NASDAQ futures are coming into Wednesday gap down after an overnight session featuring normal range and volume. Price worked to new all-time highs overnight before retracing much of the gains. Then a second wave of selling came into the market just after 8am. At 8:30am Consumer Price Index data came out in-line with expectations and Advance Retail Sales data was better than expected.

Beware Janet Yellen’s Semi-annual Testimony to the House of Representatives, which begins at 10am. We also have crude oil inventories at 10:30am and Long-term TIC flows at 4pm.

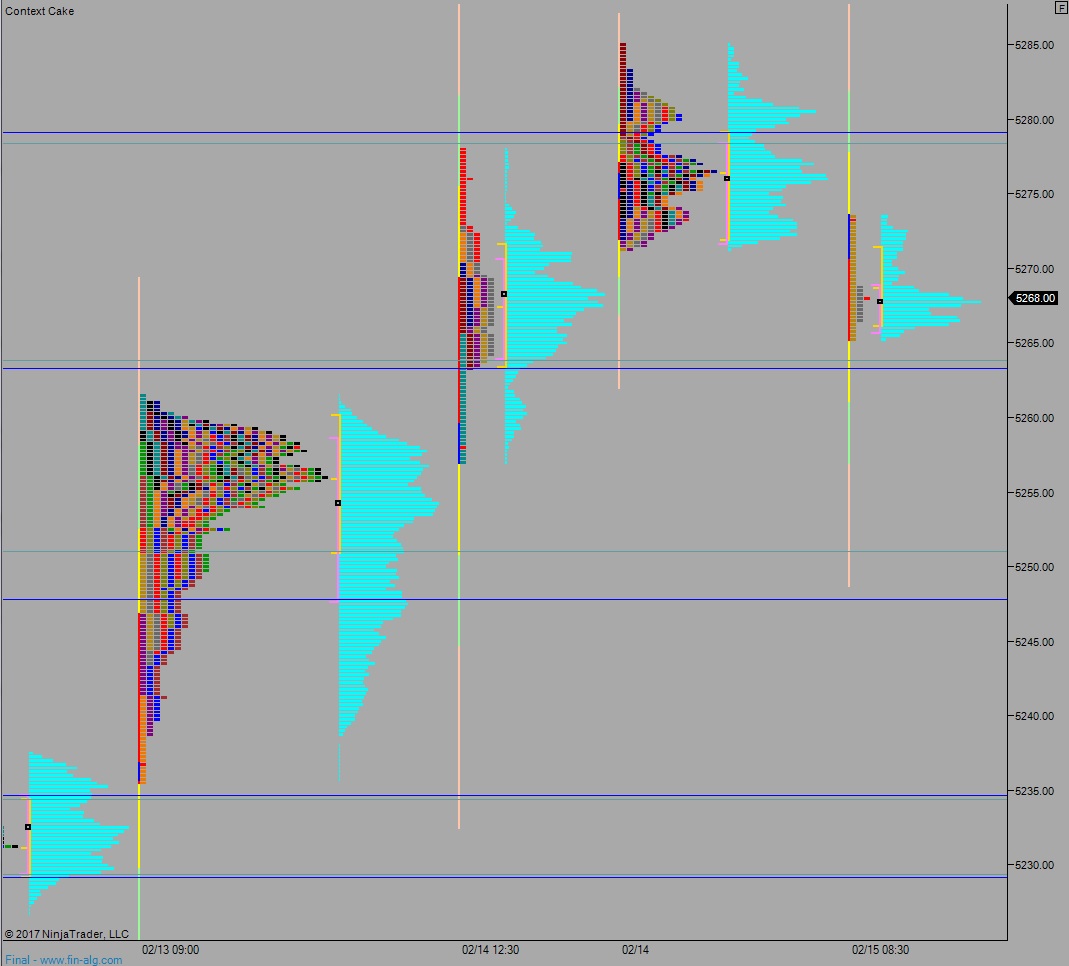

Yesterday we printed a neutral extreme up. After opening gap down sellers made a move to take out the Monday low but stalled out. Then, as Yellen was taking questions from the Senate Banking Committee, prices began to rise, pressing up through the entire daily range. The rally accelerated into the close.

Heading into today my primary expectation is for buyers to push into the overnight inventory and close the gap up to 5276. Look for sellers up at 5278.50 and two way trade to ensue.

Hypo 2 strong buyers close overnight gap 5276 then sustain trade above 5279 setting up a move through overnight high 5285. Continue exploring open air above.

Hypo 3 sellers press down through overnight low 5265.25 and find buyers just below at 5264 before two way trade ensues.

Hypo 4 selling liquidation triggered by sustaining trade below 5263.25, sending price down to close the gap at 5227. Stretch target is 5251.

Levels:

Volume profiles, gaps, and measured moves:

The selling at the session open was very strong. The shit bag transfer is almost completed.