NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price was balanced for most of the night session, trading along the lower quadrant of Wednesday’s trend before spiking higher around 3:30am. The up move found responsive sellers right at Wednesday’s midpoint and since then we have paired back half the move. At 8:30am advance goods trade balance data came out below expectations, durable goods orders came out above expectations, and initial/continuing jobless claims were better than expected.

Also on the economic agenda today we have pending home sales at 10am and a 7-year note auction at 1pm.

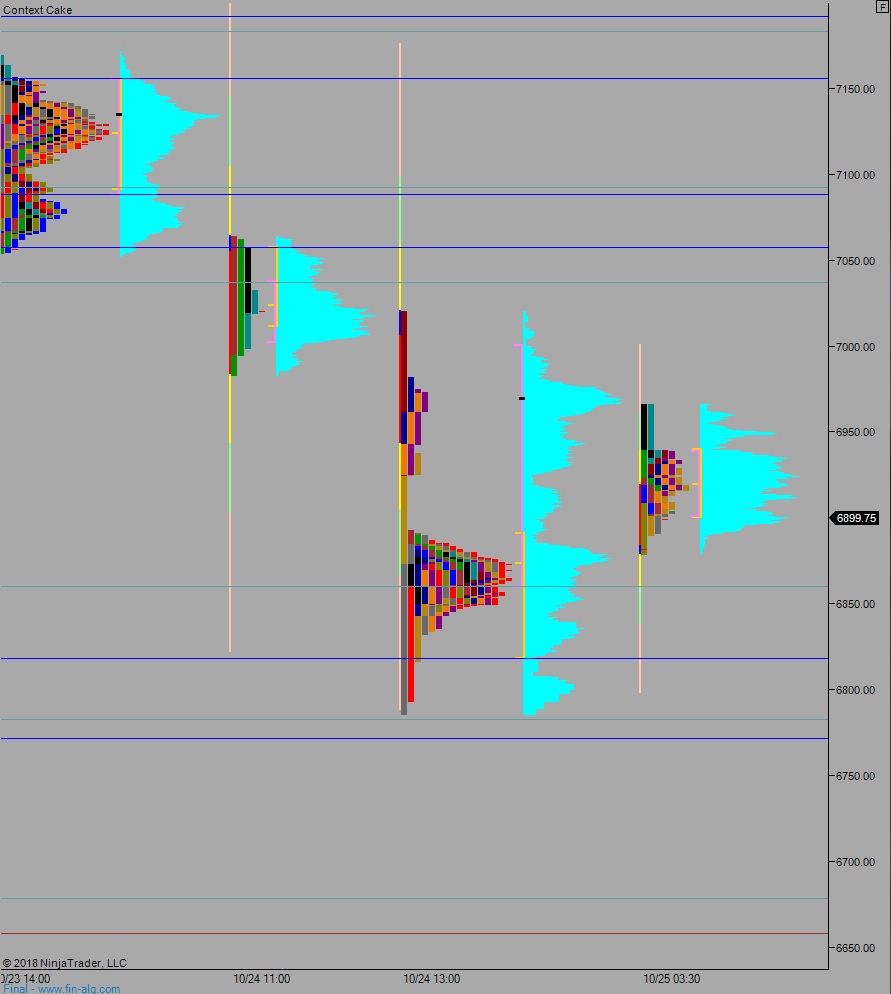

Yesterday we printed a trend down. The day began with a small gap down. Sellers stepped in right on the open, leaving the open gap behind. A responsive bid was found late in the morning and we rotated right up to the daily midpoint before sellers became initiative and began to trend the market lower. The selling continued clean through to end-of-session, pressing us down through the prior swing low and into price levels unseen since early May.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6838.50. From here we continue lower, down through overnight low 6816.75 and then down through the Wednesday cash low 6785.75 setting up a move to target 6771.50 before two way trade ensues.

Hypo 2 buyers drive off the open, rejecting trade down below 6890 and working up through overnight high 6966.50 setting up a move to target 7000 before two way trade ensues.

Hypo 3 stronger sellers trade us down to 6700 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: