NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price worked lower early this morning after spending much of the globex session in balance. As we approach cash open price is hovering just below last Friday’s low.

On the economic calendar today we have construction spending and ISM employment/manufacturing at 10am followed by a 4-week, 3-month, and 6-month T-bill auction 11:30am.

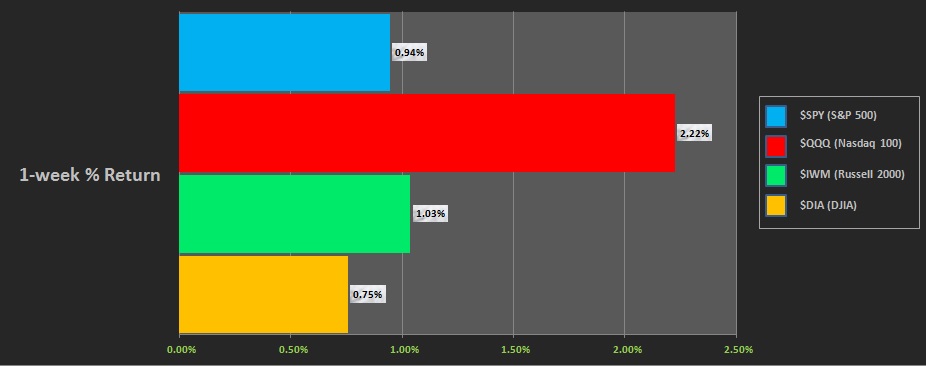

Last week began with a gap up and drive higher across the board. The rally continued into Wednesday. Then we saw divergent strength from the tech-heavy NASDAQ while the other indices retraced. The last week performance of each major index is shown below:

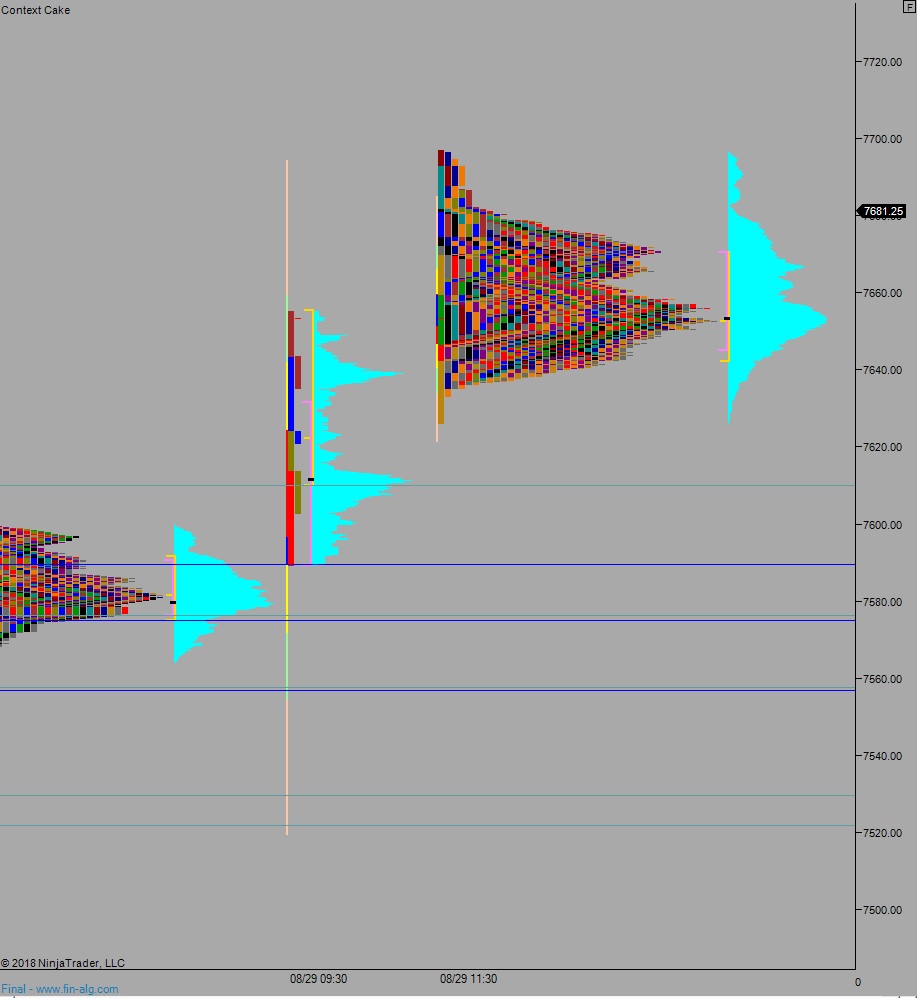

On Friday the NASDAQ printed a normal variation down. The day began with a slight gap down that buyers closed. Buyers discovered a responsive seller ahead of the Thursday high and we spent the rest of the session slowly grinding lower—eventually going RE down late in the session before bouncing back to the midpoint end-of-day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7672.50. From here we continue higher, up through overnight high 7693.75. Look for sellers up at 7700 and two way trade to ensue.

Hypo 2 stronger buyers sustain trade above 7700 setting up a move to the measured move target of 7739.50.

Hypo 3 sellers gap-and-go lower, down through overnight low 7628.50 setting up a move to target 7600 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: