NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range and volume. Price first rotated higher overnight, trading up near Friday’s cash high before discovering strong responsive sellers around midnight. From then-onward we’ve rotated lower unidirectionally. As we approach cash open, price is hovering along last Friday’s low.

There are no important economic events today.

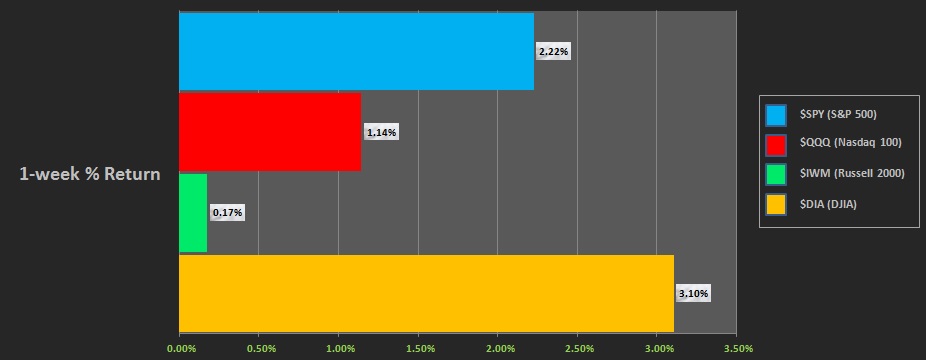

Last week the markets were strong. Early Monday the NASDAQ had standout weakness. Big gap up Wednesday across the board and trend higher. The Russell marked time, chopping along at its composite volume point of control. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap down and what appeared to be a trend lower, with sellers controlling the tape completely until about 2:30pm. Responsive sellers stepped in at last Tuesday’s naked VPOC 6988.50 and we spiked back up to the daily midpoint. Despite buyers working back to the daily midpoint, the week ended with sellers again pushing on the tape.

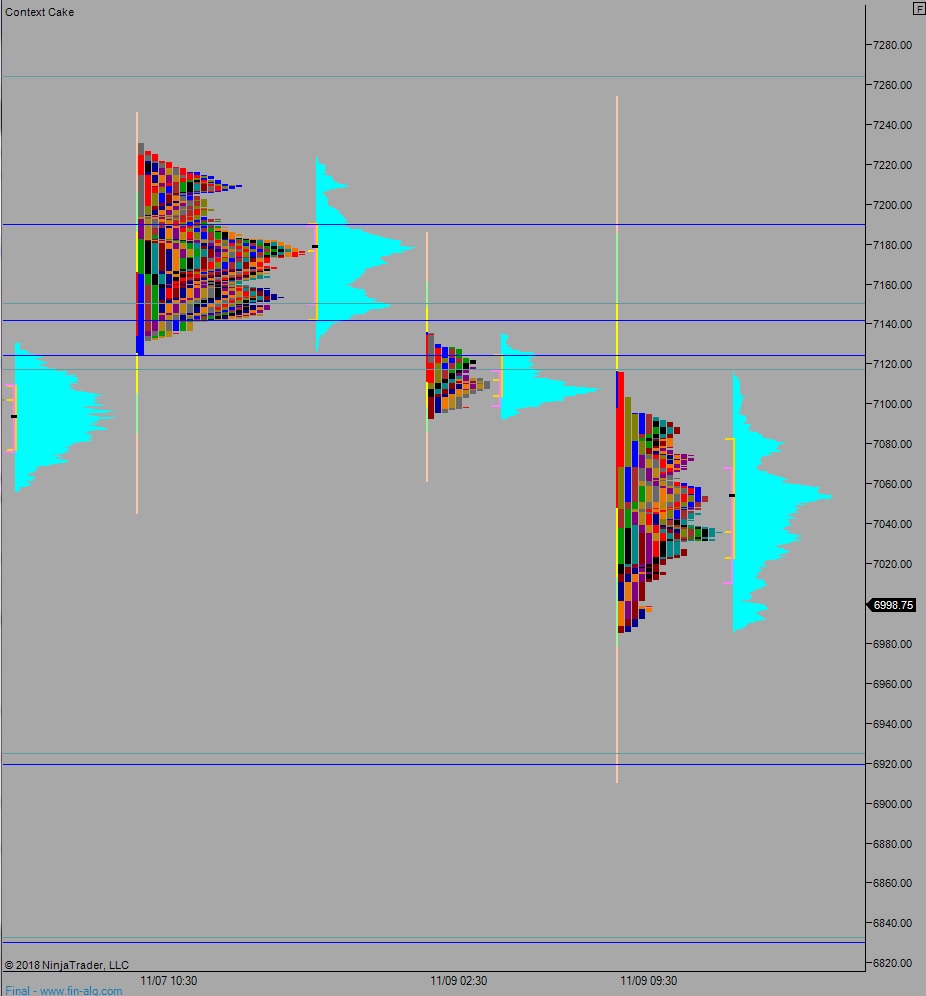

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7052.75. From here we continue higher, up through overnight high 7103.75. Look for sellers up at 7117.50 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, down through overnight low 6985.75 setting up a move to tag the composite VPOC at 6950. Look for buyers down at 6925.75 and two way trade to ensue.

Hypo 3 stronger buyers trade up to 7141.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter