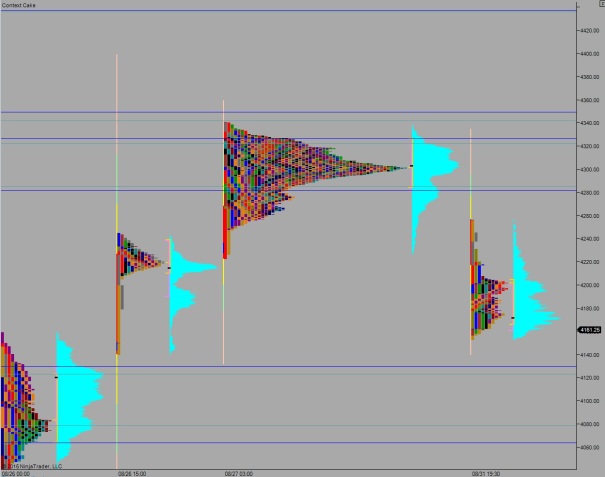

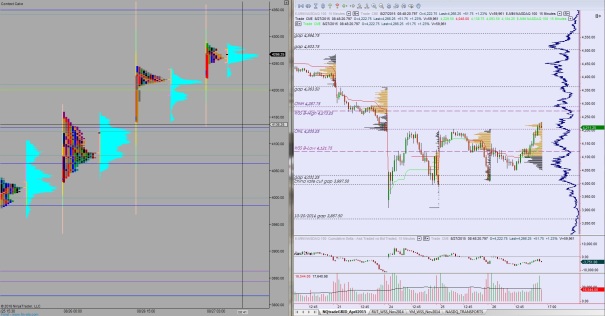

Nasdaq futures started the after hours session with a sharp knife lower after closing near the daily low. Price then spent most of the time grinding lower. At 8:30am Non-farm Payroll data yielded a sell signal on 3rd reaction analysis and the subsequent action managed to push us into extreme 3rd sigma range and volume session stats. Price managed to push down through Wednesday’s lows and down below the open gap left behind Tuesday.

The only other economic event scheduled for today is the Baker Hughes rig count at 1pm.

Yesterday we printed a neutral extreme down. It was the 8th consecutive neutral day and started with a gap up and 2 way trade. After sellers closed the overnight gap buyers worked higher before stalling at an interesting LVN left behind on 8/31. From there we pushed lower the rest of the day.

Heading into today, my primary expectation is for early liquidation action. Look for sellers to press their overnight momentum off the open to target the 9/1 low down at 4118.25. A bit of probing finds buyers and 2-way trade ensues heading into the holiday weekend.

Hypo 2 buyers push into the overnight inventory and work on closing this overnight gap. Look for a ‘check back’ to the NFP ‘crime scene’ up at 4188. If sellers are not present here then we continue higher to test value area high 4211.50. Struggle and churn, then perhaps a full gap fill up to 4228.25.

Hypo 3 grinder session, in and around 4200.

Levels:

Comments »