NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price progressed higher overnight, working up through Wednesday’s high and sustaining trade above it for much of the Globex session. At 8:30am initial/continuing jobless claims data came out better-than-expected. As we approach cash open, price is hovering in the air gap left behind during Monday’s gap down.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am and a 30-year bond auction at 1pm.

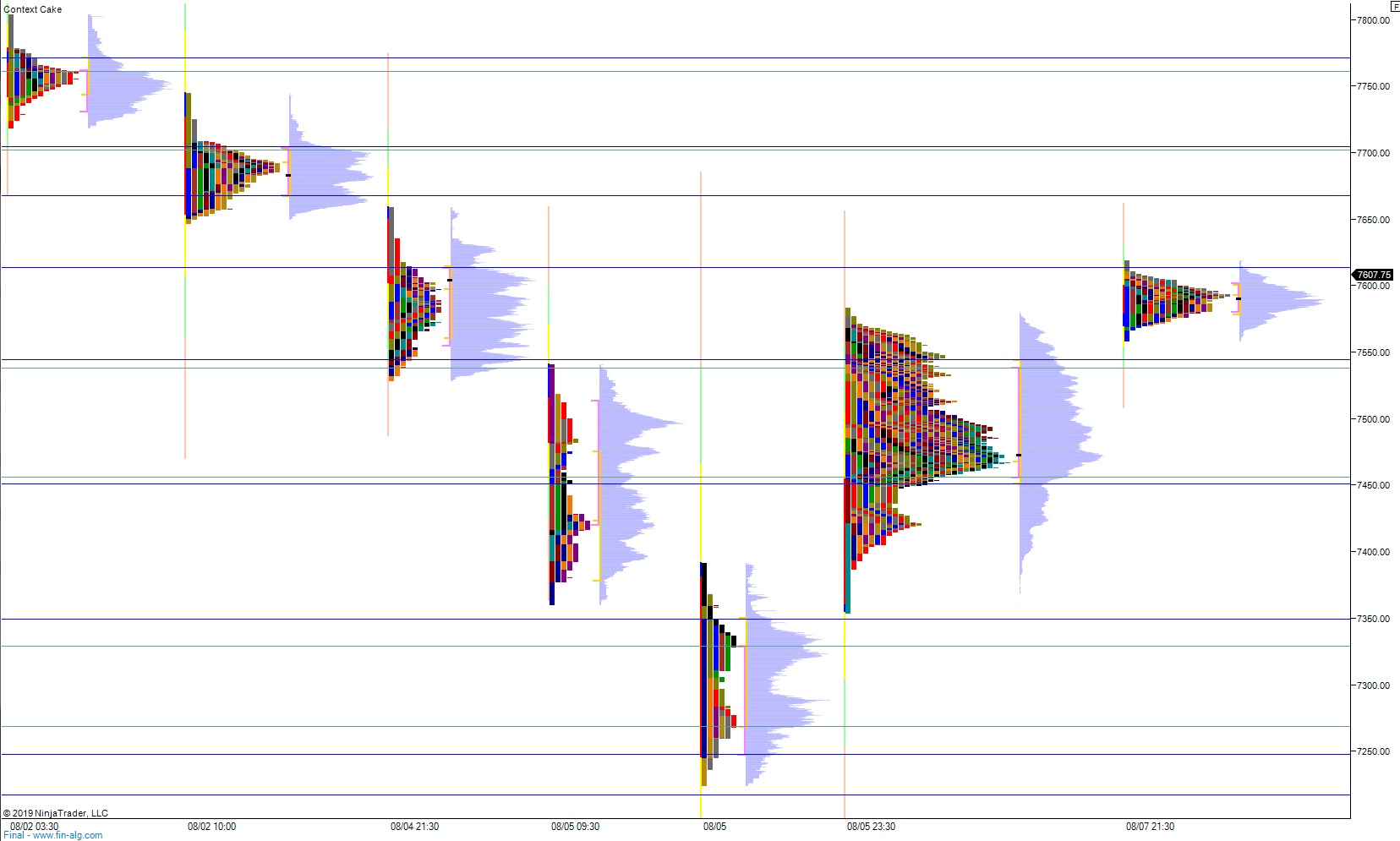

Yesterday we printed a normal variation up. The day began with a gap down near Tuesday’s low. The opening two-way auction broke lower but before sellers could close the Monday/Tuesday gap responsive buyers stepped in and a sharp excess low formed. Said buyers worked higher to fill the overnight gap before we retraced back to the daily midpoint. Buyers were initiative here (initiative relative to Wednesday open, responsive relative to Tuesday close) and defended the mid before rallying price up to a new weekly high. We ended the session near high-of-day.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 7667 before finding sellers who defend last Friday’s low and two way trade ensues.

Hypo 2 sellers press into the overnight inventory and close the gap down to 7550.75. Look for buyers just below at 7544 and two way trade to ensue.

Hypo 3 stronger sellers press down through overnight low 7526 setting up a move to tag the 7500 century mark before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: