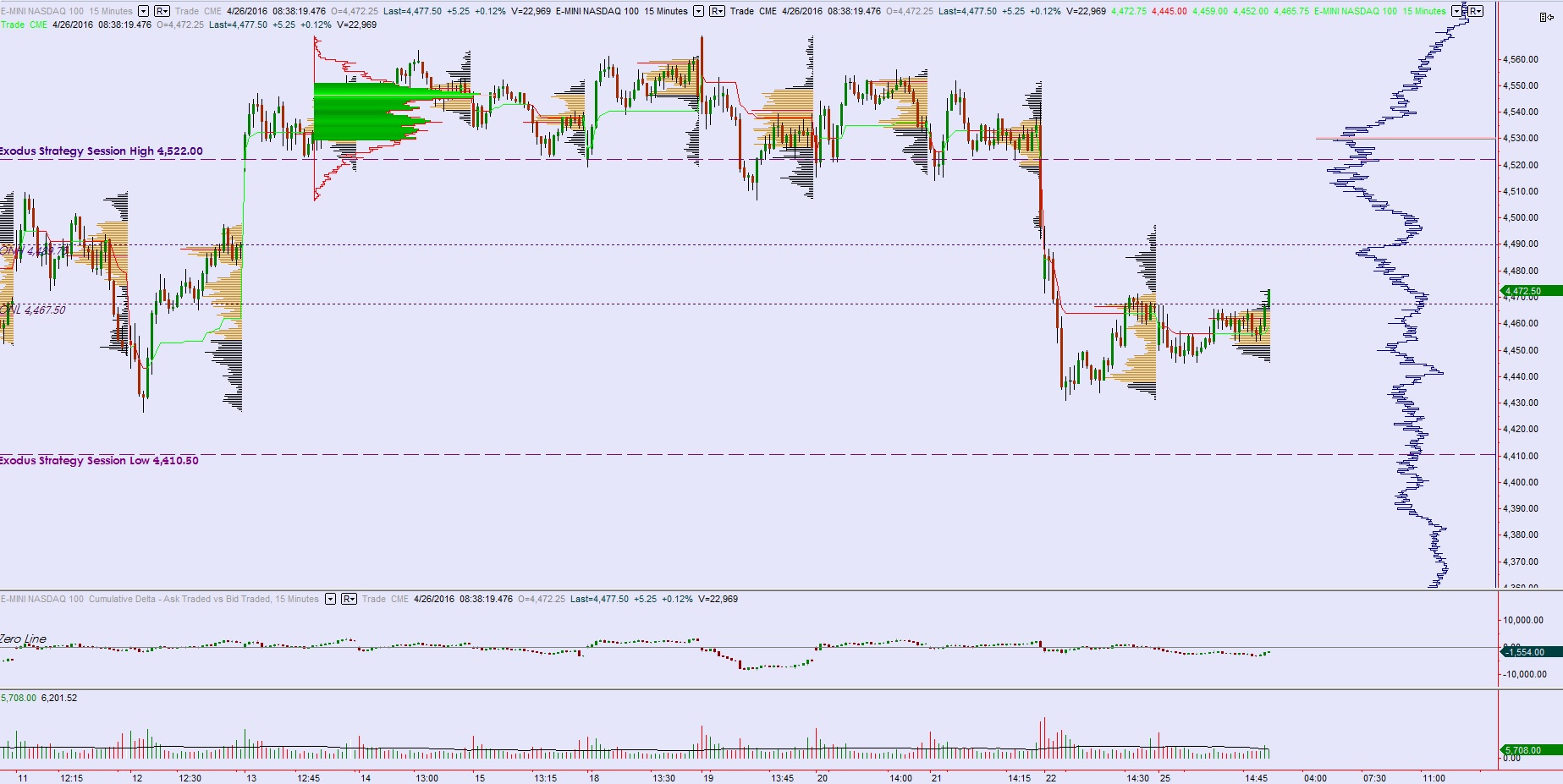

NASDAQ futures are set to begin Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher, up near last Friday’s high, before settling back into two-way trade. At 8:30am Durable Goods Orders came in below expectations. The initial reaction is a soft sale.

Also on the economic calendar today we have Consumer Confidence at 10am, 52- and 4-week T-bill auctions at 11:30am, and a 5-year Note auction at 1pm.

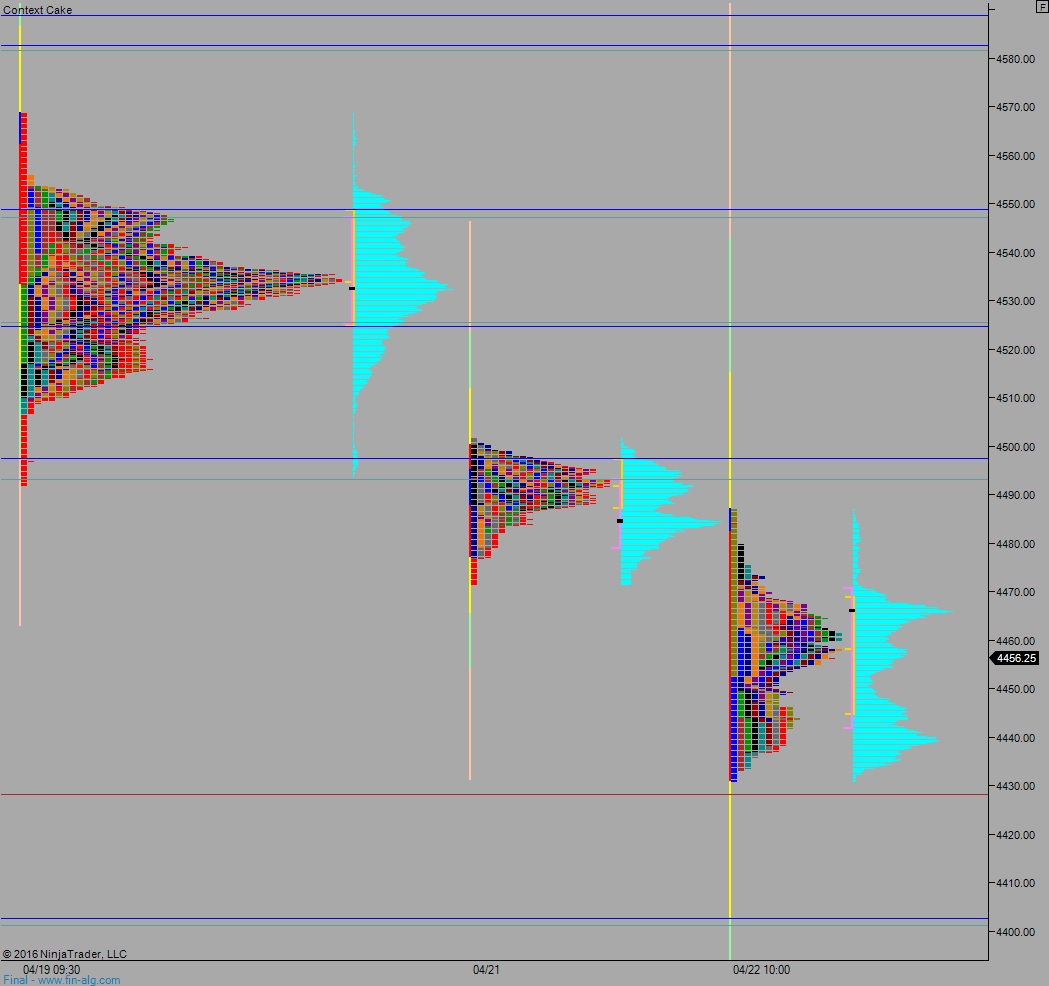

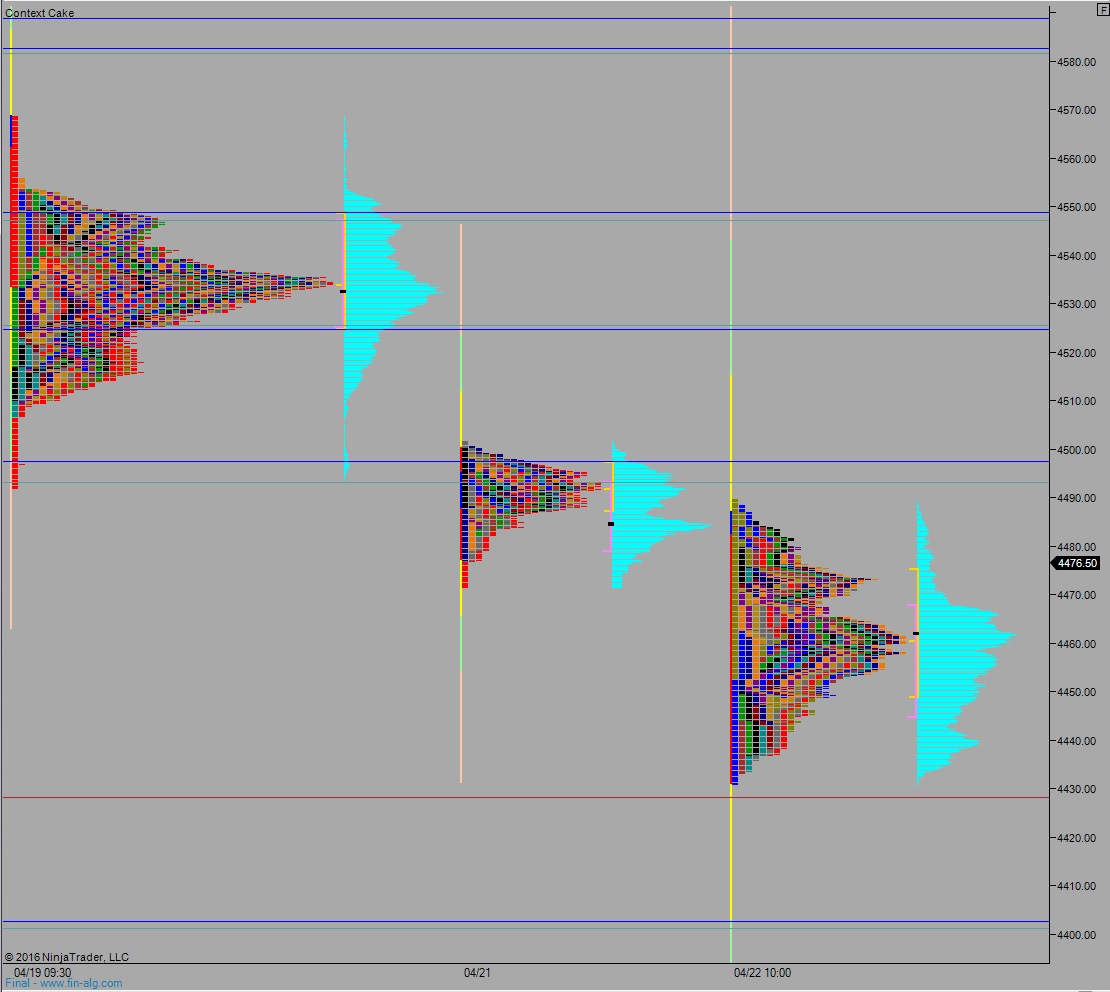

Yesterday we printed a neutral extreme up. Price worked lower after an early spurt higher closed the overnight gap. Just after going range extension down the NASDAQ printed a failed auction. After a two-way dispute regarding the matter, responsive buyers stepped in and worked price back up through the daily range and closed out the market at session high.

Heading into today my primary expectation is for two-way chop. Look for an early move lower to close the overnight gap down to 4472.50. Sellers continue lower to take out overnight low 4467.50 before finding responsive buyers down at 4448.75 and two way trade ensuing.

Hypo 2 buyers push up through overnight high 4489.75 early on setting up a move to test 4493 before two way trade ensues.

Hypo 3 strong buyers push up through overnight high 4489.75 then sustain trade above 4493 setting up a move to test the 4500 century mark.

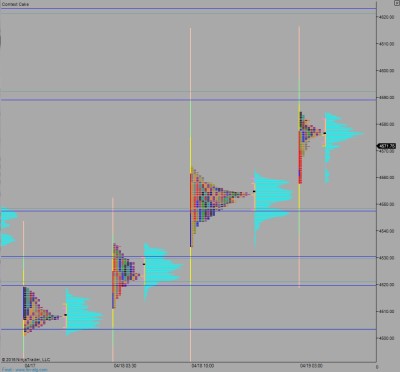

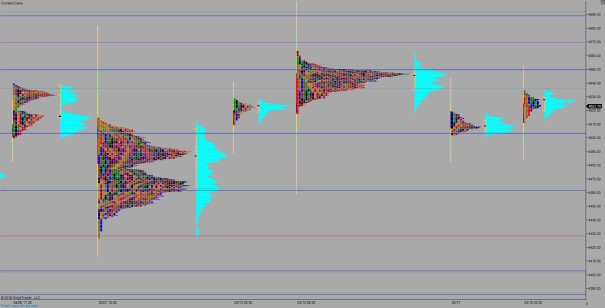

Levels:

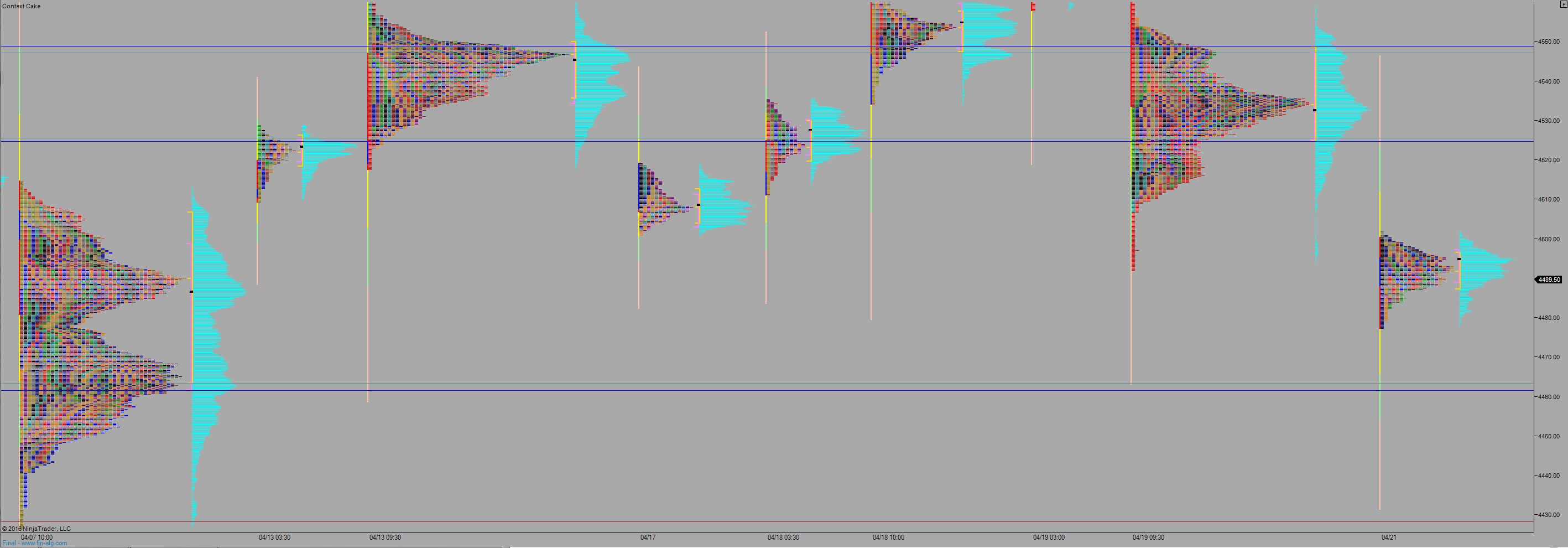

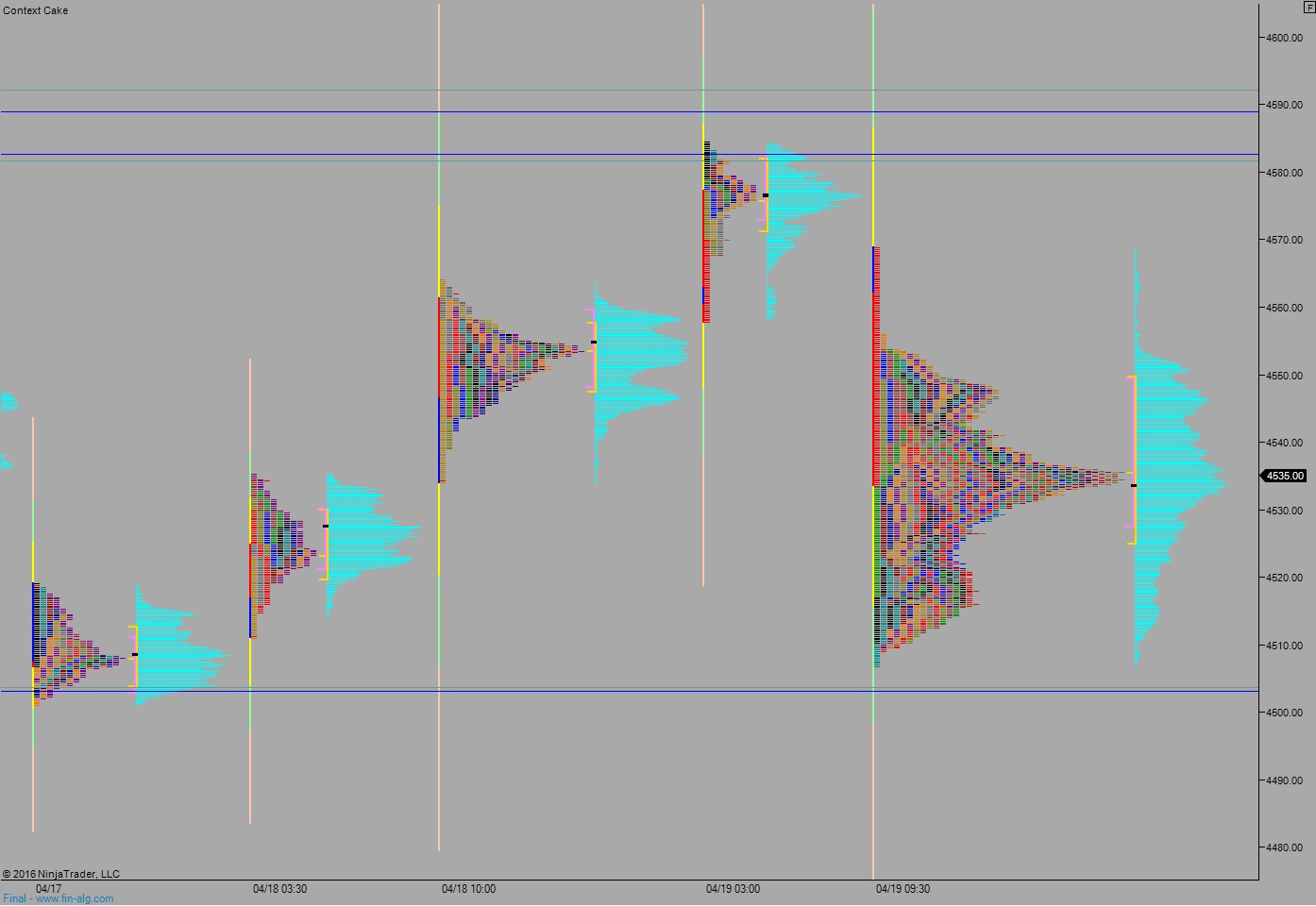

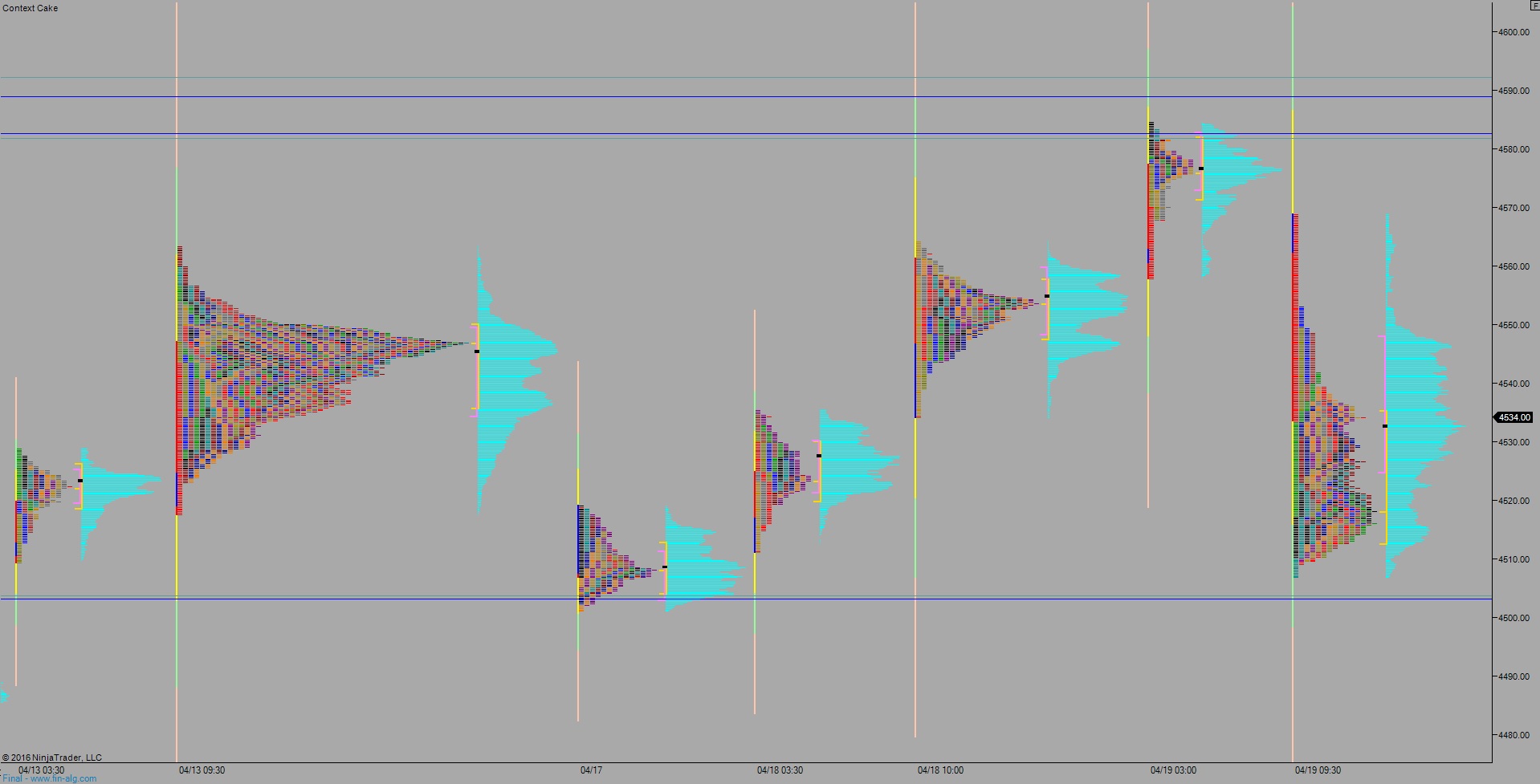

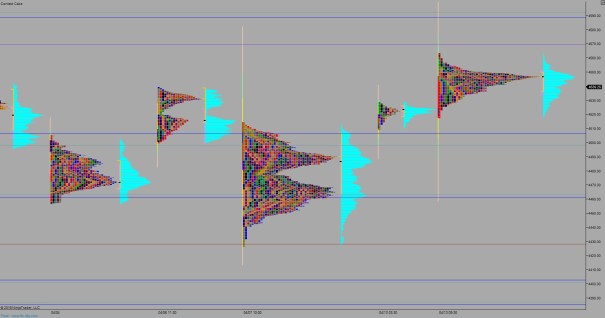

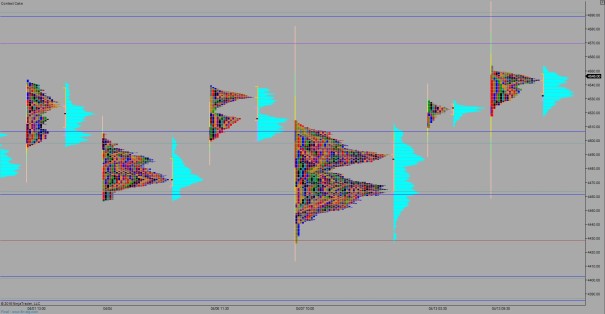

Volume profiles, gaps, and measured moves: