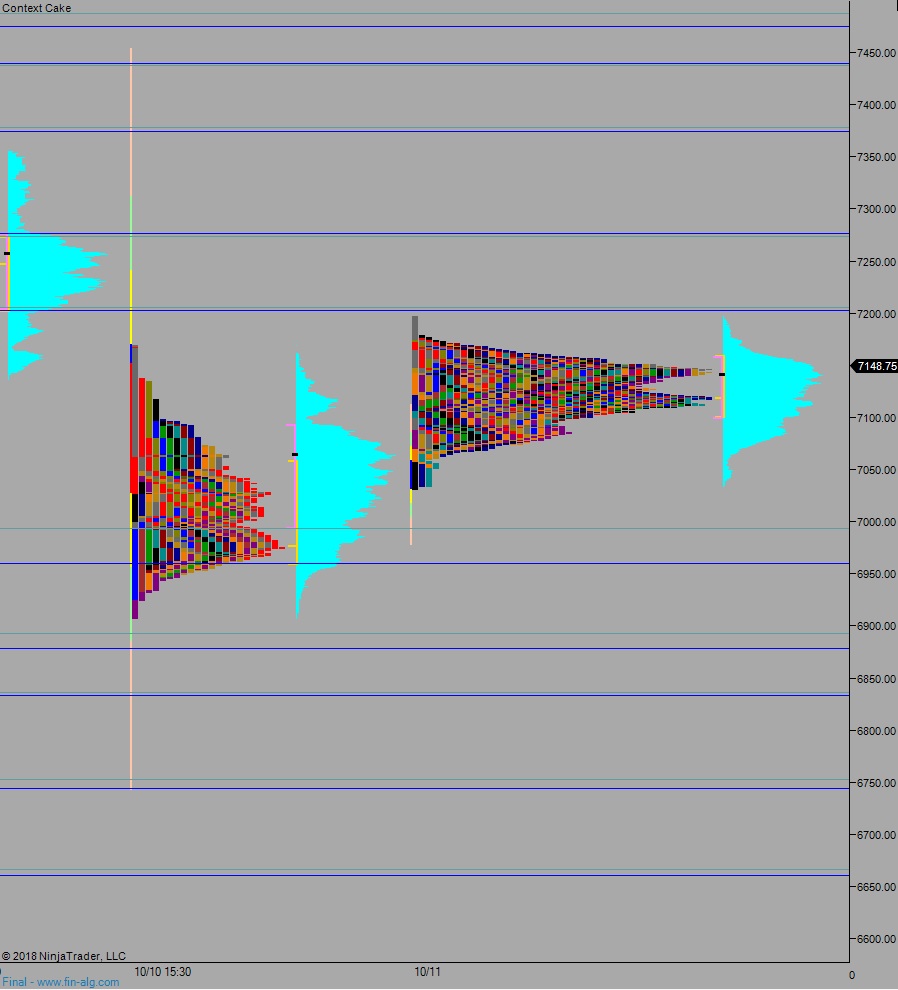

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight balancing out around the Monday midpoint for several hours before overnight buyers became initiative and worked up near the Monday high. As we approach cash open price is hovering near the Monday high but all overnight trade has been contained within the Monday cash range thus far.

On the economic calendar today we have industrial/manufacturing productions at 9:15am, NAHB housing market index at 10am, a 4- and 8-week T-bill auction at 11:30am, and long-term TIC flows at 4pm.

Yesterday we printed a normal variation up. The day began with a slight gap down and drive lower. The first hour of trade was dynamic and for most of the day we traded inside of it, making it look like we may end up with a normal print. But then, late in the session price pushed range extension up by a few ticks. Late in the session the intra-day gains were erased and we closed near session low. The entire daily range was contained inside of last Friday’s range. Therefore we printed a normal variation up, inside day.

Heading into today my primary expectation is for buyers to gap-and-go higher, close the Friday gap up at 7173.25 then continue higher, trading up to 7200 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and trade down to 7100. We chop here before rallying back up through overnight high 7153 and continuing higher to close the Friday gap 7173.25 before two way trade ensues.

Hypo 3 sellers work a full gap fill down to 7076.25 then continue lower, down through overnight low 7063.50. Look for buyers down at 6994.50 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: