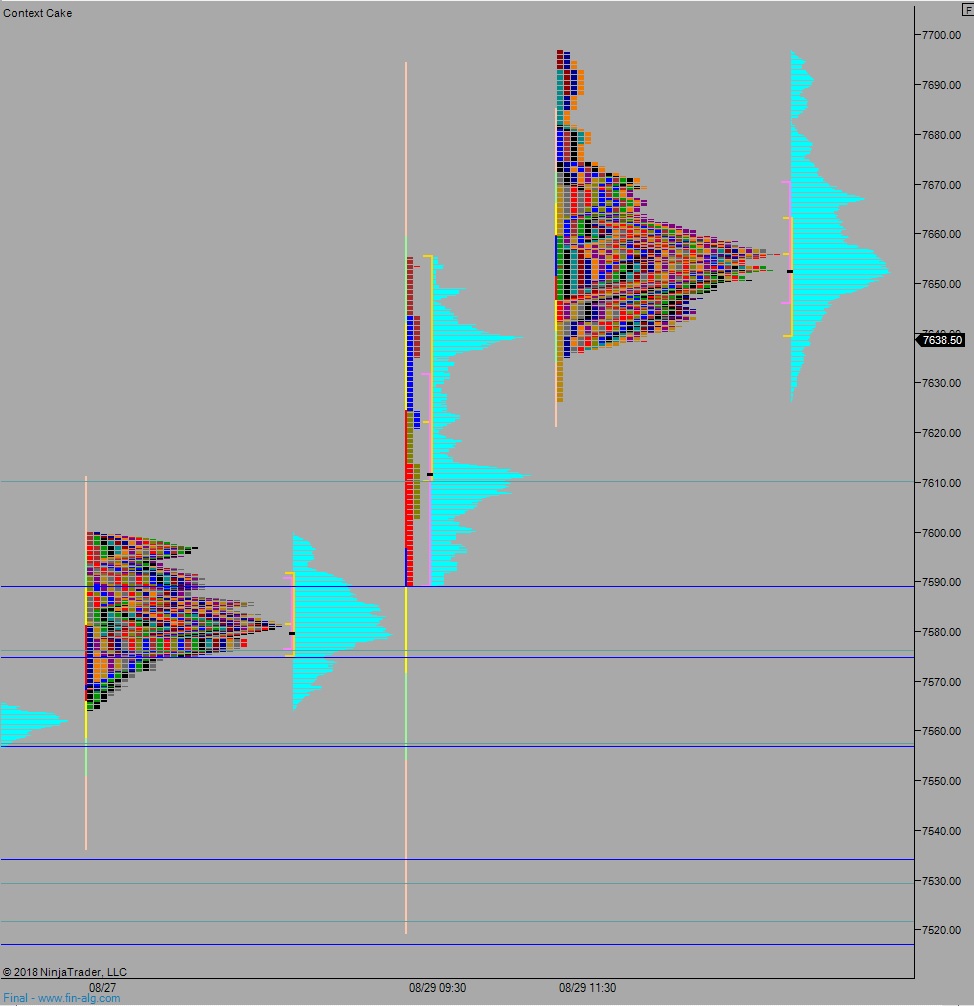

NASDAQ futures are coming into the Friday before USA Labor Day with a slight gap down after an overnight session featuring normal range and volume. Price held Thursday range overnight and as we approach cash open prices are hovering near Thursday’s low.

On the economic agenda today we have Chicago purchasing manager at 9:45am followed by a final reading of July sentiment from the University of Michigan.

Yesterday we printed a neutral day. Day started gap down and with buyers working the gap fill. Then they continued rallying, stopping just shy of the 7700 century mark before discovering a responsive seller. Sellers quickly traversed the entire daily range putting us into our second range extension. The tail-end of the session was spent drifting back towards the mean.

Neutral.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7648.75. From here we continue higher, up through overnight high 7663.25. Look for sellers ahead of 7670 and two way trade to ensue.

Hypo 2 stronger buyers trade up through Thursday high 7697 and probe the 7700 level. Open air, could continue to rally.

Hypo 3 sellers press down through overnight low 7635.25 setting up a move to target 7610.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: