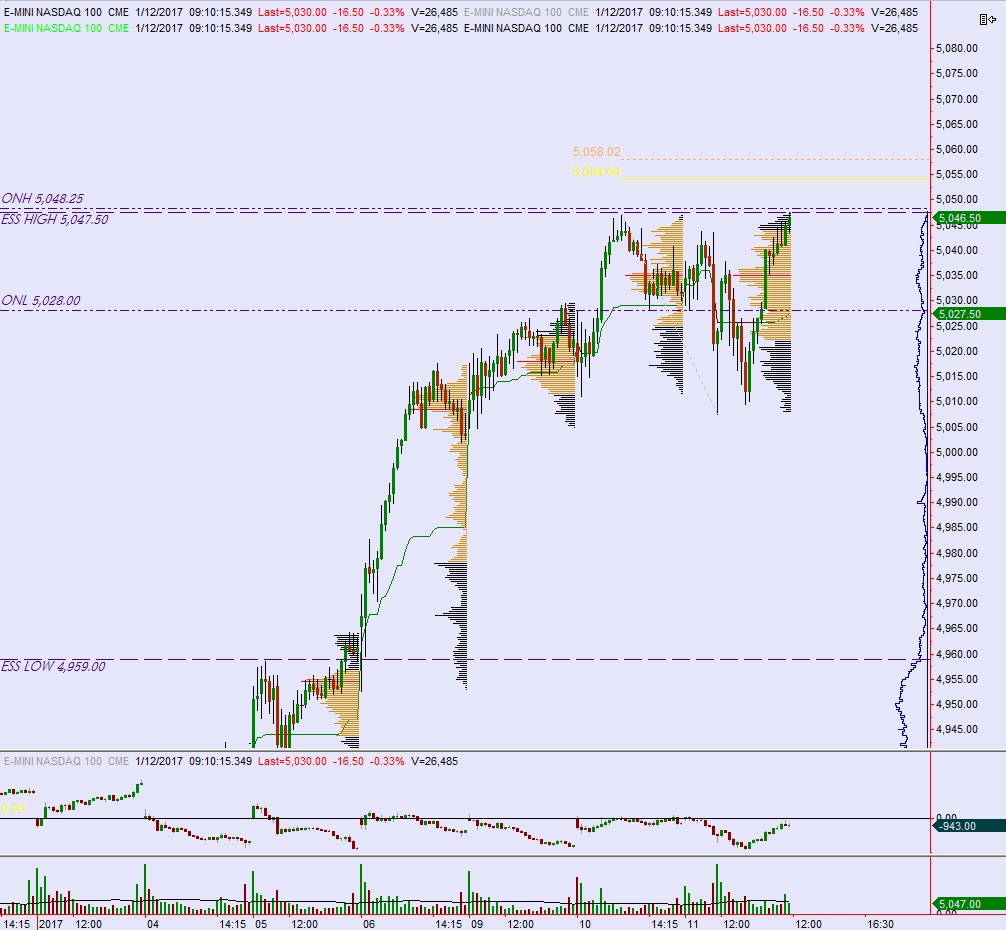

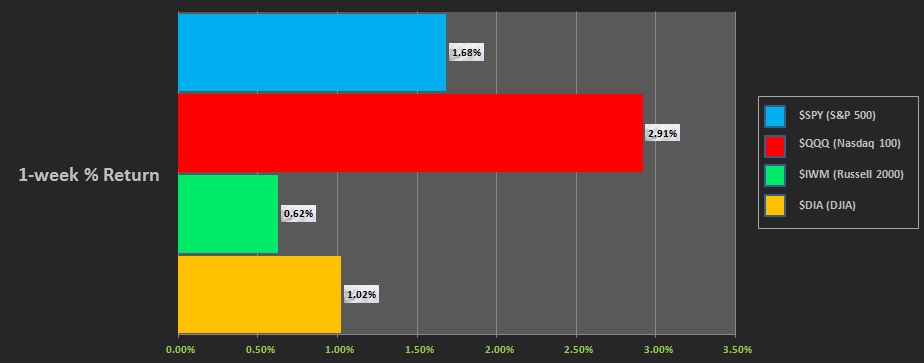

NASDAQ futures are coming into Thursday gap up after an overnight session featuring normal range and volume. Price worked more than 20 points beyond Wednesday’s high before sellers stepped in and neutralized the market. A spatter of data was released at 8:30am including Advance Goods Trade Balance, Wholesale Inventories, and Initial/Continuing jobless claims.

Also on the economic docket today are several low-impact economic releases including Markit Composit/Services PMI at 9:45am, and both New Home Sales and Leading Indicators at 10am. There is also a 7-year Treasury Note auction at 1pm.

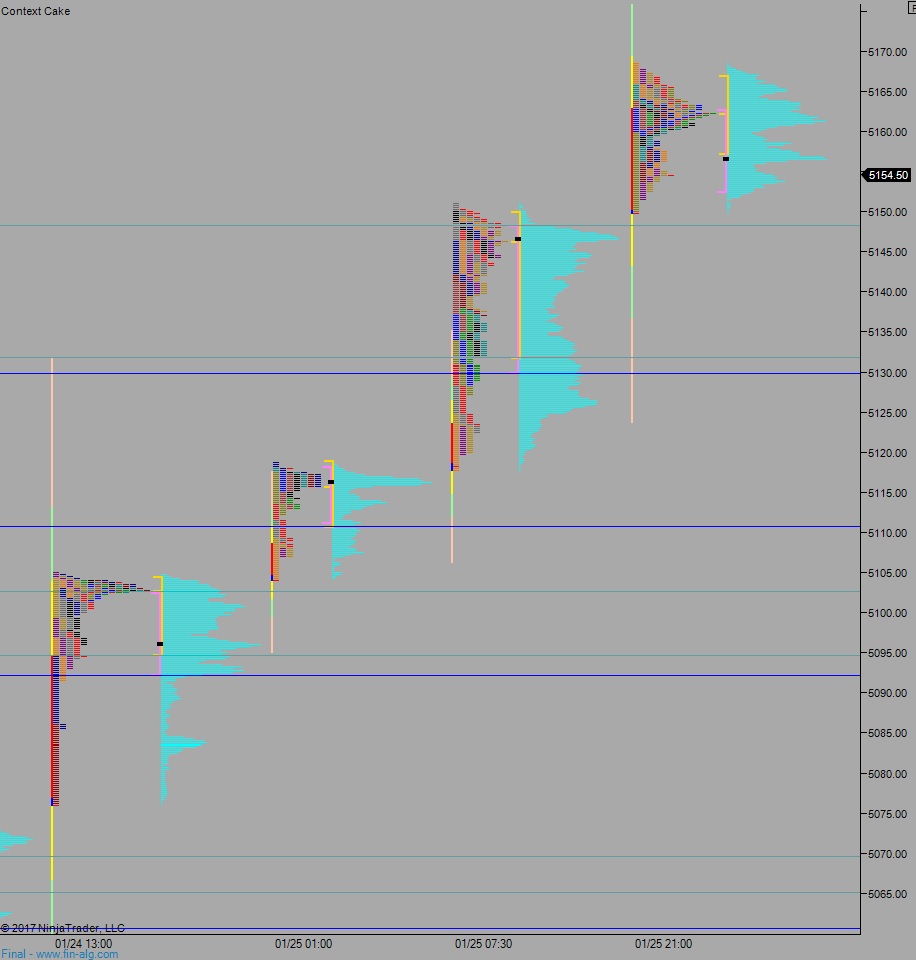

Yesterday we printed a stretched normal variation up. Price opened gap up, out of balance, at all-time highs and after an open auction buyers stepped in and initiated risk. They continued doing so throughout the session resulting in a slow ascent into closing bell.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5146.25. From here sellers continue lower, down through overnight low 5144.25 setting up a move down to 5131.75 before two way trade ensues.

Hypo 2 buyers defend an attempt back into Wednesday high 5148.50. Buyers then work higher to target overnight high 5168.50 and probe above it before two way trade ensures.

Hypo 3 choppy, two-way trade along the Wednesday high 5148.50.

Levels:

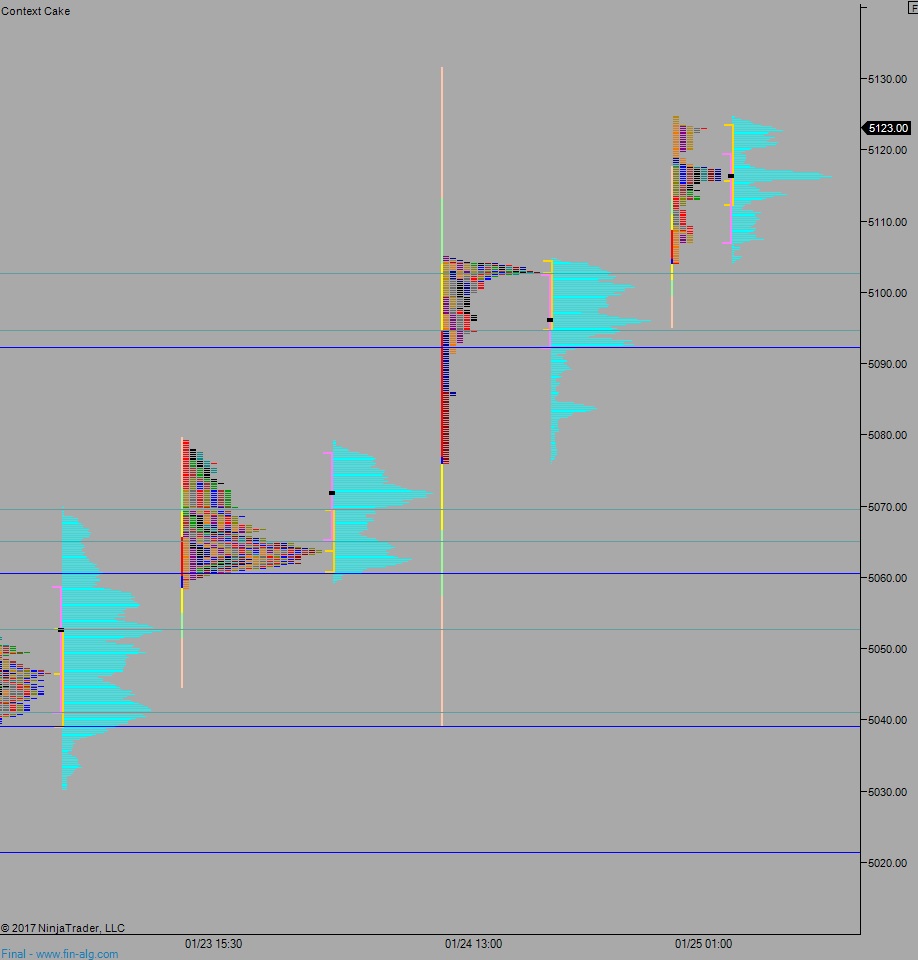

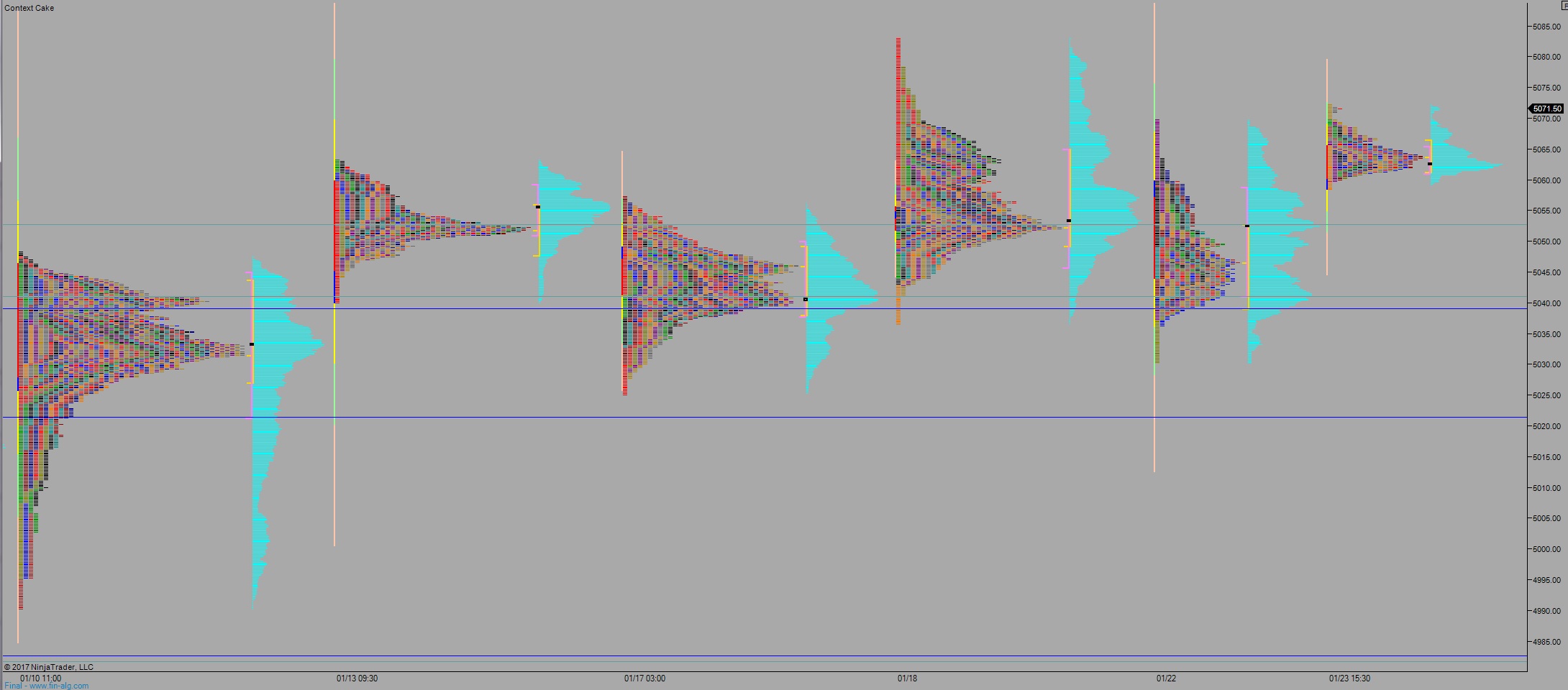

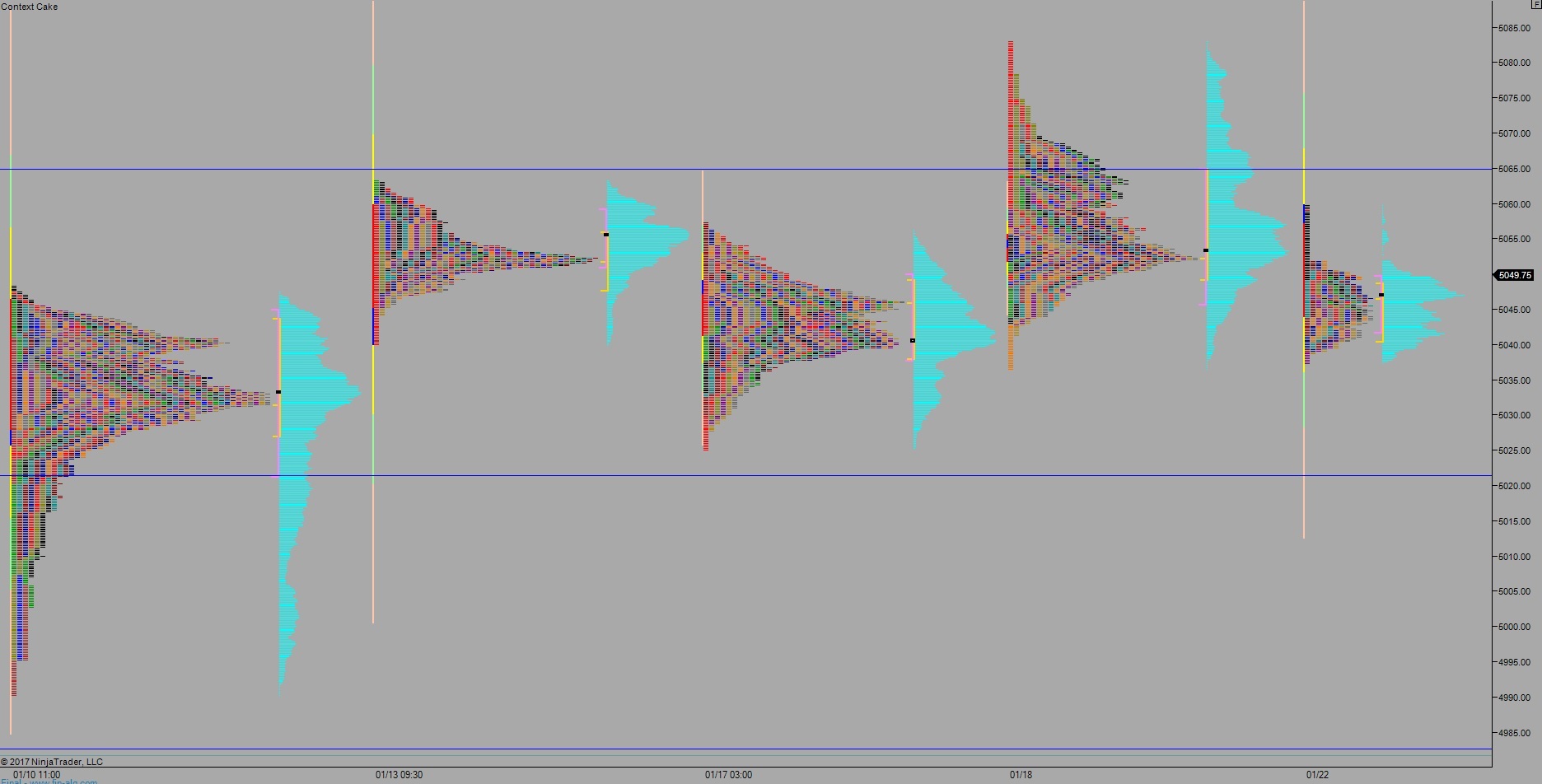

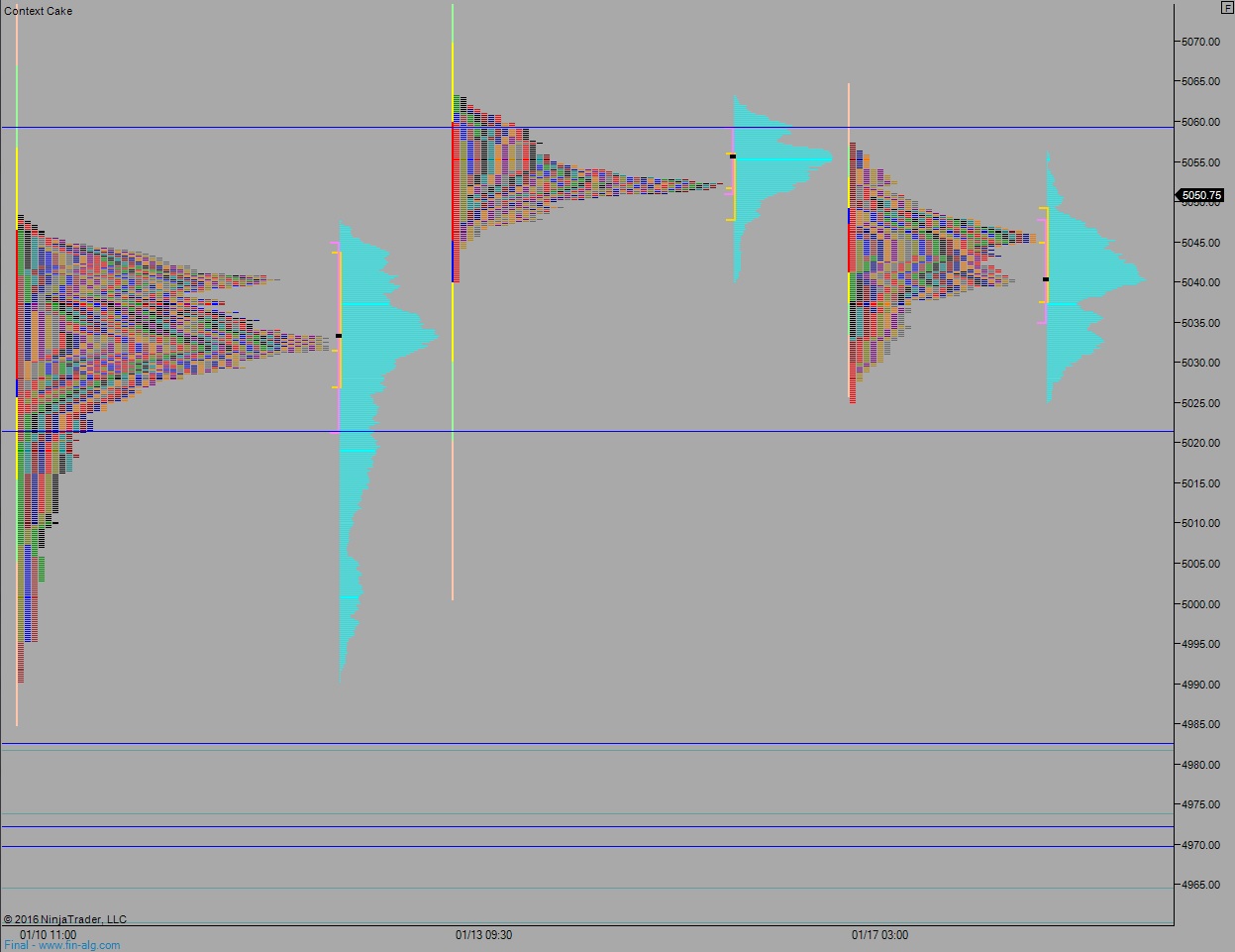

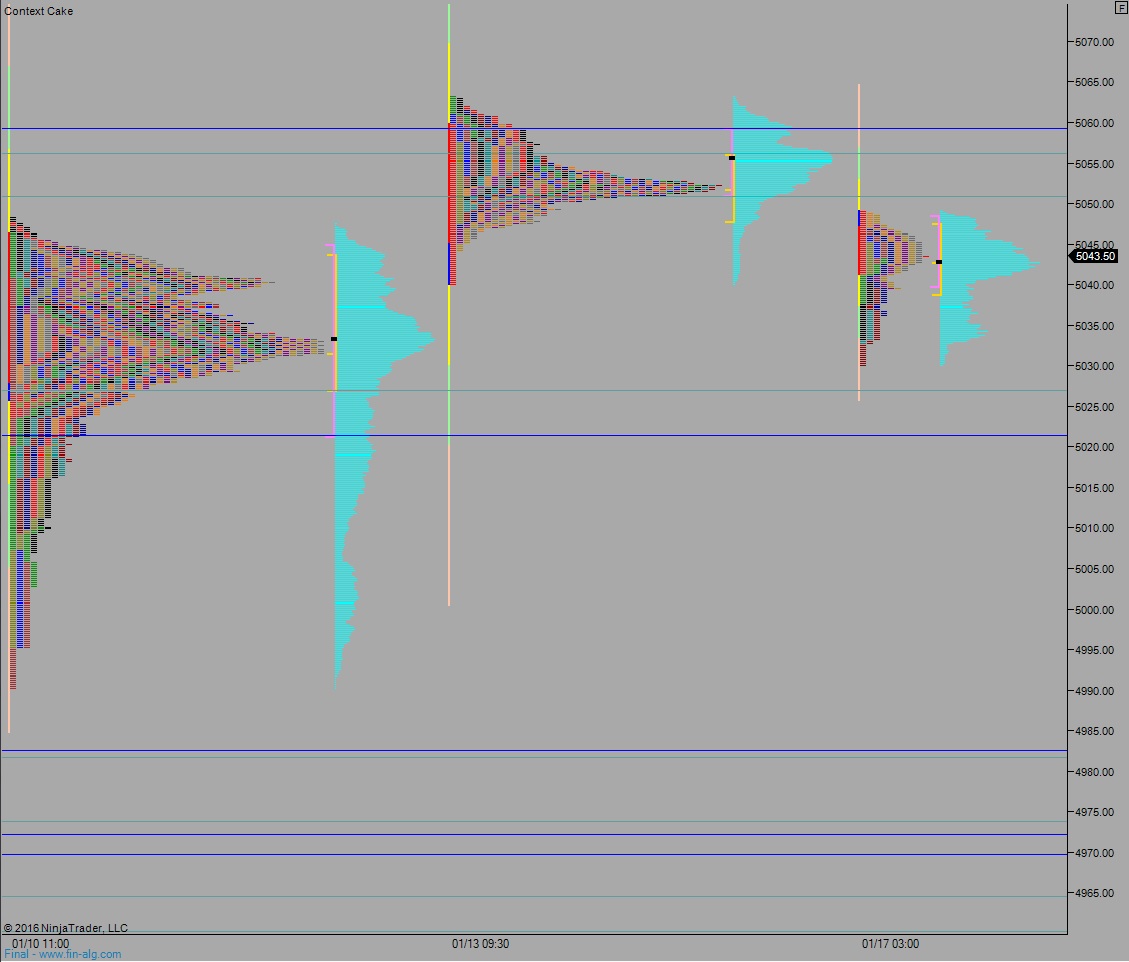

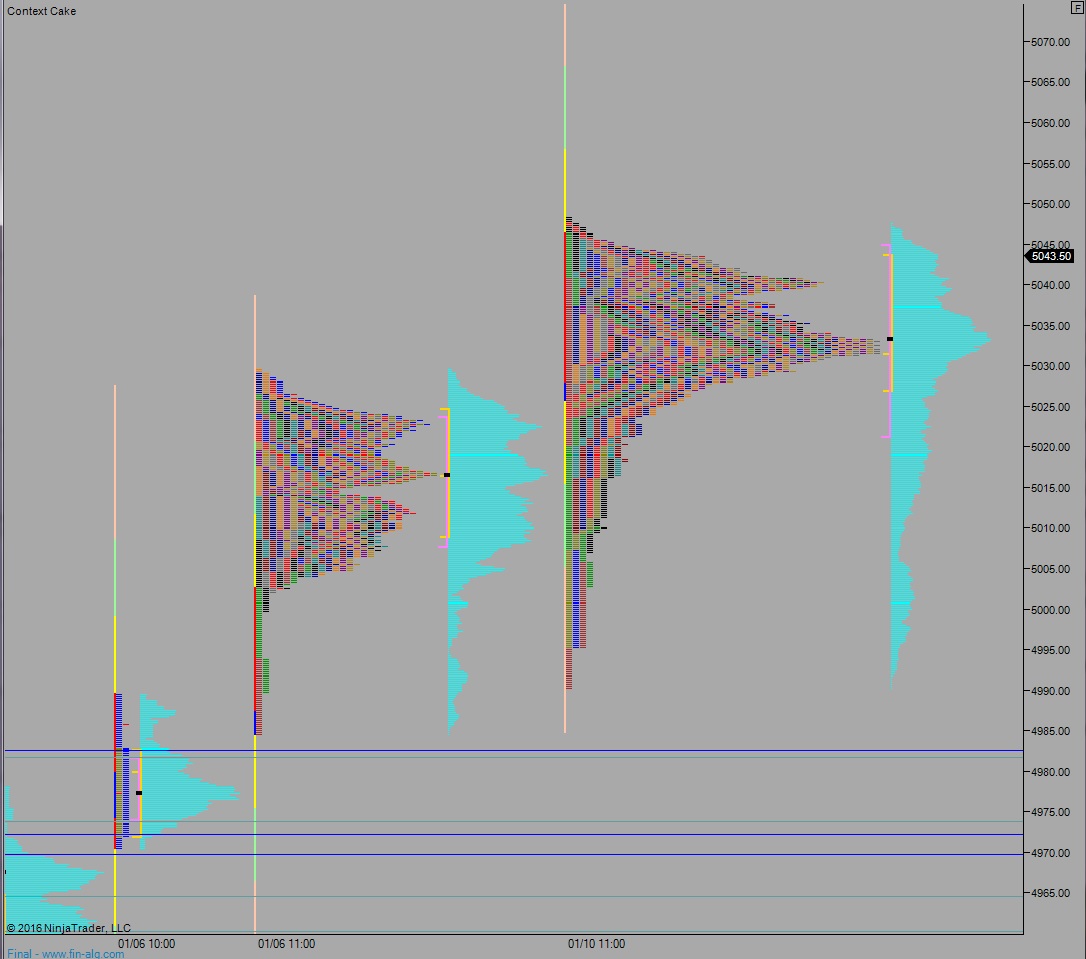

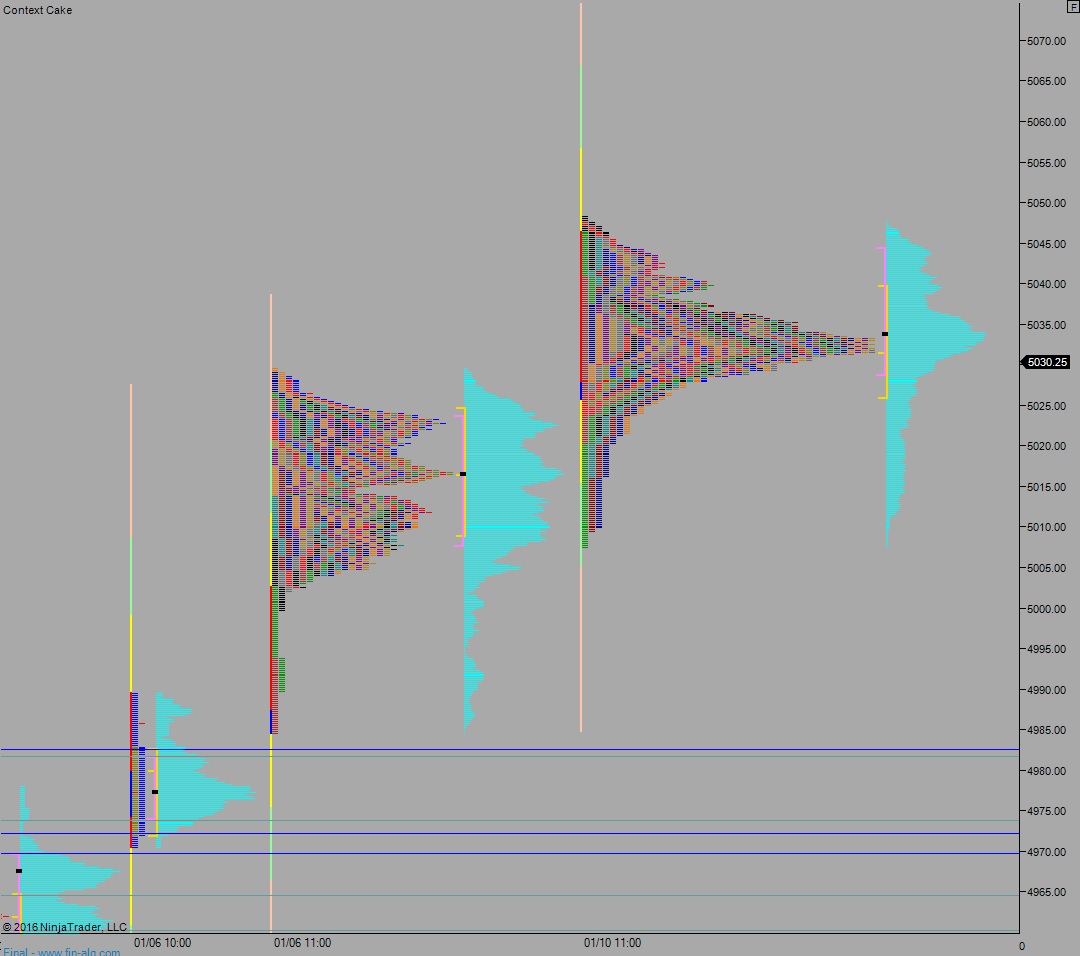

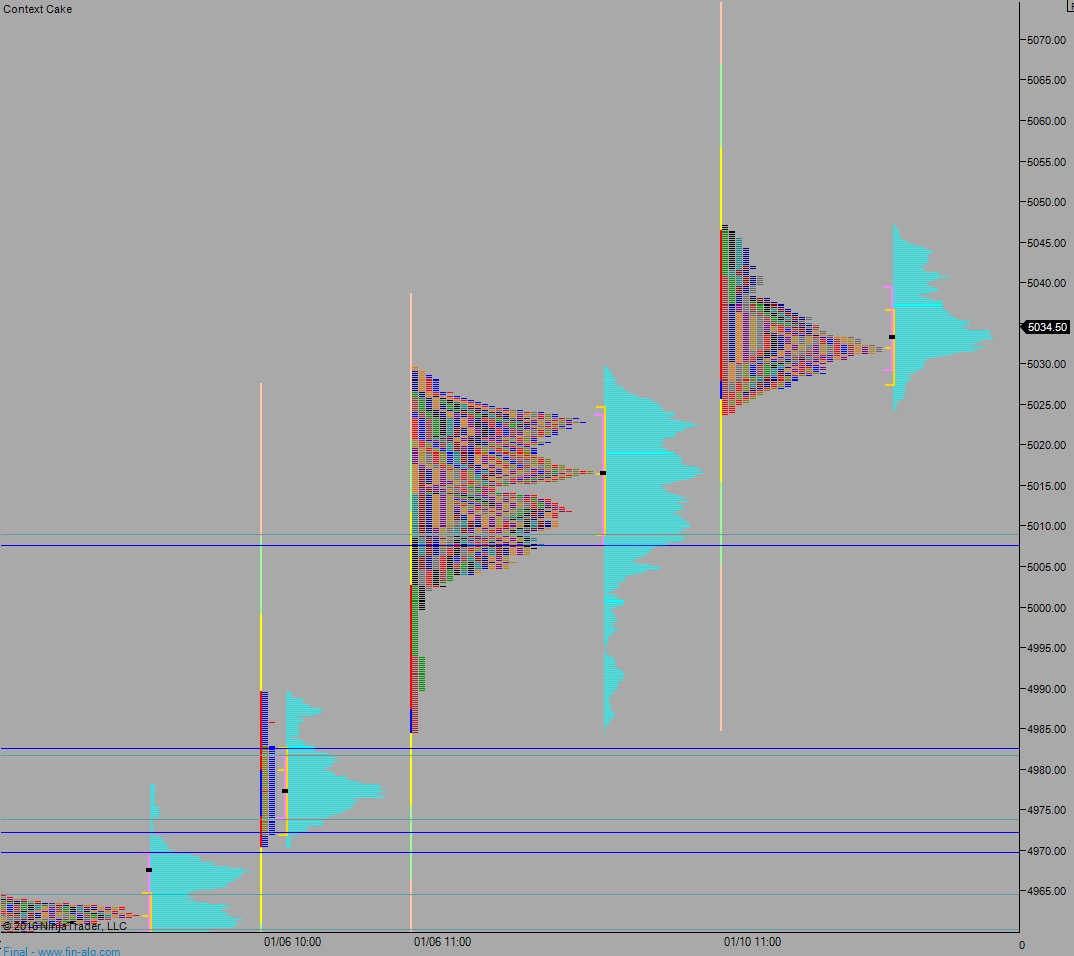

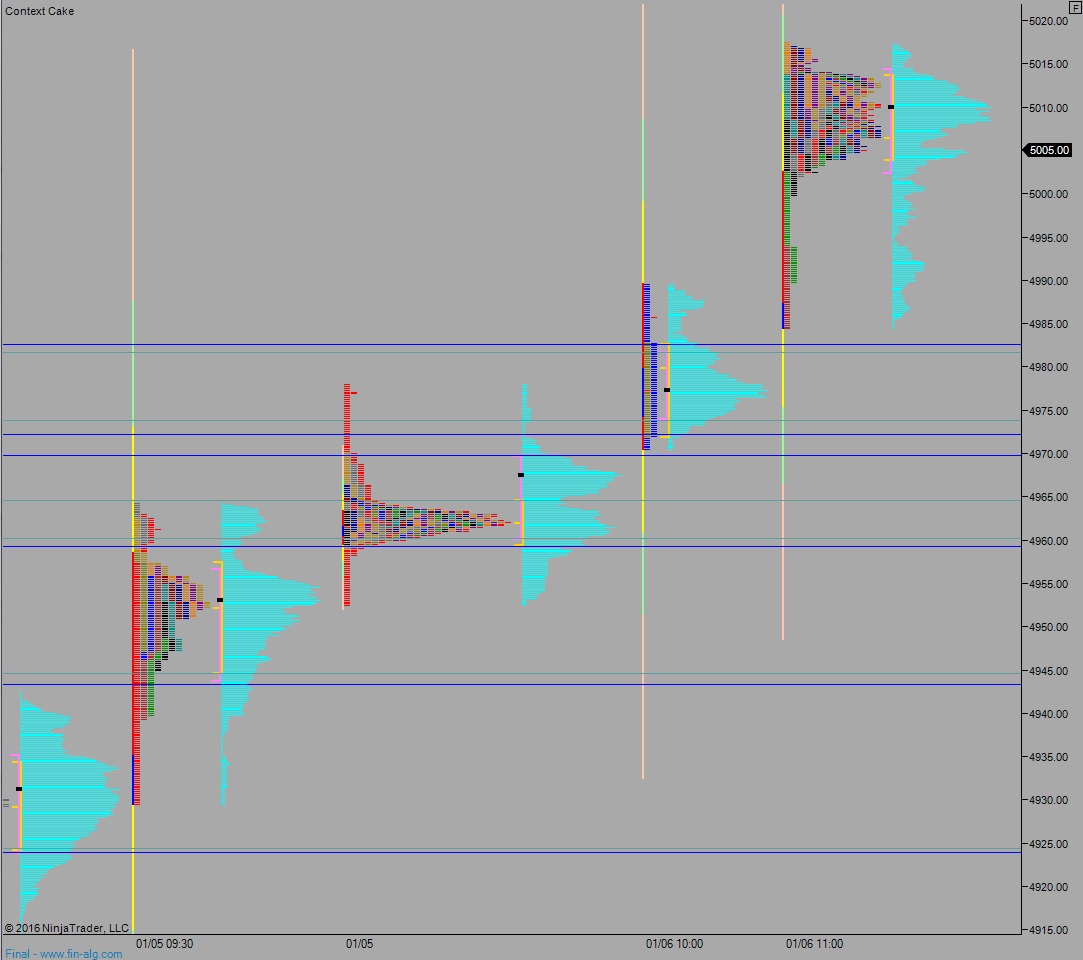

Volume profiles, gaps, and measured moves: