NASDAQ futures are coming into Thursday with a slight gap up after an overnight session featuring normal range on extreme volume. Price pushed lower overnight, discovering a bid ahead of the Tuesday low before forming a sharp reversal and trading back into the Wednesday range. At 8:30am advance retail sales data and initial/continuing jobless claims data came out better than expected. As we approach cash open, price is hovering below the Thursday midpoint.

We have a busy economic calendar today ahead of a four day holiday weekend. US markets will be closed Friday in Observation of Good Friday and closed again Monday in observation of Easter. At 9:45 we’ll hear the Markit manufacturing/service/composite PMI data, at 10am leading index and business inventories, and at 11:30am both 4- and 8-week T-bill auctions.

Yesterday we printed a normal variation down. The day began with a gap up and push to new all-time highs before sellers stepped in and worked the overnight gap fil. We then chopping along the unchanged level for the rest of the day with sellers defending the midpoint and buyers defending the unchanged mark.

Heading into today my primary expectation is for buyers to press off the open, taking out overnight high 7708.50 and sustaining trade above it to set up a probe above all-time high 7733.50 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the small overnight gap to fill down to 7689. Look for sellers to trade down through overnight low 7660.25 to target the open gap at 7648.50 before two way trade ensues.

Hypo 3 stronger sellers trade down to 7624 before two way trade ensues.

Levels:

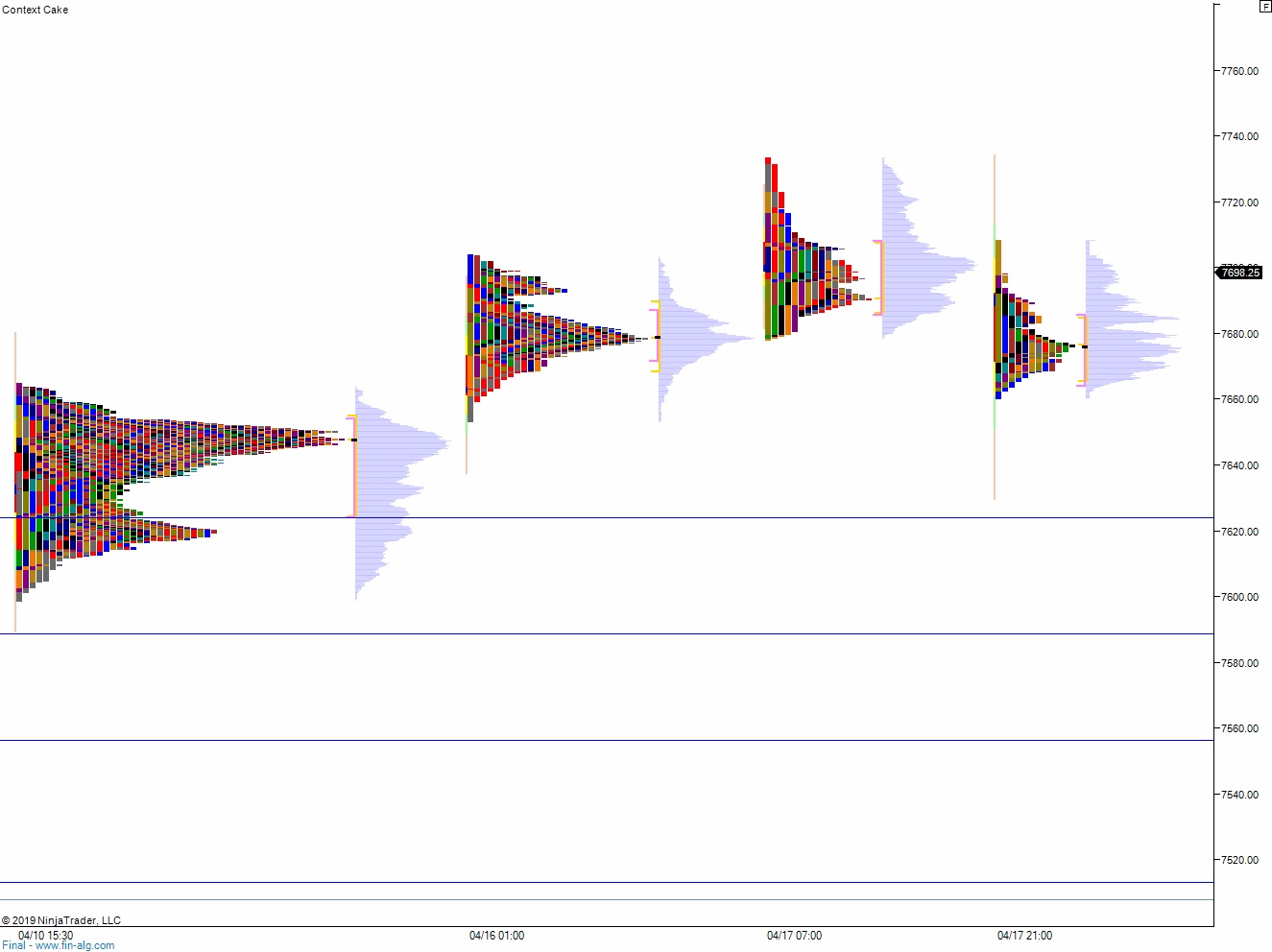

Volume profiles, gaps, and measured moves: