NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range on elevated volume. Price worked higher overnight during a balanced session that traded inside Monday’s range. As we approach cash open prices are hovering below the Monday mid-point. At 8:30am PCE core data came out below expectations.

Also on the economic calendar today we have consumer confidence at 10am and a 4-week T-bill auction at 11:30am. However the real event happens after the bell when Apple reports earnings. We may go into a holding pattern at some point today in anticipation of the big tech name’s earnings.

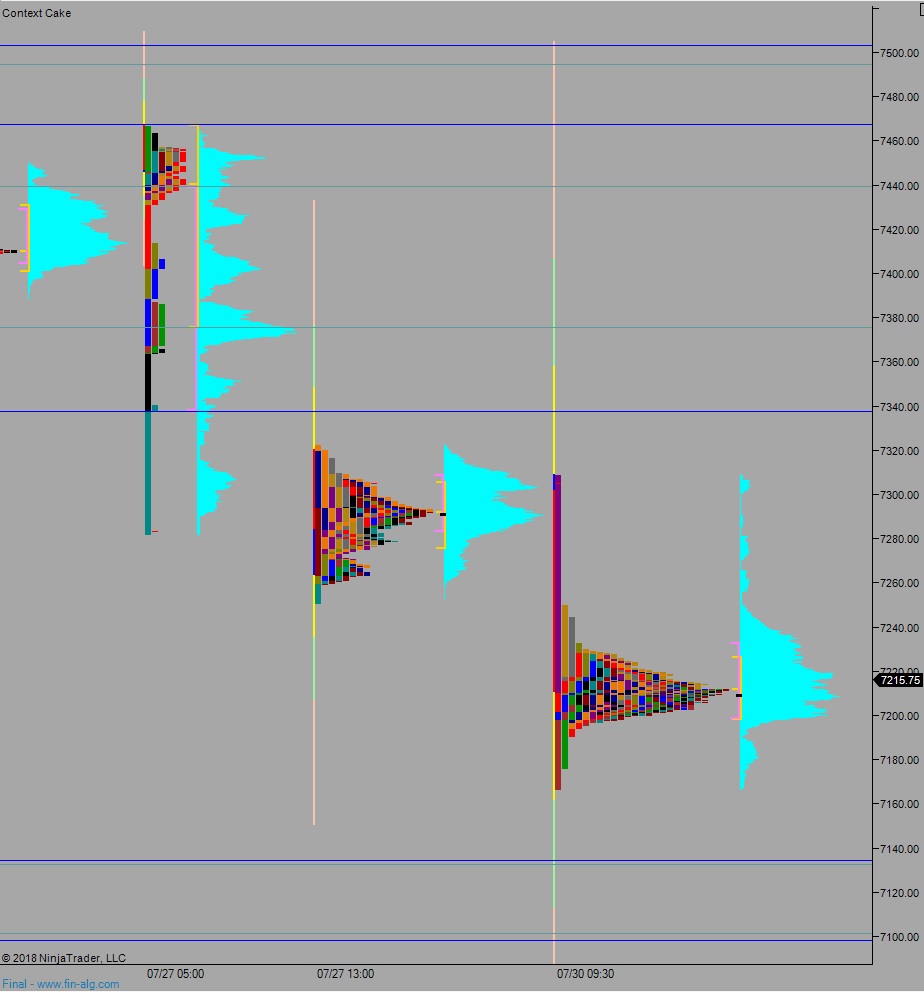

Yesterday the NASDAQ printed a normal variation down. The day began with a hard drive lower which briefly paused before continuing to make a few more lows throughout the morning before a responsive bid stepped in about 1/4th of the way down into the 07/06 conviction buy range.

As the profile begins to mature, it is taking on a lowercase letter b shape which is sometimes indicative of a long liquidation, a short term phenomenon that sometimes occurs near the bottom of a down move.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7200. From here we continue lower, down through overnight low 7191. Look for buyers just below overnight low and two-way trade to ensue.

Hypo 2 buyers gap-and-go higher, trading up through overnight high 7230. Look for sellers to defend around last Friday’s low 7263.50 and two way trade to ensue.

Hypo 3 stronger sellers close overnight gap 7200 take out overnight low 7191 and continue lower, down to 7134.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: