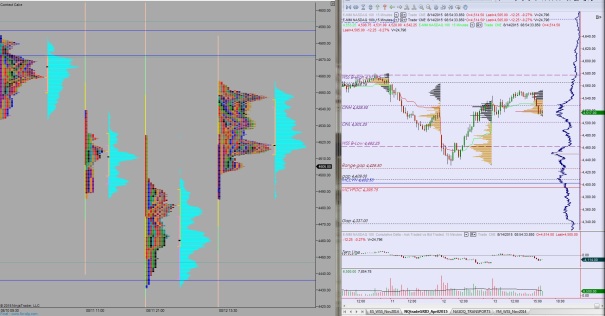

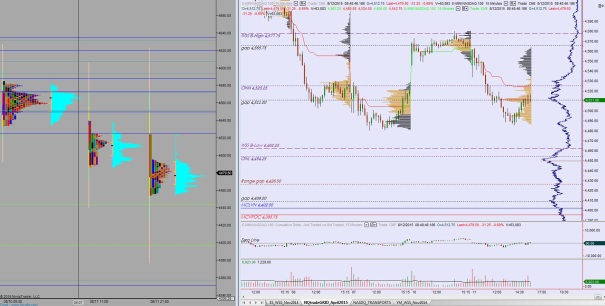

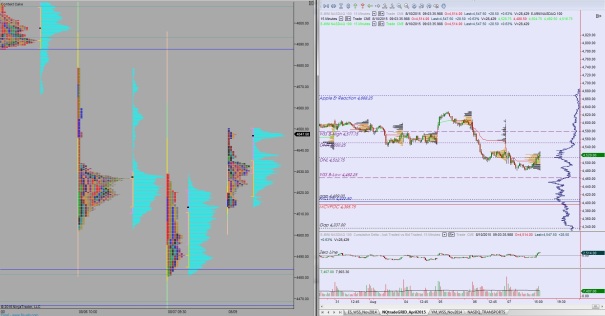

Nadaq futures are down coming into Thursday after printing an abnormal session overnight. News flow accelerated overnight as pundits generously offered reasons for market moves. The overnight range is 51.5 points thus far, well beyond the second sigma threshold on elevated volume. During globex price briefly pushed up to about the midpoint of yesterday before rolling over and taking out yesterday’s low and pressing deep into last week’s range. At 8:30am Initial/Continuing Jobless claims data came out and the initial reaction is buying.

There’s a big data dump scheduled for 10am including Existing Home Sales, Leading Indicators, and the Philadelphia Fed.

Yesterday we printed a neutral day. The day started gap down outside of Tuesday’s range and pushed lower before responsive buyers showed up. Post FOMC minutes buyers turned initiative and close the overnight gap up to 4543.25 then dried up and selling back to the mean ensued.

Neutral days are sessions where the high and low of the first hour of trade (initial balance) are breached. They suggest higher time frame posturing and often occur at/near inflection points. This one occurred in the middle of the range so it is difficult to gain an inflection point insight from it.

Heading into today, my primary expectation is for buyer to push into the overnight inventory. Look for them to struggle to close the gap up at 4503.75 then sellers resume exploring lower. Sellers target overnight low 4461.50. Buyers need to defend 4456 otherwise look for a test below last Wednesday’s low at 4431.25. Stretch target is 4400 century mark.

Hypo 2 sellers work in early buy struggle to capture 4456. Responsive buyers push the overnight gap up to 4503.75 shut then set their sights on overnight high 4513. Look for responsive sellers around 4520.

Hypo 3, chop and erosion. Tight range trade in bottom quad of yesterday’s range with a slight downward bias. Sellers capped at 4440 and two way trade ensues.

Levels:

Comments »