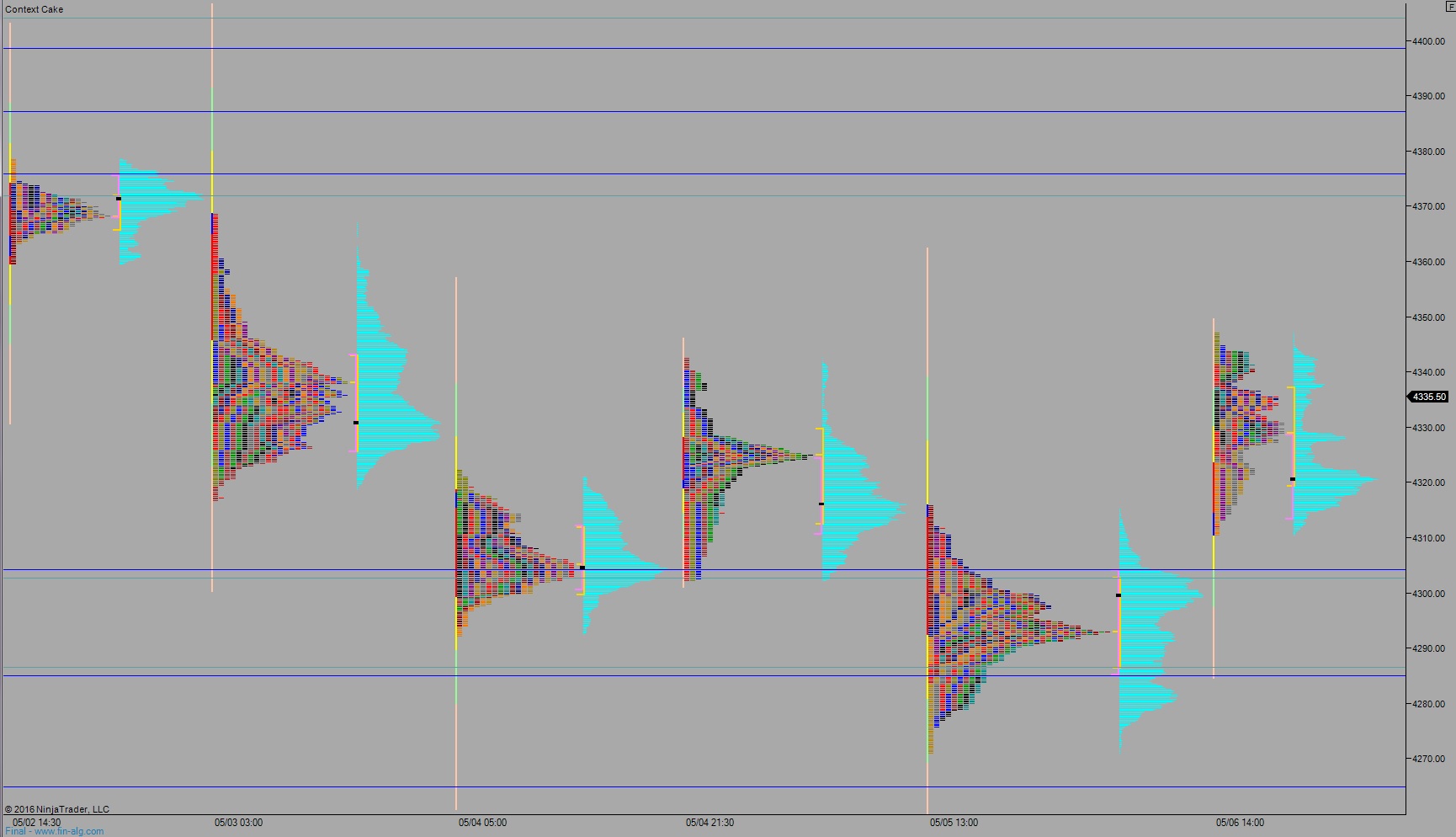

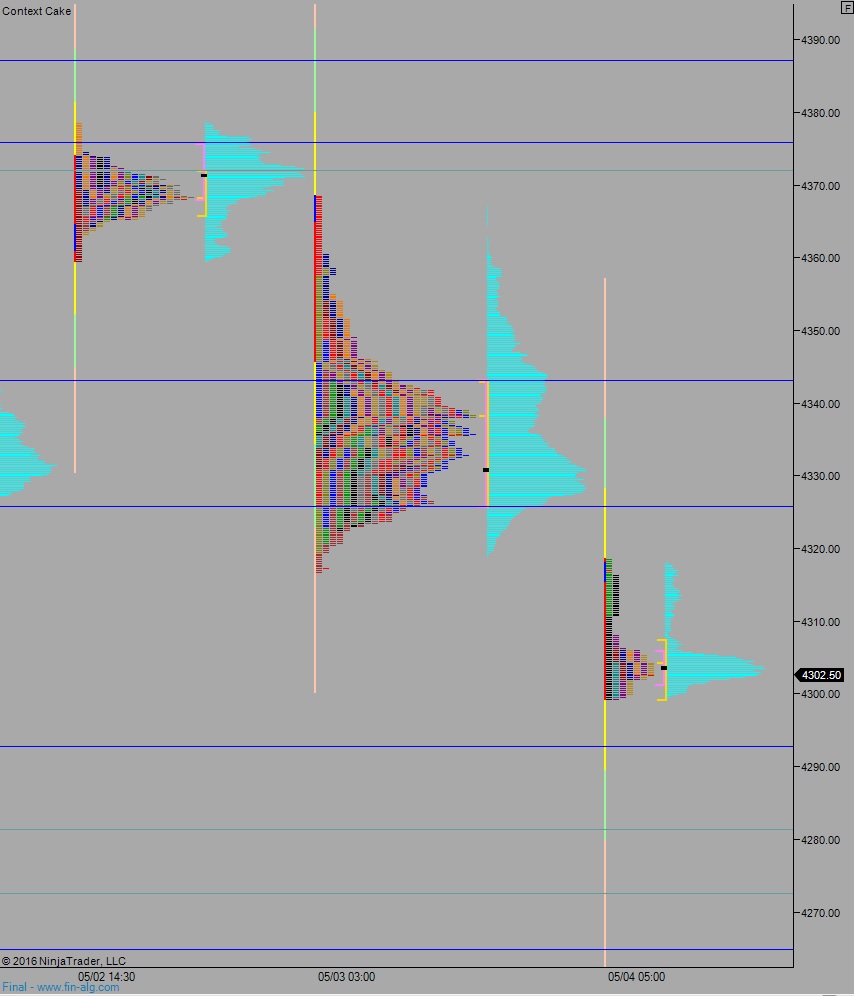

NASDAQ futures are mildly gap down heading into Wednesday trade after an overnight session featuring normal range and volume. Price was balanced overnight, holding yesterday’s lower quadrant until around 8:30am when a hard push lower took price down to new lows on the week. At 7am MBA Mortgage Applications came in at -1.6% and well below last month’s 0.4%.

Also on the economic docket today we have crude oil inventories at 10:30am. More importantly, we have Fed Minutes out at 2pm. The minutes may provide more market volatility than normal due to recent hawkish comments from a few Fed members.

SEE ALSO: FEAR THE FED

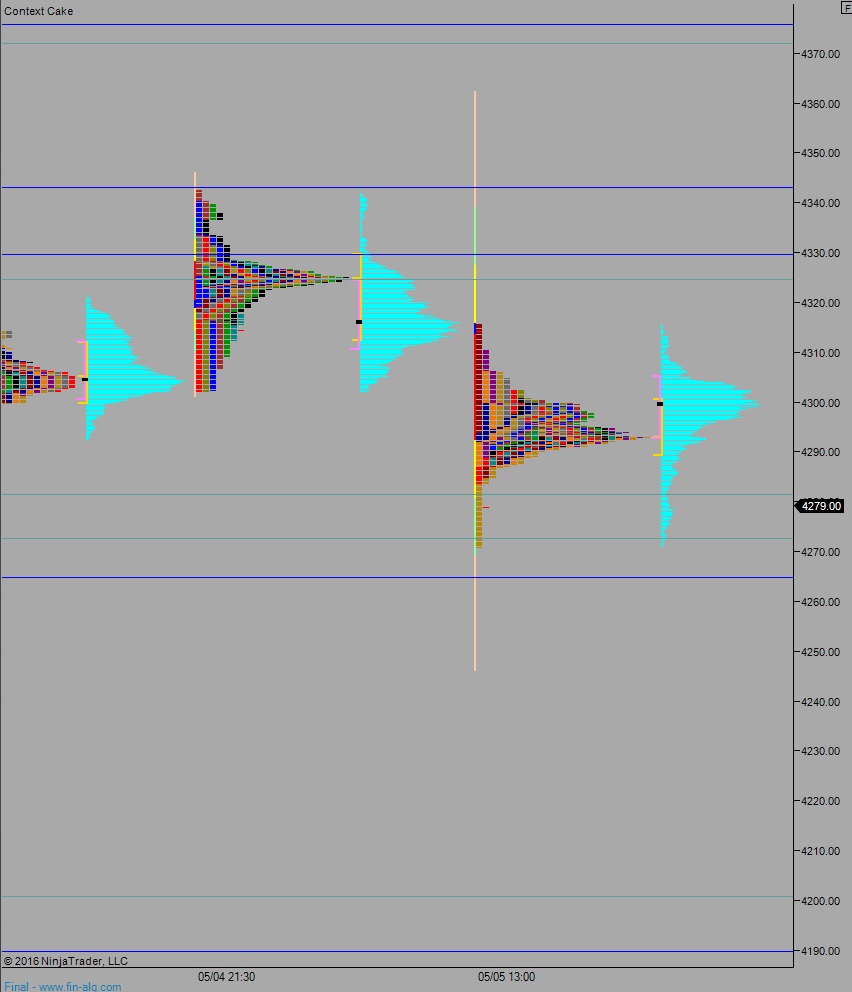

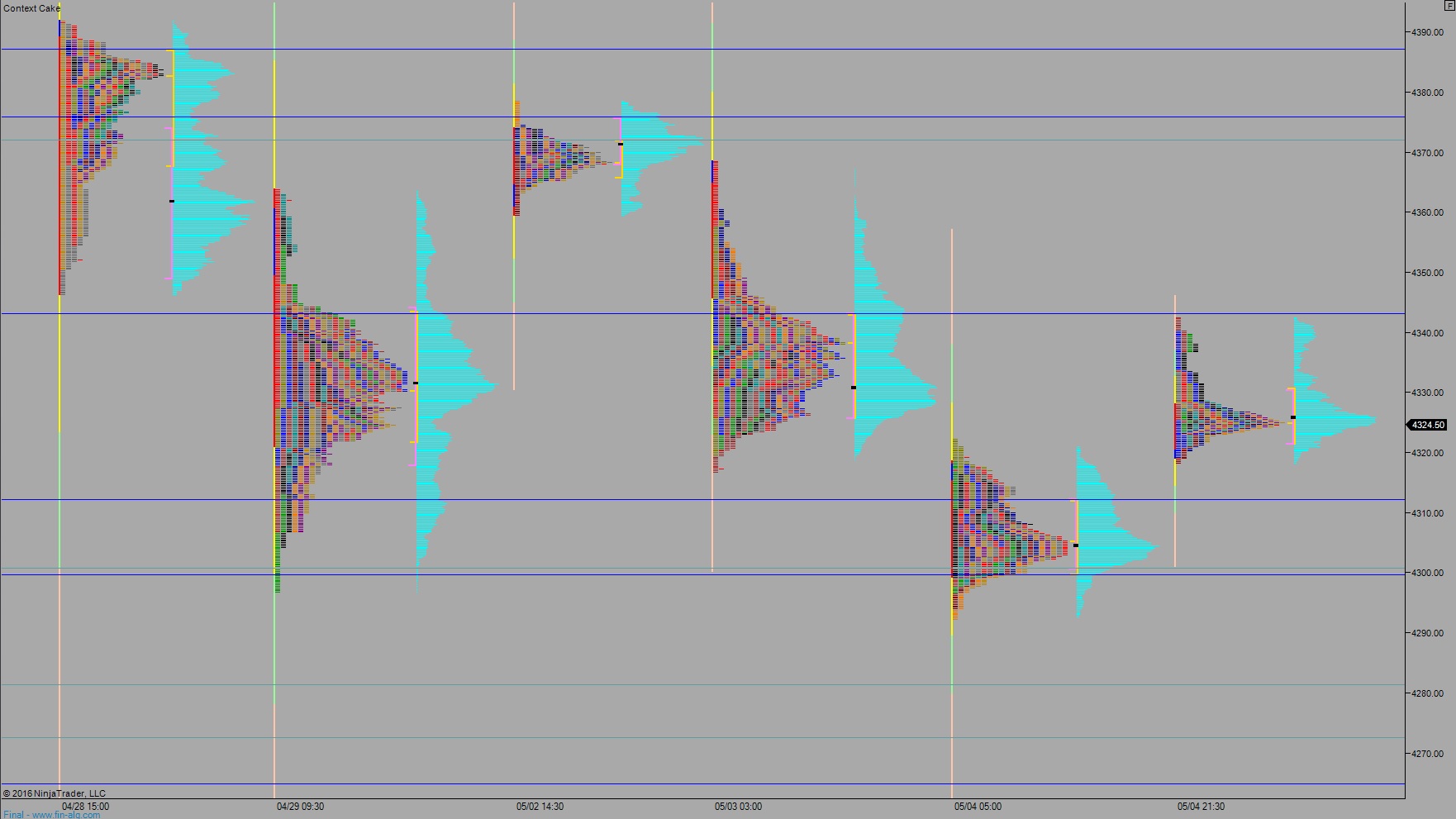

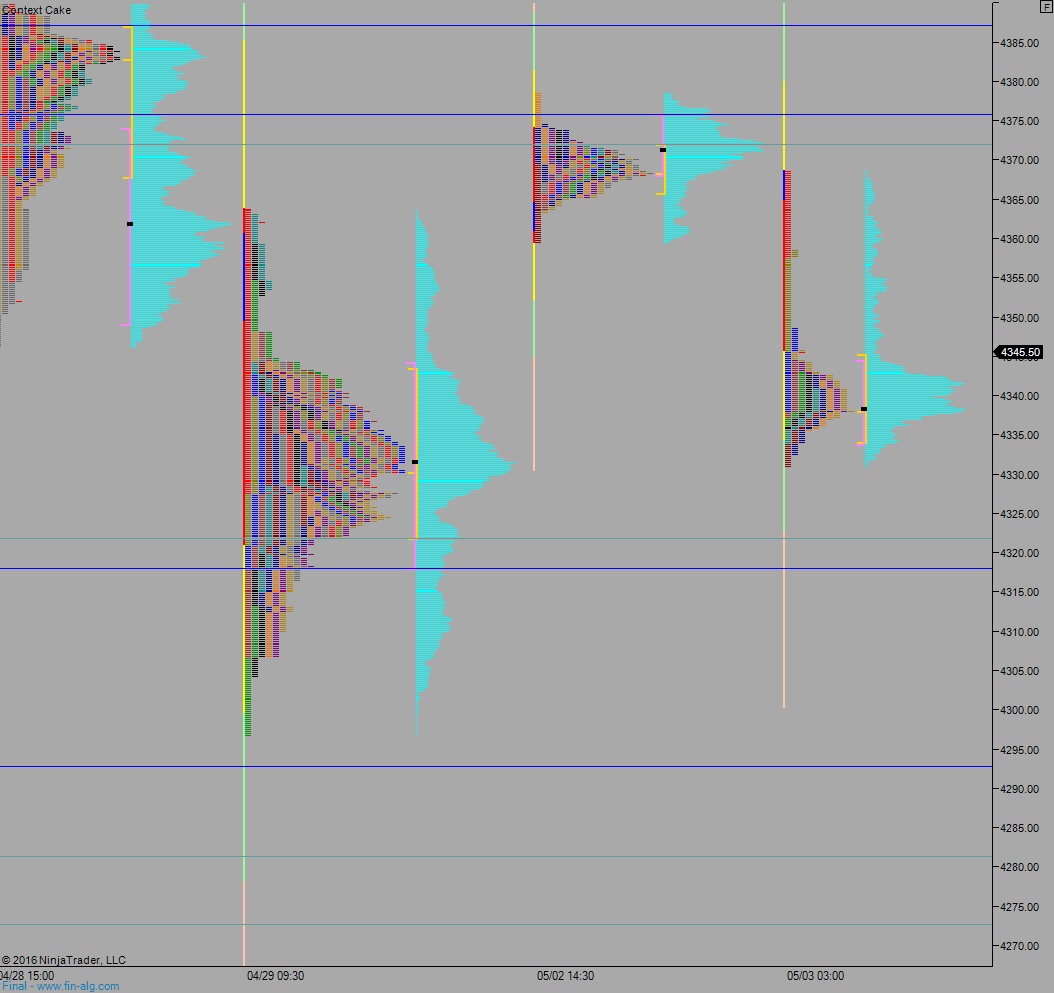

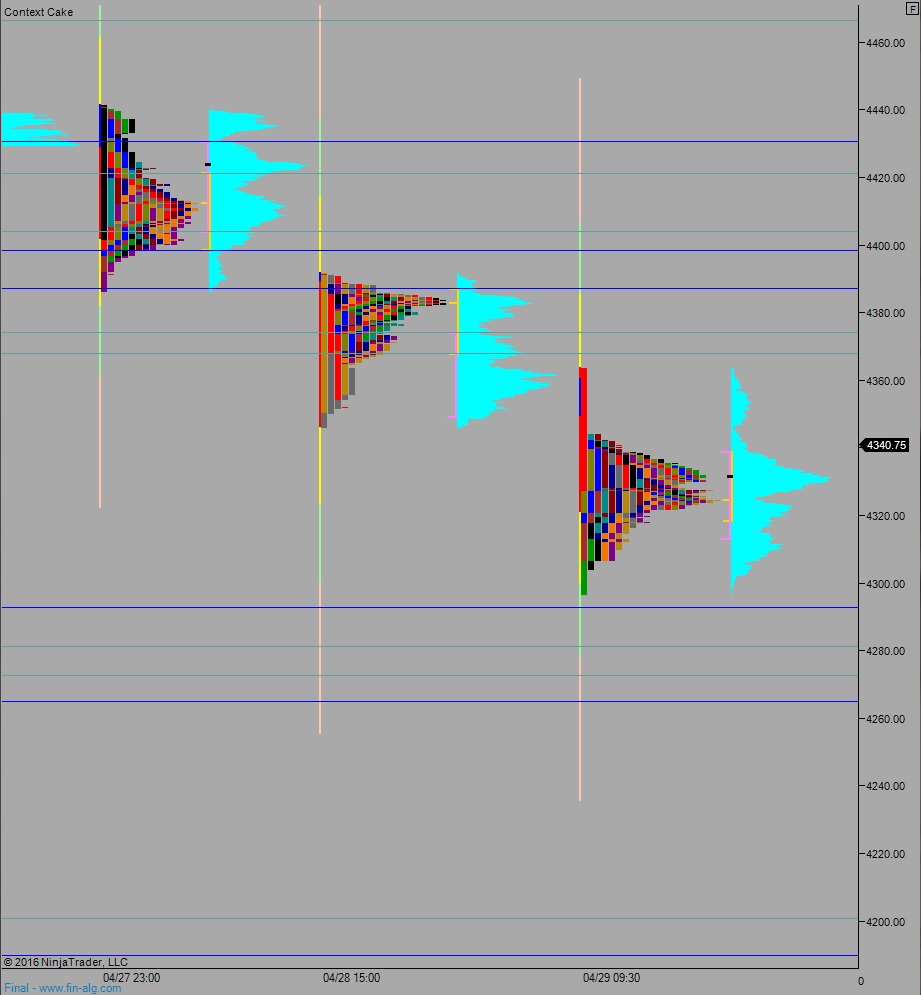

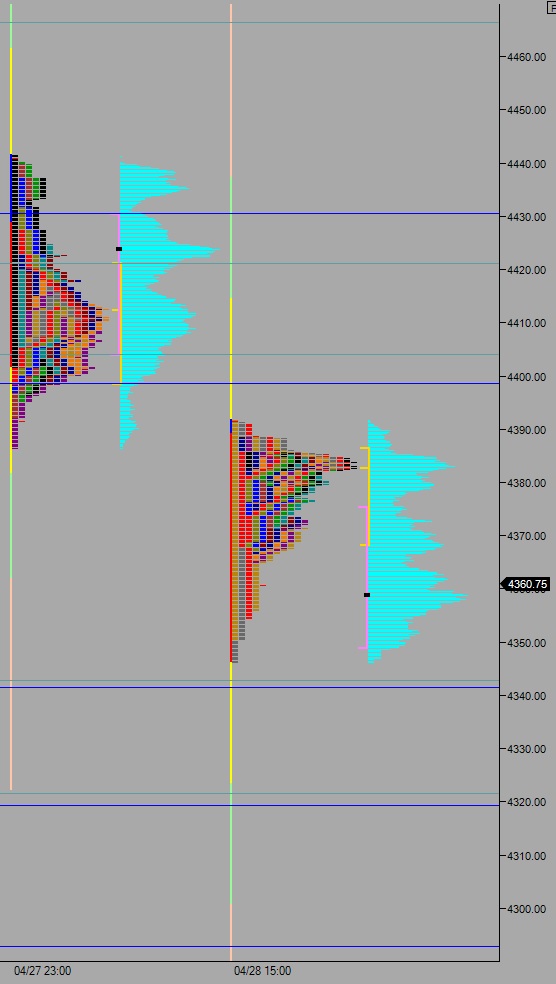

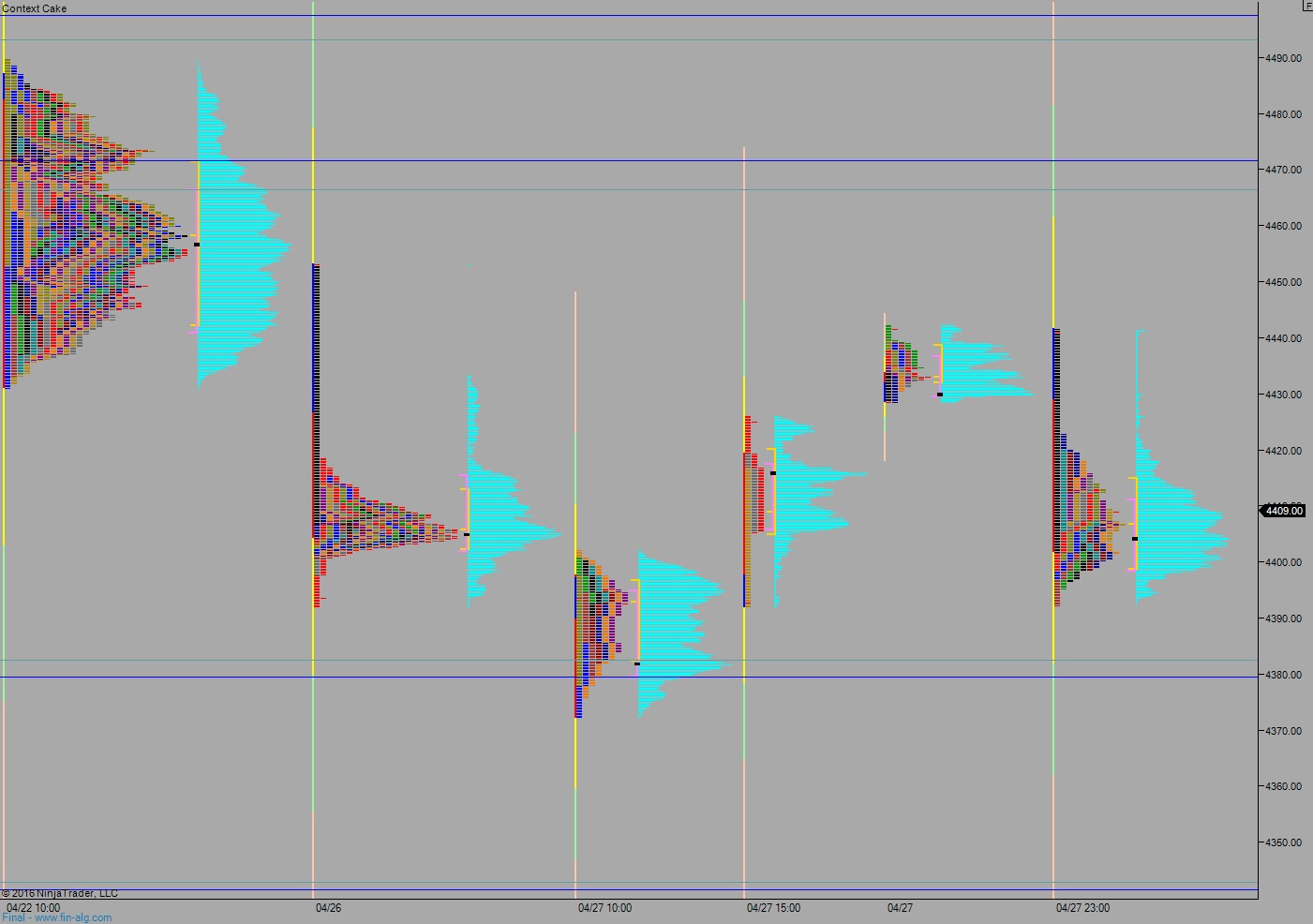

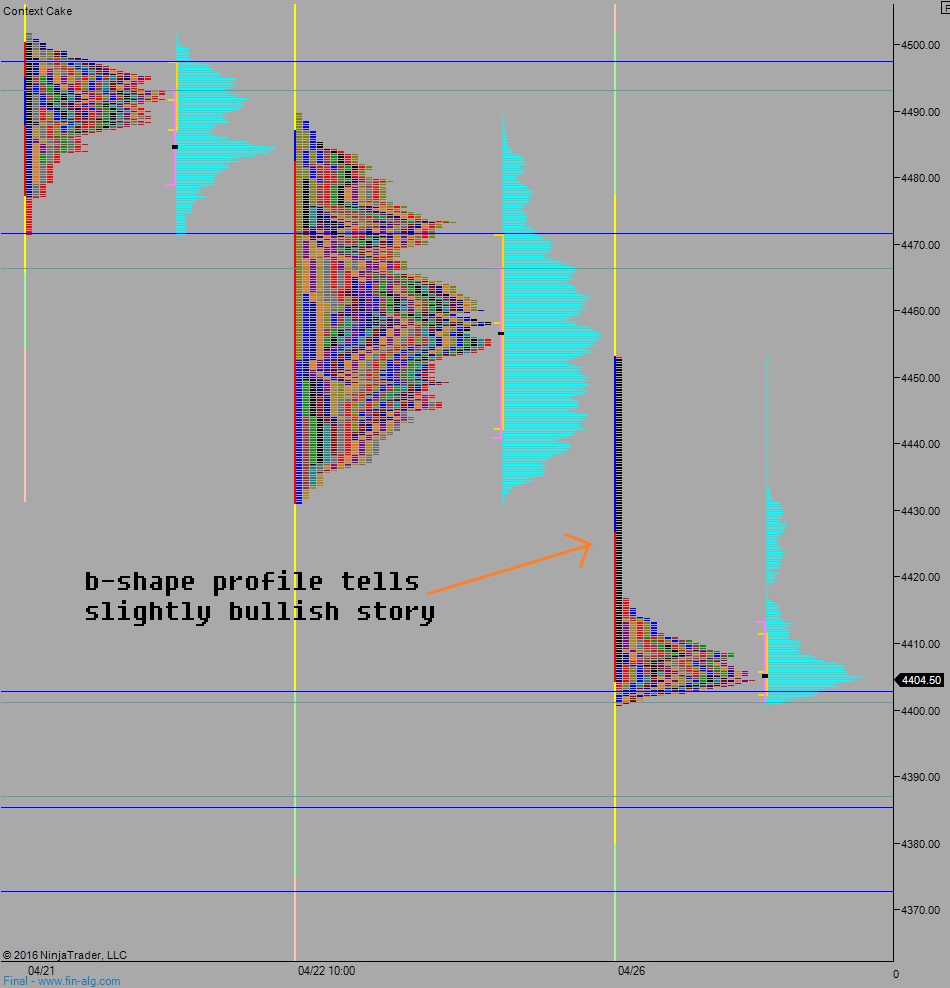

Yesterday we printed a double distribution trend down. This came on the heels of Monday’s trend up. This is the second time in the last 6 trading days where sellers promptly erased up-trend days in the following session. The same thing happened last Wednesday.

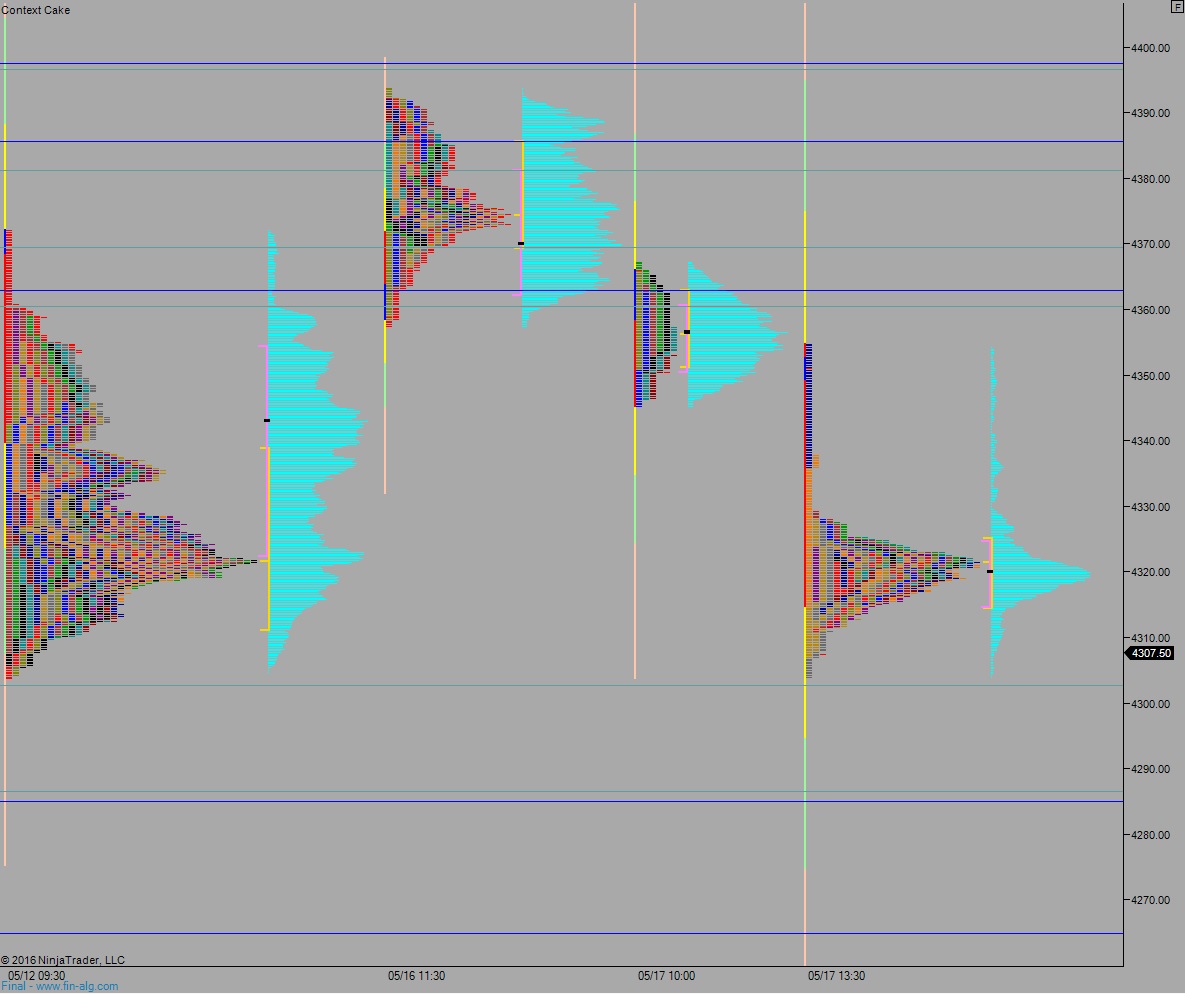

Heading into today my primary expectation is for seller to lurch lower. Look for a move to test the 4300 century mark where responsive buyers show up and make a steady campaign back up to close the overnight gap at 4321.50 before two way trade ensues.

Hypo 2 sellers push down through 4300 setting up a move to target 4286.25 before two way trade ensues.

Hypo 3 buyers work higher off the open, close the gap up to 4321.50 then target overnight high 4329.25. This triggers a rally up to 4360 before two way trade ensues.

These hypos only apply to the morning. After FOMC minutes we could see participants providing direction into the end of the week.

Levels:

Volume profiles, gaps, and measured moves: