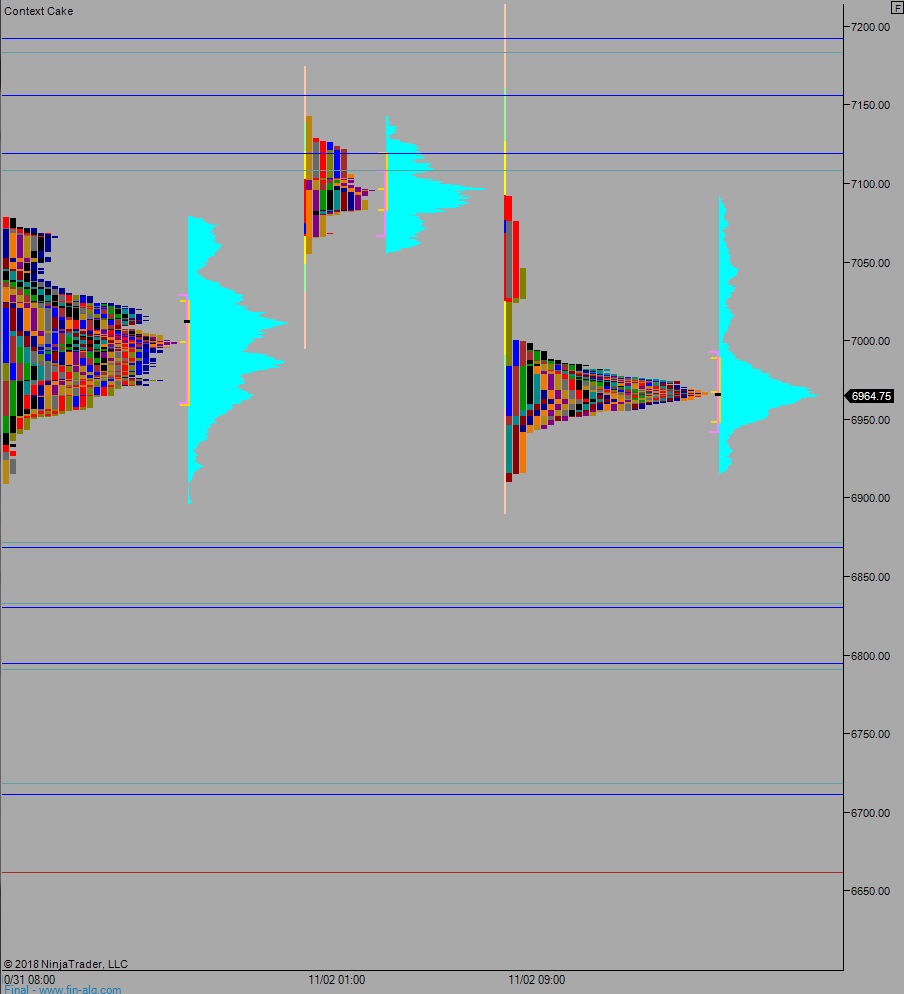

NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme volume on elevated range. Price worked sideways, chopping along the bottom-side of Friday’s midpoint and sticking inside the Friday range for the duration of Globex. As we approach cash open price is sticking inside Friday’s thick VPOC at about 6965.

On the economic calendar today we have ISM non-manufacturing/services/composite data at 10am, a 3- and 6-month T-bill auction at 11:30am, and a 3-year note auction at 1pm.

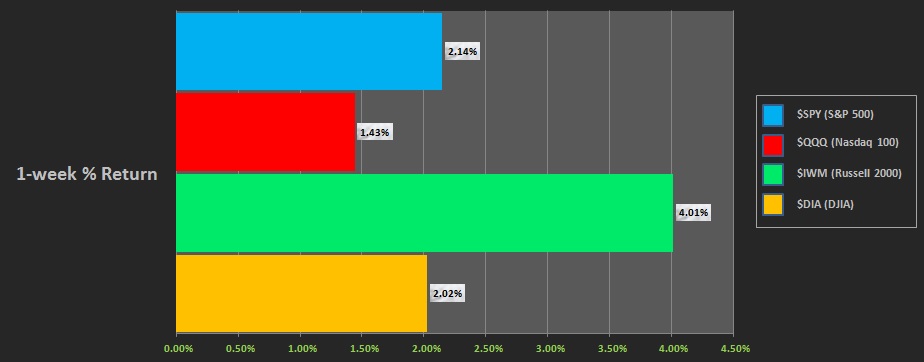

Last week began gap up across the board. Monday morning featured heavy selling that managed to form a sharp excess low late in the session. During the Monday selloff the Russell 2000 was demonstrating relative strength. The Russell carried relative strength for the rest of the week and the other major indices started to form a bounce Tuesday. Then Wednesday we saw a big gap up that had some continued buying through Thursday. Friday managed to discover some responsive sellers and we ended the week with the NASDAQ and Russell sitting at their respective composite VPOCs while the Dow and S&P both have composite VPOCs much lower. Dow and S&P did manage to hold their Wednesday gap into the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap down that buyers quickly resolved with an open spike higher. Said spike briefly took prices to a new weekly high before responsive sellers stepped in. The sellers erased the morning spike then became initiative, pressing price down briefly below the Wednesday gap range before we ultimately settled into balance near the end of the day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6979. From here we continue higher, up through overnight high 6998.50. Look for sellers around 7000 and a tight choppy two-way trade to ensue.

Hypo 2 sellers trade down through overnight low 6944.75. Look for buyers down at 6900 and two way trade to ensue.

Hypo 3 stronger sellers trade us down to 6873 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: