NASDAQ futures are coming into Monday with a slight gap down after an overnight session featuring normal range and volume. Price marked time overnight, holding to less than a 20-point range. Price briefly poked beyond Friday’s high for a bit, and and we approach cash open, price is hovering above the Friday midpoint.

On the economic calendar today we have 3-and 6-month T-bill auctions at 11:30am followed by long-term TIC flows at 4pm.

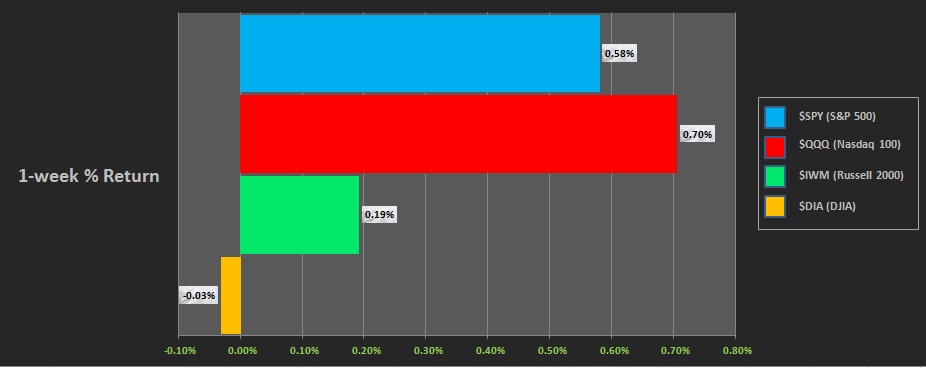

Last week was a slow drift. Price steadily worked higher, slowly, advancing in a methodical auction. Along the way the Dow started to lag behind. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap up and probe up beyond the weekly high. This introduced some selling into the tape. Said sellers worked lower, nearly closing the gap before finding responsive buyers who slowly campaigned price higher for the rest of the day. They did not, however, press the market neutral. And while the gap did not officially close, given the nature of NASDAQ futures, stopping just 1.50 point ahead of it is sufficient enough for me to consider the gap ‘filled’.

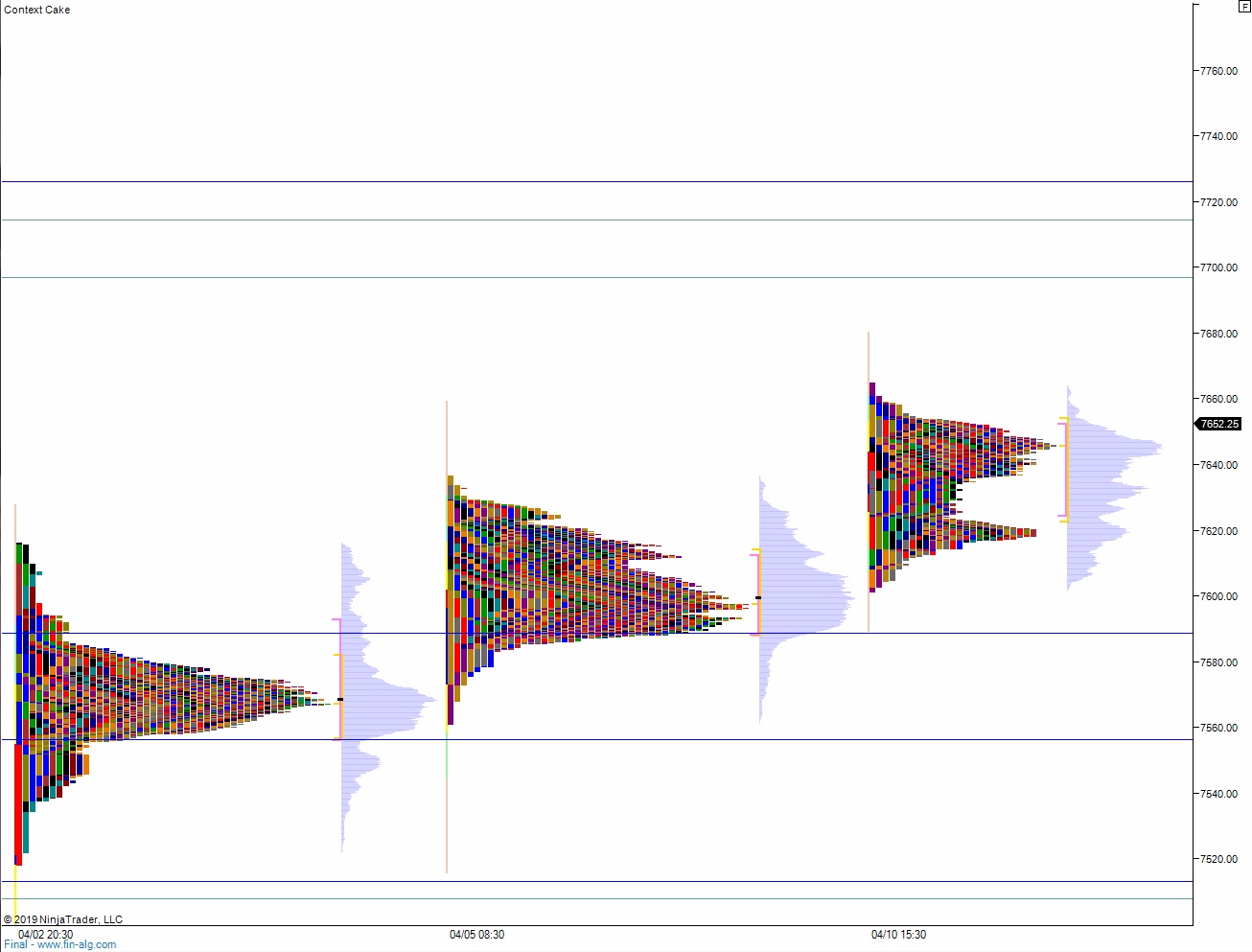

Heading into today my primary expectation is for buyers to work up through overnight high 7657 setting up a move to target the open gap at 7665.50 before two way trade ensues.

Hypo 2 stronger buyers trade us up to 7697, likely tagging the 7700 century mark, before two way trade ensues.

Hypo 3 sellers press down through overnight low 7638.25 setting up a move to target the 7600 century mark. Look for buyers down at the open gap at 7593.25 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: