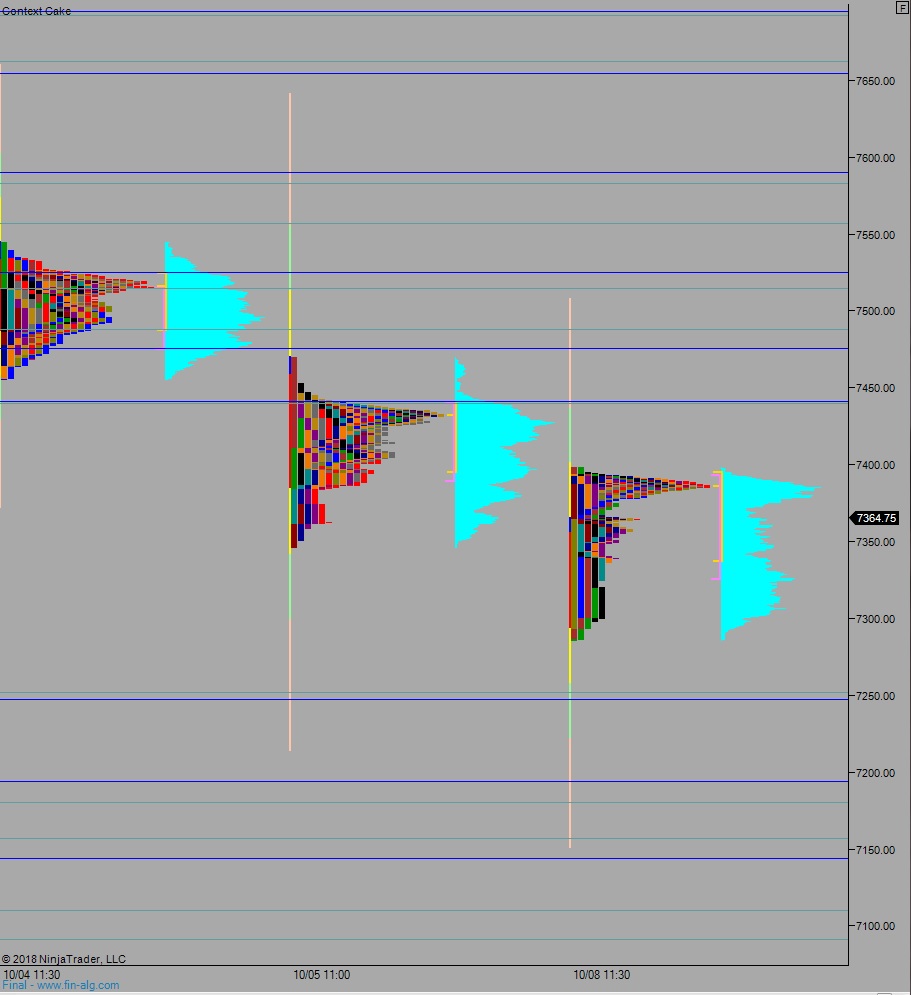

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, trading down but catching a responsive bid ahead of the lower quadrant of Monday’s cash range. As we approach cash open price is hovering at Monday’s midpoint.

On the economic calendar today we have 3- and 6-month T-bills up for auction at 11:30am and 4- and 52-week bills at 1pm.

Yesterday we printed a normal variation down. The day began with a gap down and two-way auction on the open. Buyers drove shortly after, closing the overnight gap but stalling right at it before the first hour of trade was in [initial balance]. Then, after looking like the market was catching a bid at the daily mid, sellers instead stepped in and initiated a fresh leg lower pressing up range extension down and trading deep into the August second conviction buy day. By early afternoon the market had made a low with a quality look. We then spent the rest of the day rallying higher, eventually closing up above the daily midpoint.

Normal variation down.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7392.50. From here we continue higher, up through overnight high 7398.50. Look for some chop at the 7400 century mark before buyers continue higher to 7439.75 and two way trade ensues.

Hypo 2 buyers close overnight gap 7392.50, take out overnight high 7398.50 then stall out at 7400 before two way trade ensues.

Hypo 3 sellers work down through overnight low 7337 and begin working back down to Monday low 7286.50. They test below the Monday low setting up a move to target 7251.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: