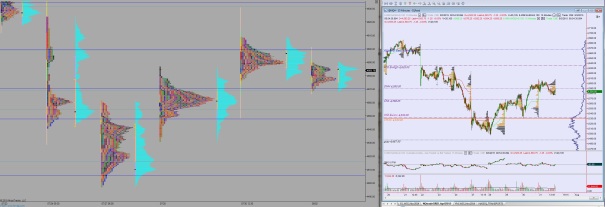

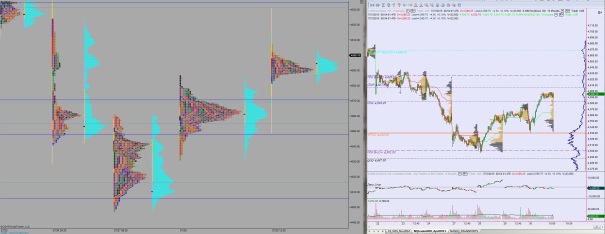

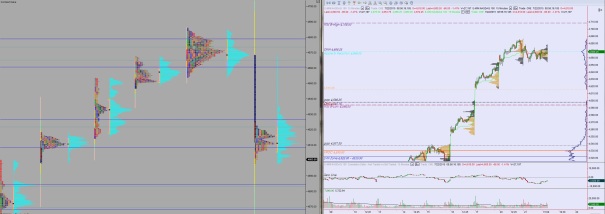

Nasdaq futures are up a touch on the overnight session. The range and volume were normal overnight and contained within Wednesday’s range. Overall the market profile structure shows a slight imbalance that would need lower prices to resolve (see blue drawing on MP chart below).

At 8:30am the Initial/Continuing jobless claims data came in mixed and introduced some sellers onto the tape. We also have natural gas storage data at 10:30am, but investors will be turning their attention to tomorrow morning when the monthly NFP stats are slated for release.

Yesterday we formed a normal variation up day type. Price opened gap up and drove higher but big sellers were seen selling into the drive. By early lunch buyers ran out of steam and the market rolled over. Selling was not dynamic enough to push the day into neutral territory and Tuesday’s open gap remains open.

Heading into today my primary expectation is a choppy session with a downside bias. I expect big rotations to lack follow through making momentum difficult to trade. Look for sellers to push down through the overnight low 4586.75 setting up a gap fill trade down to 4551.75. From there look for sellers to attempt a test below Monday’s low 4540.50.

Hypo 2 buyers push on the open and take out overnight high 4608.75 and make a move to target 4632.

Levels:

Comments »