I was going through my archives and realized I haven’t messed your mind up with my CRISPR immortality chatter since April 2017. Back then I was way out on the fringe of society, living in a van, preferably down by a river when possible. My exuberance has been tampered several times since then.

I remember being on the final leg of a ski bum road trip across the west, meeting up with some corporate friends at mammoth mountain, who had ridden that nice Italian-sounding CRISPR stock, Sangamo, higher with me since around 3.50. They were of course stoked to see me, first because they’d caught a fresh dumping of powder out on Chair 9 earlier in the day, and next because there we were, toasting our commanding of the financial markets with fireball and mountain ale.

I had been to seven other mountains before then, including two days at Jackson Hole, having caught powder on all of them, and was thinking with a clarity reserved for the truly satisfied mind.

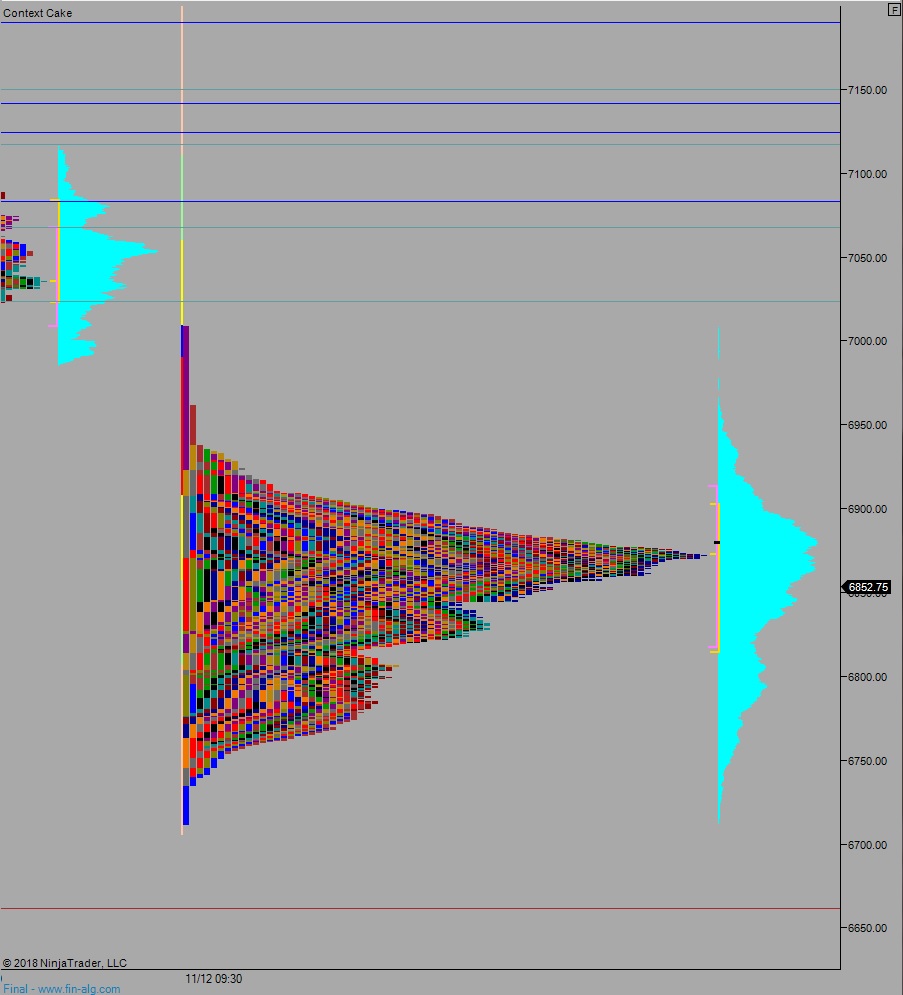

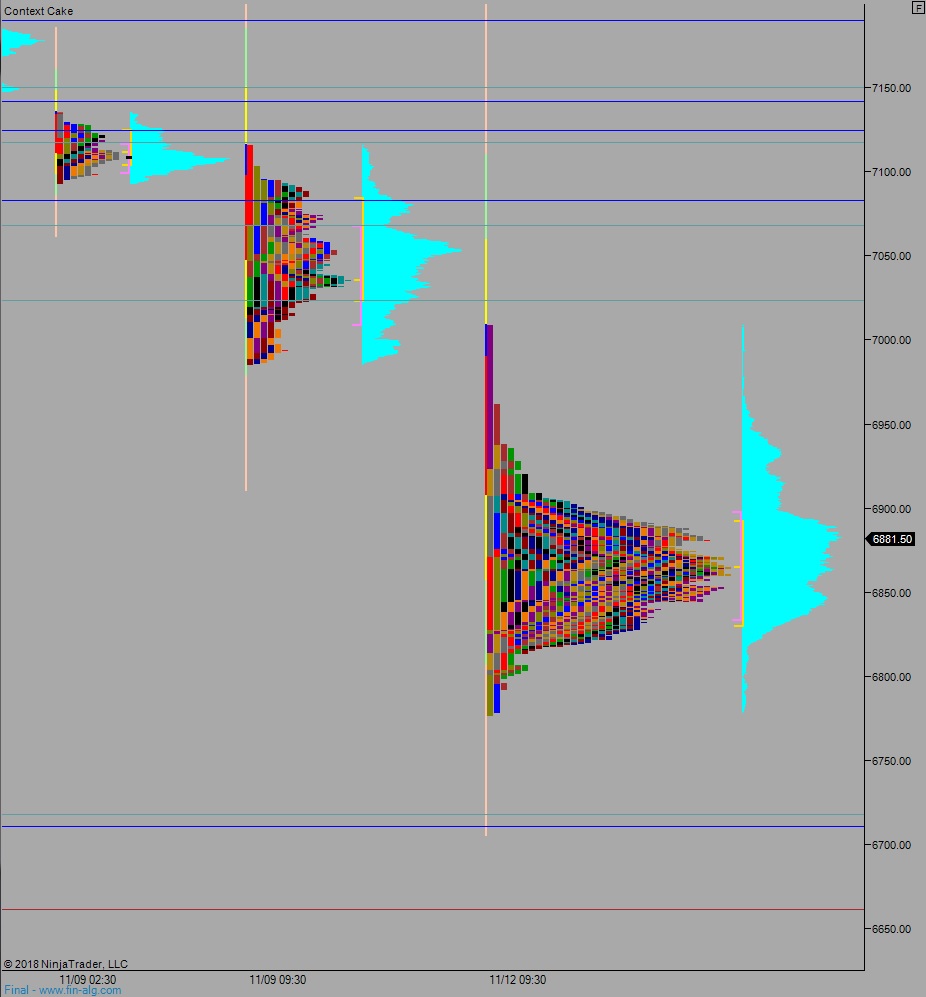

They wanted to buy more Sangamo. Whatever, this sounds like a brag at best, a downright fiction at worst. I told them to instead sell a third or their position from 3.5o and lock in the profits. I did the same a few days earlier, selling a third of my original position from inside the RV. Look at this freaking chart:

We scaled 1/3 of our position at swing high. Santa Lucia, say what you will about charts and timing and technical analysis guff—the right ingredients and you can think clearly, man. I said to him, a Santa Barbarian mind you, I said, “We know very little about CRISPR science. All we know is the rich have aspired to immortality since hording religious icons in Byzantium. They have good reason to live. Life has been good to them, they have complete command of reality and want to enjoy here on earth the fruits of their power. That’s all we know. Scale a third.”

It was a hard sell, selling them on selling but I had been targeting $25 all along. Old swing highs. Not rocket science.

Anyways, clearly these people harp me as they see their net worth wither away, watching their papered gains on the remaining 2/3rds dwindle away, along with their aspirations for Tesla cars and coastal real estate.

What do we do now, RAUL, you fucking cave dwelling fuck?

I couldn’t care less. I can live off of canned fish and river water. Probably longer than a person subjected to the stresses of corporate servitude. But I like CRISPR…I like selling rich assholes the promise of immortality.

So I would tell them. I’m holding off until November. This wasn’t some prophetic vision. I just feel like I have/had a sense of the overarching sentiment surrounding this whole CRISPR situation. Money changes people. It makes them confident. Which is fine. Sometimes it makes them overconfident. Which is fine too, but overconfidence opens up space for a scrappy and resourceful competitor to take. There is a real balance to nature.

The bill always comes due.

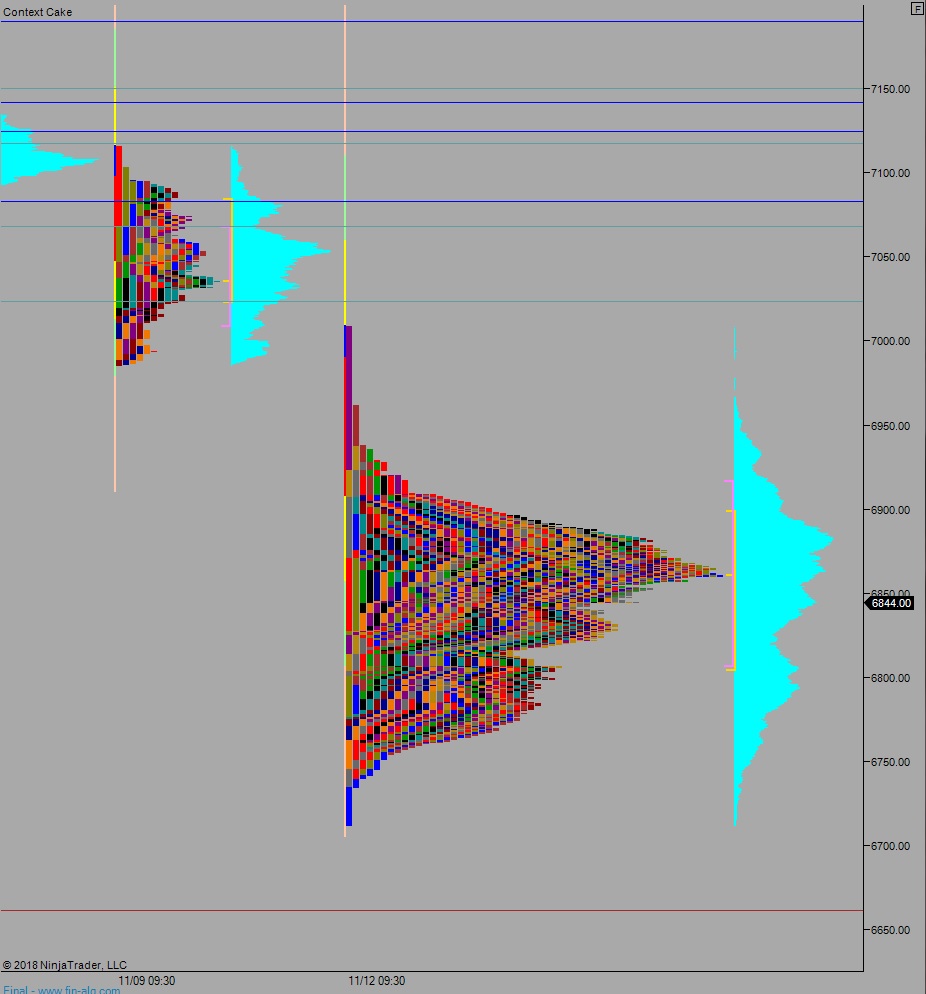

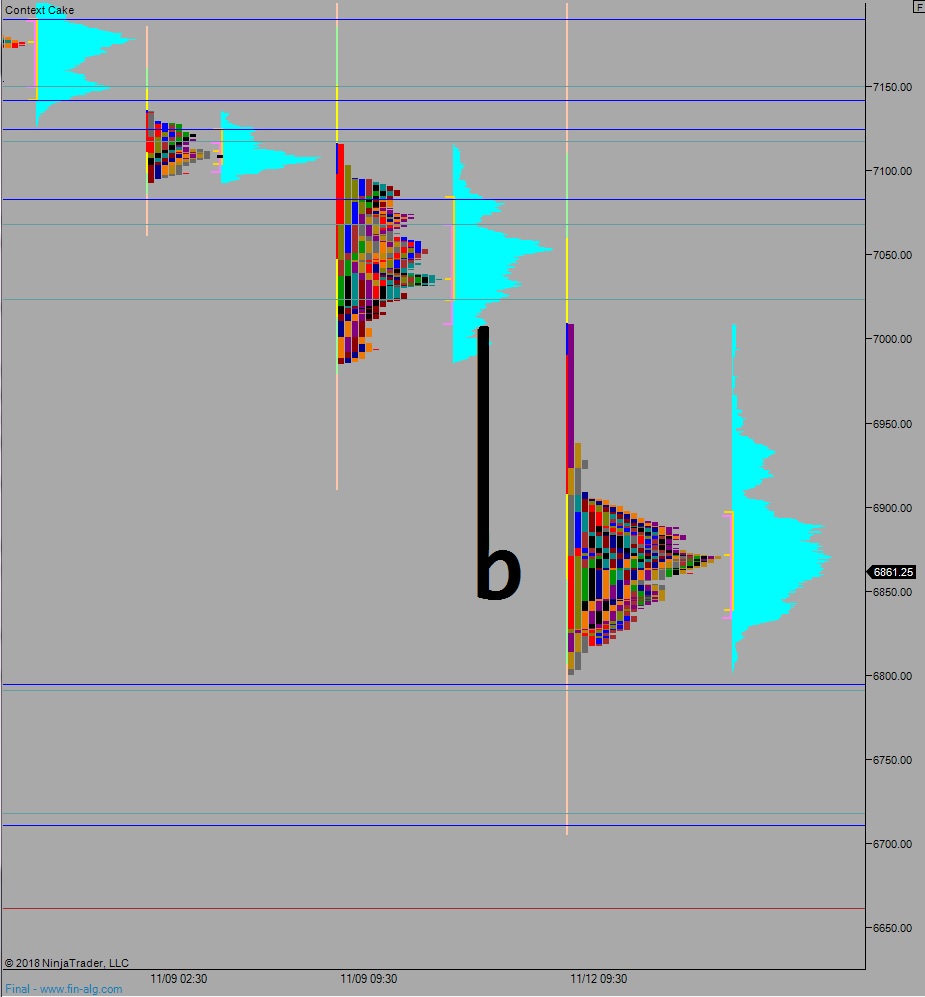

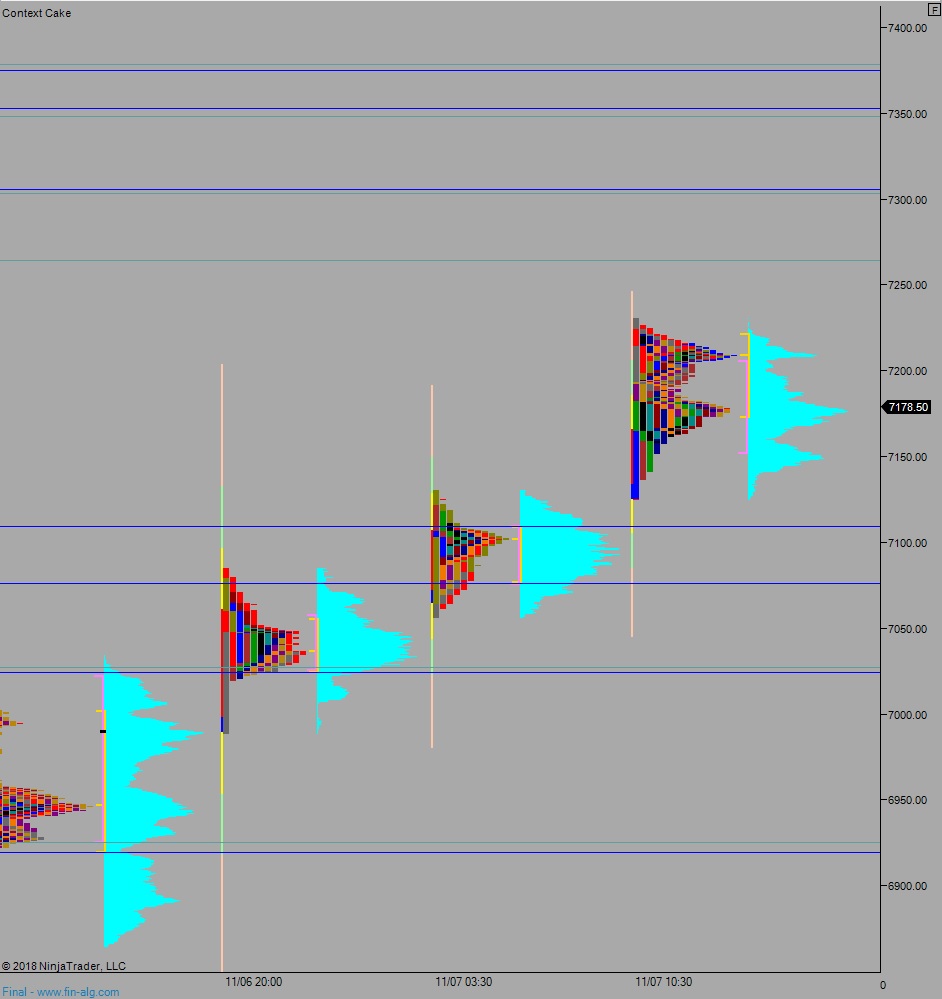

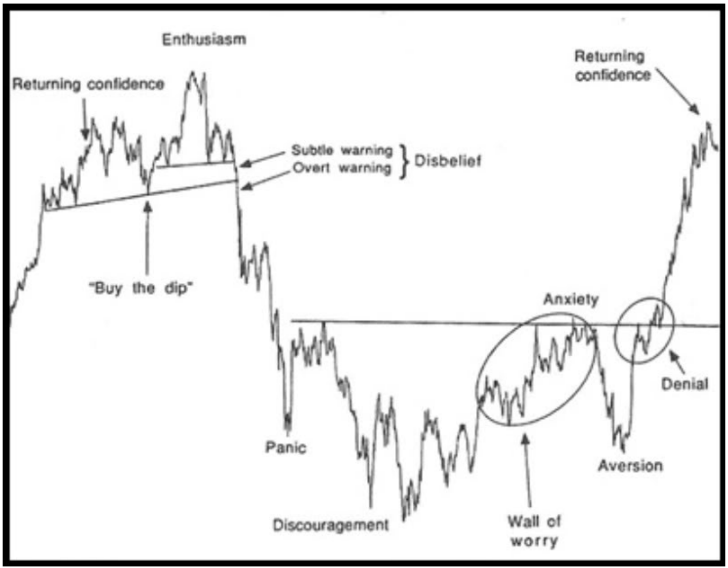

Enthusiasm had returned to science, to immortality, to CRISPR—to the stock market in general. This chart is quietly passed around by a small circle of traders:

And as you might imagine, I sensed it when people started to panic about Sangamo. A fall from $25 to $16 in two months (March-April 2018) puts some panic in people. Hahaha, funny humans.

Anyways, I figured we had to make panic lows. After which there would be a violent bounce higher before making another new low, which meant another long, bitter, shitty stretch of discouragement was in the cards. So I figured wait until November, then take it from there.

I pay attention to things most of yous overlook. It’s a product of consuming raw inputs as opposed to cooked up media bits or other foolishness. Raw stock market interactions. That is how I measure the temperature of the collective human mind. Say what you will about my school of thought. It lets me slide through the financial complex like a fox, snagging meals along the way. No ones master. No ones slave.

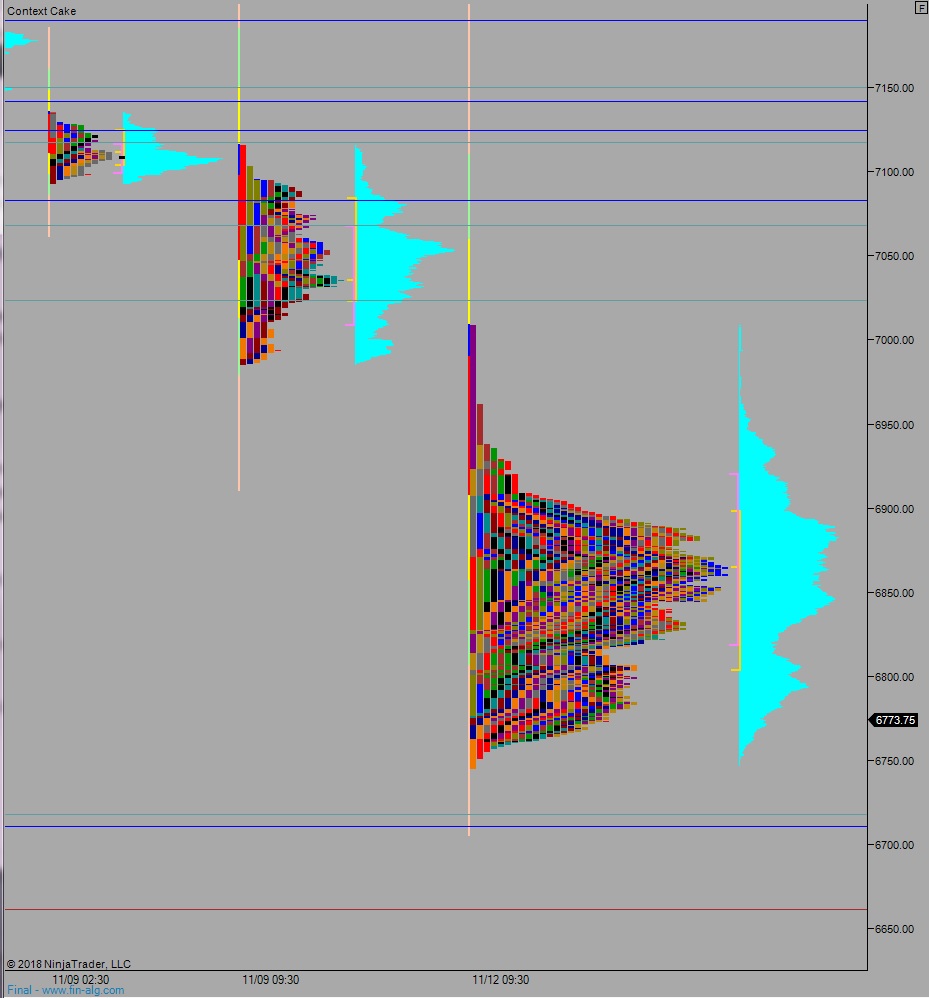

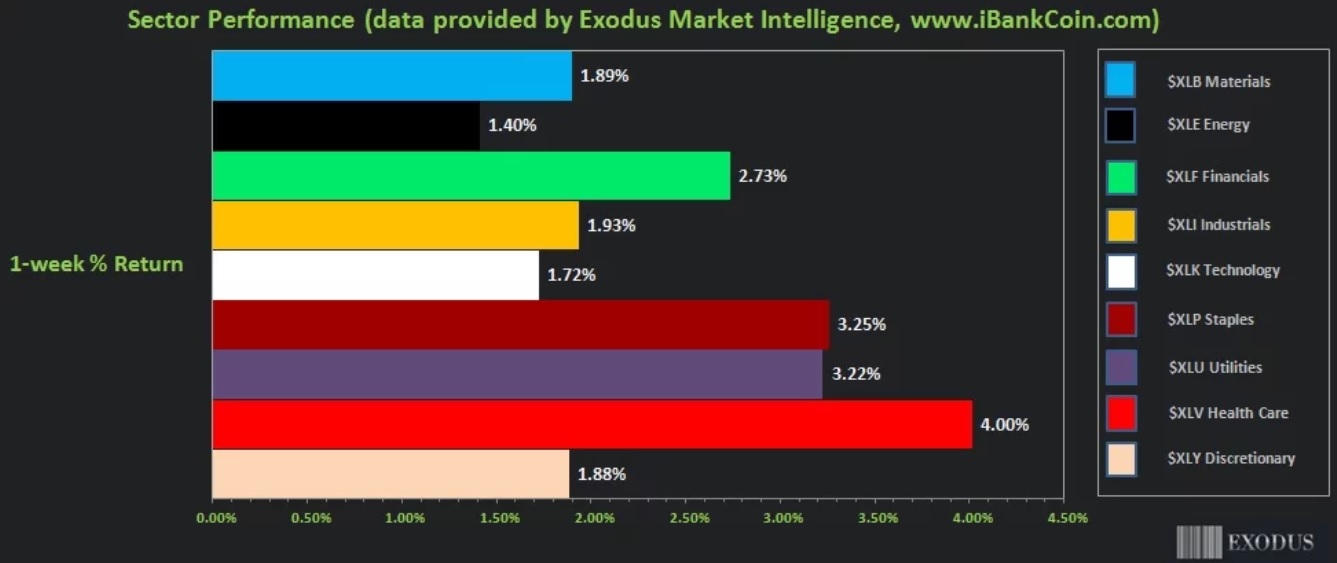

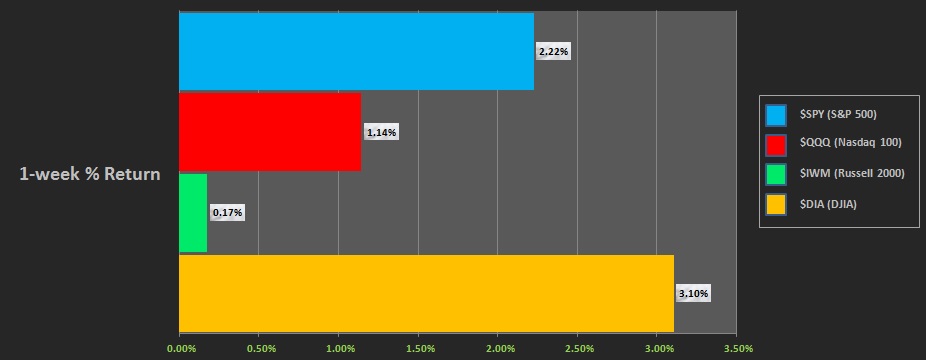

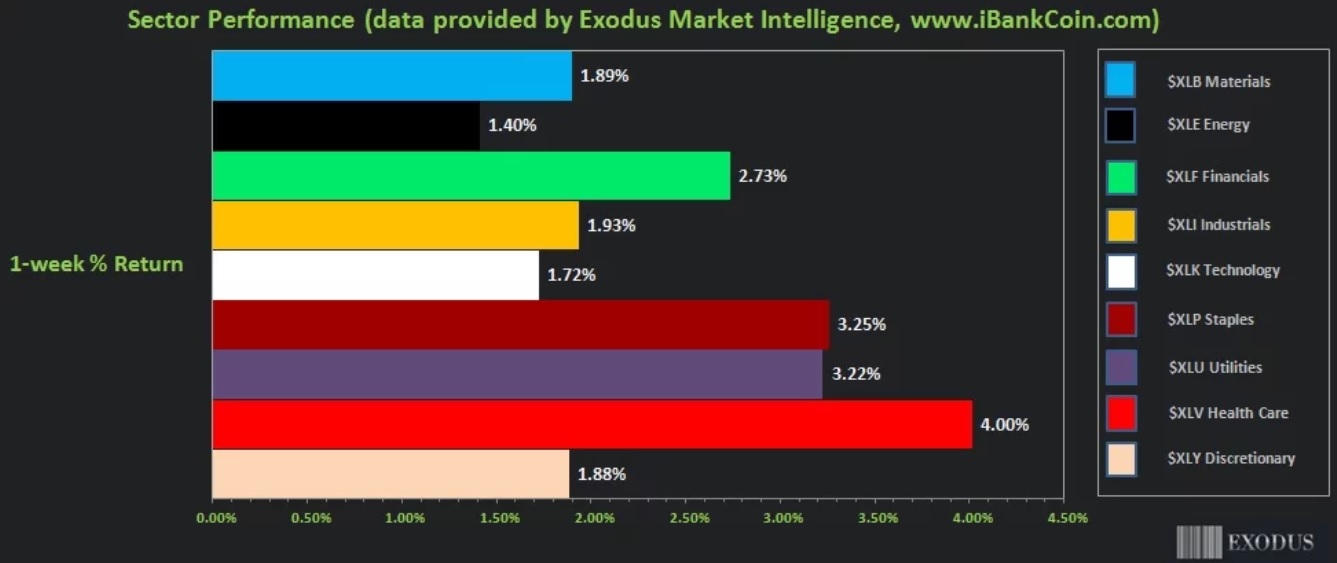

Anyways, something caught my interest on last Sunday’s strategy session. During our first material bounce of the Great Bear Market of 2018 [sarc] the Health Care sector turned out the best 5-day return, look:

So I’m sitting here Monday, trying to take the week off because my signals were crossed, and the stock market is being obliterated. I remembered the conversation I had with one of my closest confidants, ROBERTO BREGANTE, and how I had informed him that I had begun stalking SGMO—since it was now November and Sangamo was having its shit tossed last week. I told him resting bid at 10, resting bid at 10…might inch up higher if buyers step in before then.

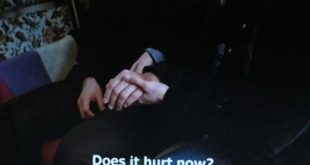

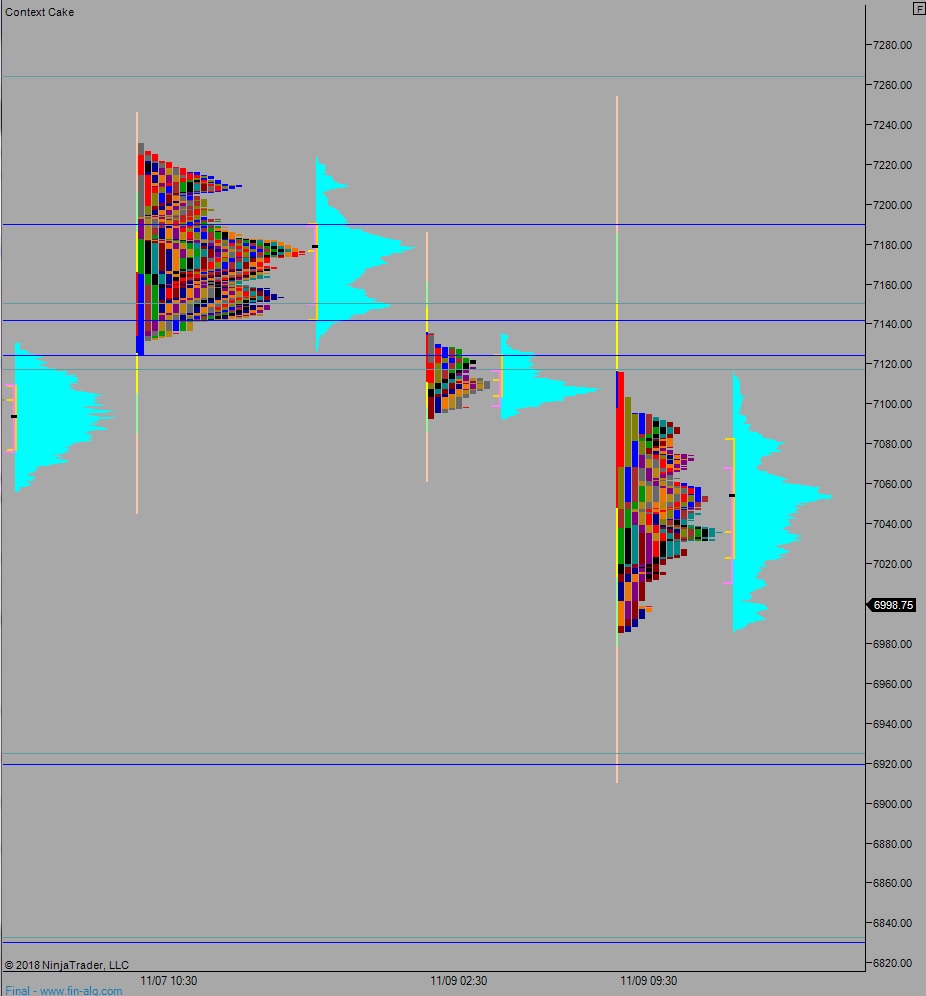

The truth was I had no resting bid. I never rest bids unless I absolutely have to. I was here Monday morning, sending emails and pacing around Mothership and preparing morning trading plans and shit. When I dialed up a quote on the NAS100 futures at about 11am I was surprised at what all of you had done to the stock market. I didn’t look for a reason why it happened beyond a cursory scan of Twitter. I realized nothing horrible had happened, aside from a shite tonne of primitive missiles being fired from the Gaza Strip, a variety of shoddy ballistics fired towards the citizens of Israel. This is like the Holy Land equivalent of a mass shooting in America. It has almost zero likelihood of needing to be priced into the stock market. So I directed my attention back to the NASDAQ futures.

I went long 6833 despite it being my week off. I was in a jovial mood so I live tweeted the trade.

Since I was back at the trading turrets on Mothership, I dialed up Sangamo. And there it was, back at 10, right where I wanted it. While capturing 65 nasdaq points, I watched to see if buyers would step into Sangamo at $10, and when it seemed they did I added to the position.

This is my first SGMO buy since about 3.50.

I hope this blog entry doesn’t come off as some kind of brag. I also hope you do not take action based off this blog post. All I am trying to do is expand upon my thought process when investing. I feel like you have to bring a unique perspective to a game as competitive as speculating if you intend to produce unique returns. That being said, everyone is different and their ability to dedicate resources to their way of life or their mind or investment process is different. When I was a younger lad, I scoured the internet for real people who operated inside the financial complex, starving for information on how they do it. That is why I blog. I blog as if leaving a bottled message for 21 year old me.

Godspeed old sport.

Hopefully an entry like this gives you some insight and makes some light bulbs emit lumens into a dark corner of your own mind–expanding your investor mind.

Or not, whatever. I am longer CRISPR as of today via more shares of that nice Italian sounding CRISPR stock SANGAMO.

ciao ciao kiss kiss

Comments »