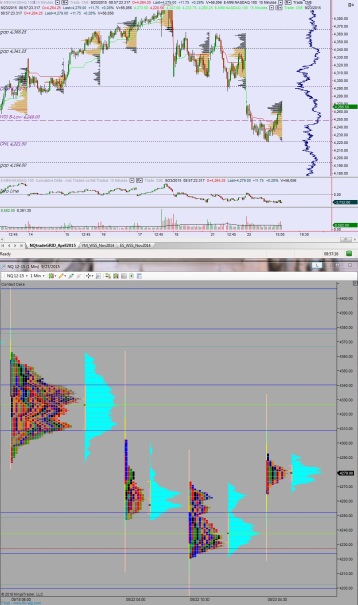

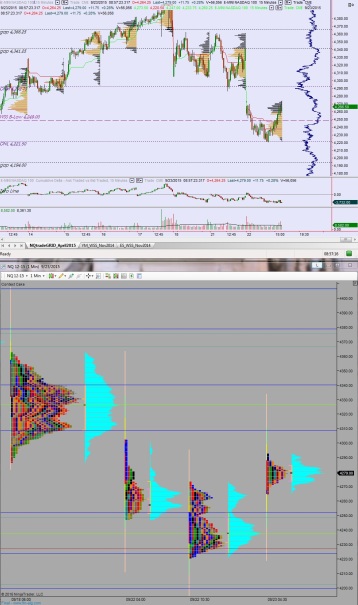

Index futures are pricing a positive open for stocks this Wednesday. The NASDAQ managed to print an extreme range as it moved higher on elevated volume. Price managed to hold Tuesday’s low before turning higher and trending for most of the session to make a fresh weekly high heading into the midweek trade. At 7am MBA Mortgage Application data came out much higher than expected. The initial reaction was a small buying pulse.

The only other economic event today is the Consumer Credit data at 3pm. Investors are likely to begin weighing the looming FOMC minutes (tomorrow at 2pm) into the decision process as today progresses.

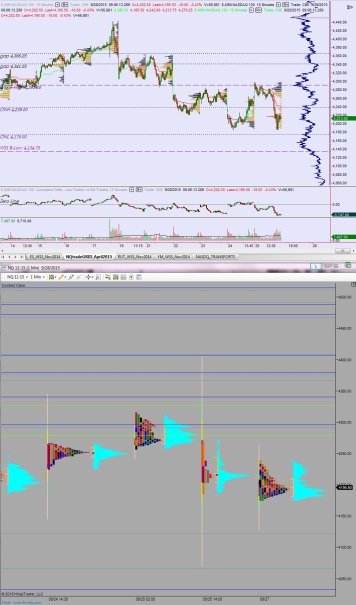

Yesterday we printed a normal variation down. This day type is characterized as having a balanced, bell-shaped volume distribution. It earns the ‘down’ potion from extended price lower after forming initial balance (first hour of trade). It carried a slight expectation for lower prices heading into today—thus its reasonable to surmise short sellers being in an uncomfortable position heading into today.

My primary expectation today is for buyers to push off the open and trade up to the open gap at 4341.25. This is also the VAH of a well established balance area formed around 09/18. From there look for sellers to step in and work into the overnight inventory to test down to 4304 where I expect buyers to defend and two-way trade to ensue with a slight positive drift.

Hypo 2 buyers gap-and-go up. Price takes out 4341.25 and overshoots it early, setting up a move to target the open gap at 4366.25. Stretch target is 4378.50.

Hypo 3 sellers work down through 4304, muddle about the 4300 century mark, then continue working lower to close the overnight gap down to 4289.50. From there they seek to target overnight low 4270.75 and Monday’s still open gap down at 4261.75 before two way trade ensues.

Levels:

Comments »