NASDAQ futures are set to enter Wednesday gap up after an overnight session featuring a trend up. The globex print features and elevated range on normal volume. Price continued to work higher, reaching prices not seen since April 6th. At 8:30am Advance Retail Sales data came out below expectations.

See also: Advance Retails Sales Whiffs; Market Rallies

Also on the economic docket today we have Business Inventories at 10am, crude oil inventories at 10:30am, a 10-Year Note Reopening auction at 11:30am, and the Fed Beige Book at 2pm.

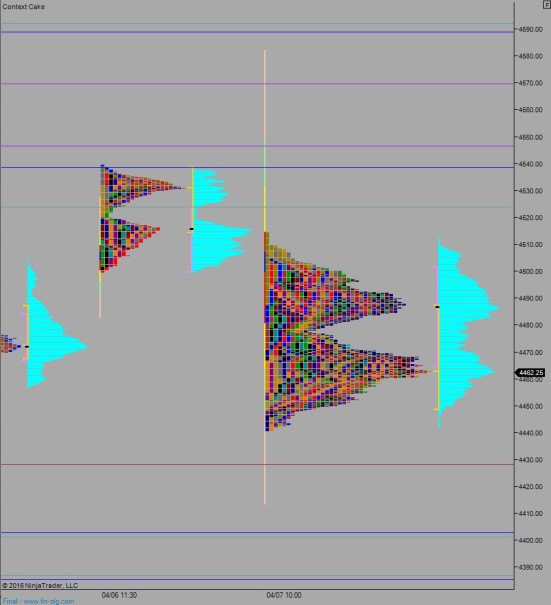

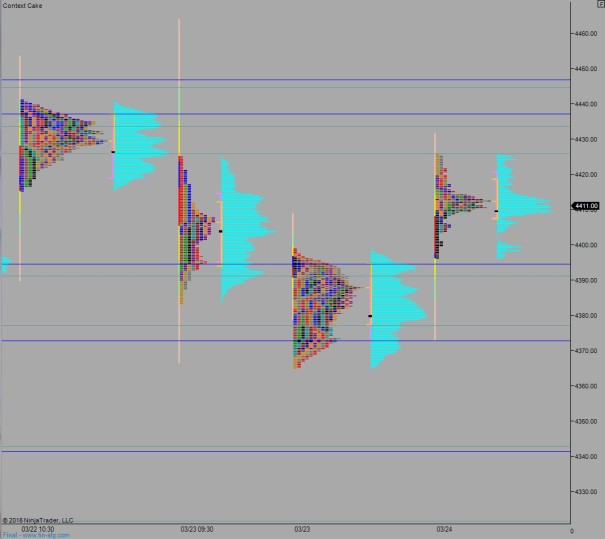

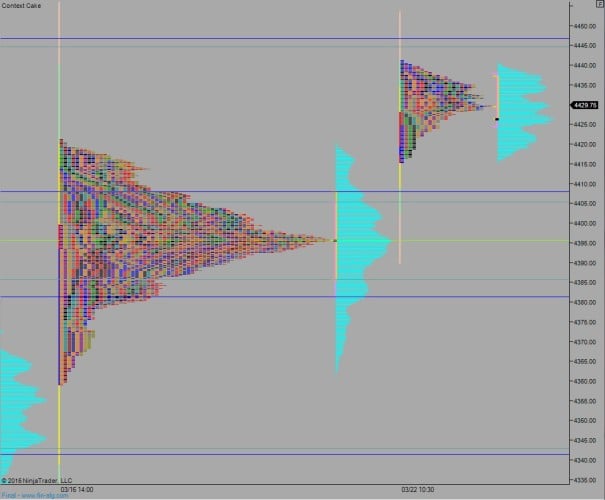

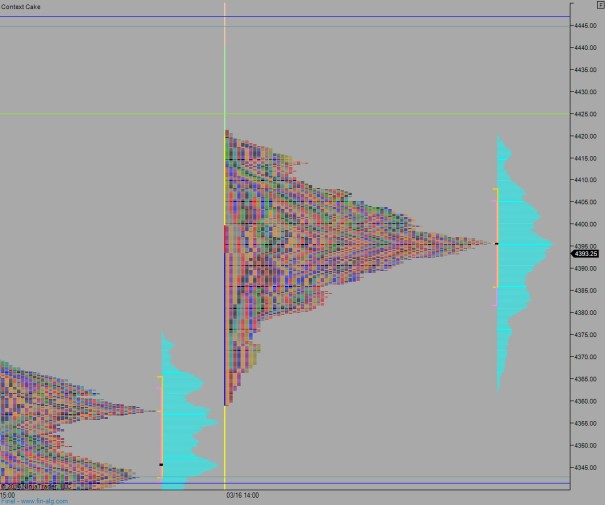

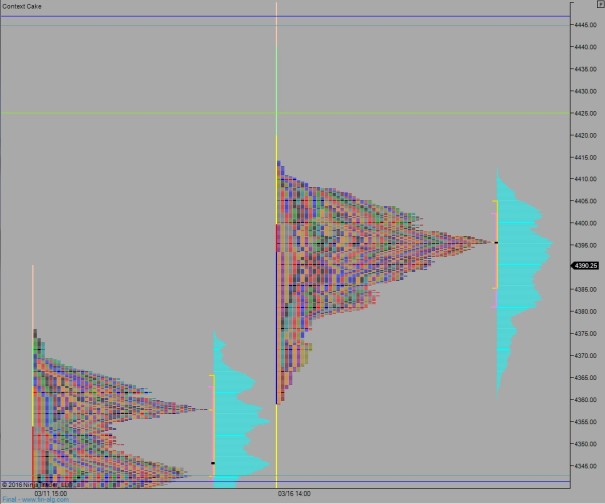

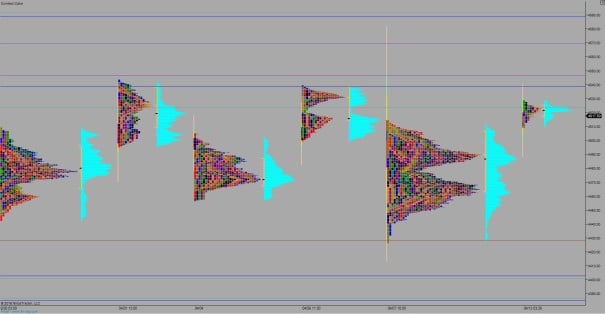

Yesterday we printed a double distribution trend up. The first hour of trade featured selling. It was fast, but just as we entered a string of market profile single prints [slip zone] a strong responsive bid came in and sharply reversed the price action. From there price resumed its grind higher, migrating value up as the day progressed.

Heading into today my primary expectation is for sellers to work into the overnight inventory and test the 4500 century mark. Look for responsive buyers (responsive relative to the open, initiative relative to yesterday’s close) who work to take out overnight high 4528.75 then set their sights on the open gap at 4535. Responsive sellers up at 4538 then two way trade ensues.

Hypo 2 sellers work all the way into overnight inventory and close the gap down to 4489.75 setting up a test below overnight low 4486. Look for responsive buyers down at 4477.75 before two way trade ensues.

Hypo 3 strong buyers push up through overnight high 4528.75 and close the gap up at 4535 early then sustain trade above it, setting up a move to target 4546.75 then 4570.

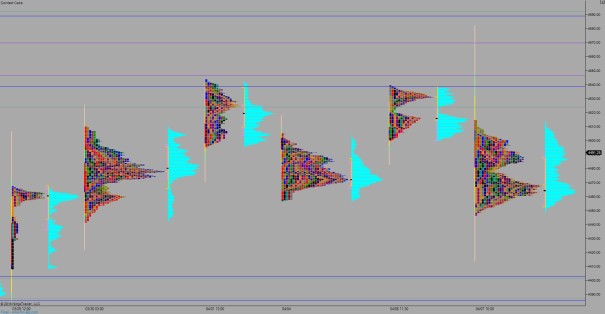

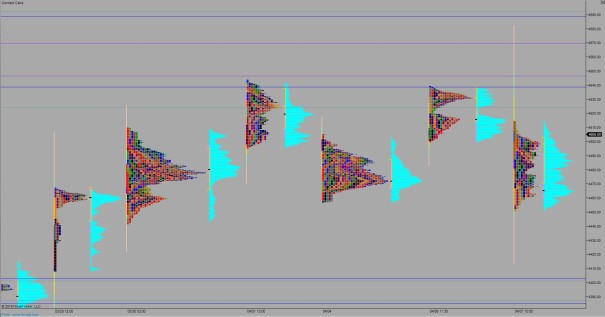

Levels:

Volume profiles, gaps, and measured moves: