NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight after plunging lower after closing bell Monday evening. Volatility is high, that is for sure. The selling late Monday took price to levels untouched since June 6th. As we approach cash open, price is hovering above Monday’s midpoint.

On the economic calendar today we have a 3-year note auction at 1pm.

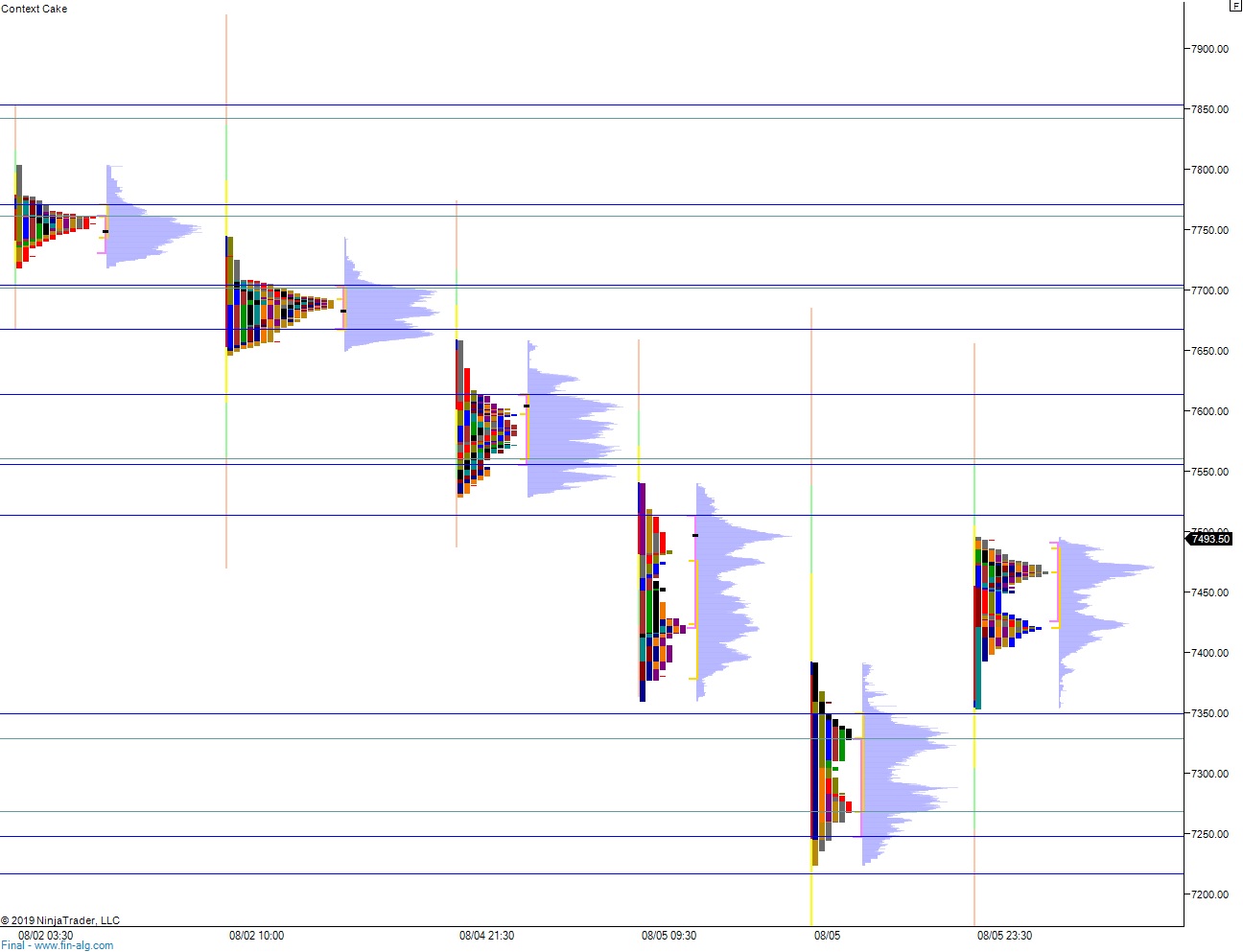

Yesterday we printed a double distribution trend down. The day began with a pro gap down and after a brief two-way auction at the open, price began a steady campaign lower. The sell-off found buyers late in the session around 7400 but they were overrun as the session completed. We formed balance distributions along the way which is why yesterday’s action does not classify as a pure trend day.

Heading into today my primary expectation is for sellers to press into the overnight inventory and close the gap down to 7380.75. Look for buyers to defend Monday’s low 7360.75 and two way trade to ensue.

Hypo 2 stronger sellers close overnight gap 7380.75 then continue driving lower, taking out overnight low 7224.50 before two way trade ensues.

Hypo 3 buyers gap-and-go higher, up through overnight high 7493.75 and sustain trade above 7513.75 which sets up a move to tag 7555.

Levels:

Volume profiles, gaps, and measured moves: