NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price slowly worked higher overnight. At 7am MBA mortgage applications came out stronger than last week. At 8:30am the Building Permits number was a huge upside beat.

Also on the economic calendar today we have crude oil inventory at 10:30am.

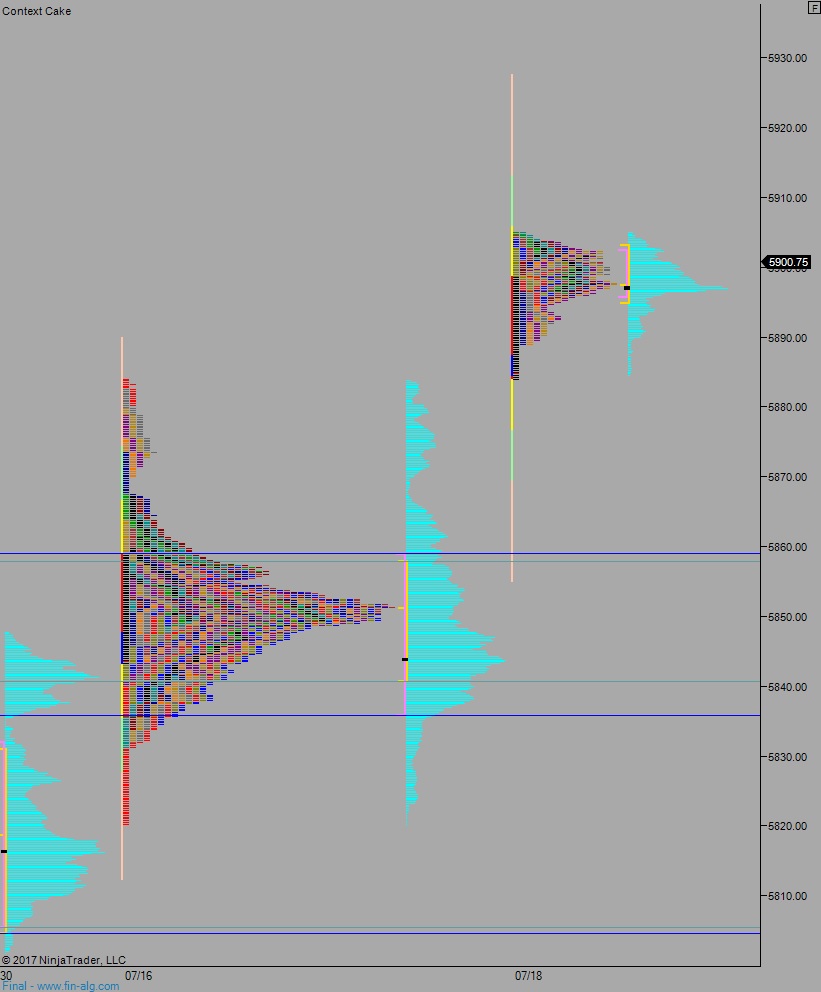

Yesterday we printed a double distribution trend up. The day began with a hard sell. Where sellers quickly stalled out, and a sharp reversal occurred, tells a story of trapped short sellers. It was right at the 68% Fibonacci retracement of the June sell-off. Sellers failed to engage the market at this level last Friday—we pushed right through it. Then yesterday the zone was bid as sellers tried to cover their positions.

However, the speed of the reversal off of the 5823 levels speaks to trapped short sellers.

Heading into today my primary expectation is for continued pressure on the short seller. A push up through overnight high 5905 and a move through all-time highs. Look for sellers up at 5921 and two way trade to ensue.

Hypo 2 sellers work into the overnight inventory and close the gap down to 5883.25 setting up a move down through overnight low 5881.75. Look for buyers down at 5868 and two way trade to ensue.

Hypo 3 stronger sellers push trade down to 5858.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: