I just filed the Exodus (Sunday) strategy session about 36 hours later than normal, which means it’s a day late and maybe a dollar short we don’t know—but being able to sit down at my terminal and rip through a handful of screens has me feeling prepared for what has all the markings of an eventful week.

TSLA, MSFT, FB, AMZN, and INTC are set to report earnings. These are our benevolent tech overlords. How the report will tell the story. The NASDAQ is out in front, taking its shot at sustaining all-time highs. The right blend of good earnings could keep the tech-heavy NASDAQ on its upward trajectory. The most bullish behavior would be, of course, if all these tech companies report below expectations and forecast weak yet we still rally. Recall the reaction grid:

negative data, positive reaction – strong bullish

neutral data, positive reaction – medium bullish

positive data, positive reaction – bullish

negative data, negative reaction – bearish

neutral data, negative reaction – medium bearish

positive data, negative reaction – strong bearish

Trading is not rocket science. It is a few simple tactics executed well. Balance and discovery. Statistical probabilities. Risk management. Over and over again.

Anyways this is becoming a fatigued ramble. Here is the Exodus Strategy Session in it’s entirely, enjoy.

Exodus members, I am having difficulty uploading the 231st edition of Strategy Session into Exodus. Hopefully I will have the issue resolved by next week. In the meantime, if you would like to read the Strategy Session, it is published below in entirety. Thank you.

Exodus Strategy Session: 04/22/19 – 04/26/19

I. Executive Summary

Raul’s bias score 3.38, medium bull*. Calm drift until Wednesday evening, then watching for big tech earnings MSFT, FB, and TSLA to put a direction to the tape into the second half of the week. Watch for Thursday afternoon earnings from AMZN and INTC to either affirm or conflict the direction established Wednesday evening-thru-Thursday.

*extreme Rose Colored Sunglasses [e(RCS)] bullish bias signal triggered, see Section IV

II. RECAP OF THE ACTION

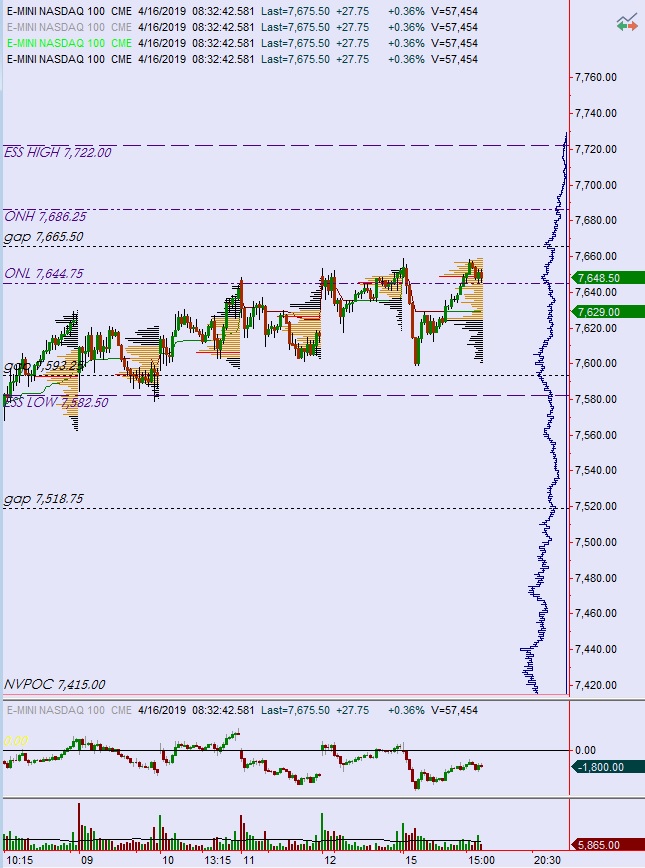

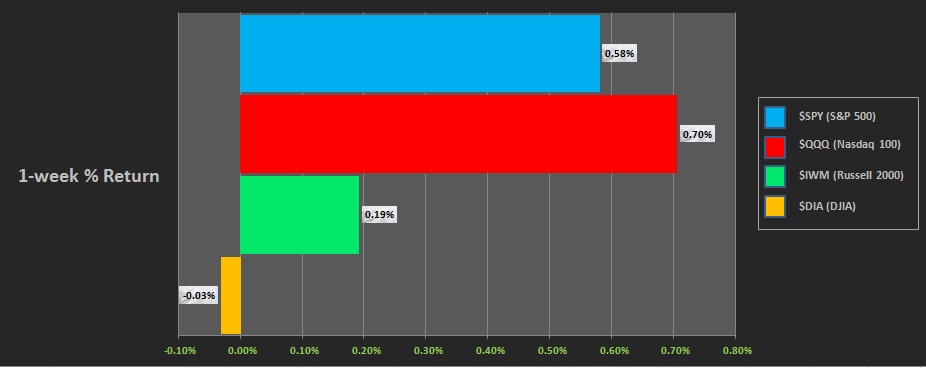

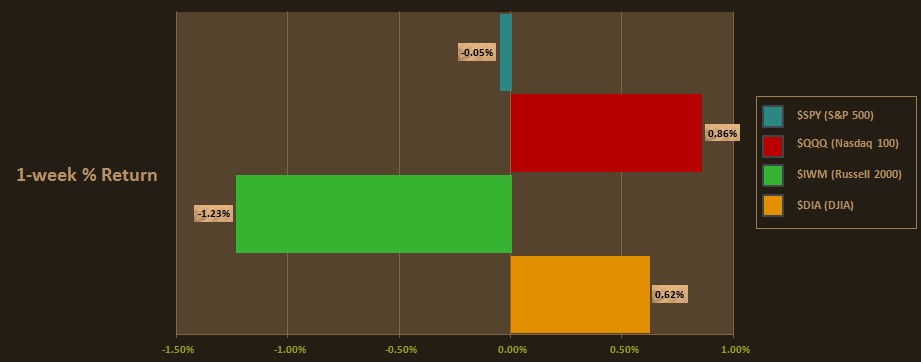

NADSAQ leads a charge higher, Russell lags. Dow and S&P not taking out their respective all-time highs alongside the NASDAQ.

The performance of each major index is shown below:

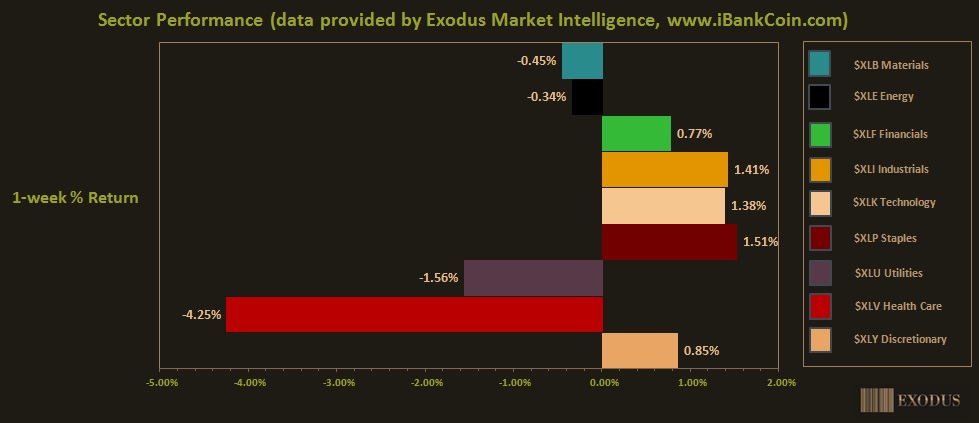

Rotational Report:

Odd mixed bag with Healthcare taking a hard hit. Staples leading the way.

neutral

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

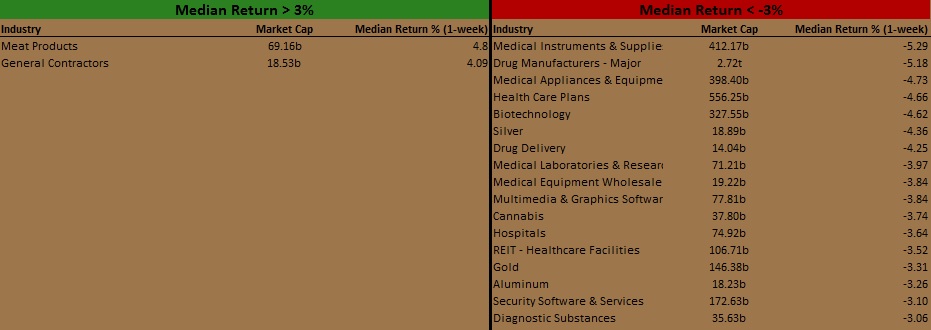

Exodus [PPT 2.0] streamlines how we can research the individual behavior of each industry and how it pertains to overall market sentiment.

Using the Industries screen, we can filter for the Median Return [1 week] of each industry. I have established an arbitrary -/+ 3% cutoff for qualifying industries of interest.

Looking closer we see the broad weakness in Healthcare, along with precious metals.

bearish

Here are this week’s results:

III. Exodus ACADEMY

Catching up using Exodus

Being able to log into Exodus a day later than the Strategy Session is normally published and having the ability to work back a day into the data is a huge factor in my feeling confident in my ability to interpret the new information we’re set to receive.

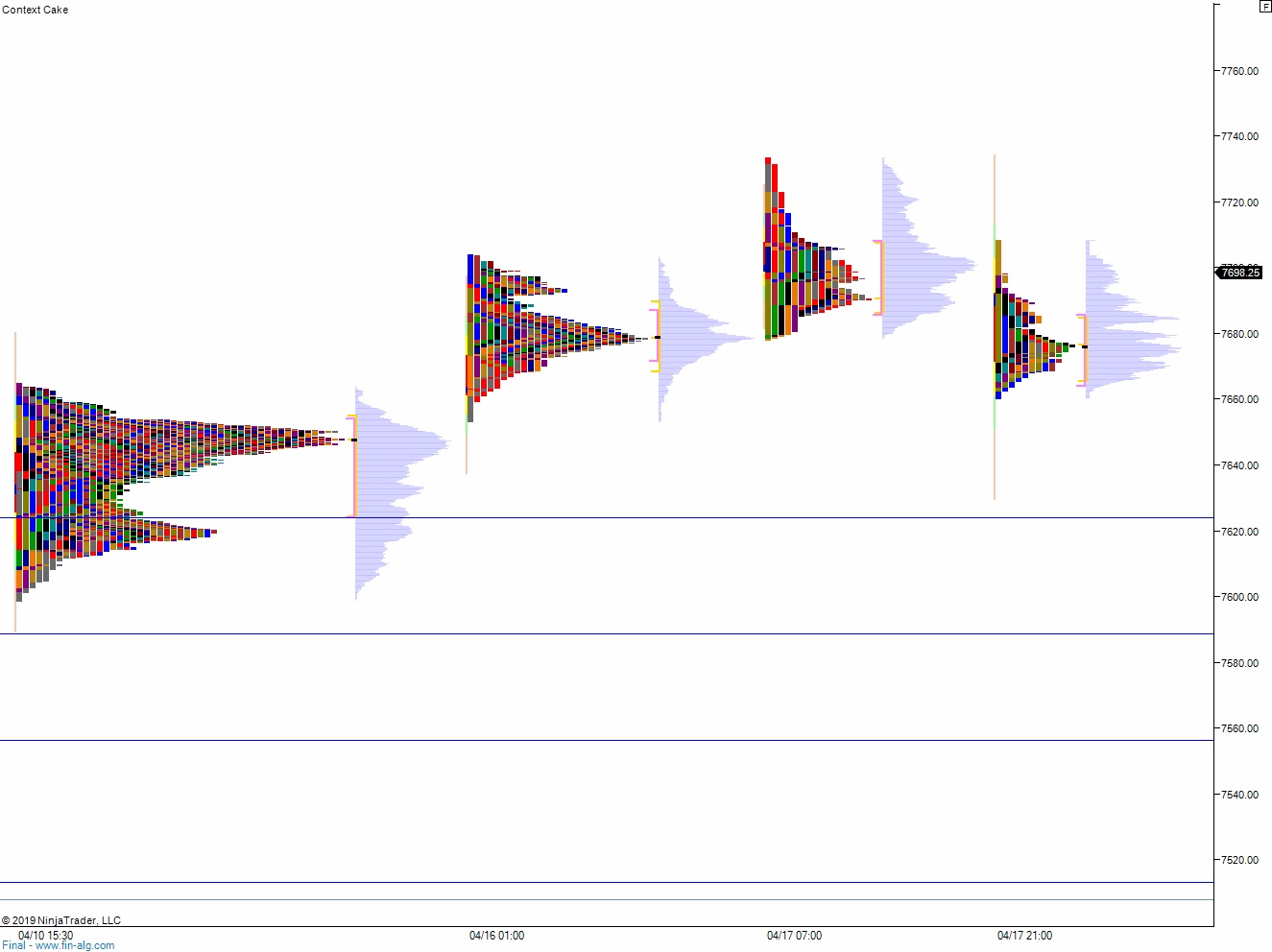

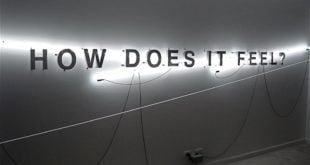

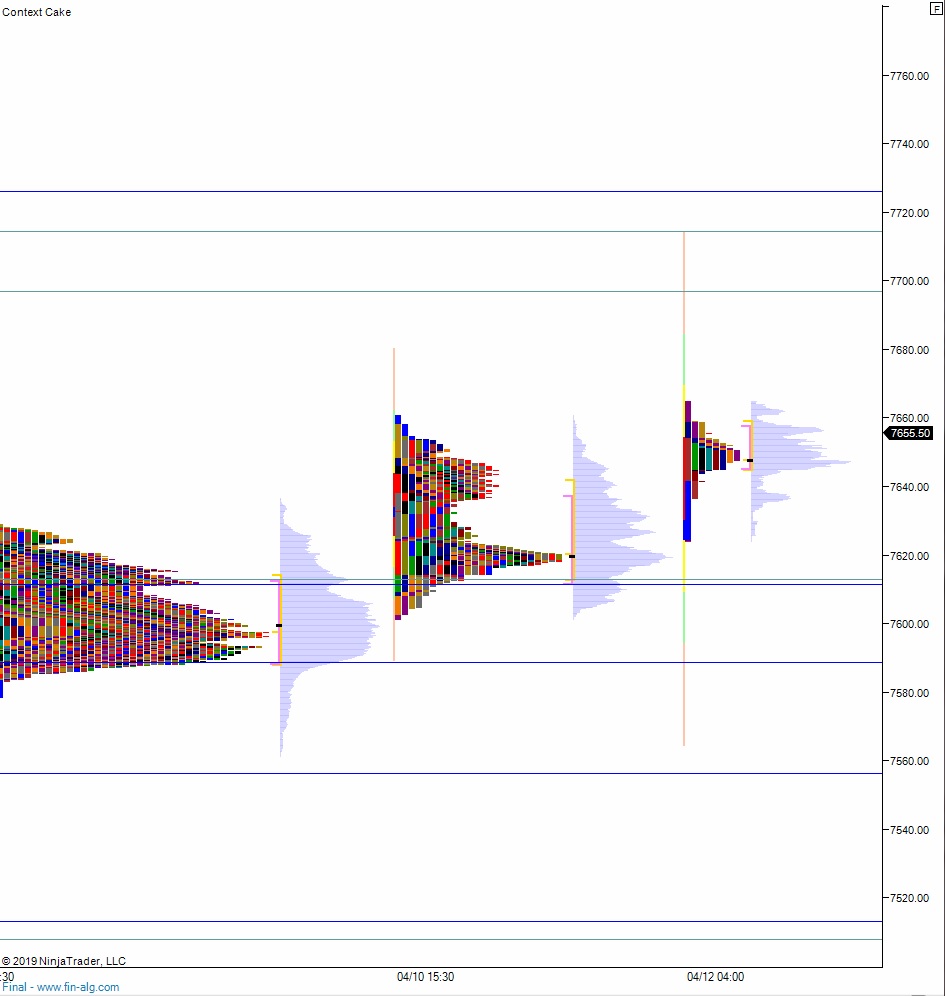

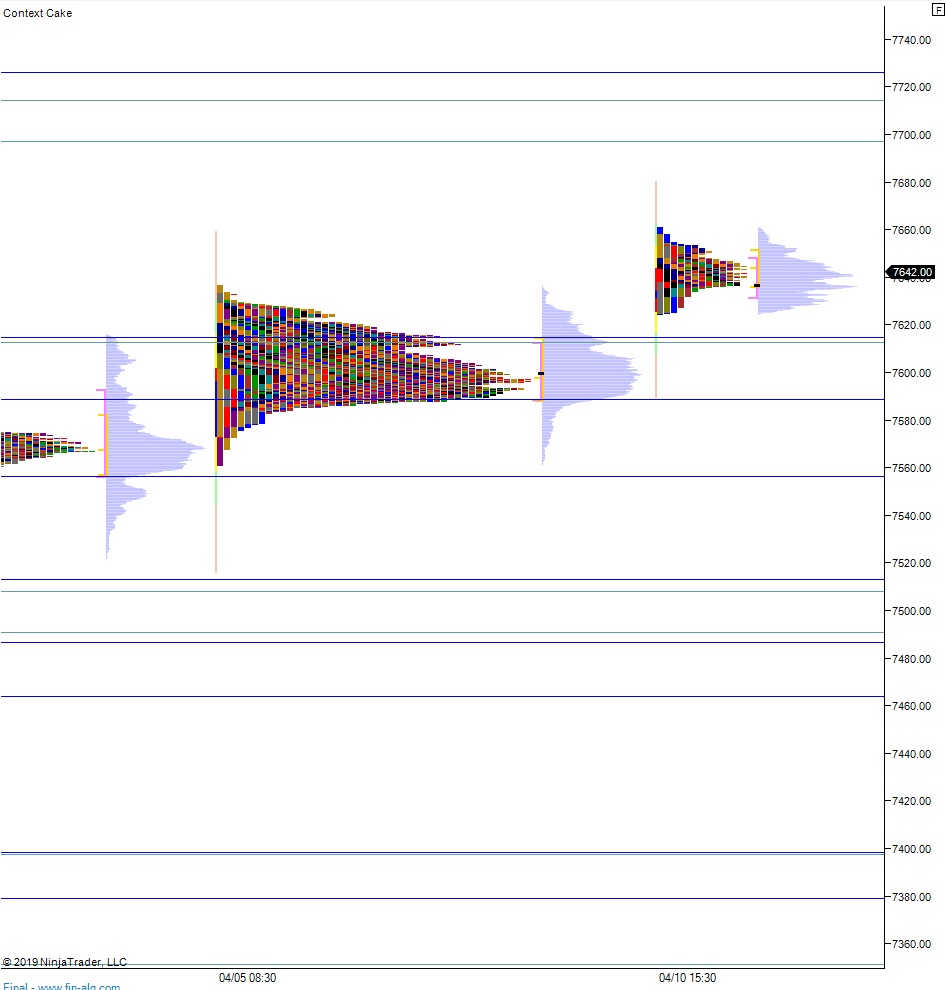

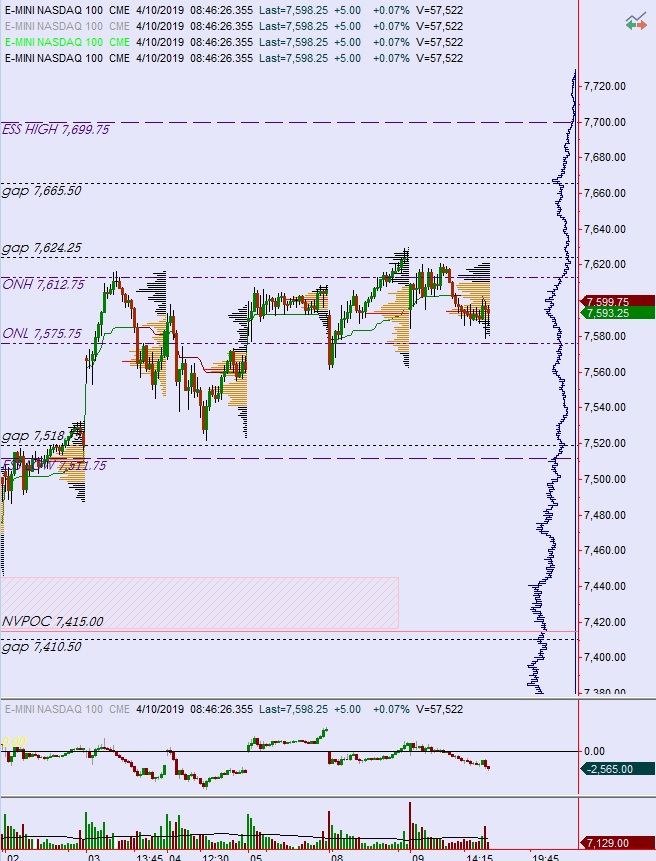

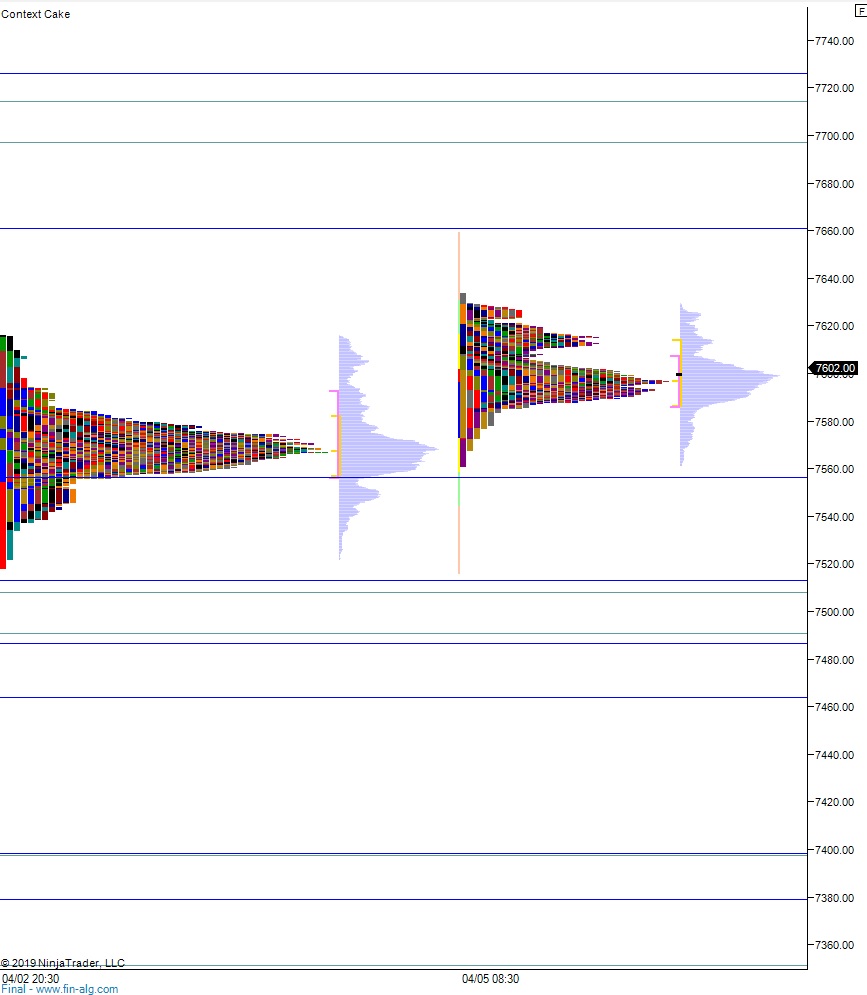

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

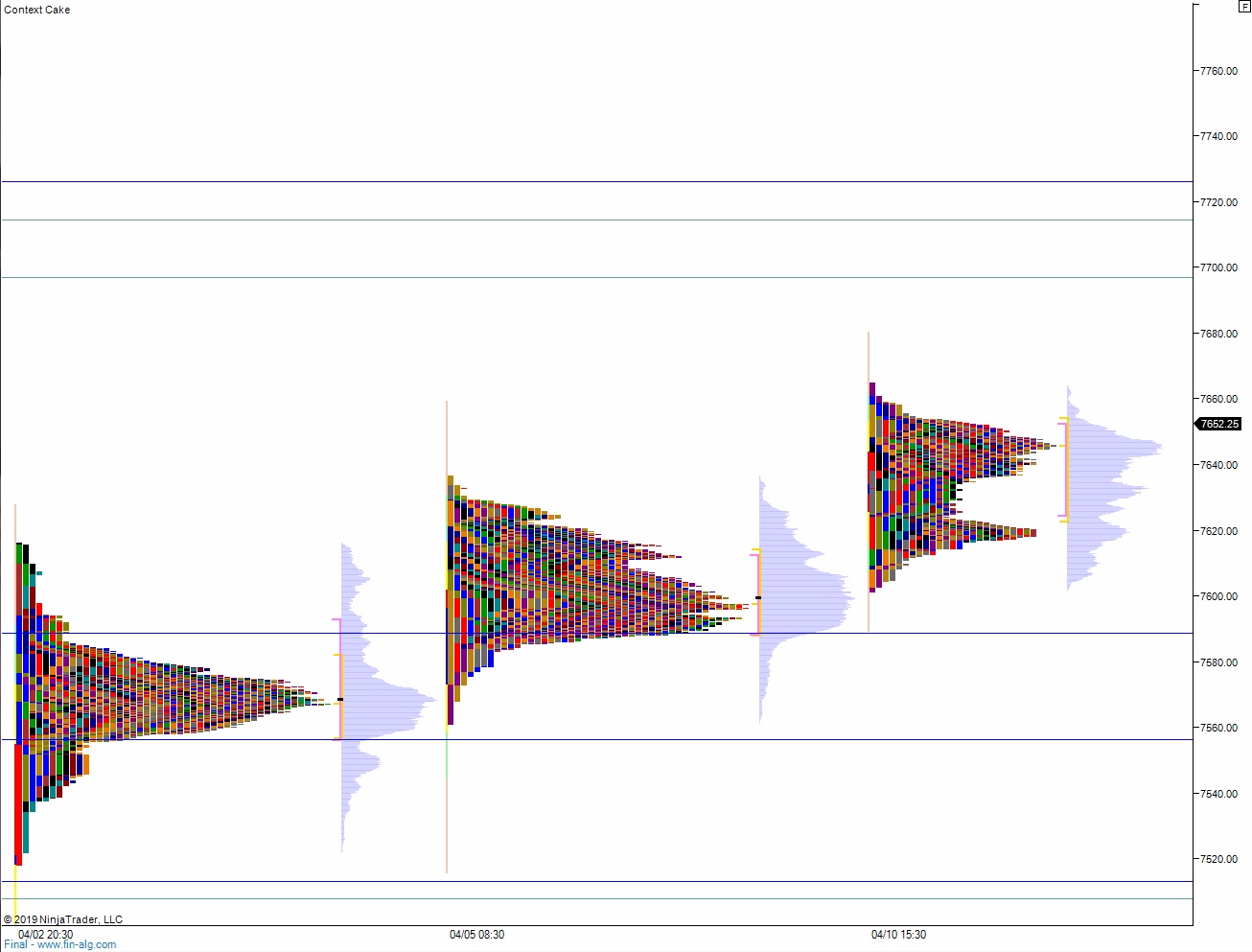

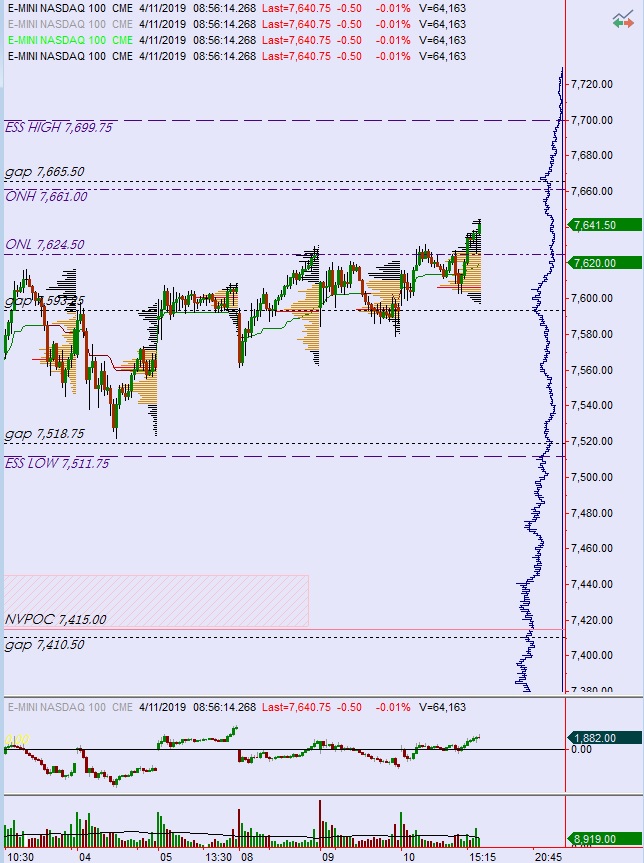

Bias Book:

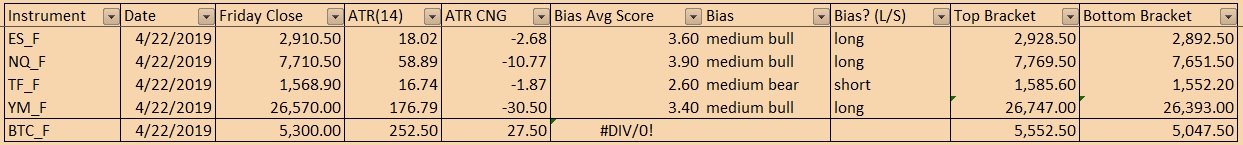

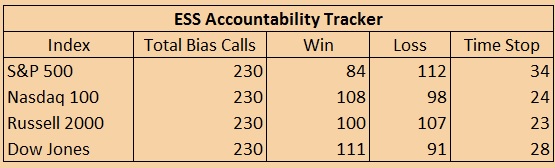

The following biases were formed using basic price action and volume profile analysis. By objectively observing these actual attributes of the market we gain a sense of the overall market context. To quantify the effectiveness of this approach, each of the 4 equity indexes (/ES, /NQ, /YM, and /TF) has been assigned a fixed long/short target using a standard 14-period ATR. Each week there will be an outcome of win, loss, or timed stop on all four indexes. The first bracket level hit is deemed the winner in the event that both sides are tagged. This will be tracked and included in the Exodus Strategy Session.

Here are the bias trades and price levels for this week:

[Note: All levels are as quoted on the front month future contract (currently June 2019) by the IQFeed Data Servers. Prices may differ slightly from your data provider. If you do not have a platform which provides real-time futures quotes, please click here for a free (but limited) alternative.]

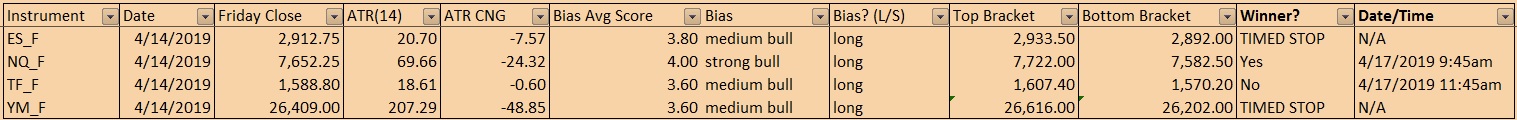

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

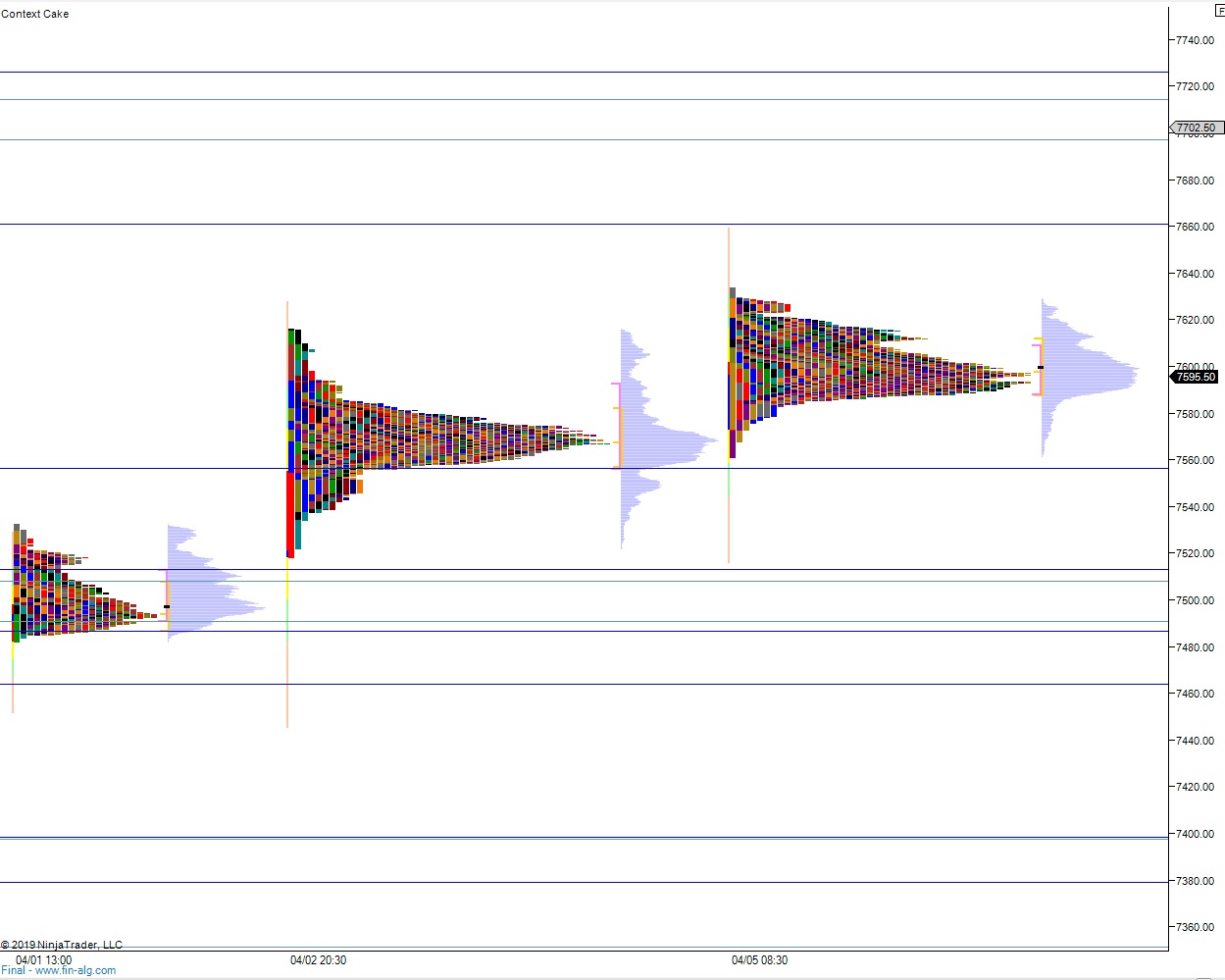

Compression Watch: Semis really matter now

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

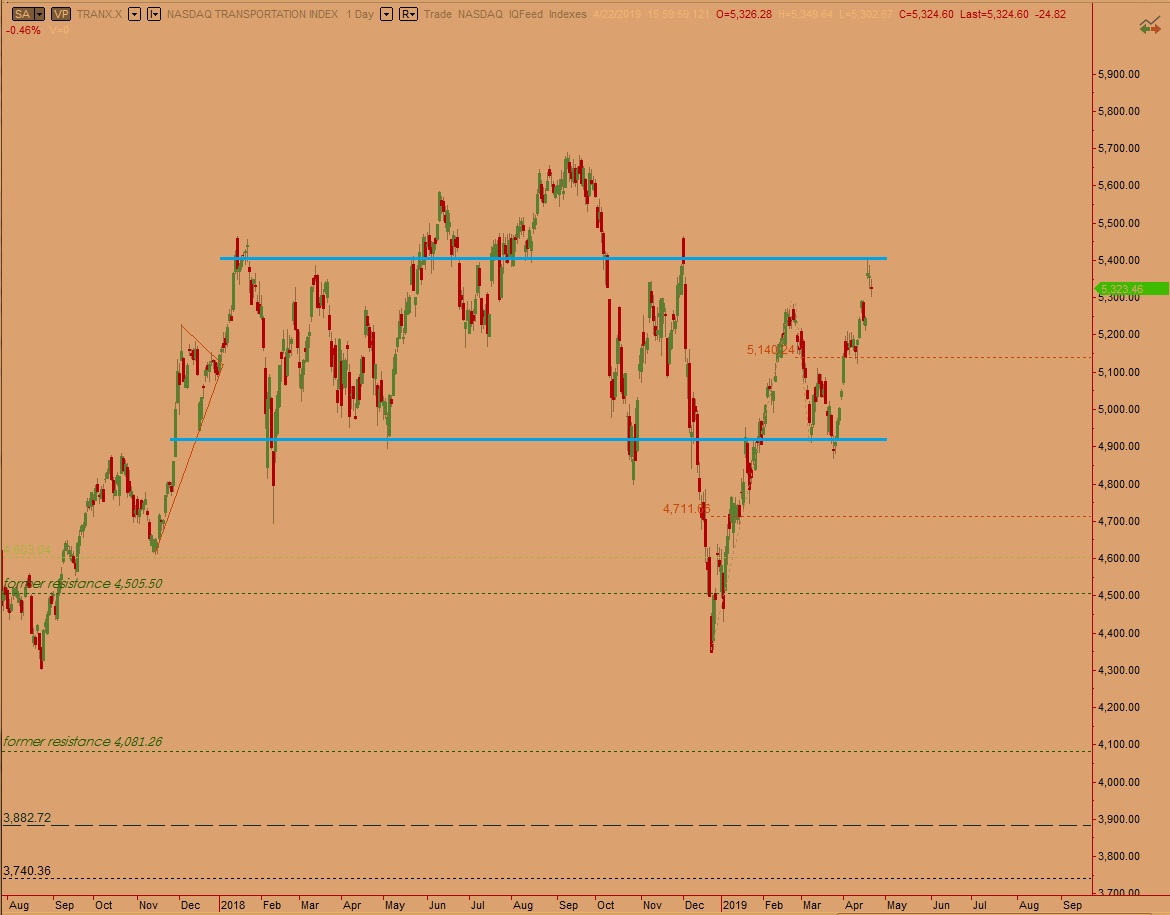

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports found the upper bracket. Likely next move is back down through value. The longer we linger near bracket high, the more likely it becomes that we enter a fresh leg of discovery up.

See below:

The semiconductor index came into some measured move targets (Fib extensions) and found sellers at the logical level. However, one day of selling does not negate the clear discovery mode this index is in.

See below:

V. INDEX MODEL

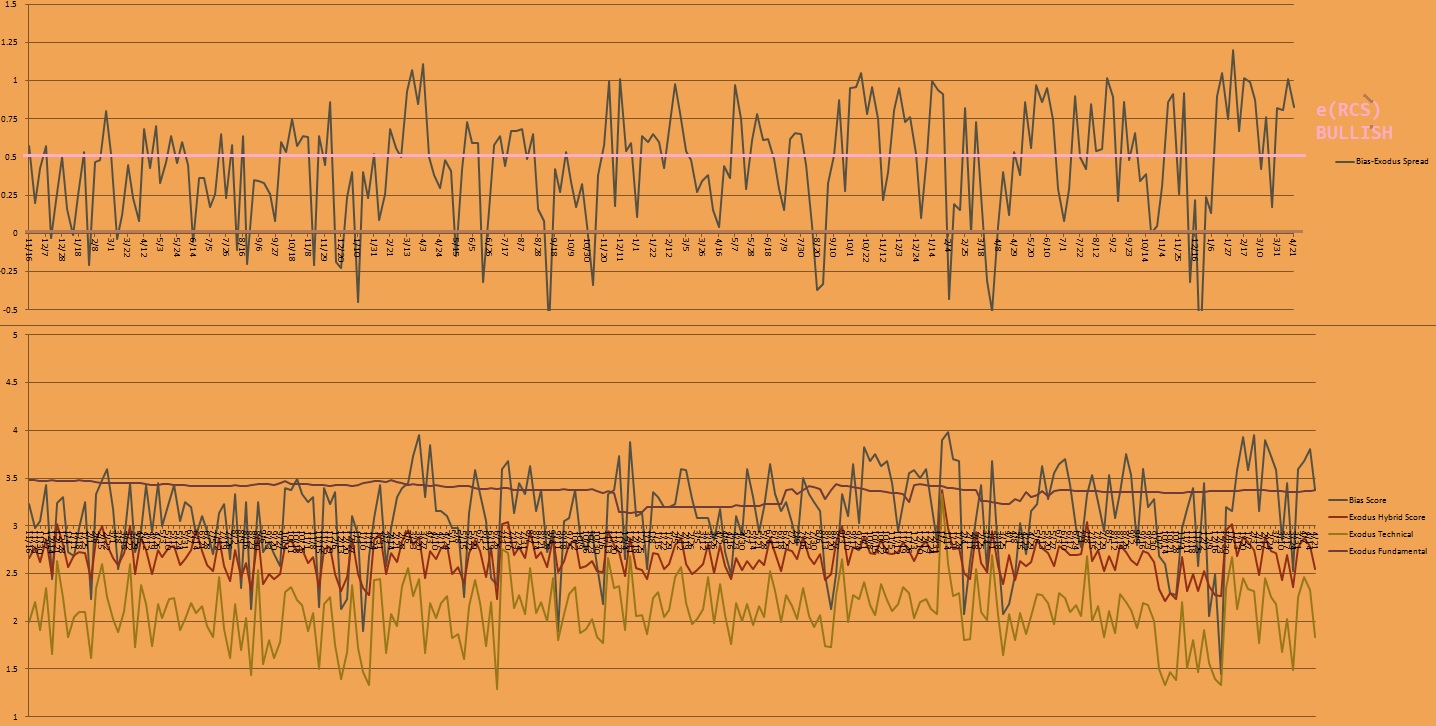

Bias Model: extreme Rose Colored Sunglasses

Bias model bullish for a fourth consecutive week after being neutral four weeks back week and bullish the three week’s prior.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“It is not the man who has too little, but the man who craves more that is poor.” – Seneca

Trade simple, with purpose

Comments »