NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range and volume. Price worked higher overnight, slowly working up near last Friday’s high before coming into balance. As we approach cash open price continues to hover up near Monday’s high.

On the economic calendar today we have a 3- and 6-month T-bill auction at 11:30am followed by consumer credit at 3pm.

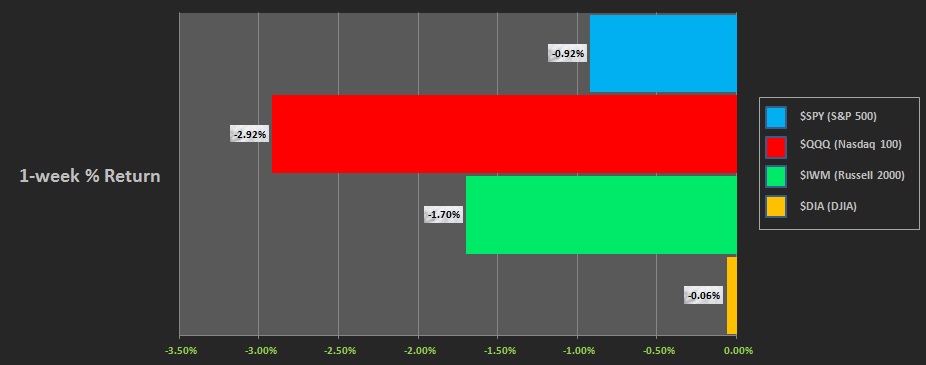

Last week began with a gap down Tuesday after US markets were closed Monday in observation of Labor Day. A drive lower Tuesday morning discovered a responsive bid and the rest of the day was balanced. Then Wednesday featured another gap down and drive lower, this time with more downside. While the NASDAQ continued lower for the rest of the week the Dow Jones Industrial Average demonstrated relative strength. The last week performance of all major indices is shown below:

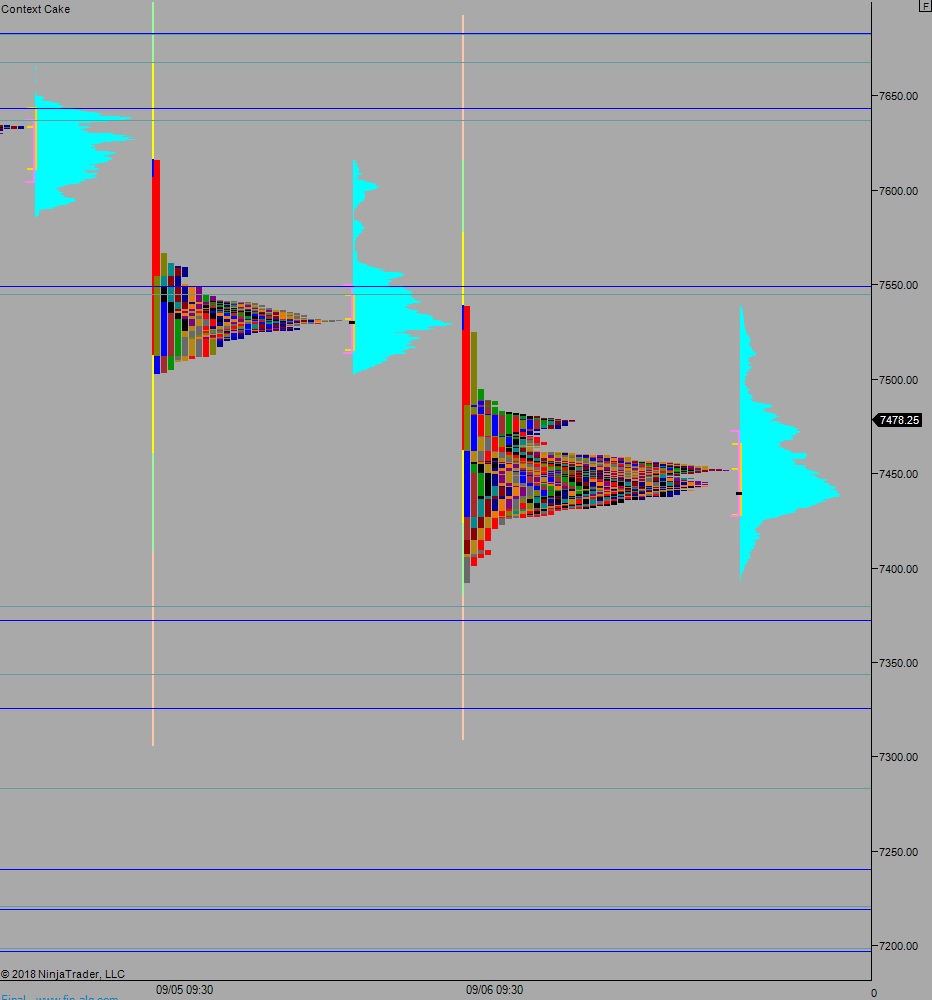

On Friday the NASDAQ printed a normal variation up. The day began with a gap down below the Thursday low. Responsive buyers quickly worked the gap closed and continued a bit higher before finding a responsive seller. We then spent the rest of the day in balance, slowly working lower.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7439.75. From here we continue lower, down to 7400 before two way trade ensues.

Hypo 2 buyers gap-and-go higher, take out overnight high 7483.50 ad sustain trade above it setting up a move to target 7500 before two way trade ensues.

Hypo 3 stronger buyers trade up to 7515.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: