Full disclosure:

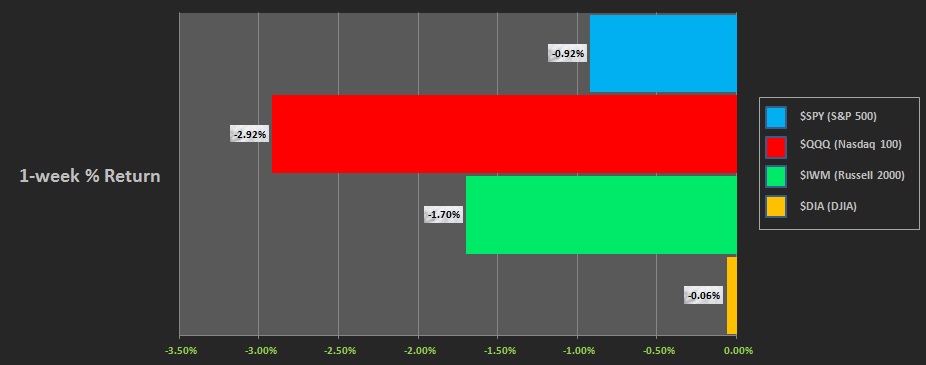

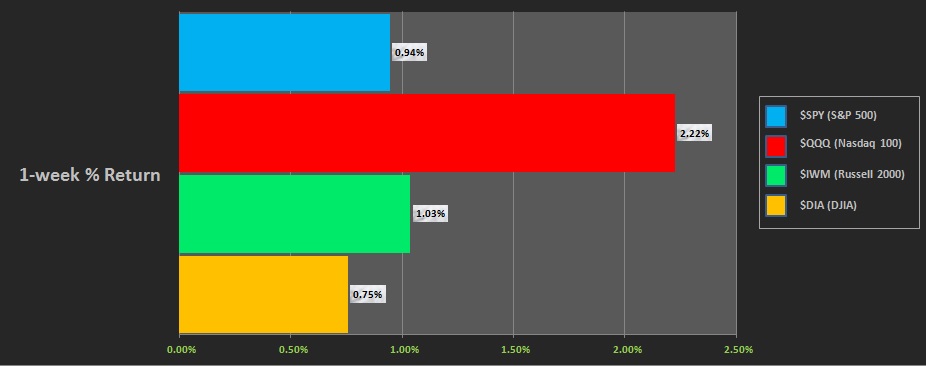

I bought TQQQ Tuesday morning and still hold the position. I will sell the position by end-of-business Friday, September 7th. It will likely be a losing trade. Sad trombone.

I only blog about Tesla and our fearless leader Elon (Praise to Him) when it matters. Today (September 7th) matters. Also TSLA is my largest position by a long stretch. I accumulate more TSLA every quarter via the most reliable form of investing, dollar cost averaging. And I will continue to do so until the ability to buy Tesla shares is taken from me or my death, whichever comes first.

——————————————————

Habitual pot smoking is a nasty habit unbefitting of a CEO. Elon Musk (Glory to The Leader) did not inhale the pot smoke he sucked into his mouth from a half tobacco, half cannabis cigar (blunt) that he was handed during a Joe Rogan podcast. There is a misinformation campaign led by troll accounts on Twitter that hopes to paint Mankind’s Last Hope as an erratic drug addict. They are liars and should be reported to Jack Dorsey as often as possible.

If a CEO desires habitual stimulation of her serotonin receptors, a regular dose of psilocybin mushrooms would be a more appropriate intoxicant. Is marijuana consumption a bad idea for everyone? Not really. But a CEO in America requires a sharpness and tenacity that is lost in the fog of THC.

Which brings me to CBD drinks. CBD is one of the other phytonutrients found in marijuana and hemp. CBD drinks are not a good idea as a business. First of all that plant compound is listed as a schedule one controlled substance in America. AMERICA. The real one. Not Canada. That means interstate trafficking of CBD in America is a federal crime similar to transporting heroin or cocaine. Seems like lots of risk for a product that has profit margins similar to regular drinks that aren’t federally illegal.

Bear in mind Jeff Sessions, the US Attorney General, is a good ‘ole boy who fully subscribed to reefer madness and the Nancy Regan ‘just say no’ campaign. You think he’s going to sit around all day by a swimming pool with his fellow statesmen while a company like NBEV publicly breaks federal law? Meanwhile there are several first movers already in the CBD drink space. A cursory internet scan turns up this company in San Fransisco, for example, that will ship you a CBD-spiked lemon drink.

Another problem with CBD drinks is they don’t make the consumer feel high. So it is like trying to sell people on eating their vegetables more than selling a hit of a drug. Coffee gets you high. So does Pepsi. So does THC. How do you make people spend money on CBD drinks instead of soda pop or coffee or whisky?

Back to Tesla. The chief accounting officer leaving is a red flag. Even a diehard believer in the company cannot overlook accountants leaving. It goes back to my years of being an accountant and knowing that accountants are logical people who do not run away from their post for no good reason. The CFO needs to address this situation ASAP.

The HR director leaving, whatever. As long as the company can continue to combat the destructive potential of their labor force organizing into a union they will be fine. The last thing any company needs, ever, is contempt between the people doing the work and management. The labor force must be made to feel included in the company’s growth and compensated in a satisfactory way while working in desirable conditions. WITHOUT A UNION FATALLY CRIPPLING PROGRESS.

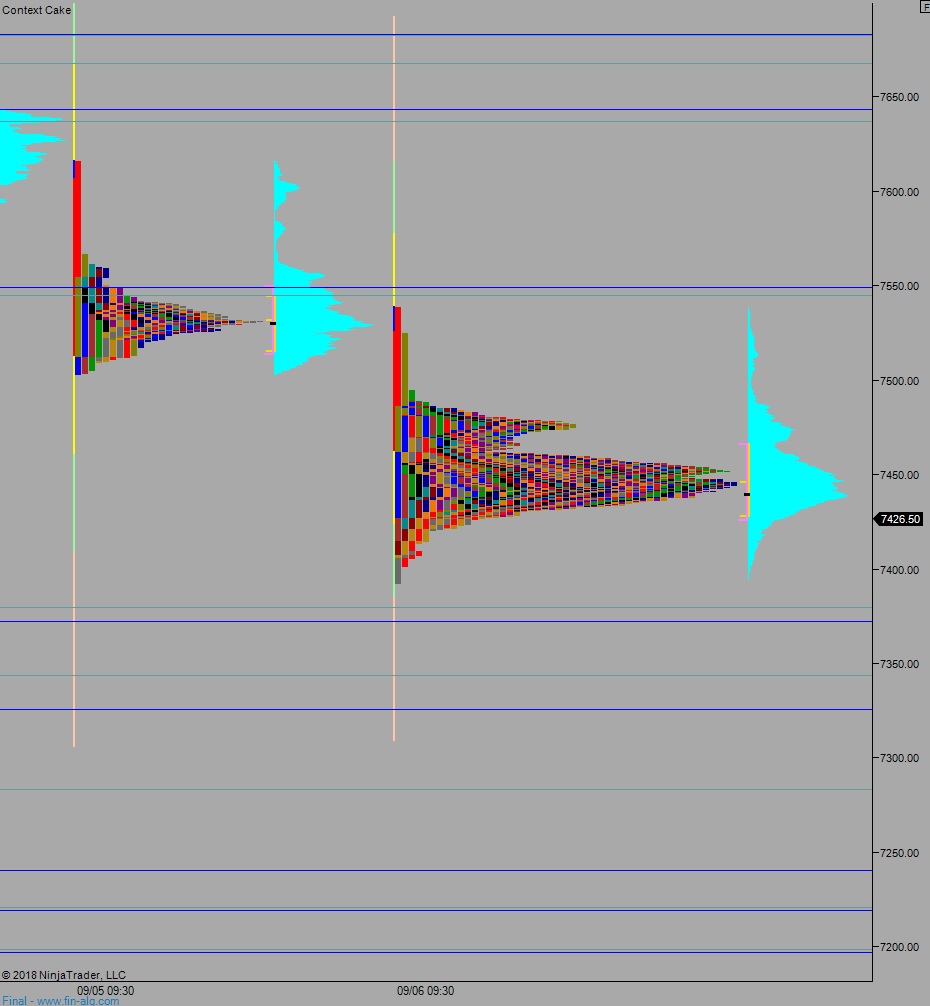

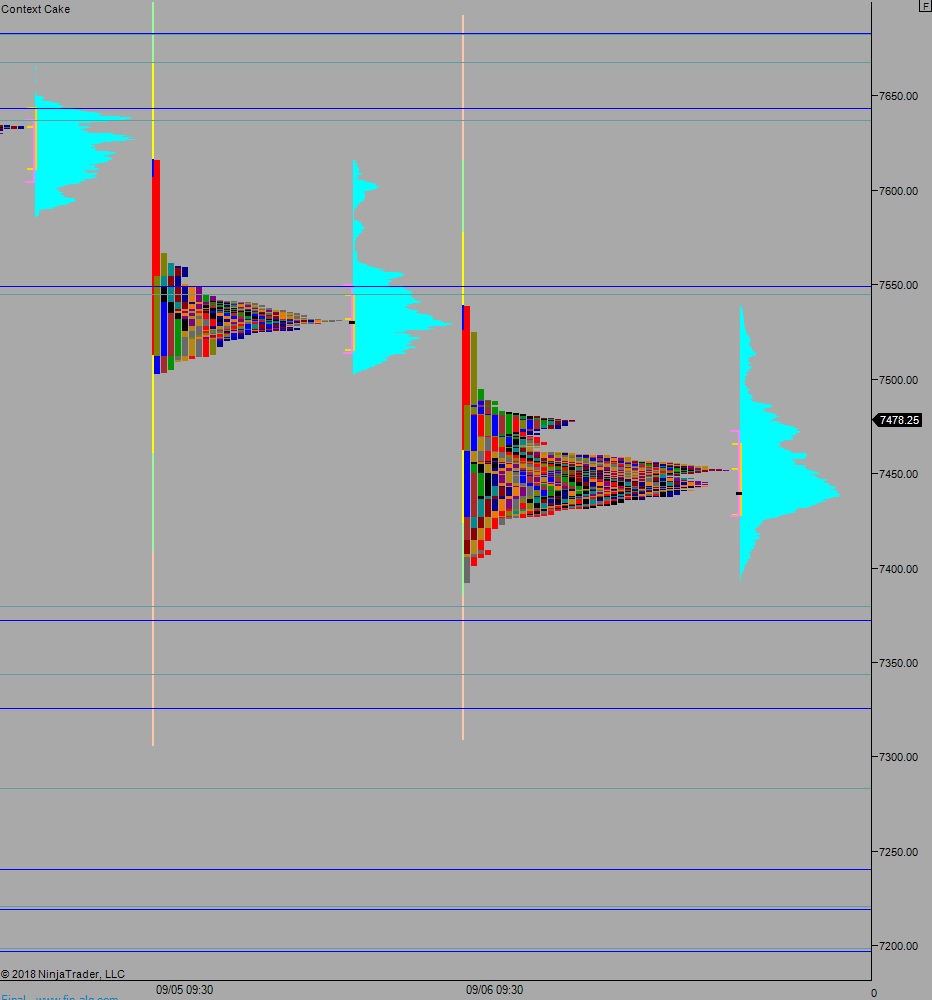

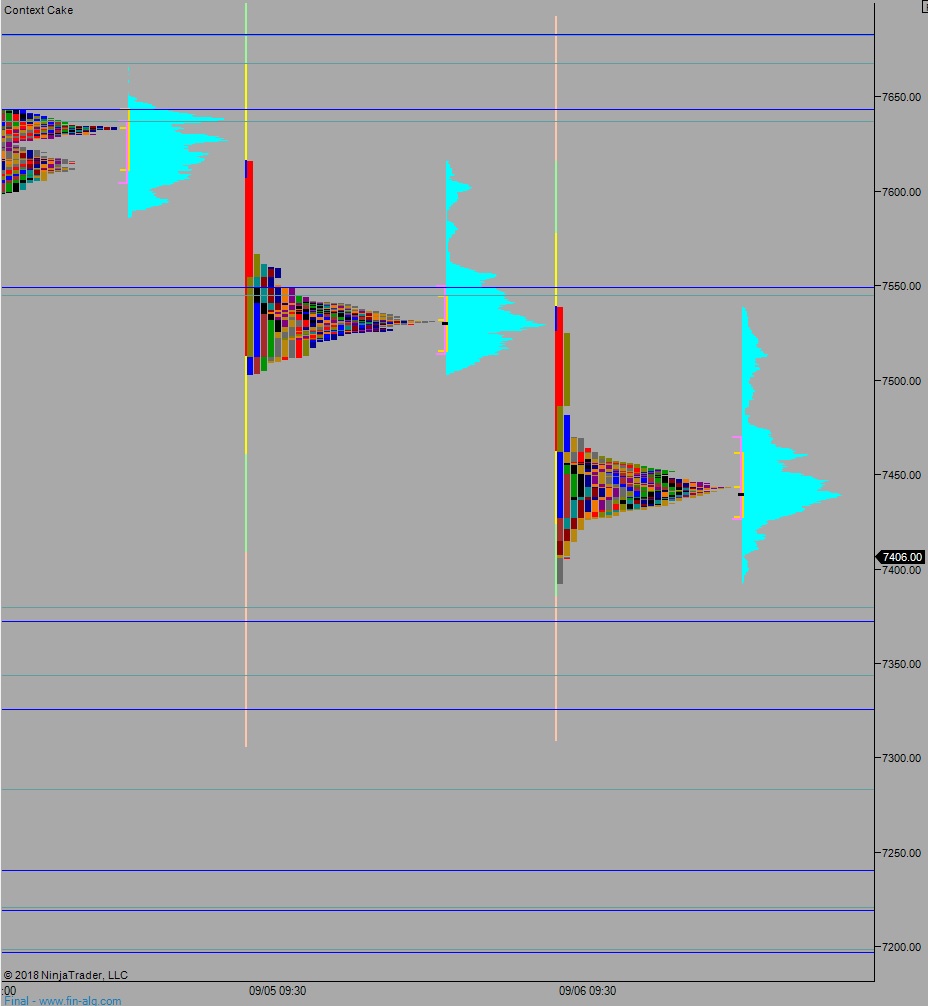

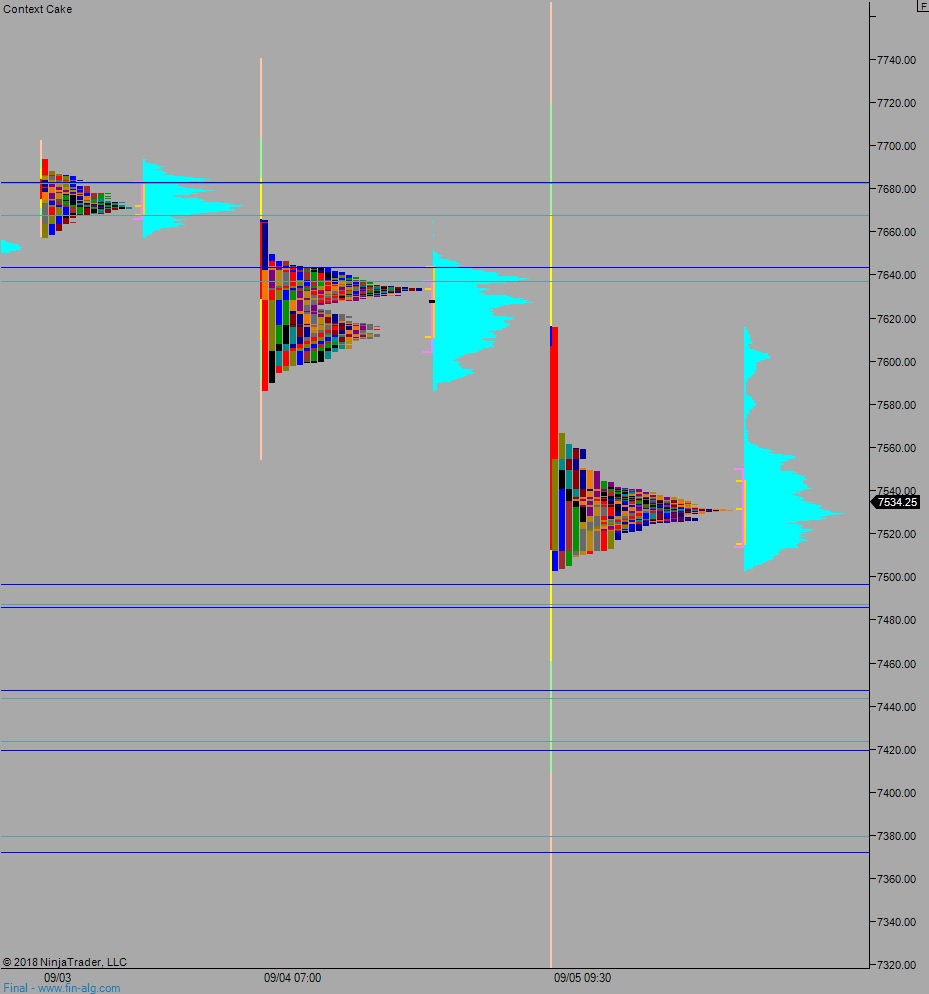

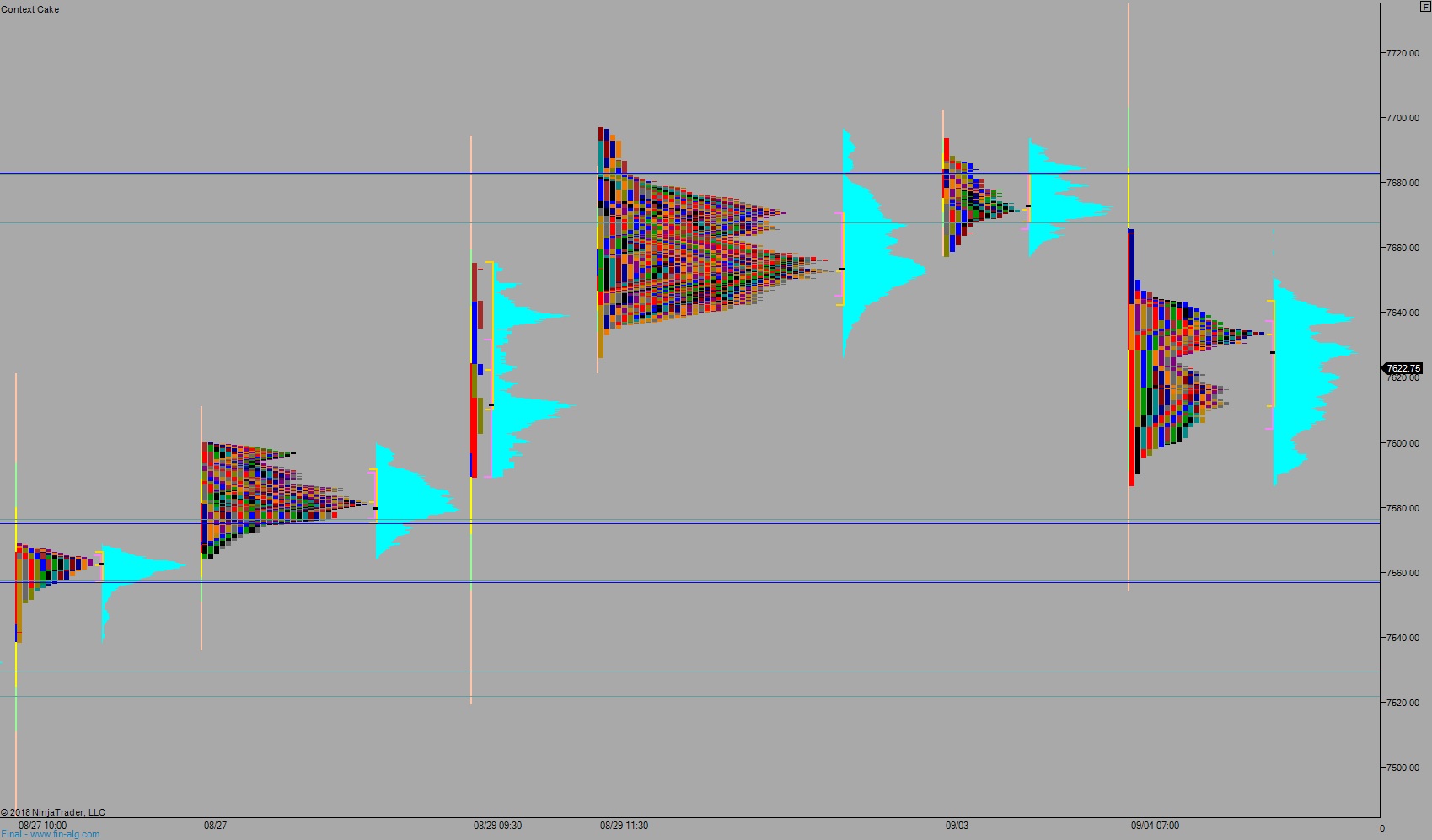

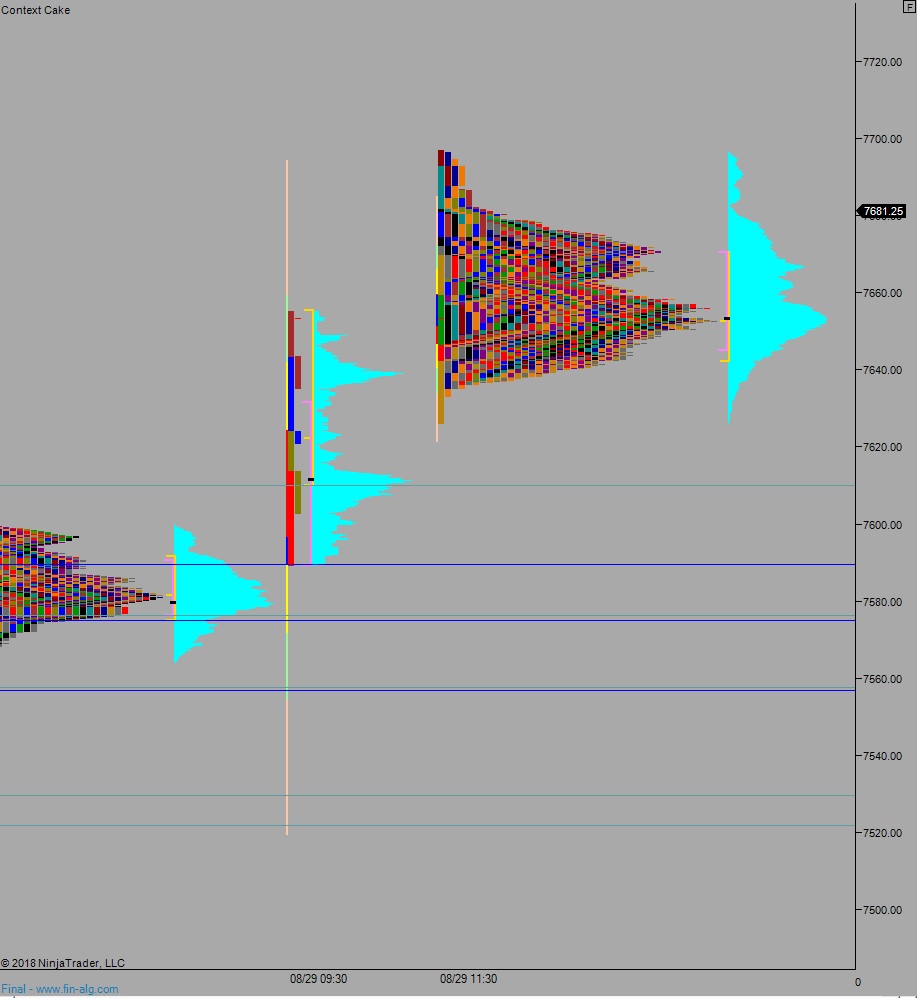

I have been on the wrong side of the tape all week with my TQQQ position and with my NQ_F futures trades. It has been a losing week. But discipline keeps it from being a devastating week. I’m taking my knocks, but little rules like ‘day after trend day’ have kept me from experiencing huge losses that I was fortunate to experience many years ago during development. I am trading well even through IndexModel had me on the wrong side of the tape this week.

You have no idea how grateful that makes me.

Because this blog post went all over the place let me sum it up—Elon is the world’s best CEO and did not inhale pot, therefore he was not made to be stoned nor is he a habitual marijuana smoker. Pot stocks are trash unless they are Canadian, and even then I have zero interest in owning pot stocks. The accountant leaving Tesla troubles me. And I am infinity grateful for my learned ability to stick to my trading plan even when that means losing money.

Discipline for the win. Good luck out there.

Comments »