NASDAQ futures are set to start today gap up after an overnight session featuring extreme range on elevated volume. Trade was balanced overnight, quickly exceeding and sustaining trade above the Wednesday close before trending higher from 7am onward. The trend was driven by news from Europe, that their Central Bank has cut borrowing rates to -0.40% and also expanded their quantitative easing program to include the purchase of corporate debt. At 8:30am Initial/Continuing Jobless claims data came out better than expected.

See also: Draghi Surprises To The Upside And Throws The Kitchen Sink at Markets

Also on the economic docket today we have a 30-Year bond auction at 1pm and the Monthly Budget Statement at 2pm. Today is also rollforward. After the open, most active participants will begin trading the June index futures contract instead of the March, which expires next Friday.

Yesterday we printed a normal variation up. Price opened gap up but well within the Tuesday range and sellers quickly close the gap with an opening drive down. Sellers were not able to push the market down below the Tuesday low before responsive buyers stepped in and worked price range extension up. Sellers made a second aggressive attempt lower, but were not able to push the market neutral for a third consecutive day. Instead buyers defended session low and then worked price slowly higher for the remainder of the session.

Heading into today my primary expectation is for sellers to push into the overnight inventory and work price down to 4310. Buyers defend here, ahead of the gap fill, and we work higher to take out overnight high 4347.50 before testing above the weekly high 4355 before two-way trade ensues.

Hypo 2 sellers push a full gap fill down to 4294.25 then set their sights on the overnight low 4283.50. Selling accelerates and we trade down to 4269 before two way trade ensues.

Hypo 3 buyers jam the gap and go drive higher. Take out overnight high early 4347.50 then sustain trade above the weekly high 4355 setting up a move to target the 4400 century mark. Stretch target is 4406.75.

Levels:

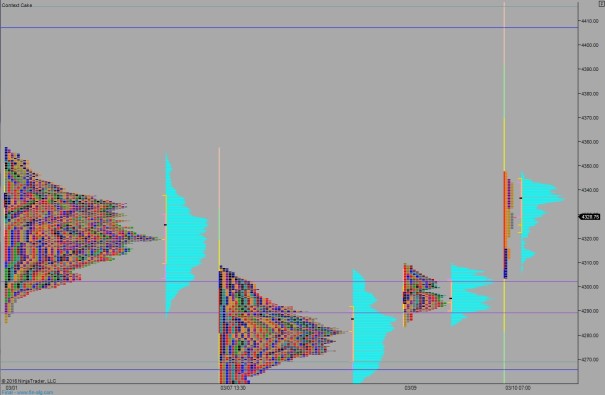

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter

I still don’t really understand why you like to initiate in LVN’s your gonna have to explain.

we trade for price to move through lvn’s why do you plan for that to be a pivot? or do you plan for market to overshoot lvn or its a good spot to snipe if market holds?

talkin 4310 btw

Can anyone explain 2 me why Treasuries AND equities are selling off?

All but gold and shit.

Why the hell is the curve flattening so much?