NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight until about 5am New York when sellers stepped in and drove down into the Tuesday morning rally. As we approach cash open, price is hovering along the lower quadrant of Tuesday’s range.

On the economic calendar today we have crude oil inventories at 10:30am.

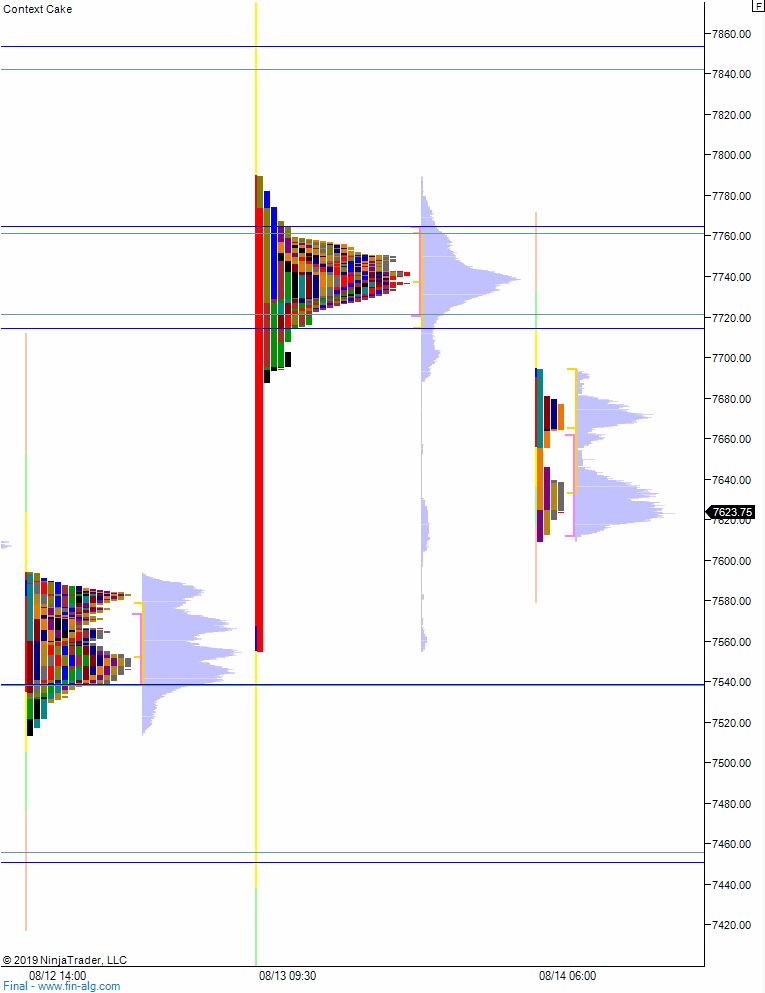

Yesterday we printed a normal variation up with a distinct short-squeeze P-shape. The day began flat and after a brief two-way auction price drove higher, up through last week’s high to close the gap left behind on August first before settling into a tight range. While the market was able to push range extension up, the shape of the profile suggests a temporary phenomenon known as a short-squeeze took place, which lacked the ability in entice initiative buyers.

Heading into today my primary expectation is for buyers to press into the overnight inventory and trade up 7700 before sellers step in and two way trade ensues.

Hypo 2 sellers gap-and-go lower, trading down through overnight low 7609.75. Look for a battle at 7600 to eventually break down, setting up a move to target 7538.75 before two way trade ensues.

Hypo 3 stronger buyers work a full gap fill up to 7749.25 then continue higher, up through overnight high 7767.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Is there a Hypo 4?

No but when we exceed all levels highlighted during the morning report, that provides information also

that the higher timeframe is very active