NASDAQ futures are coming into Wednesday gap down after an overnight session featuring elevated range and volume. Price worked lower overnight, staying inside Tuesday’s range before coming into balance. As we approach cash open price is hovering along Tuesday’s midpoint. At 8:30am Trade Balance data came out better-than-expected.

There are no other major economic events today. Federal Reserve’s Kashkari is giving a talk at 4pm that may be interesting but will likely not impact today’s tape. Fed’s Bullard is speaking at 9:20am but Bullard is rarely a market mover.

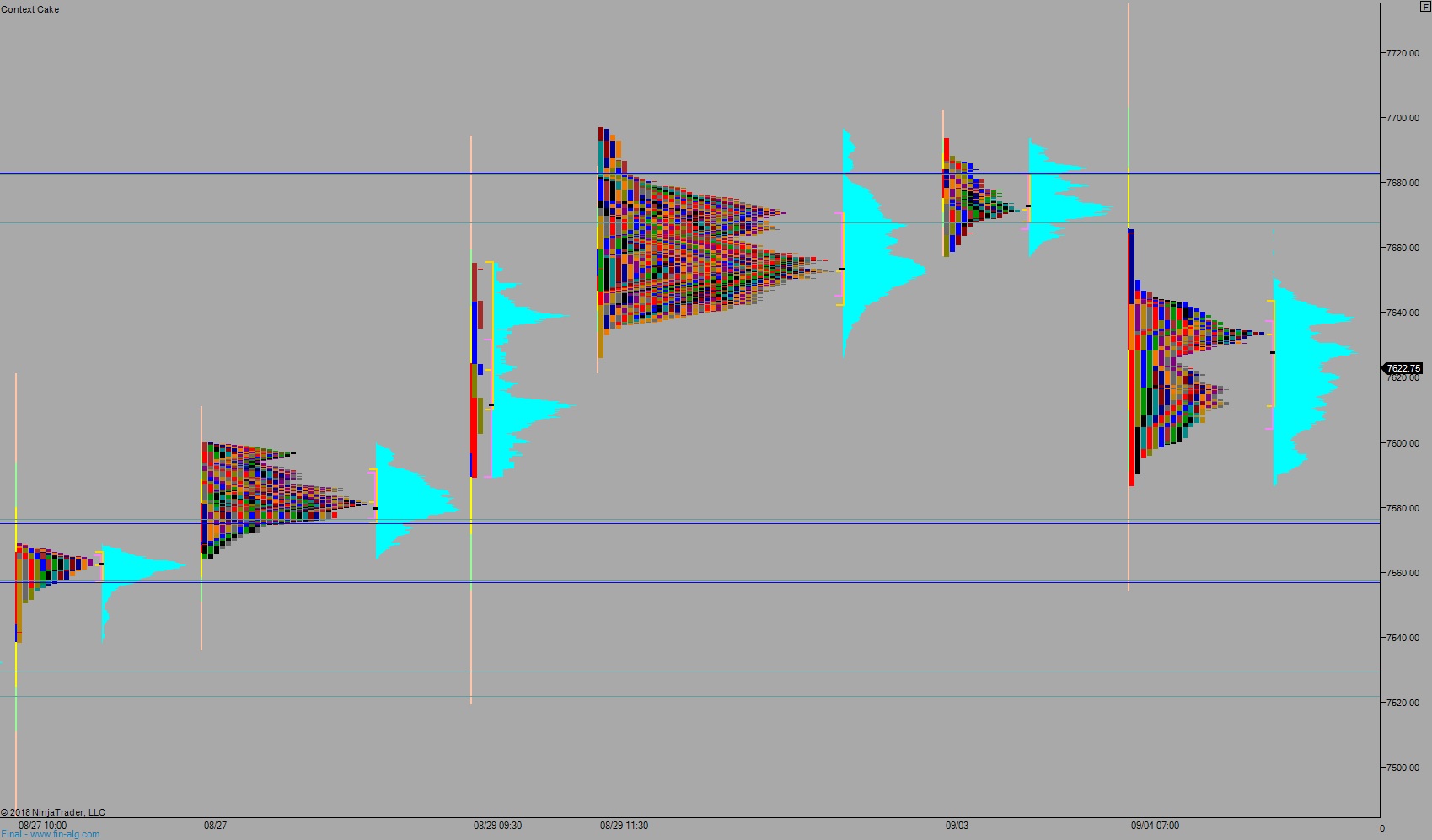

Yesterday we printed a normal variation up. The day began gap down, down to last Thursday’s low. Sellers drove lower off the open, rejecting us away from the Thursday range. We traded right down to the weekly lower ATR band where a strong responsive bid stepped in and drove price up through the entire daily range and briefly pushed us range extension up. Sellers stepped in again and worked us lower, nearly taking out the morning low. But responsive buyers showed up again and we slowly rallied for the rest of the day. closing near the daily high but not making a new high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7640. From here we continue higher, up through overnight high 7644.75 setting up a move to target the labor day gap at 7668.25 before two way trade ensues.

Hypo 2 sellers press down through overnight low 7595.25 settign up a move to target the open gap at 7578.75 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 7668.25 setting up a move to target 7682.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: