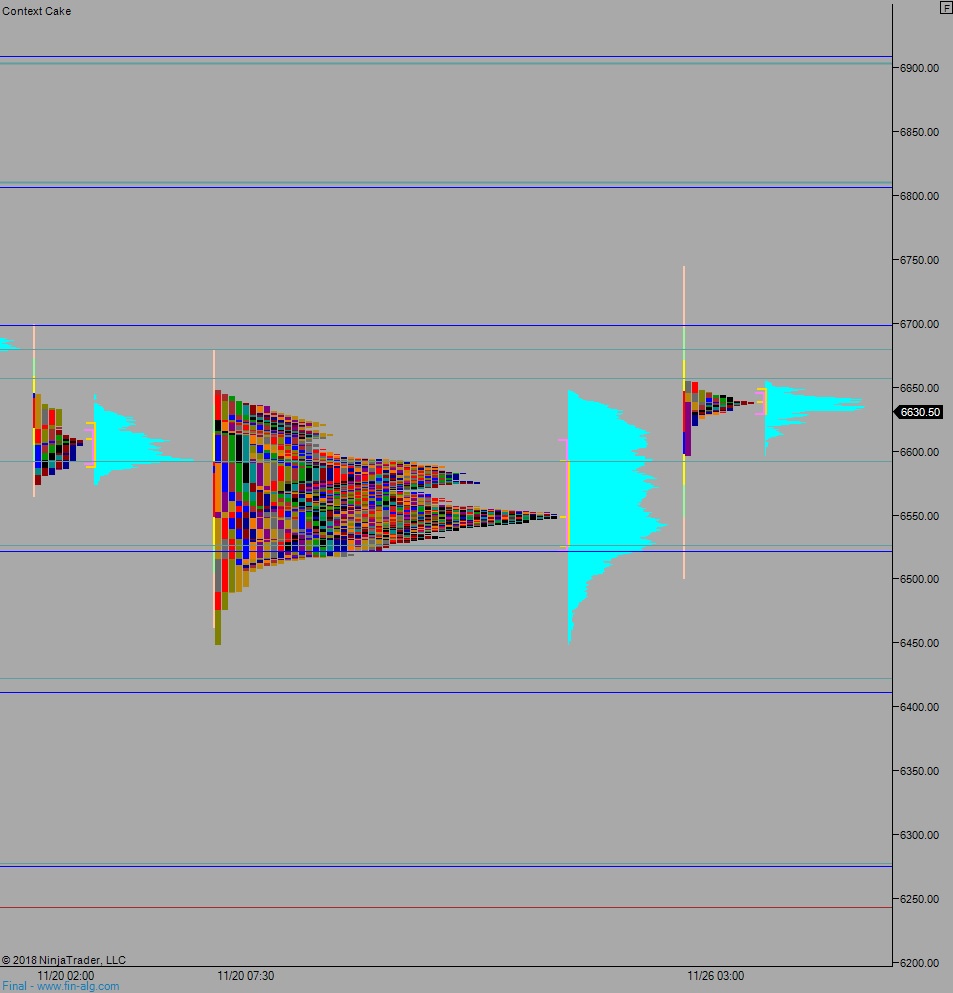

NASDAQ futures are coming into Monday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, uni-directional up, trading up into last Monday’s trend down range briefly before discovering responsive sellers. As we approach cash open price is hovering down below Monday’s low.

On the economic calendar today we have 4- and 8-week T-bills up for auction at 11am, 3- and 6-month bills at 11:30am, and a 2-year note auction at 1pm.

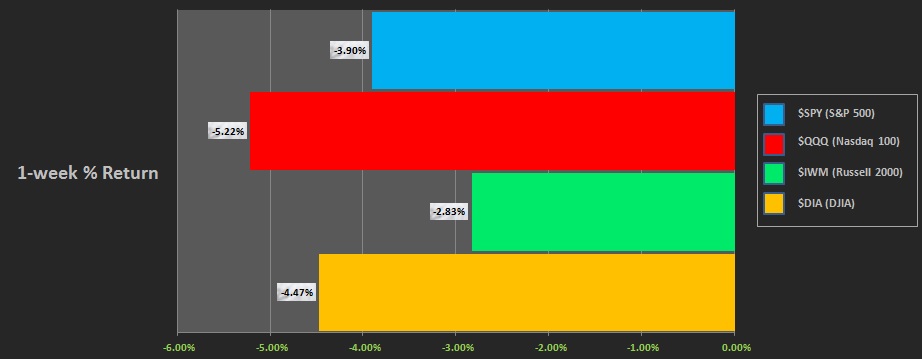

Last week started off with a gap down and liquidation sale lower. The selling continued overnight Monday and we had a big gap down Tuesday. This gap down discovered a strong responsive bid early Tuesday and the rest of the week was light, with the holiday on Thursday reducing volume for the rest of the week. The Russell and NASDAQ demonstrated relative strength during the holiday drift, never returning to their Tuesday low, unlike the S&P and Dow which did take out their lows later in the week. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal day. It was a half day. There is not much insight to gain from it. Wednesday was a normal day also.

Heading into today my primary expectation is for buyers to gap-and-go higher, reclaiming last Monday’s range by taking out overnight high 6655 and closing the Monday gap at 6672 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and trade down to 6600. Buyers reject a move back into the Friday range (6601.50) and two way trade ensues.

Hypo 3 stronger sellers work a full gap fill down to 6530.50 then continue lower, down through overnight low 6522. Look for buyers down at 6527 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: