NASDAQ futures are set to open gap up after an overnight session featuring elevated range and volume. During Globex, price spent most of the time trading higher and managed to briefly trade beyond the Alphabet euphoria gap left behind on 02/01 before settling into two-way trade. At 8:30am GDP data came out mostly in line. The initial reaction appear to be a buy.

Also on the economic calendar today we have Personal Consumption Expenditure and the final February reading of U. of Michigan Confidence at 10am, and the Baker Hughes Rig Count data at 1pm.

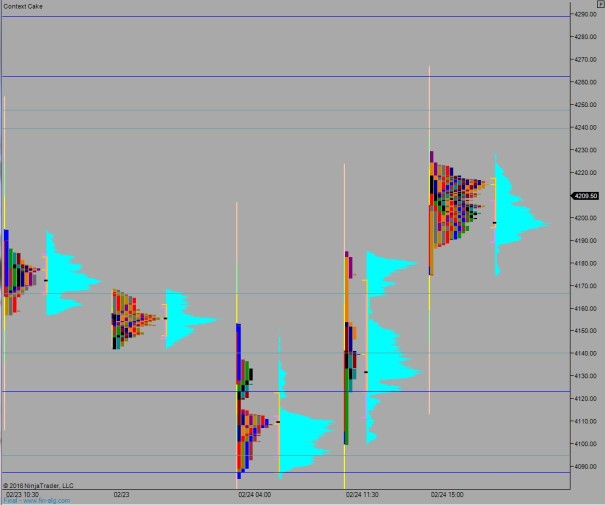

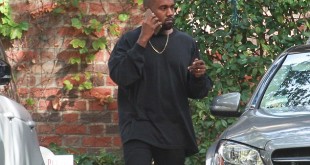

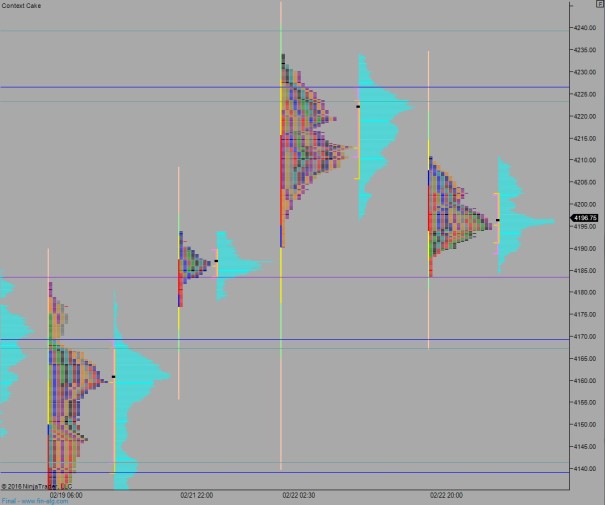

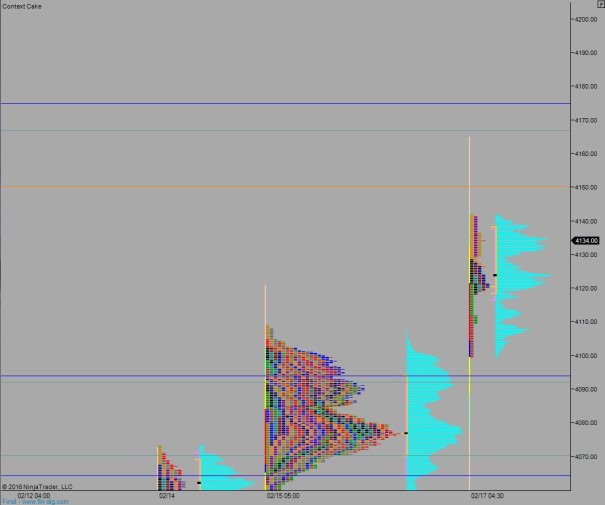

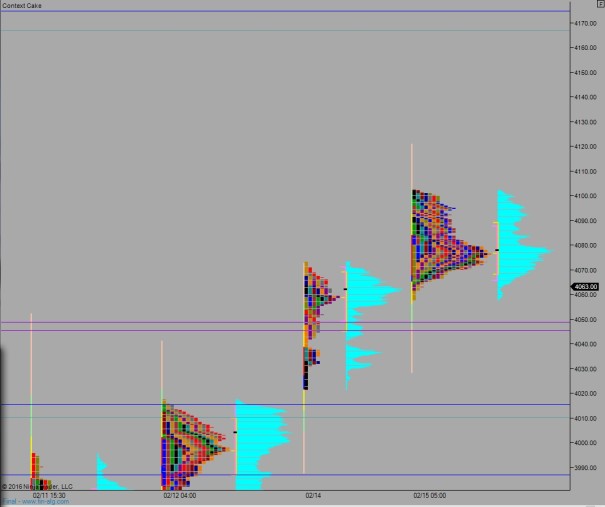

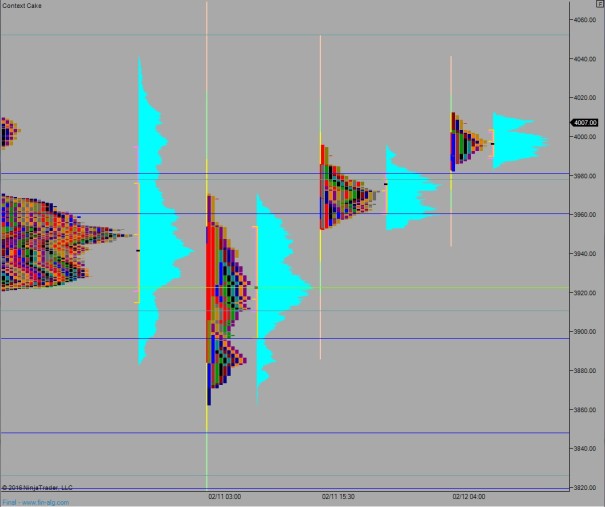

Yesterday we printed a double distribution trend up. Price opened flat. An early push lower was defended by responsive buyers who turned the market well-above the upper quadrant of Wednesday’s trend day. By early afternoon buyers turned initiative and managed to rally price through to the close.

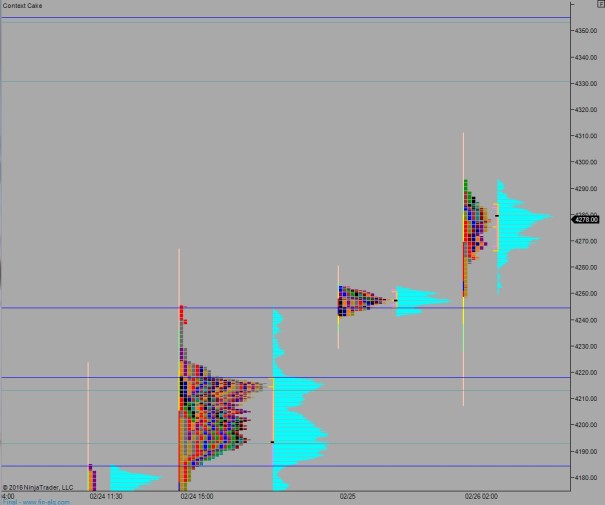

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to 4267 before finding buyers who work to target overnight high 4293.25. Look for a test above the February high 4309.25 then sellers step in and two way trade ensues.

Hypo 2 sellers work down through 4267 setting up a full overnight gap fill down to 4245. Responsive buyers are overrun as sellers test below overnight low 4240.75 briefly before two way trade ensues.

Hypo 3 buyers thrust off the open, strong, and take out overnight high 4293.25 early. Then they sustain trade above 4309.25 setting up a fast rally. Upside target is 4330.25 with a stretch target of 4353.

Hypo 4 sellers trigger a liquidation. They close overnight gap down to 4245 then sustain trade below overnight low 4240.75 setting up a fast move down to 4225 before two way trade ensues.

Levels:

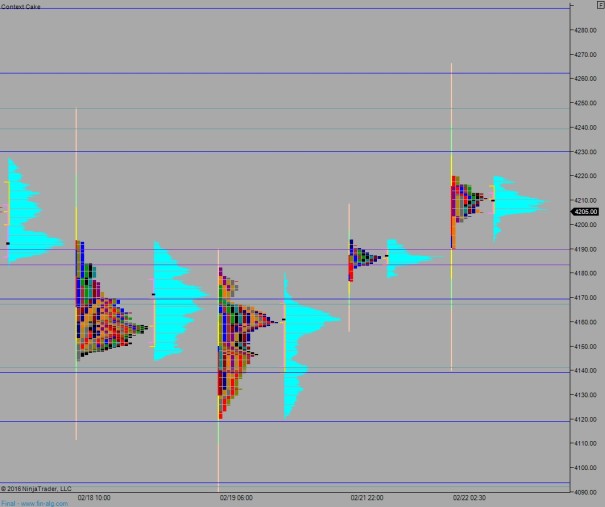

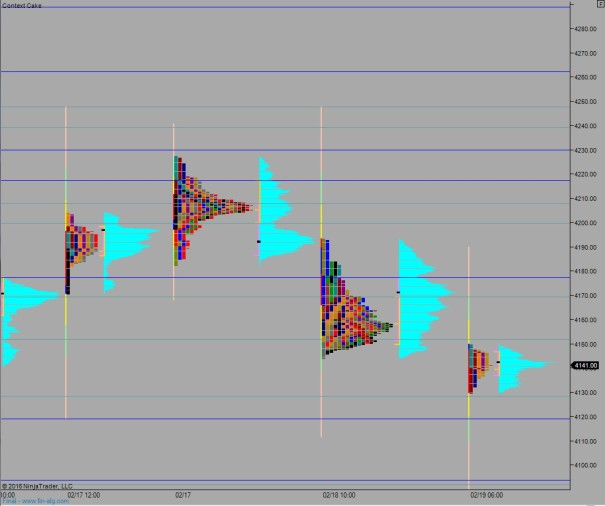

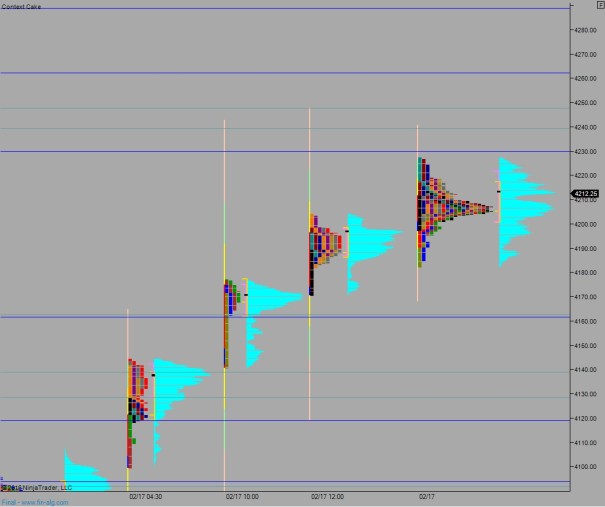

Volume profiles, gaps, and measured moves: