Nasdaq futures are priced to open down over 100 points and well into ‘pro gap’ territory. By pro gap I mean any attempt to fade the big change in price would require professional resources and is large enough that we are unlikely to fill it. The volume and range both blew outside of 3rd sigma—like we have not seen since last Thursday. Price began pushing lower from the close of regular trading and steadily declined all night.

On the economic calendar we have only one event today. At 10am we willvhear the ISM Manufacturing read. Keep in mind we have The Fed Beige book tomorrow afternoon and Non-Farm payroll data Friday morning.

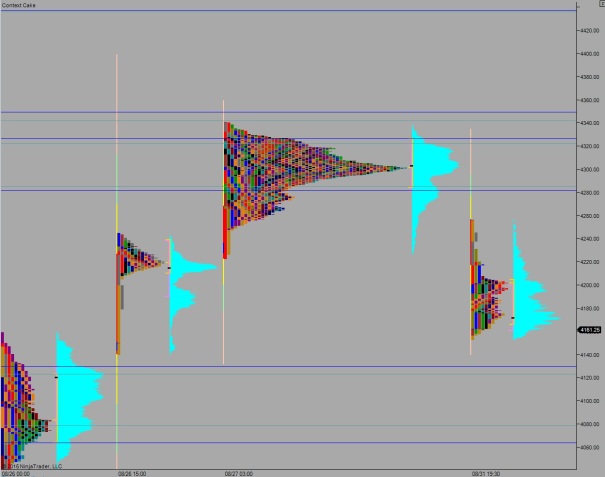

Yesterday we printed a neutral extreme down. It was the fifth consecutive neutral day as higher time frame investors aggressively push this market around.

Heading into today, we are trading in some single prints meaning it is a fast zone. My primary expectation is for price to continue sliding lower to test 4130.25. Look for buyers to defend ahead of 4122.75 and push back up to around 4170 then two-way trade ensues.

Hypo 2 sellers push down through 4122.75 as panic ensues. Look for a move down to 4080 before buyers step back in.

Hypo 3 buyers push into the overnight inventory and trade up to 4200 before price rolls over and continues probing lower to target 4130.25.

Hypo 4 buyers push up through 4200, churn, then leg higher to close the overnight gap up to 4262.50.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

would a lower low here on volume signal the end of the bull run for you?

I think this all resolves by October, but I will just take it 1 week at a time

Lolz at that picture!

Hat Tip: Good-day, Sir.

ravenous women

Our Grinder is more closely resembling a soggy Frenched Dip this morning… I was so ready to raise some cash early in the week before Labor Day, but was hoping for some “up” days…

me too Unc, meeee…too.

Rule 48 invoked, Open rejection reversal open type, working into 4200, potential for hypo 4

TRIN however calls this morning push up into question

Run for your lives!!!!

quite hard too understand reasons you posted why this particular gap of today can’t fill

sheer size, but anything is possible

if bulls can sustain over 4200 might change the tone back to bullish on the day

Do you know what happens when a statistically improbable event happens 5 days in a row? Your uncle thinks it’s going to happen a 6th time…. ha ha! (not really) – IT’S NOT HAPPENING!!!

professional money and single digit zone is bit hard to position too..while i think we must clomb lower to other supports , to grind back and more later , not so sure bears are so confident selling all day at this levels with the open gap layin around..sure the gap can be partially filled , and sold too by bears…….

i’m up for the day and considering all I should ( and will ) refrain trading more in this range

longer horizon , market needs to check supports / DJ 14000+ / to get back in bull mode

sooner or later . it may be sooner then later .

thanks for sharing your ideas bood

happy to share

didn’t mean to sound harsh just that money selling today -through professional resources or not-is the same that bought before ..about single prints zones i simply do not think they reply very much the behavior ( or volumes..) showed in the past

all of this , obviously , is just a personal opinion