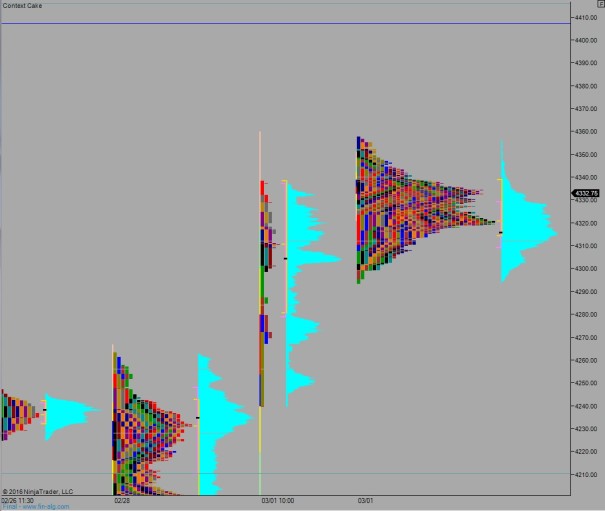

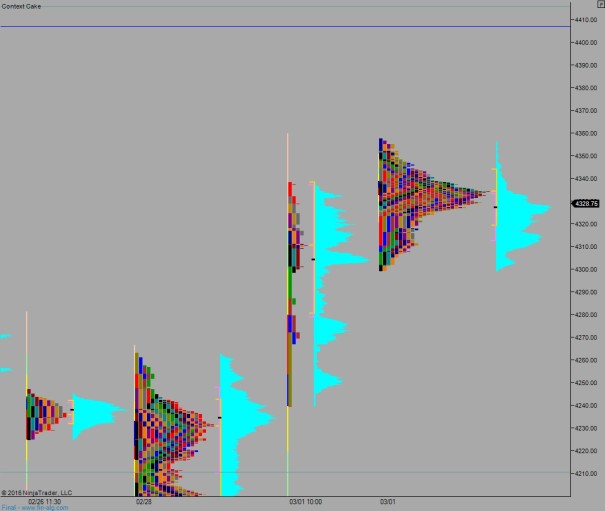

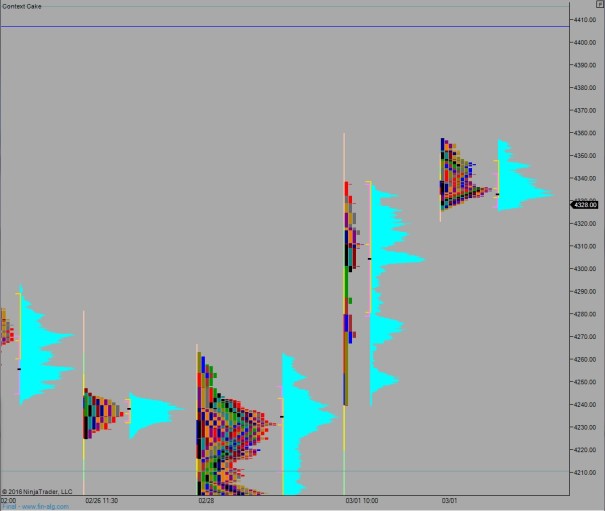

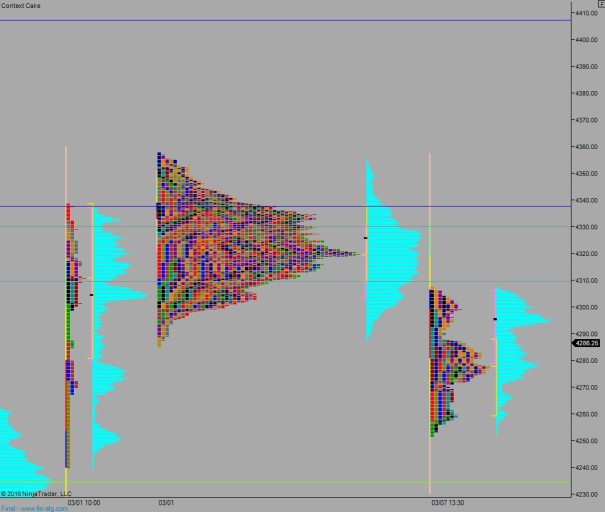

NASDAQ futures are set to enter Tuesday gap down after an overnight session featuring elevated range on normal volume. Price pushed lower early on, deep into last Tuesday’s conviction range before finding a responsive bid and trading back into the Monday range.

The economic calendar is quiet today, but we have a 4-Week T-Bill auction at 11:30am and a 3-Year Note auction at 1pm.

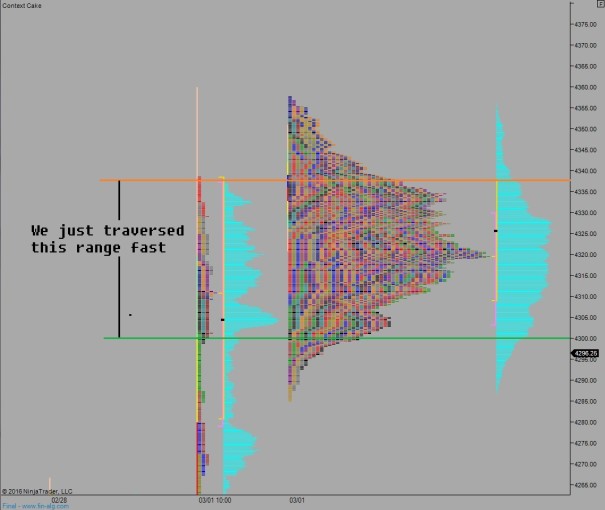

Yesterday we printed a neutral day. We came into the week gap down. Sellers made an early attempt lower but were thwarted by responsive buyers who worked up to close the overnight gap. Just after NYC lunch a strong sell hit the market and price traversed the entire daily range putting the session neutral. By the close a responsive bid worked price essentially back to where the day began.

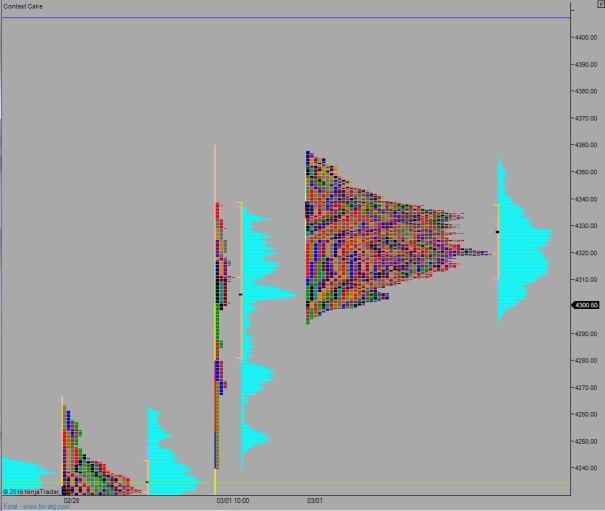

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4300.25. From here look for a move to take out overnight high 4304. Look for responsive sellers up at 4309.50 and two way trade to ensue.

Hypo 2 buyers strong, close gap at 4300.25 then push up through and sustain trade above 4309.50 setting up a move to target 4320 then 4330.

Hypo 3 sellers step in ahead of the overnight gap fill, around 4291 and push lower to test below the Monday low print 4268.75. Responsive buyers step in ahead of 4259 and two way trade ensues.

Hypo 4 strong selling works down through the Monday low 4268.75 and continues lower to target overnight low 4251.50. Stretch target is 4234.50.

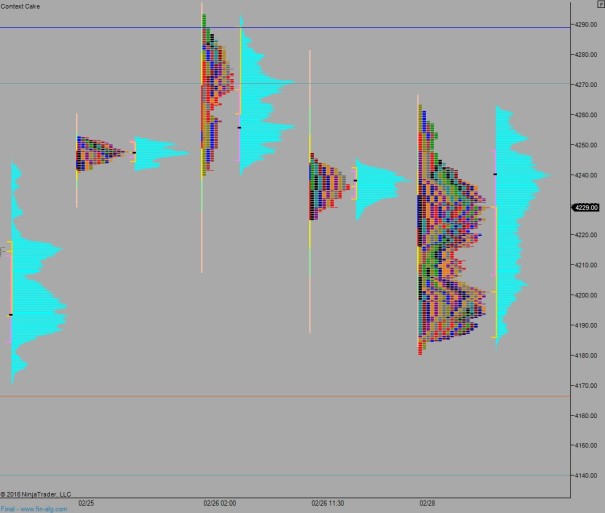

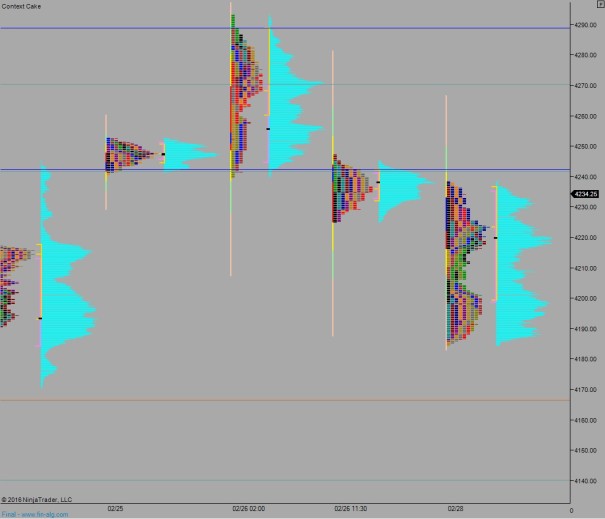

Levels:

Volume profiles, gaps, and measured moves: