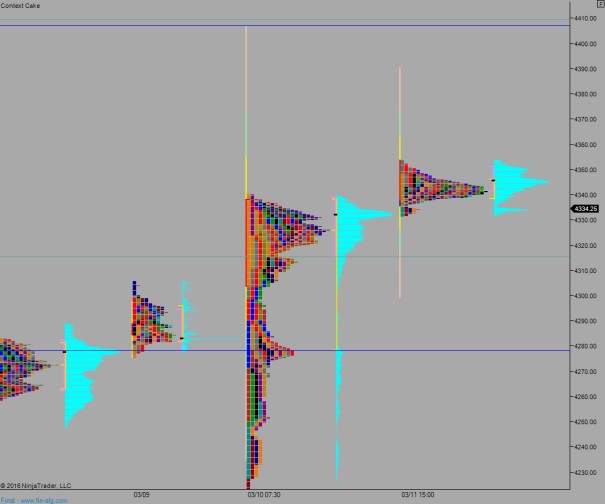

NASDAQ futures are priced to open modest gap up after a balanced overnight session featuring normal range and volume. The Globex session was literally the most mild one, year-to-date. Price held yesterday’s mid on a test down to up and is now up near weekly highs.

On the economic agenda we have U of Michigan Confidence at 10am and Baker Hughes rig count at 1pm.

Yesterday we printed a normal variation up. There was a hard move lower off the open that quickly fizzled out and price spent the rest of the session churning higher.

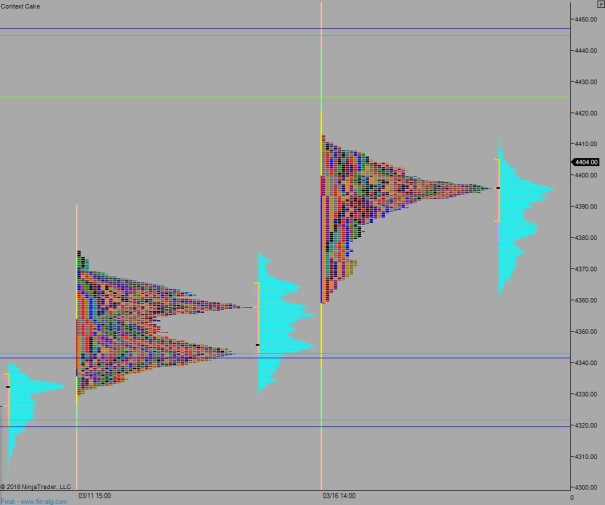

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 4393. From here look for a move to take out overnight high 4405.75 then continue higher to probe above the weekly high 4407.75 before two way trade ensues.

Hypo 2 buyers keep the gap open and race up through overnight high 44057.75 early on before sustaining trade above 4407.75 to set up a move to target 4416 before two way trade ensues. Stretch targets on the upside are 4424.75 then 4444.75.

Hypo 3 sellers close gap down to 4393 then take out overnight low 4384.25. Look for responsive buyers down at 4378.50 before two way trade ensues.

Hypo 4 strong sellers show up, take out overnight low 4384.25 then set out to target 4343 before two way trade ensues.

Levels:

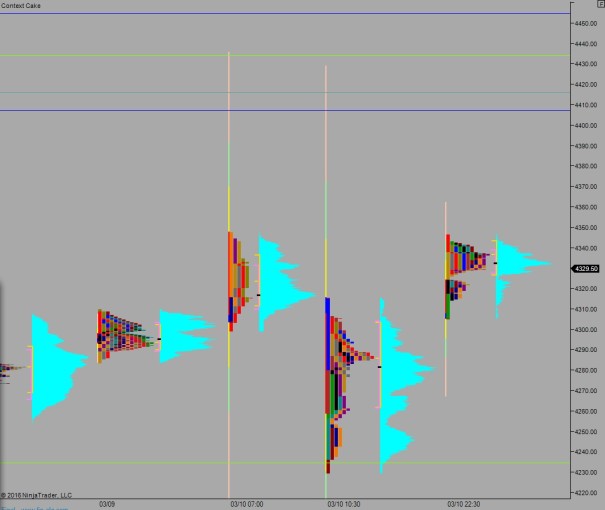

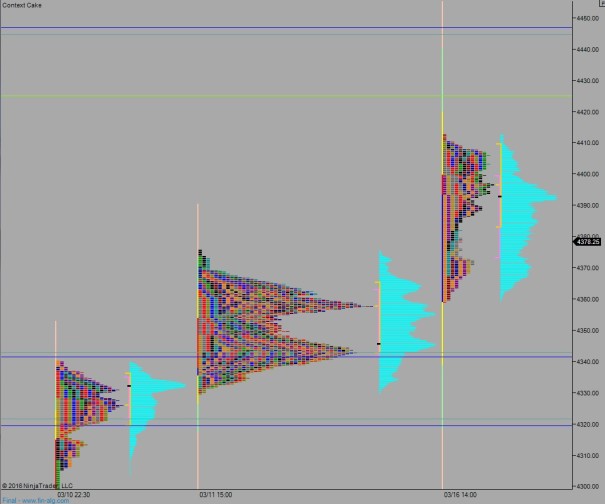

Volume profiles, gaps, and measured moves:

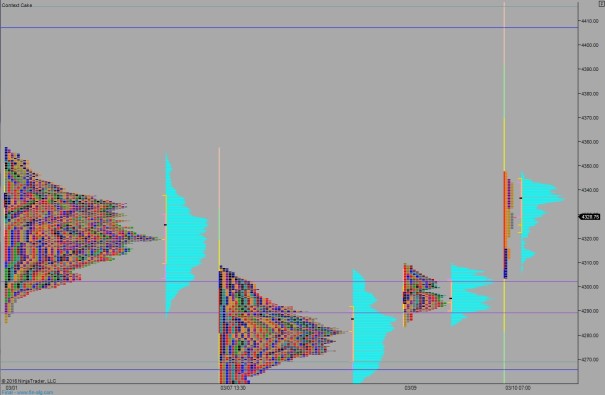

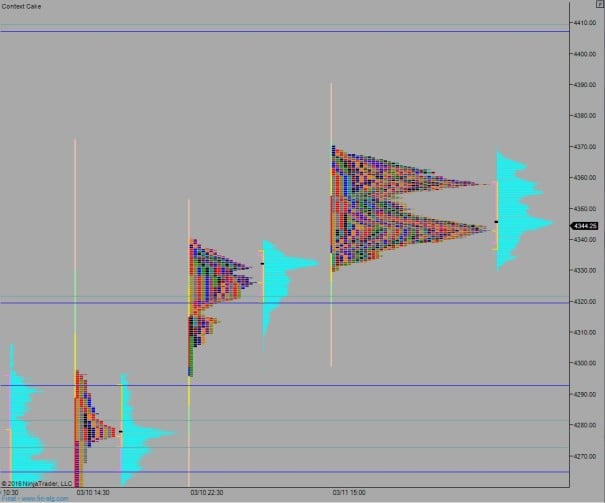

Volume profiles, gaps, and measured moves:

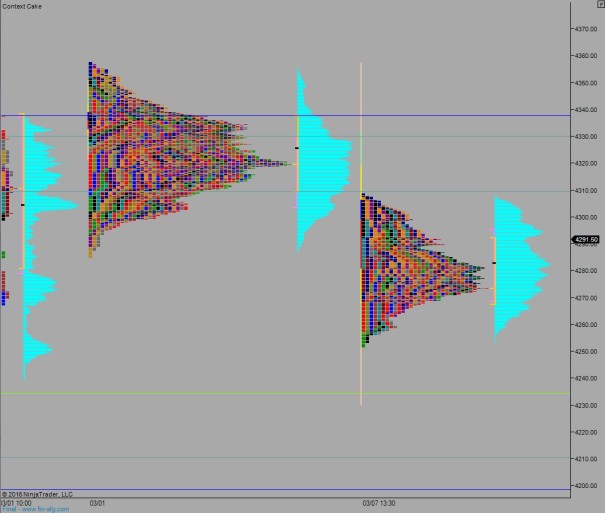

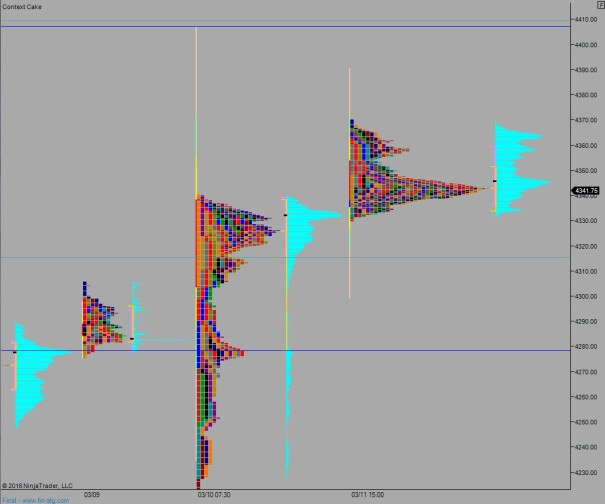

Volume profiles, gaps, and measured moves: