NASDAQ futures are coming into Wednesday gap down after an overnight session featuring normal range and volume. Price held Tuesday’s high mark for several hours before retracing back to about the midpoint of the cash session. At 7am MBA mortgage applications came out lower than last week.

Also on the economic agenda today we have Markit manufacturing/service/composite PMI data at 9:45am, new home sales at 10am, crude oil inventories at 10:30am, then a 2-year floating rate auction at 11:30am.

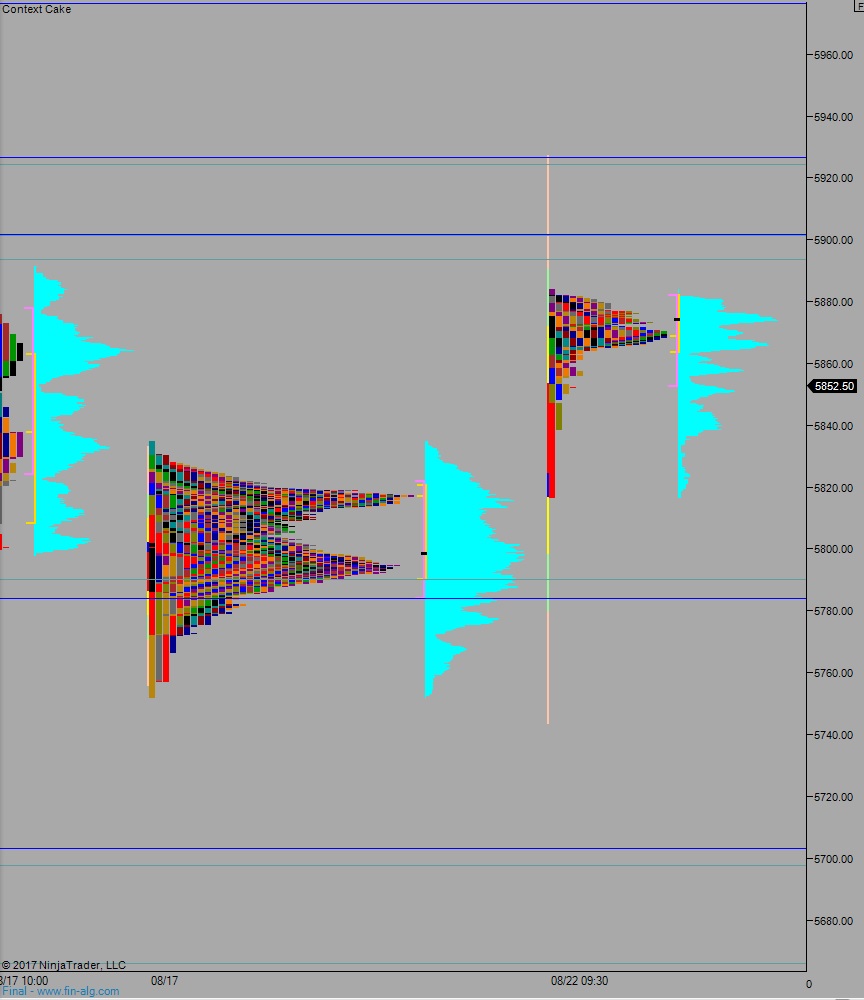

Yesterday we printed a trend day. This is the one of the cross-currents against our bearish bias on the week. There is a high probability statistic that the day after a trend day up we will exceed the day’s high by at least a tick. The day began with a decent gap up and drive higher. Then, after stalling for a bit at some market profile levels, we continued higher into end-of-day.

Heading into today my primary expectation is for sellers to gap-and-go lower, but trade only down to about 5838.75 before two way trade ensues.

Hypo 2 buyers work into the overnight inventory and close the gap up to 5878.75. If they manage to take out overnight high 5884 and sustain trade above it, the bunker buster short signal is negated.

Hypo 3 stronger sellers erase all of Tuesday’s gains, trading a gap fill dwn to 5795. Look for buyers down at 5790 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

Hello Raul,

So you are still expecting a swift market sell off soon? I don’t see it. Take a look at sentiment. Thank you

Hello Raul,

I think you should consider that this is the correct play from your Sunday post…not a sell off but a bone shattering rally. Consider the massive gap,up and go yesterday (you were a day off) followed by a gap lower and hollow candles higher today. Get ready for big squeeze higher. Sentiment is confirming. Locked and loaded via calls. GL

“Our alternative theory is a strong gap up to start the week, and then a continuous, bear-bone shattering, rally”

We did not gap up into week. Still looking for the crescendo selling. I could be.wrong.