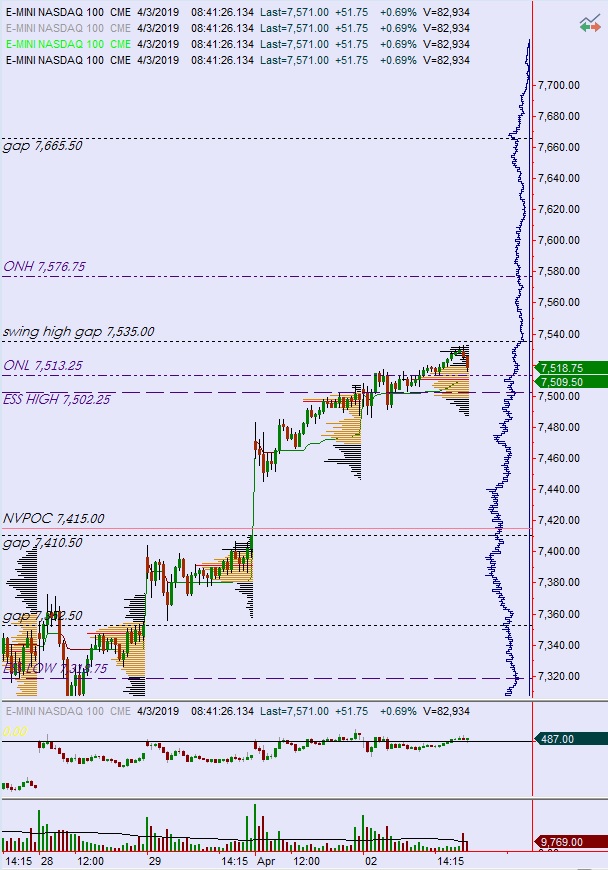

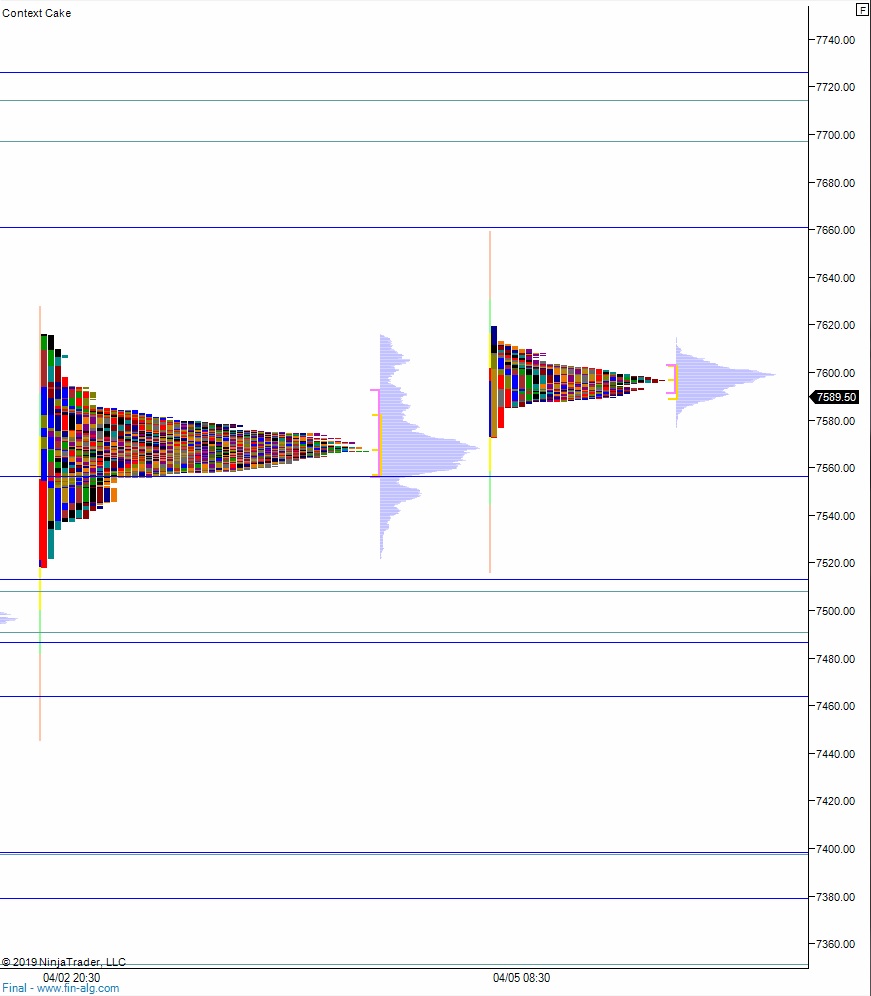

NASDAQ futures are coming into Monday with a slight gap down after an overnight session featuring elevated range and volume. Price worked up through last week’s highs briefly before falling back down into Friday’s range. The nature of the move suggests a mini failed auction to the upside. 7600 is a key battleground for sellers as it marks where the aggressive selling began late last year as we ended Q3. As we approach cash open, price is hovering below last Friday’s midpoint, about 10 points below 7600.

On the economic calendar today we have factory orders at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

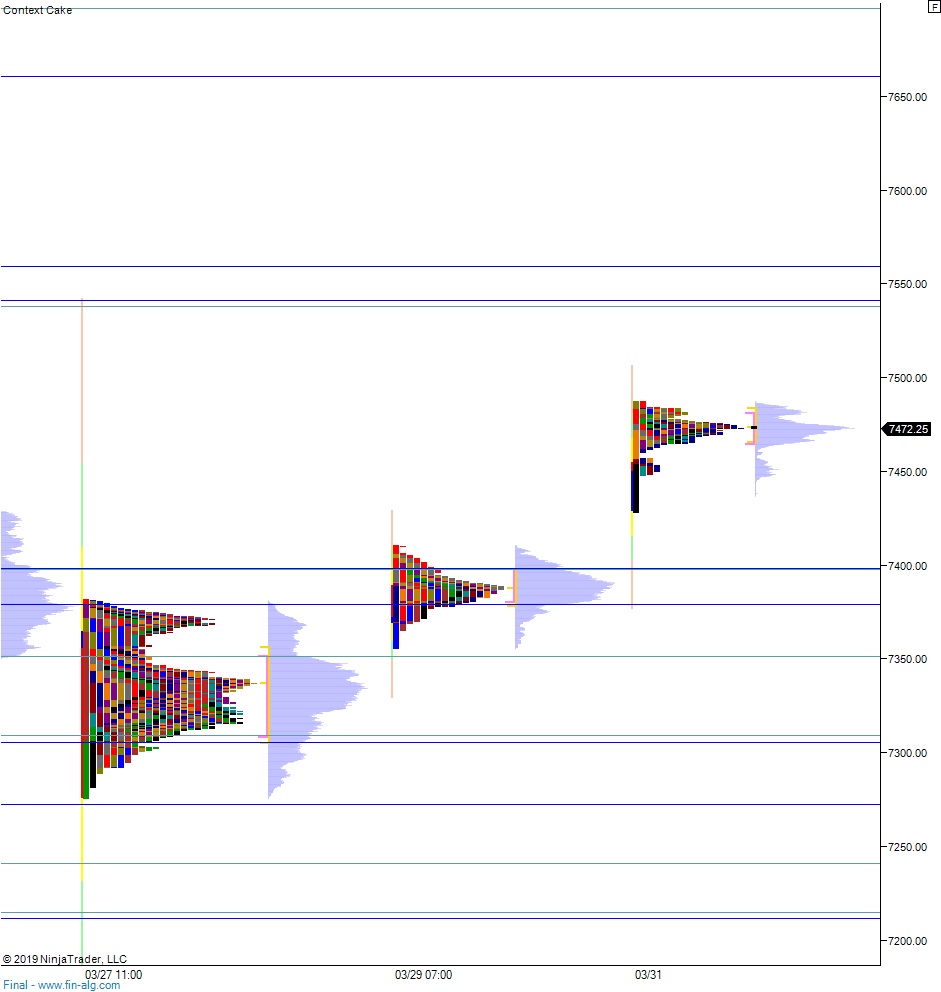

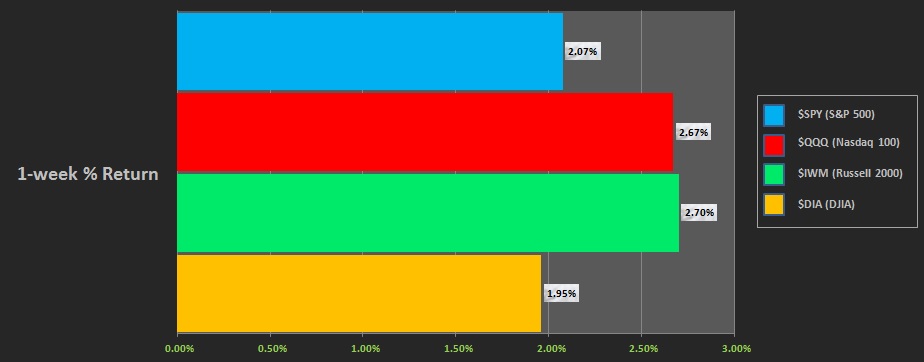

Last week began strong. Unexpectedly strong economic data from China eased worries that the world’s second largest economy was leading us into a global recession. The data put a strong big into the markets early Monday morning. Buyers drove higher off the gap up clean through Wednesday afternoon before discovering strong responsive sellers. The selling continued through Thursday afternoon before buyers again stepped and worked price higher. Most of the indices finished the week at-or-near their highs. The last week performance of each major index is shown below

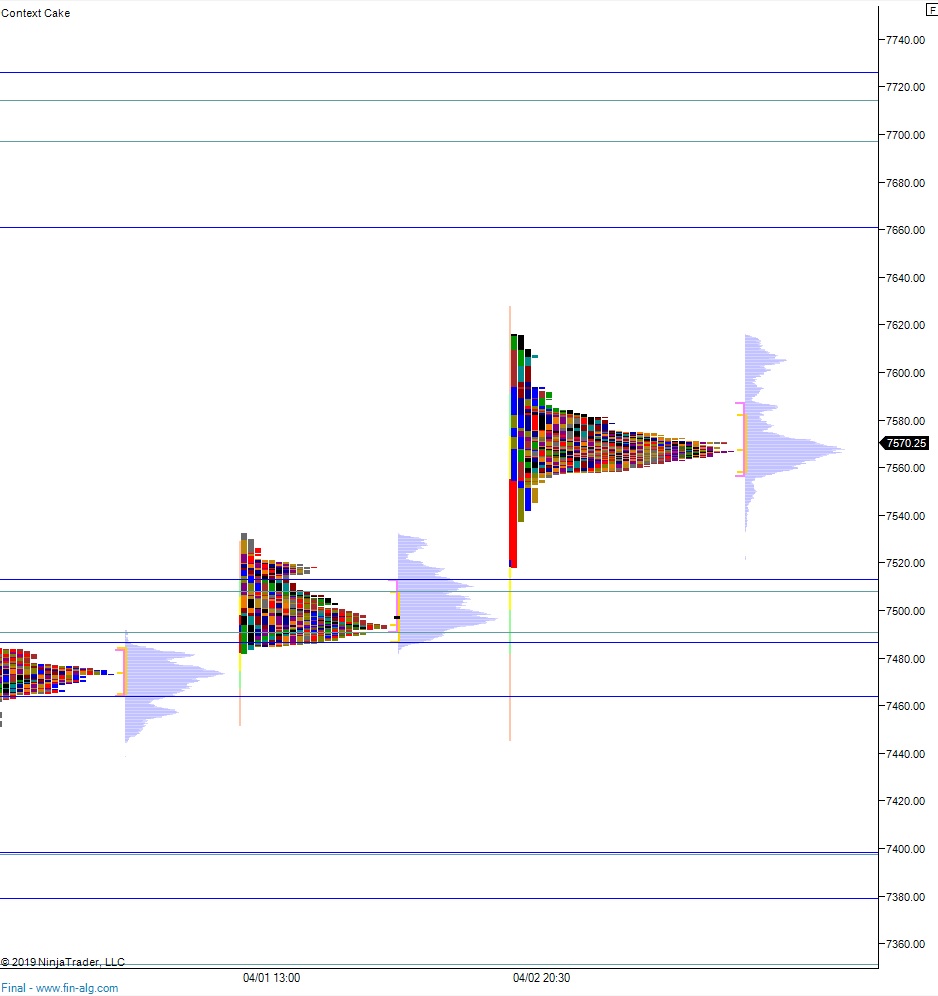

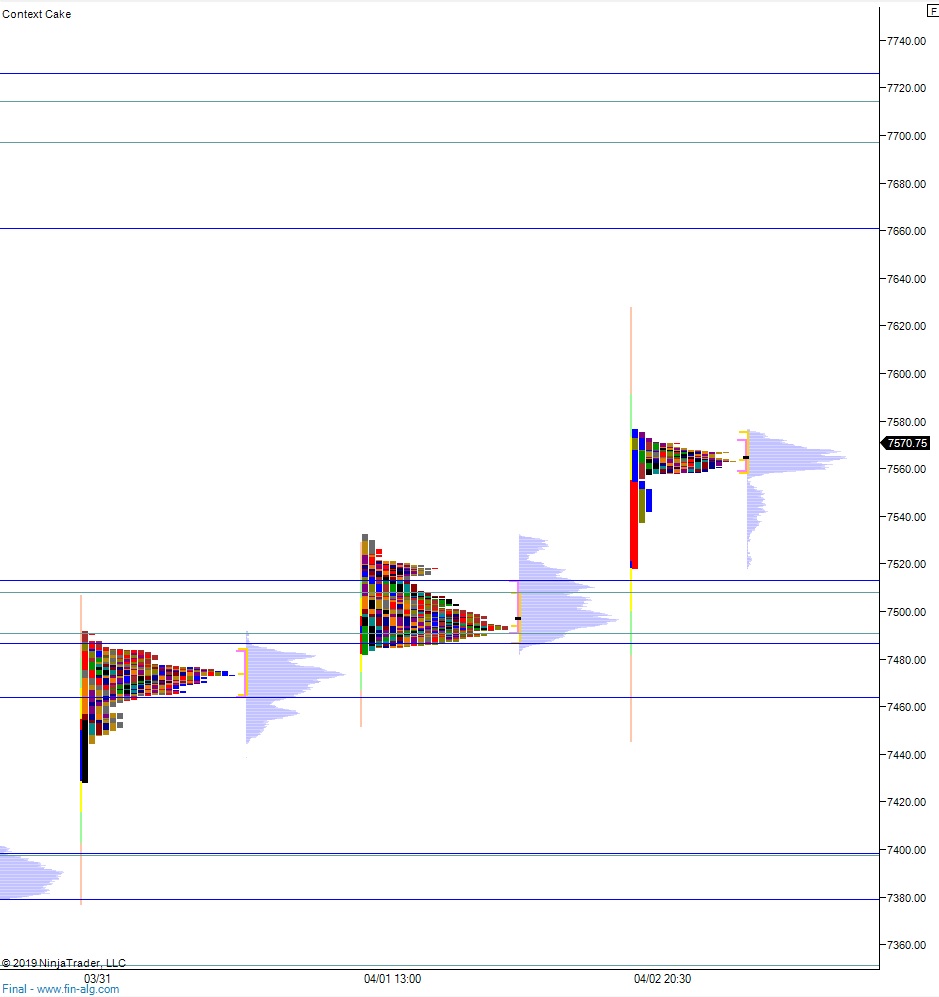

On Friday the NASDAQ printed a normal variation up. The day began with a gap up, inside the prior day range. Sellers were unable to close the gap during an early two-way auction. Instead we held a tight range above the daily mid for most of the day before finally going range extension up near the closing bell.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7605.75. From here we continue higher, up through overnight high 7619.75. This sets up a move to target 7660 before two way trade ensues.

Hypo 2 sellers trade down through overnight low 7585.50 setting up a move to target 7556.75 before two way trade ensues.

Hypo 3 stronger sellers sustain trade below 7556.75 setting up a move to close the open gap at 7518.745 before two way trade ensues.

Levels:

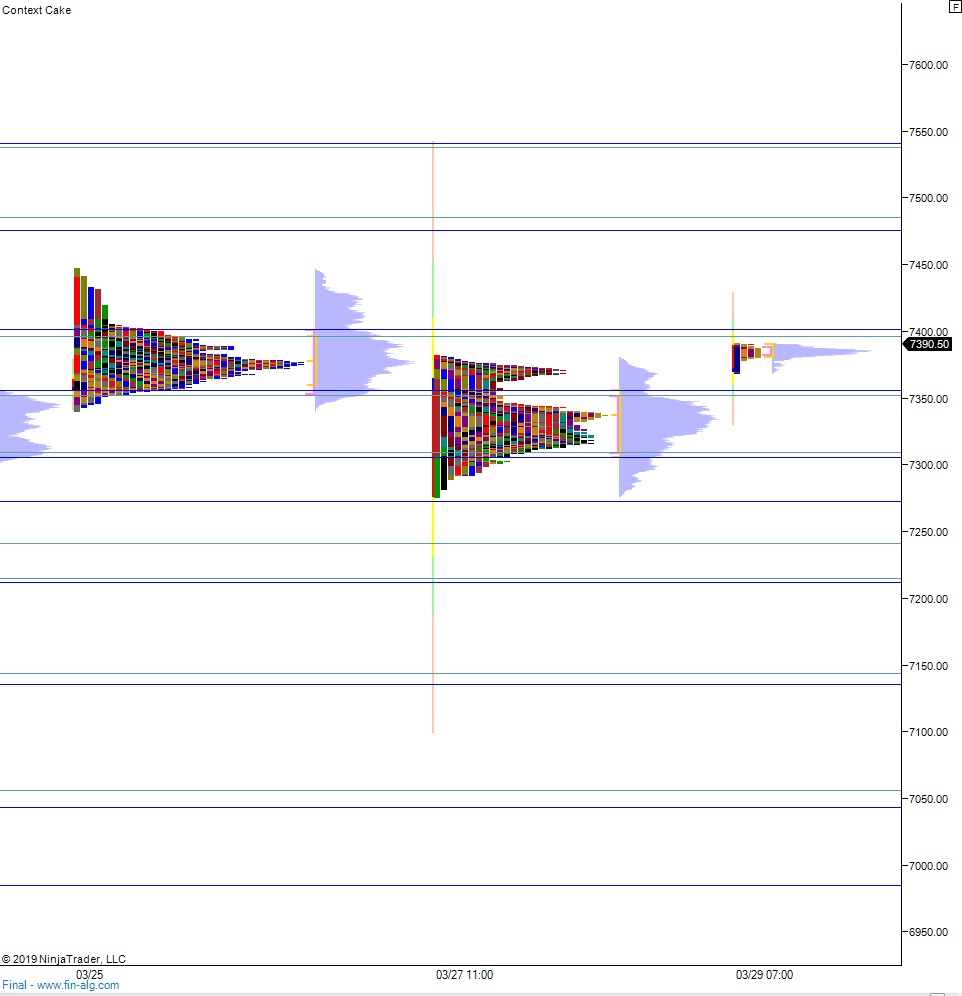

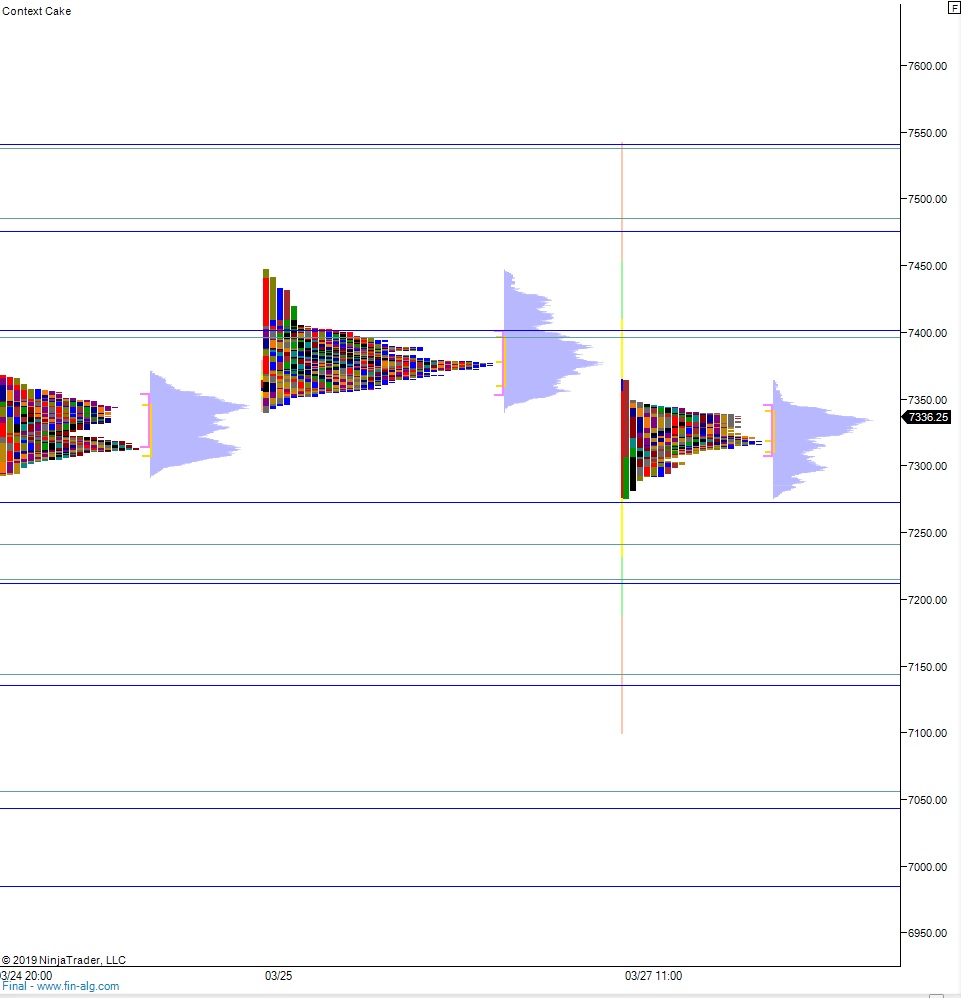

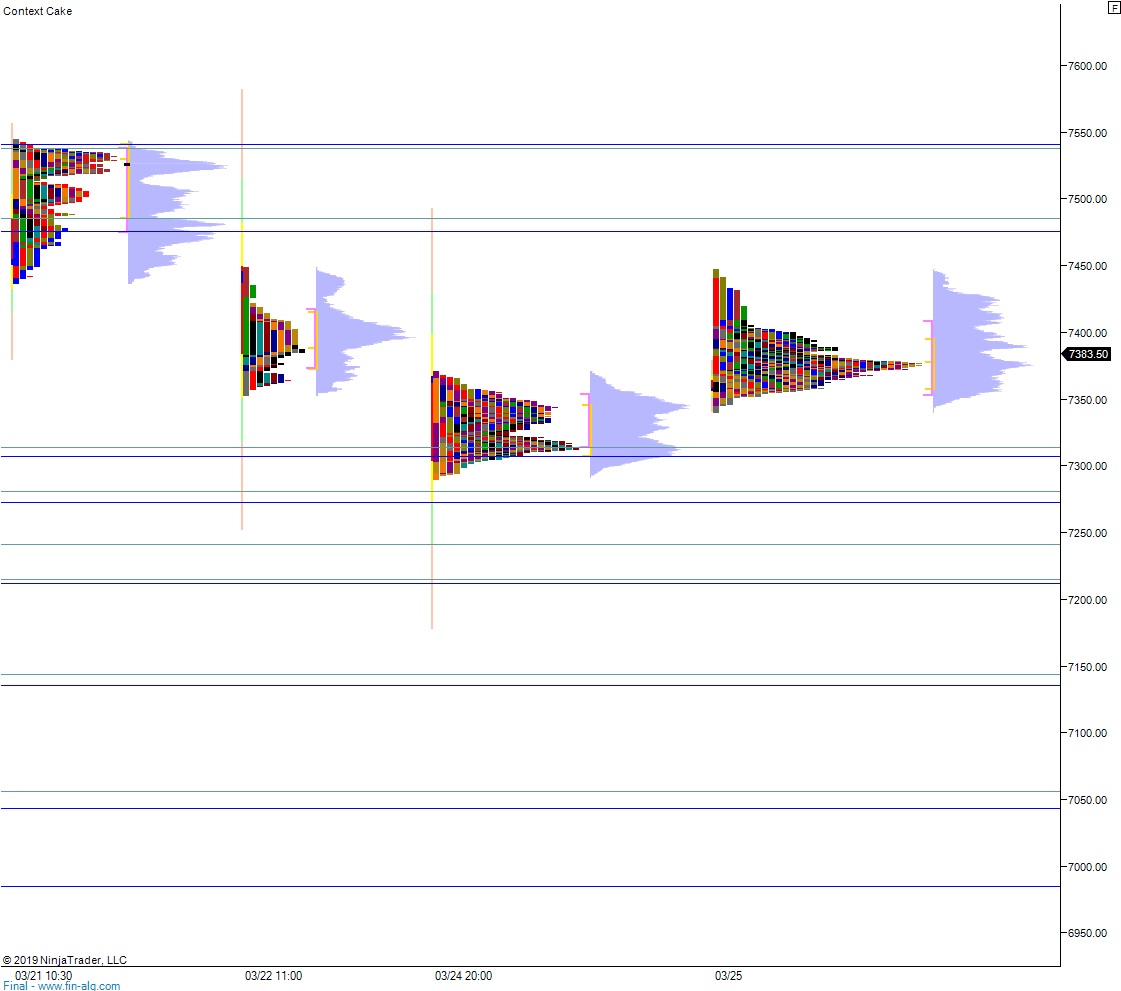

Volume profiles, gaps, and measured moves: