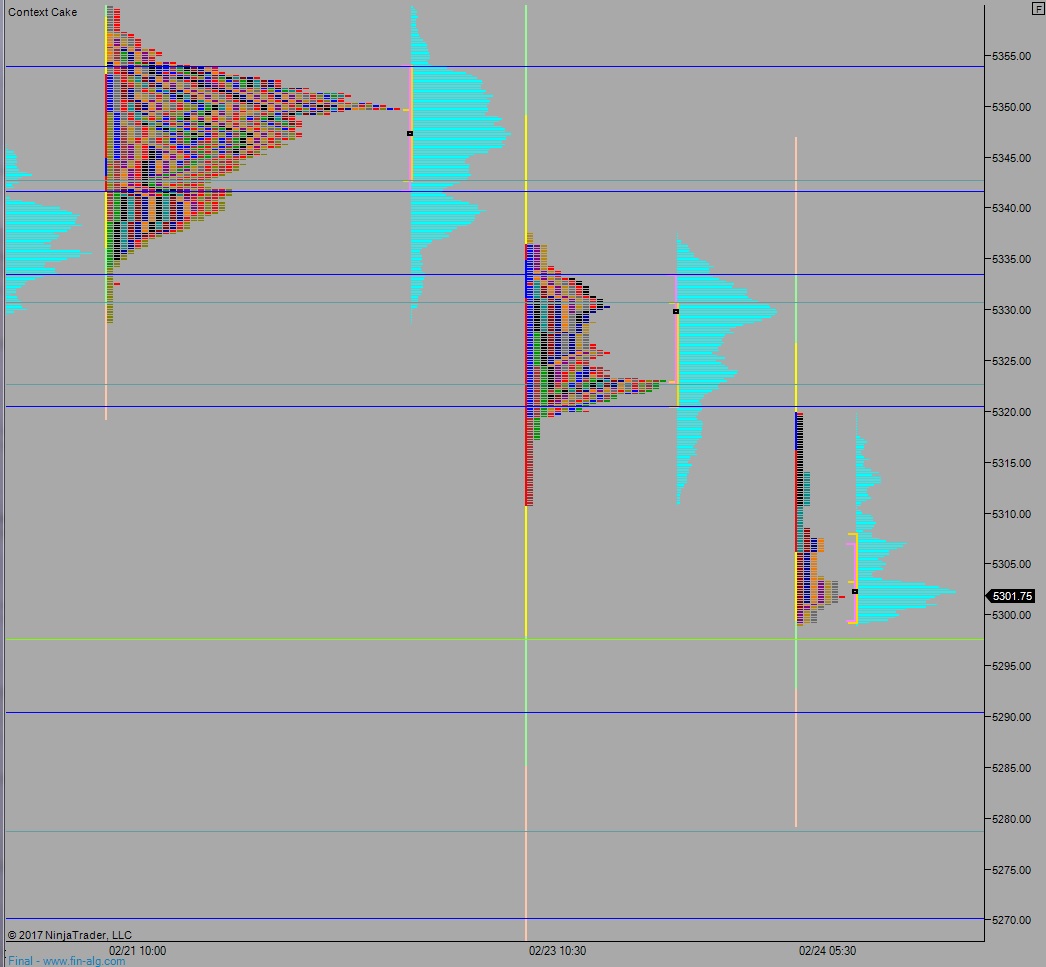

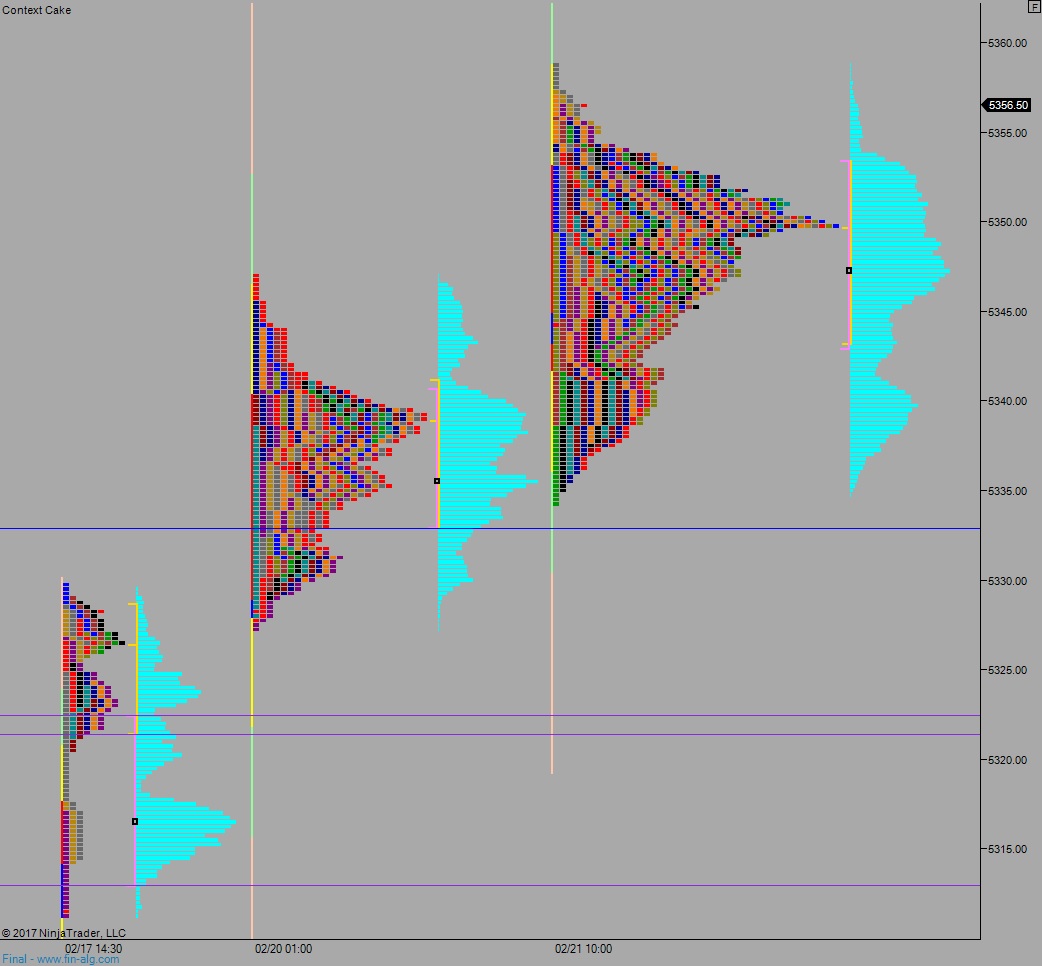

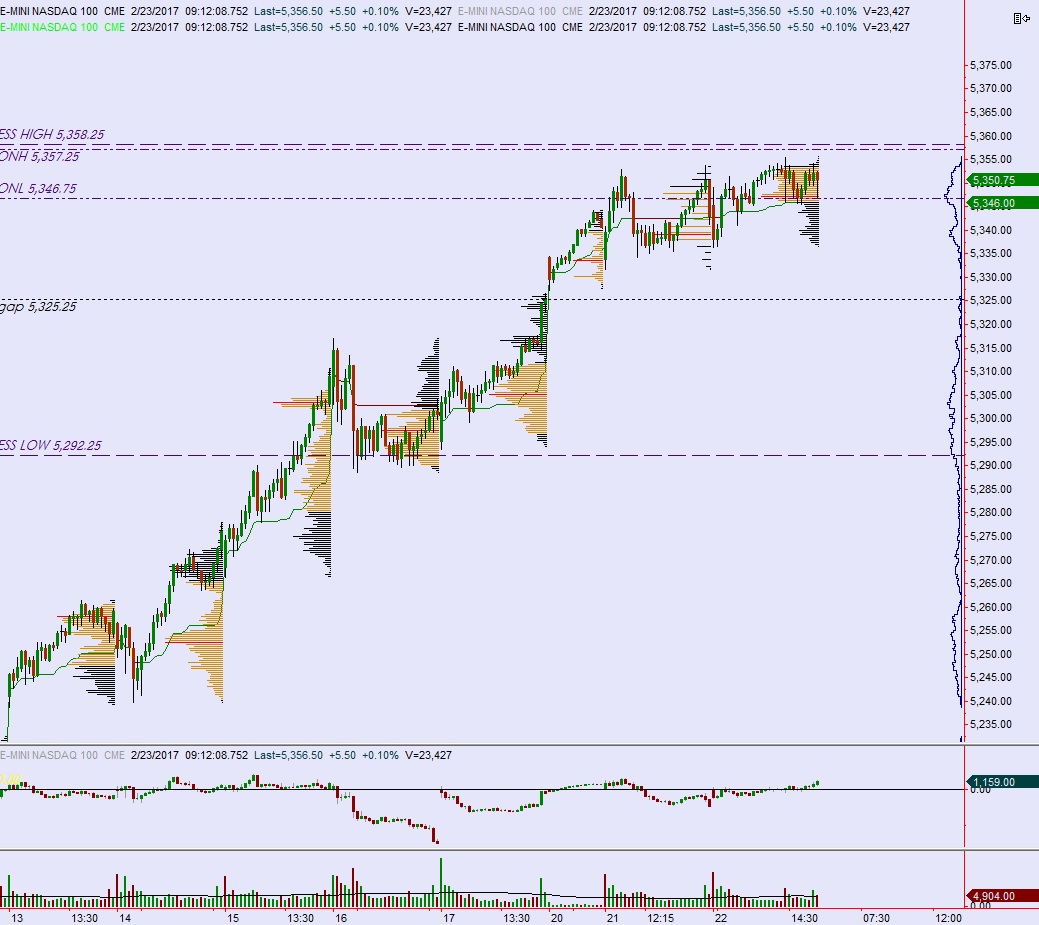

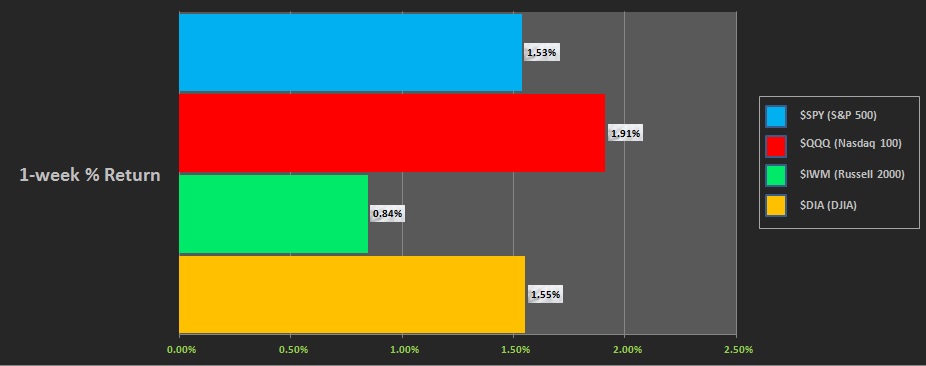

NASDAQ futures are coming into Thursday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, making new highs before settling around the Wednesday, post-FOMC rate hike high. At 8:30am a slurry of economic data came out mixed.

There are no other economic events today.

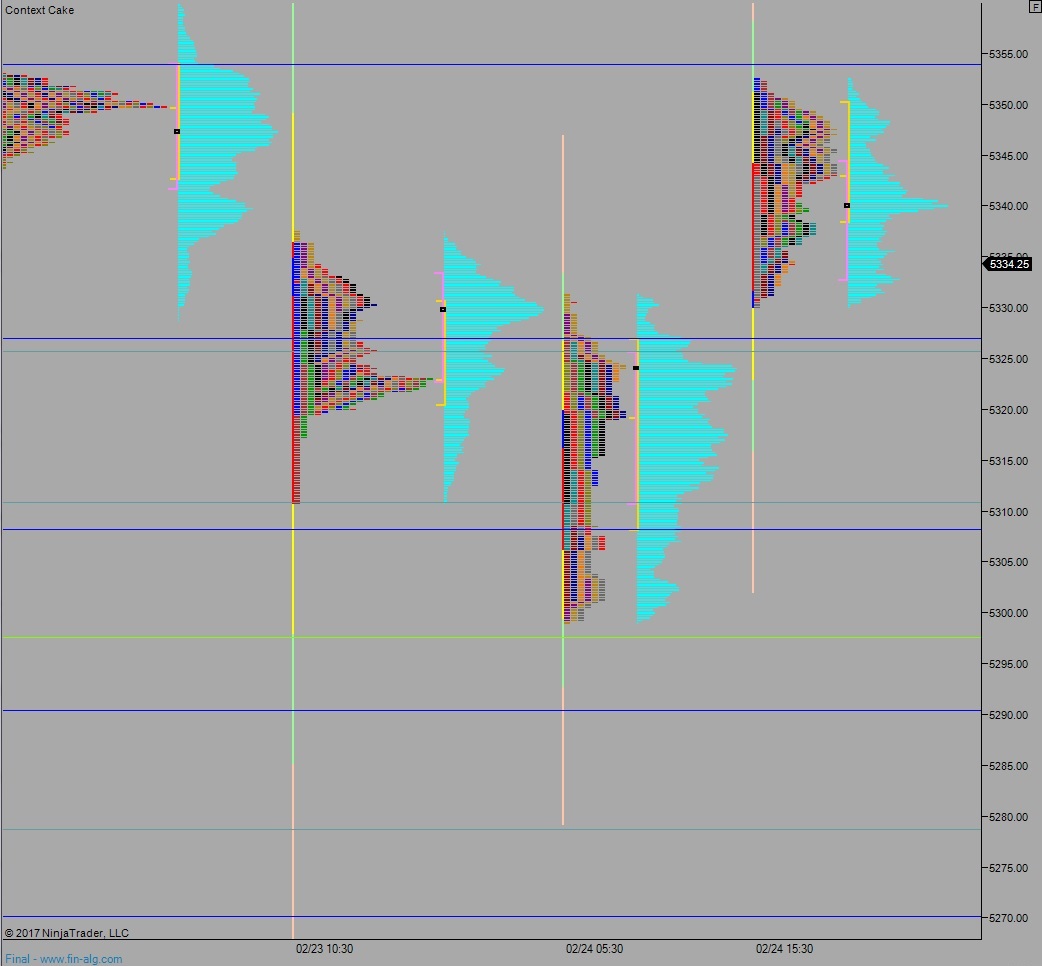

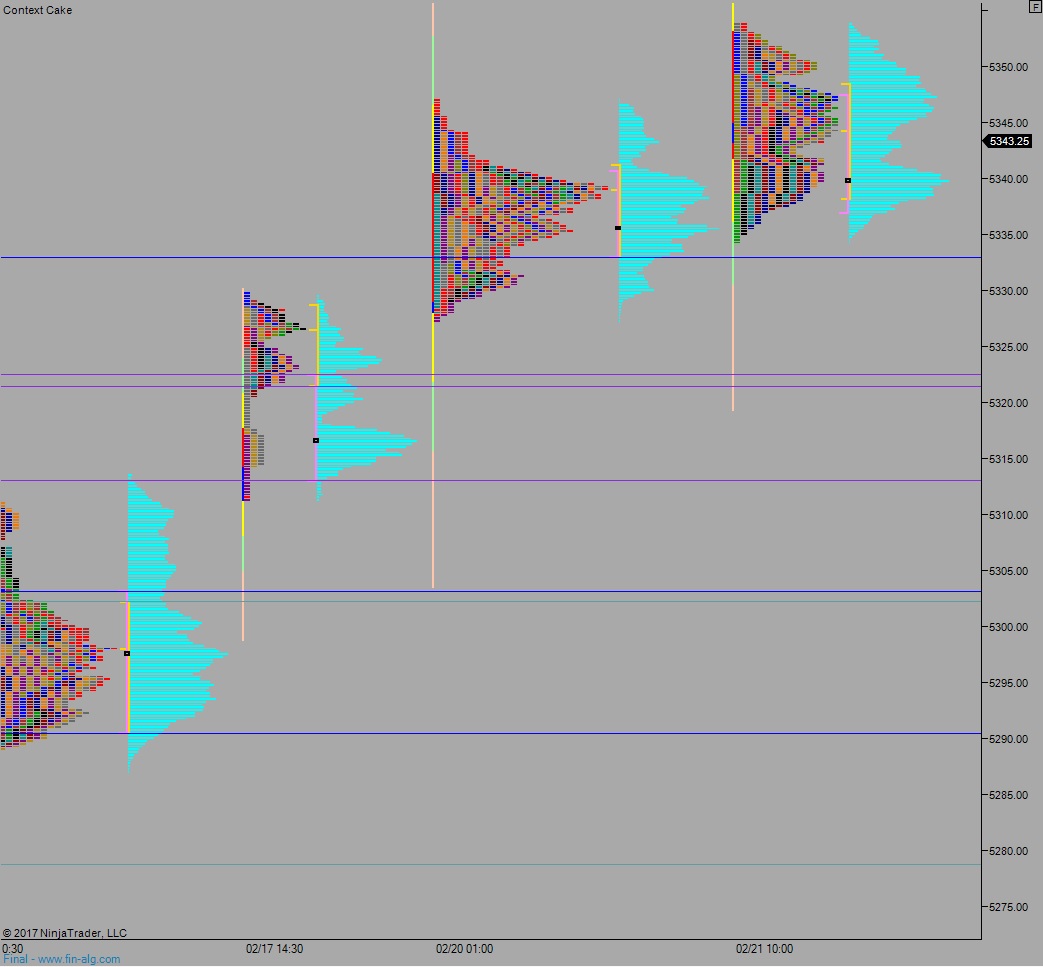

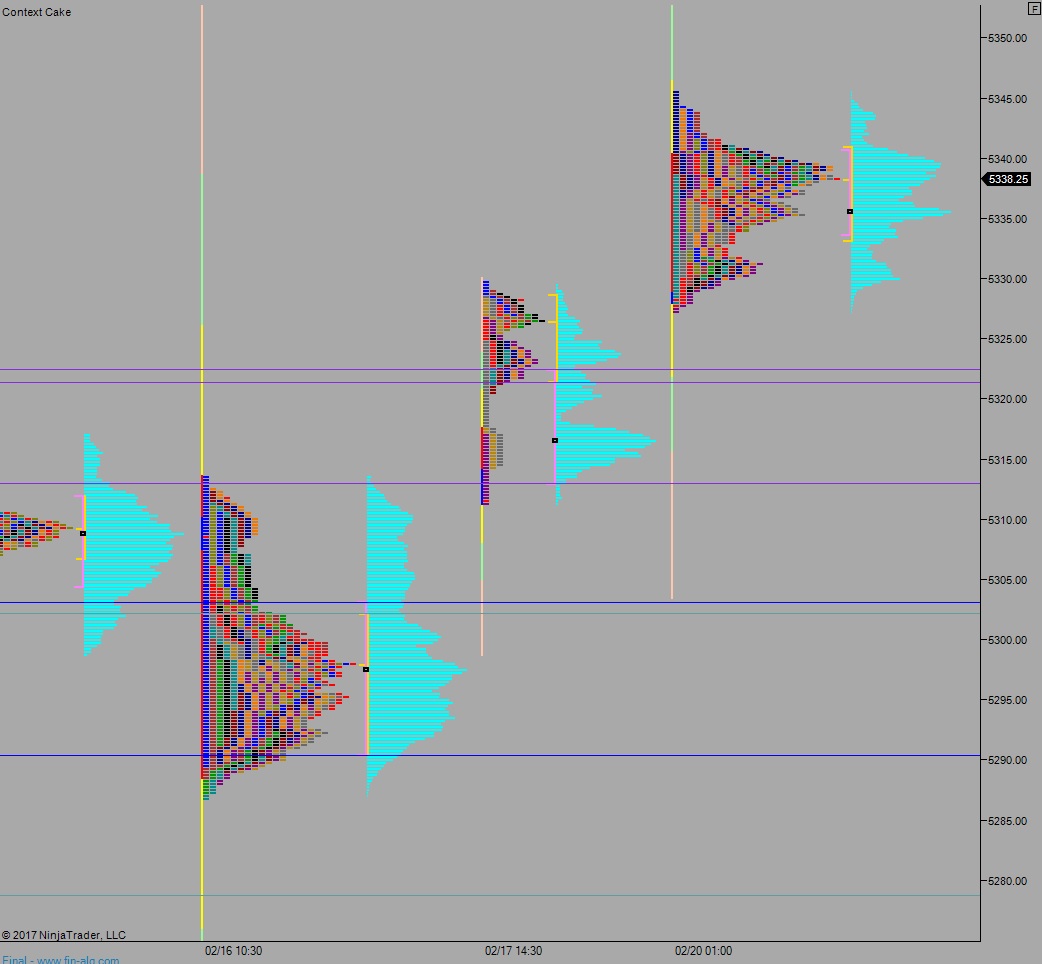

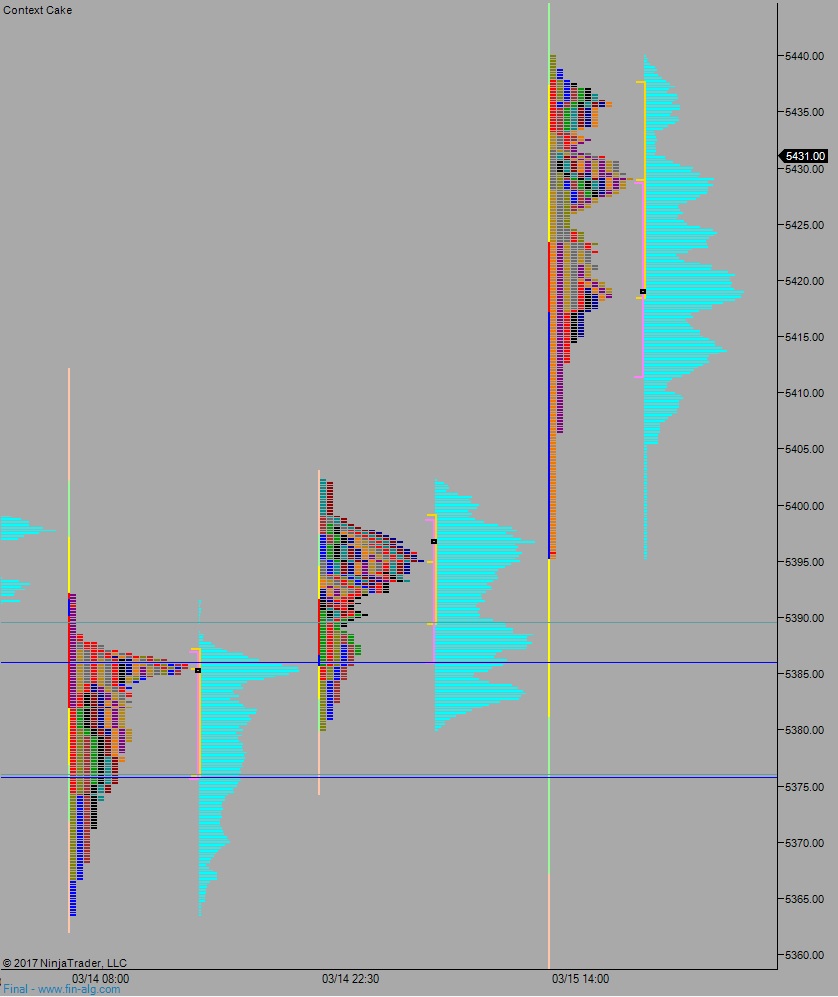

Yesterday the NASDAQ printed a double distribution trend up. There was a gap up in the morning that sellers quickly faded. Then sellers could not press range extension down, instead stalling just before 10:30am. Then the march higher began, and it accelerated after the Fed raised their benchmark interest rate at 2pm. Third reaction yielded the buy signal and we continued higher into to bell.

Heading into today my primary expectation is for buyers to work through overnight high 5440 and continue exploring higher prices, open air. No target or price levels are in play.

Hypo 2 sellers work into overnight inventory and close gap down to 5419.50 then continue lower, down through overnight low 5414.50 before two way trade ensues.

Hypo 3 strong selling presses down through overnight low 5414.50 then tags the 5400 century mark before two way trade ensues.

Levels:

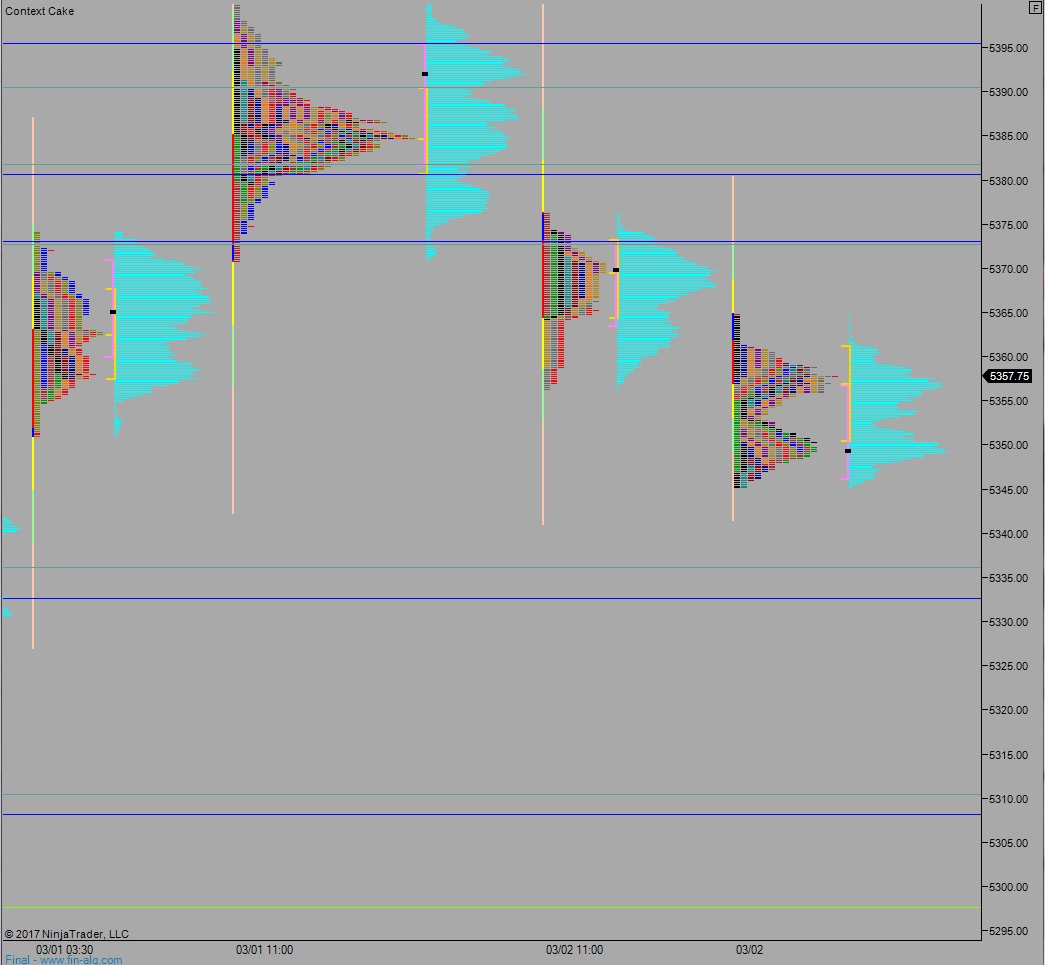

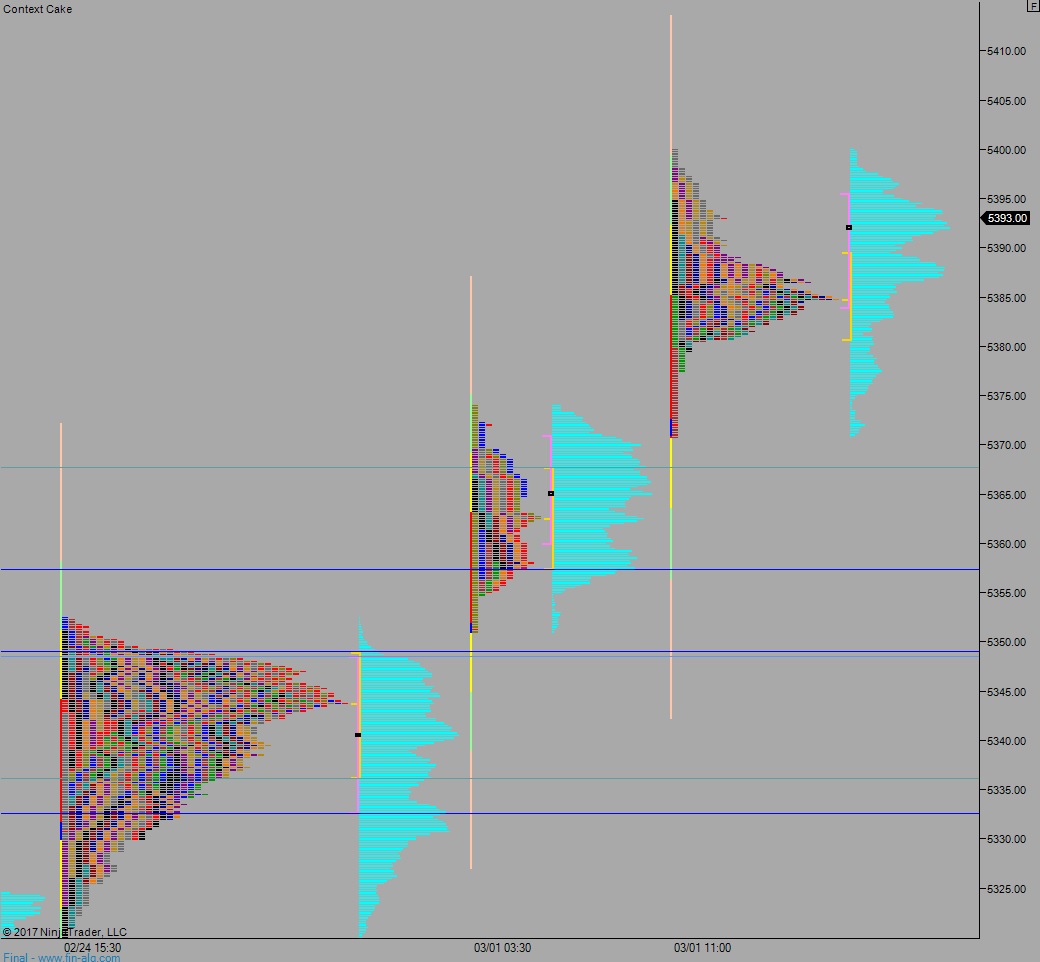

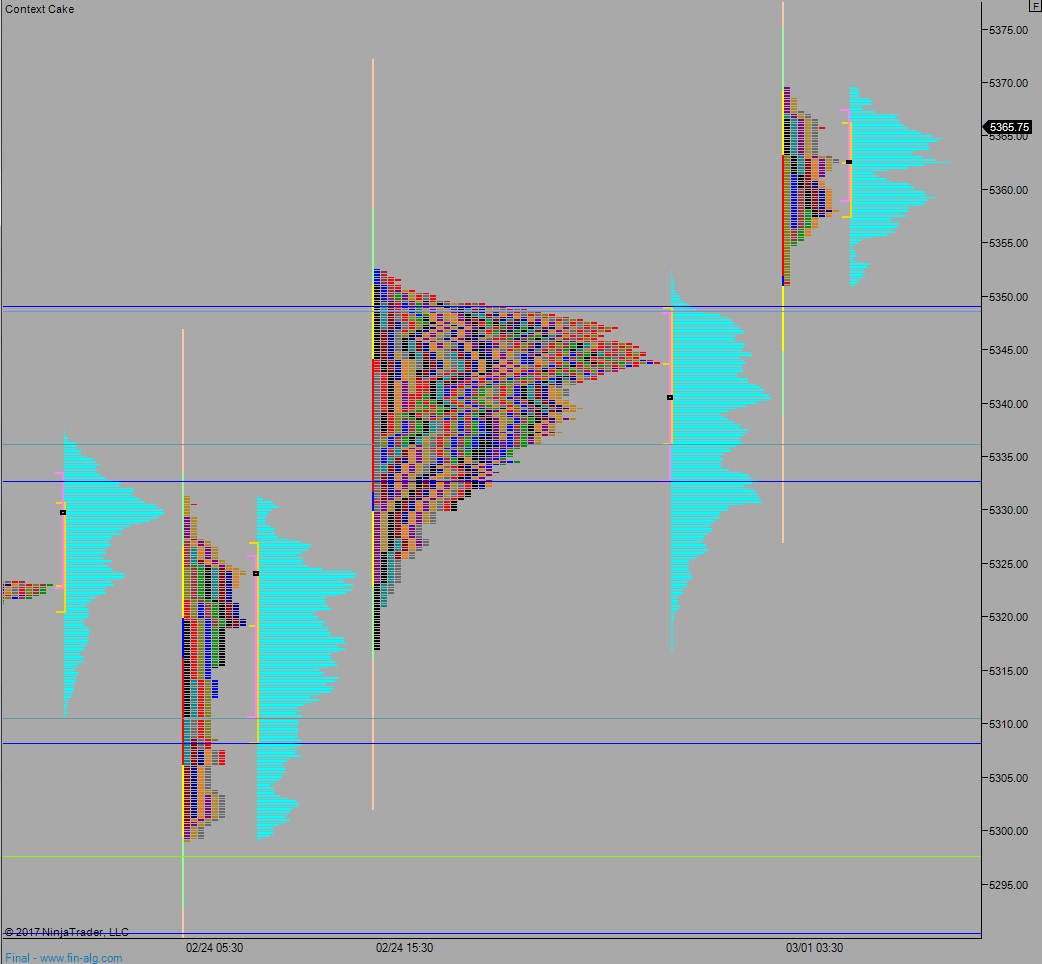

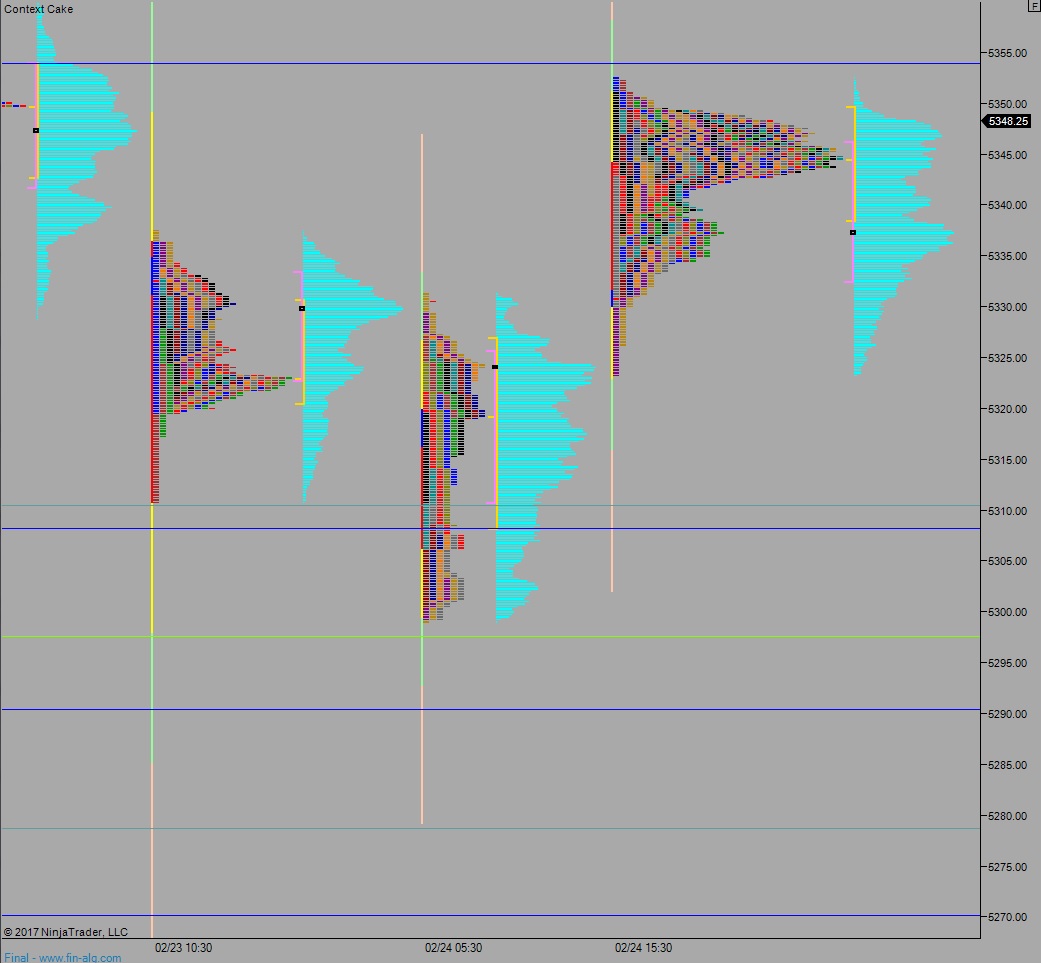

Volume profiles, gaps, and measured moves: