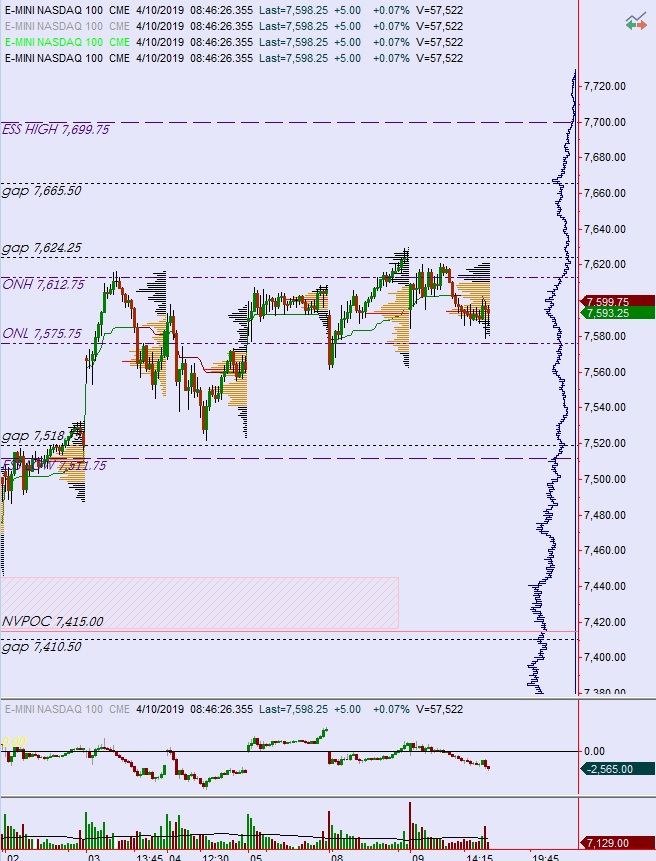

NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring elevated volume on normal range. Price worked down through the Tuesday low last night before popping back up through the daily midpoint. At 8:30am consumer price index data came out below expectations. As we approach cash open, price is hovering right along the mid.

Also on the economic calendar today we have crude oil inventories at 10:30am, a 10-year note auction at 1pm, and FOMC minutes at 2pm.

Yesterday we printed a neutral day. The day began with a gap down in range. After an opening two-way auction, buyers began to work into the gap but were unable to completely fill it. Instead, shortly after going range extension up the market ran into sellers. Two more attempts were made to work higher before sellers pressed down through the entire daily range and sent us neutral. Late in the day we worked back up off the lows.

Neutral day.

Heading into today my primary expectation is for buyers to work up through overnight high 7612.75 to target the open gap at 7624.25. Then look for the third reaction after the FOMC minutes to dictate direction into the second half of the day.

Hypo 2 sellers work into the overnight inventory and close the gap down to 7593.25 then continue lower, down through overnight low 7575.75. Look for buyers down at 7556.75, then look for the third reaction after the FOMC minutes to dictate direction into the second half of the day.

Hypo 3 stronger sellers press a liquidation, trading down to the open gap at 7518.75. Then look for the third reaction after the FOMC minutes to dictate direction into the second half of the day.

Levels:

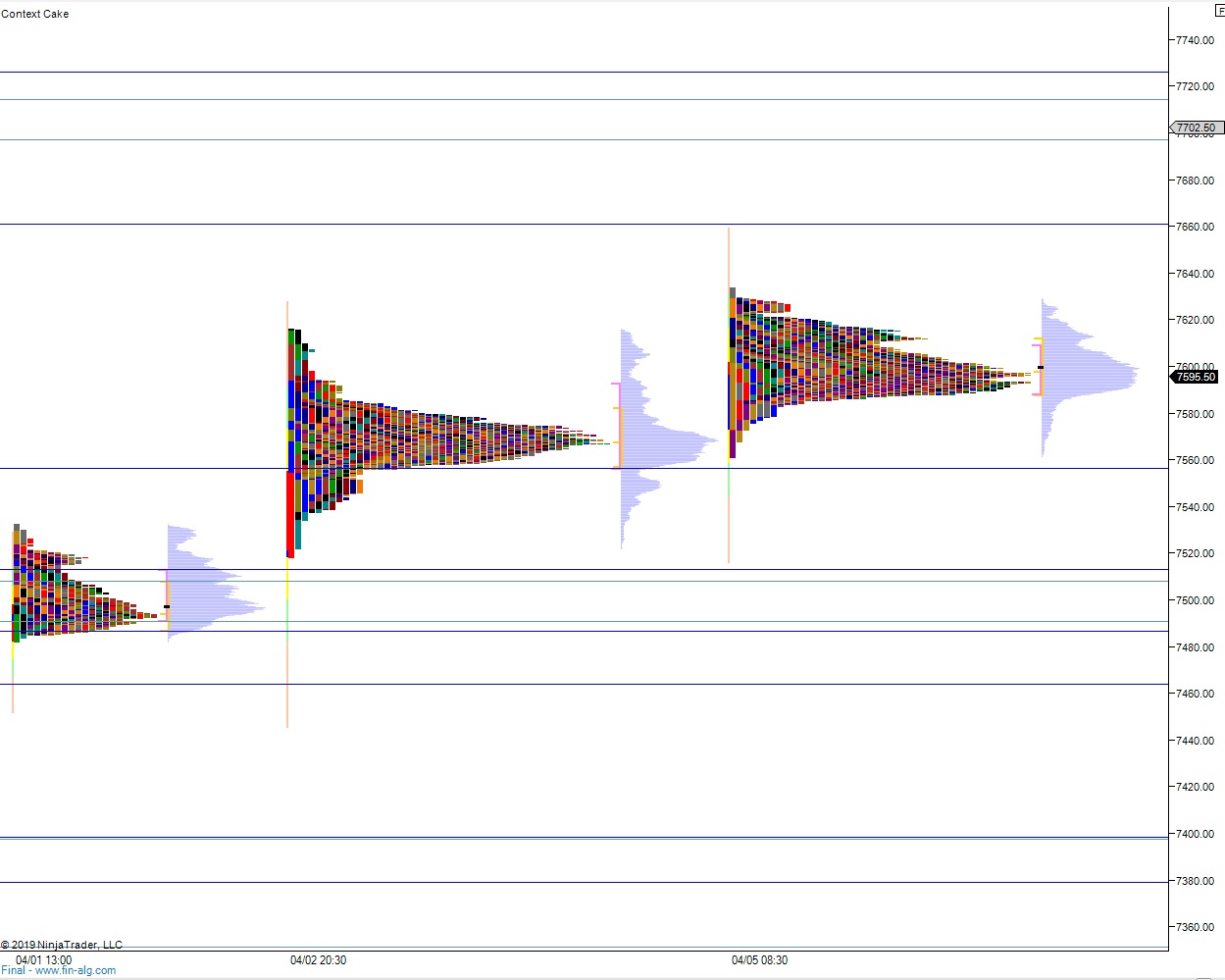

Volume profiles, gaps, and measured moves: