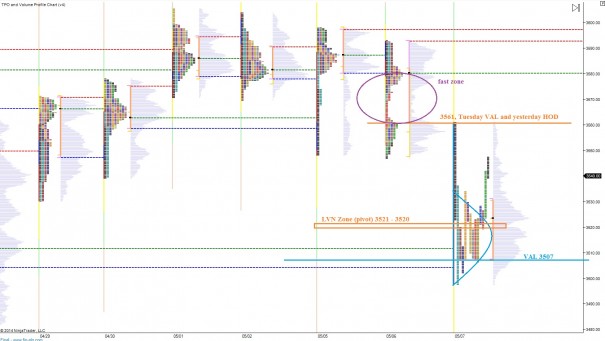

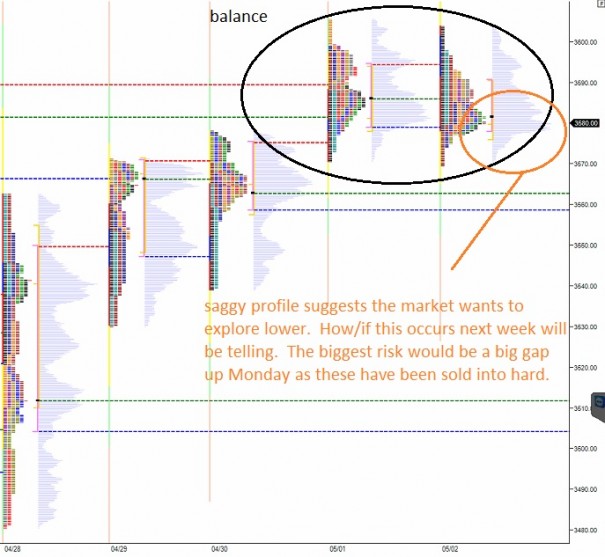

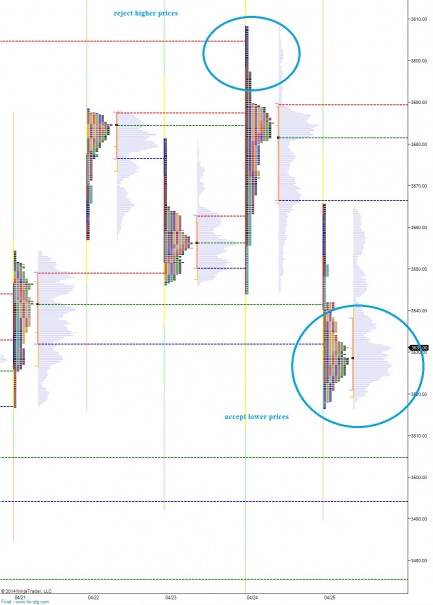

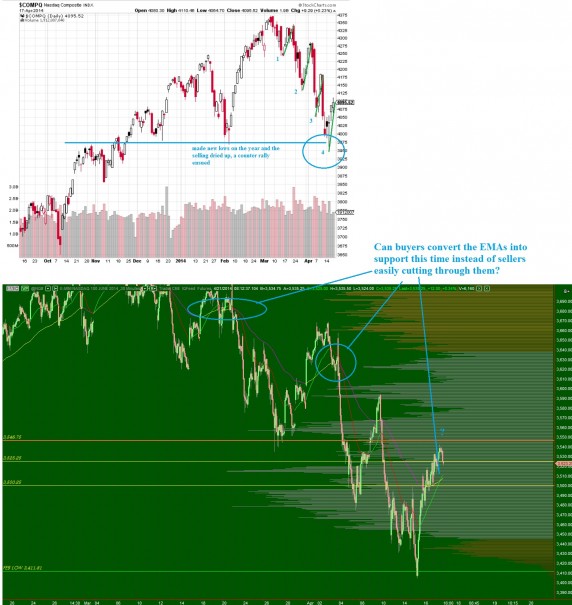

Although we spend most of our time seeking the early stages of trends in either direction, trends we can ride for profit, we must accept that more than half the time the markets simply balance inside of bracketed ranges. Right now is one of these times in the Nasdaq, where price has come into balance on the long term timeframe.

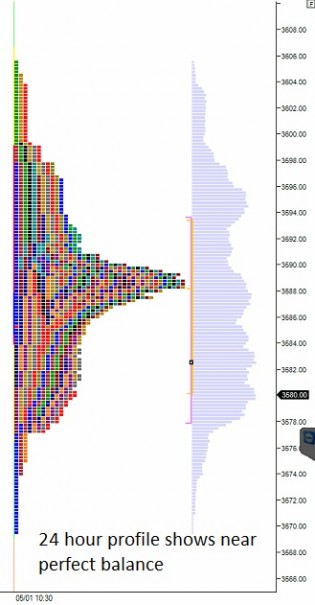

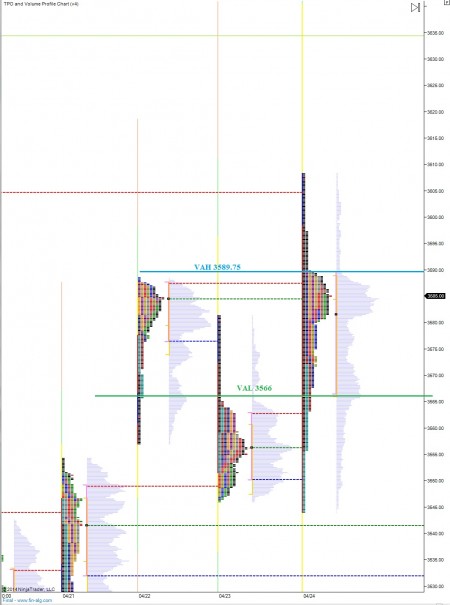

Making the picture even more interesting today is how our intermediate term is also in balance. See below:

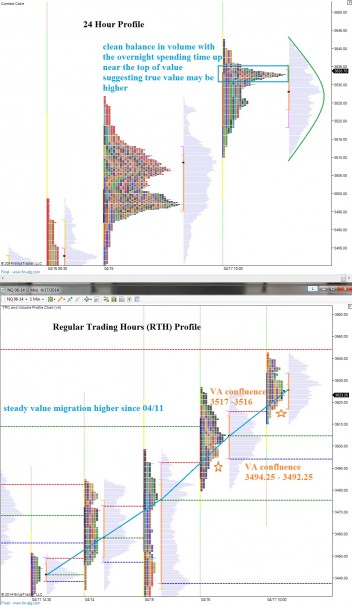

The best strategy until this balance resolves is to ride out any current positions, and sit on your hands unless you have an enticing setup you simply cannot resist. If you do enter a position, it is best to stick to one side of the trade (long or short) and use the bracket extremes to gauge the correctness of your trade. Thus, risk skews in your favor if you can enter a long position below the midpoint of balance or above the mid for a short.

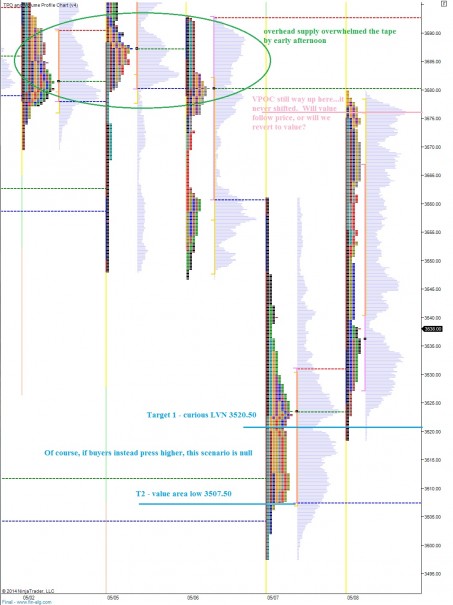

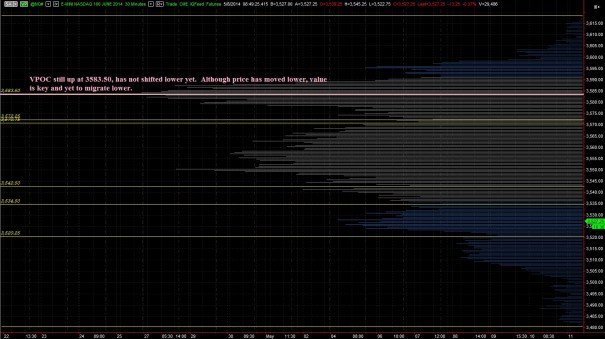

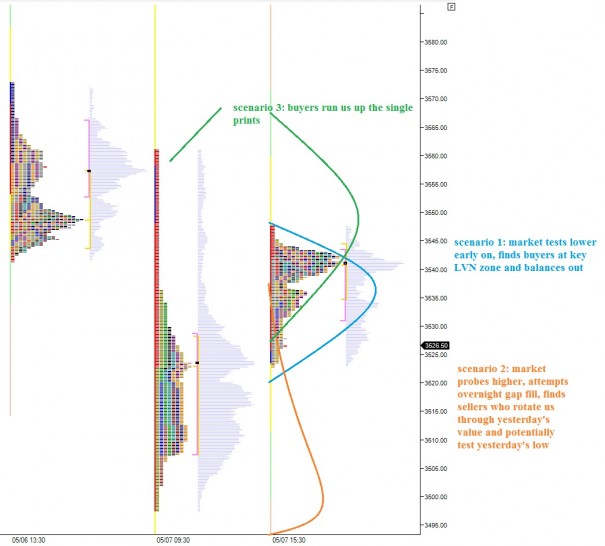

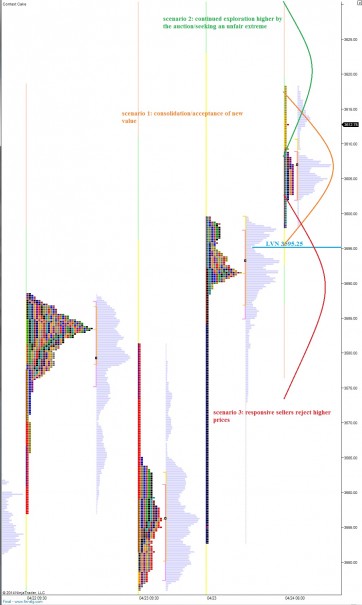

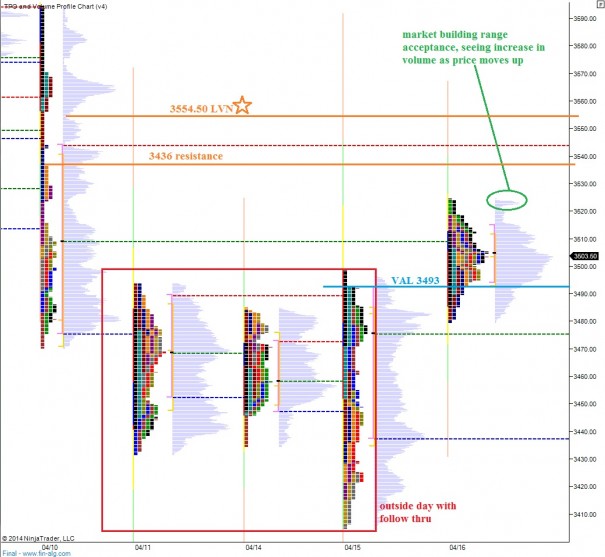

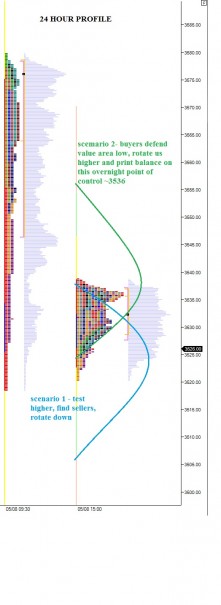

The short term timeframe is nuanced. Buyers pressed value higher yesterday, but the afternoon fade had a sharp velocity and certainly punished almost any new long positions initiated intraday. The buyers controlled yesterday on the net by range extending higher, printing a buying tail, and pressing value higher. However much like a movie, we tend to remember the ending the most, which in the markets case was weak.

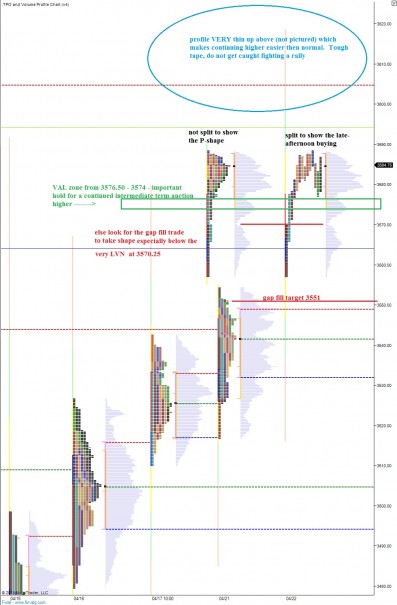

Since we have printed more than three TPOs (time price opportunities, the blocks that form market profile) inside of Wednesday’s range, my goal is to find a clean short entry intraday to ride a rotation through Wednesday’s value while targeting scales at the curious low volume node at 3520.50 and the value area low at 3507.50. Since I know my targets, all I need to find is an entry intraday with risk less then ½ or 1/3 my desired profit. This is risk management. I have highlighted these observations and more on the following market profile charts:

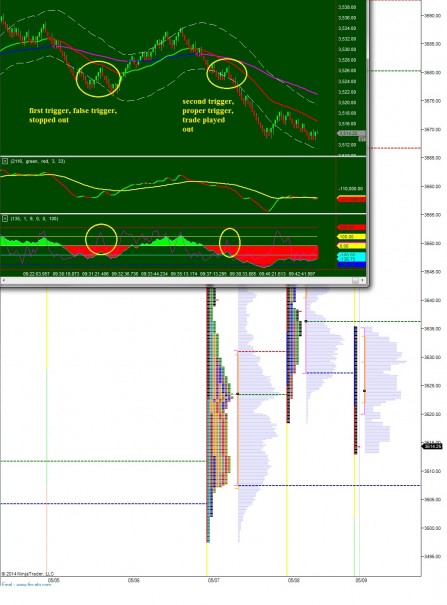

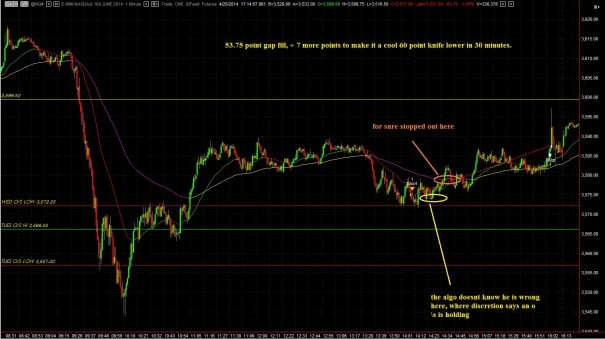

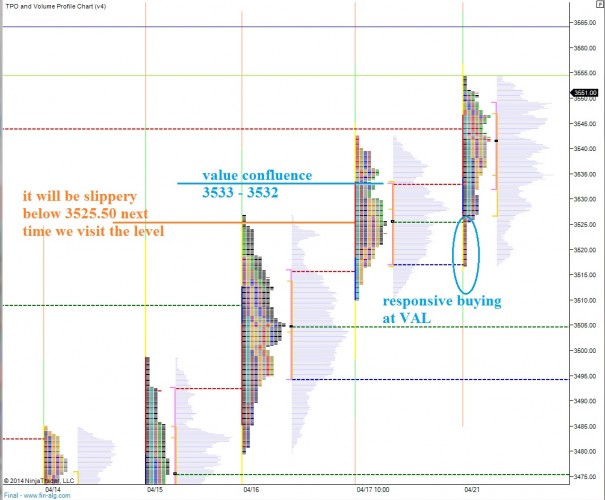

UPDATE: The trade played out mostly as anticipated, here’s the look:

Comments »