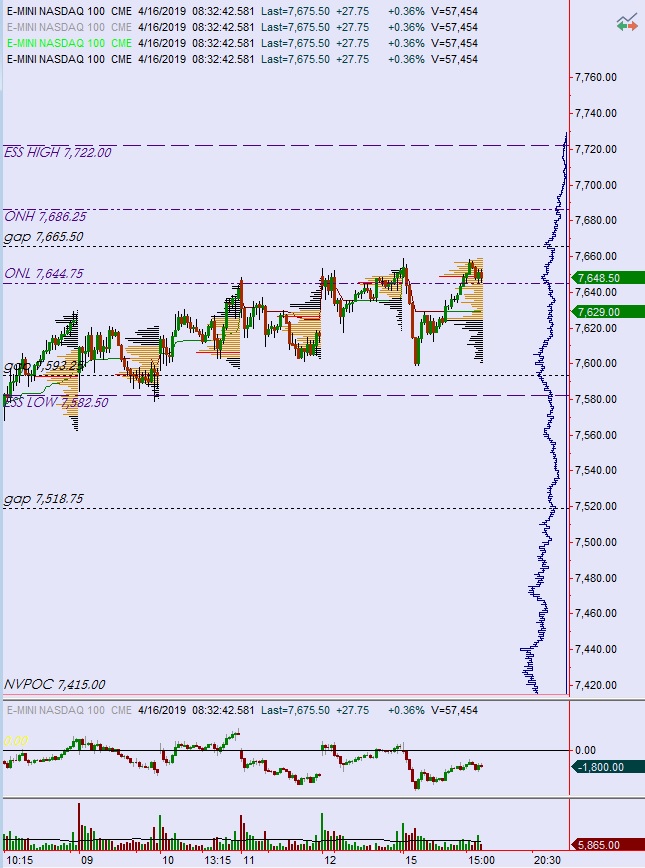

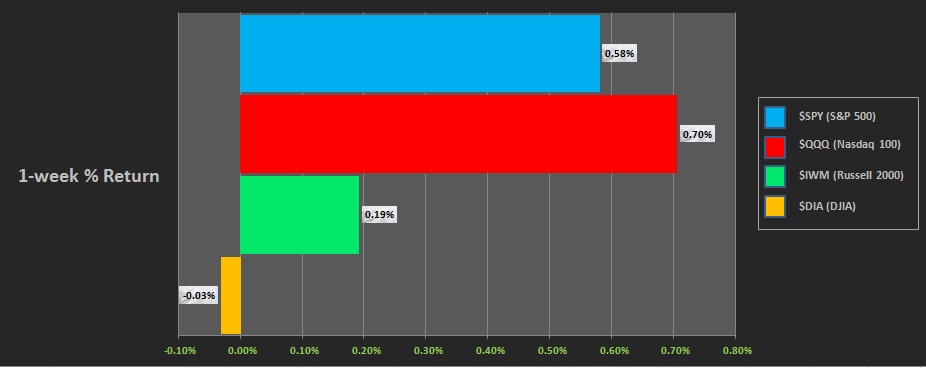

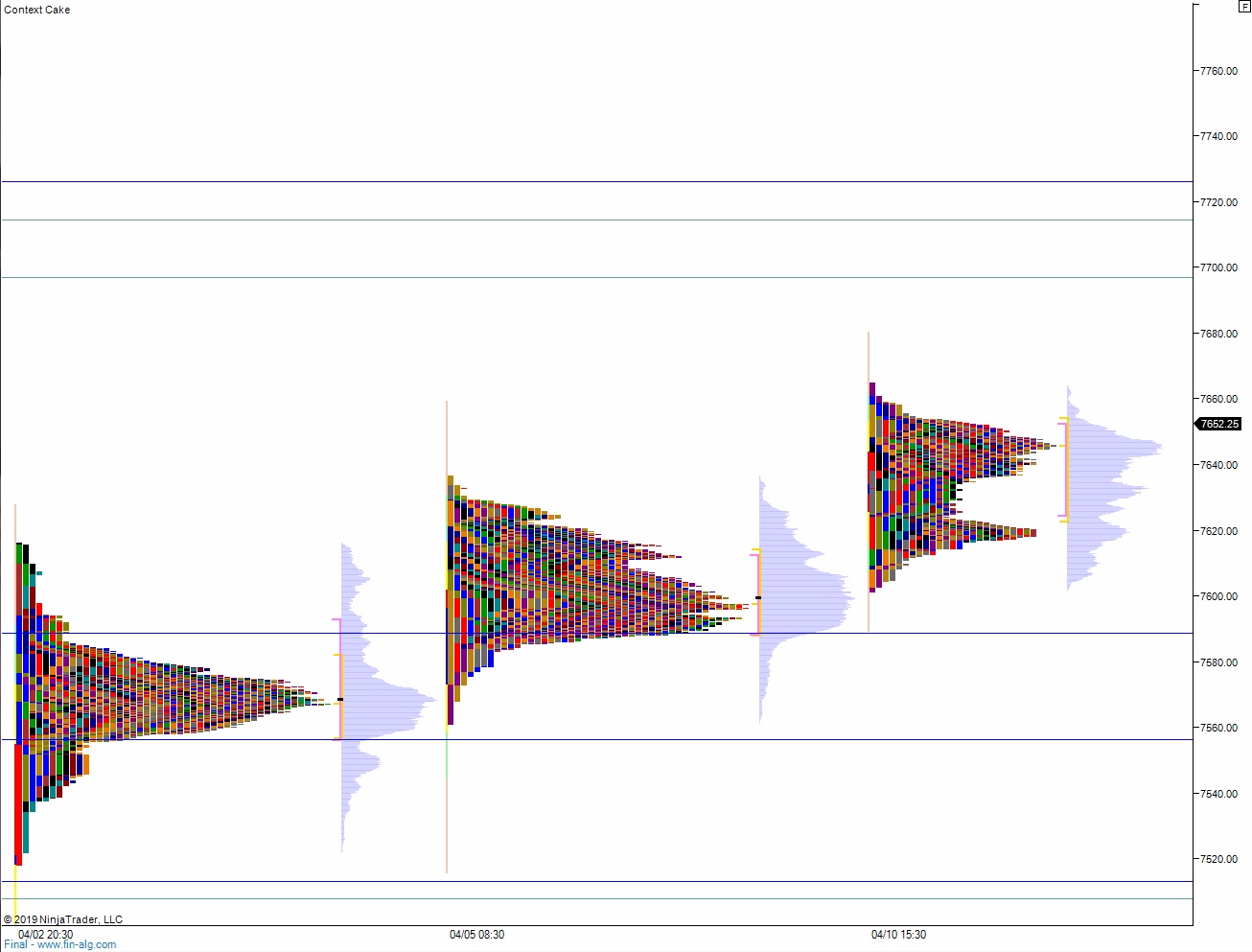

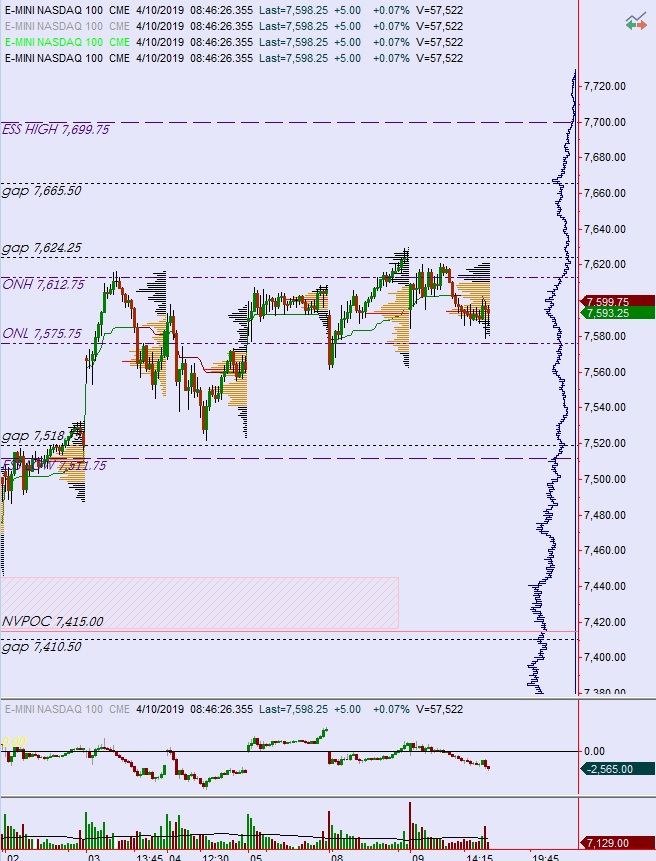

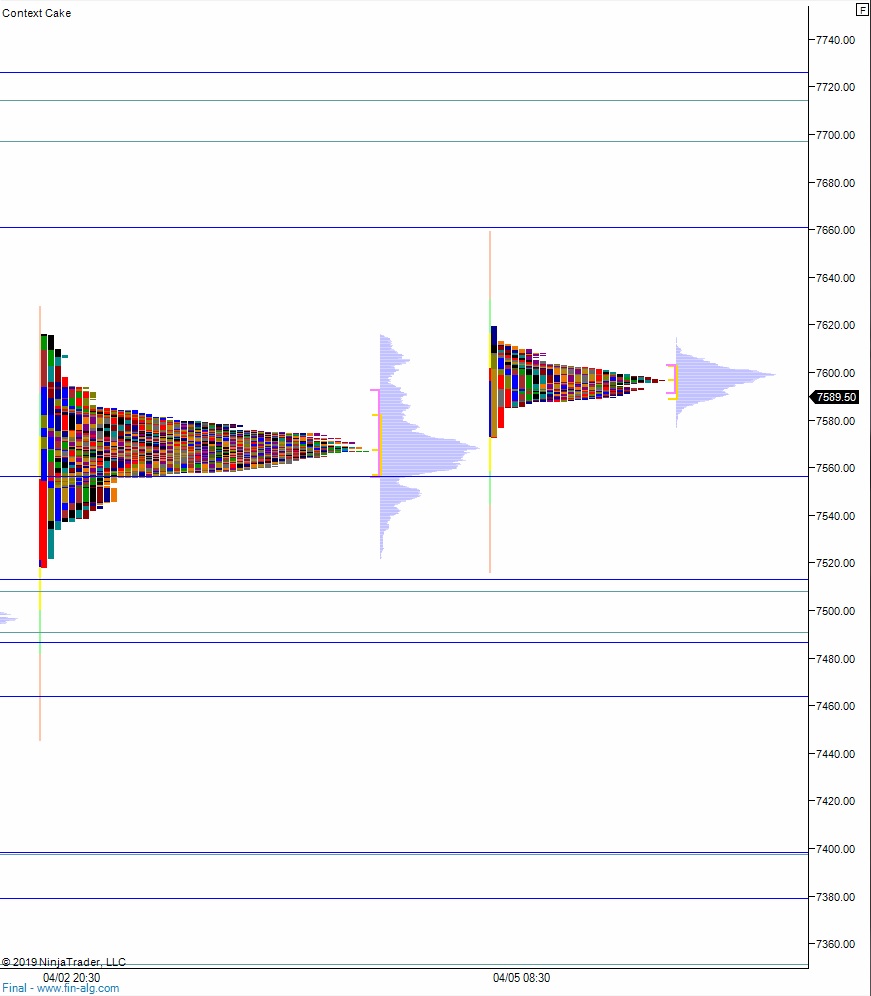

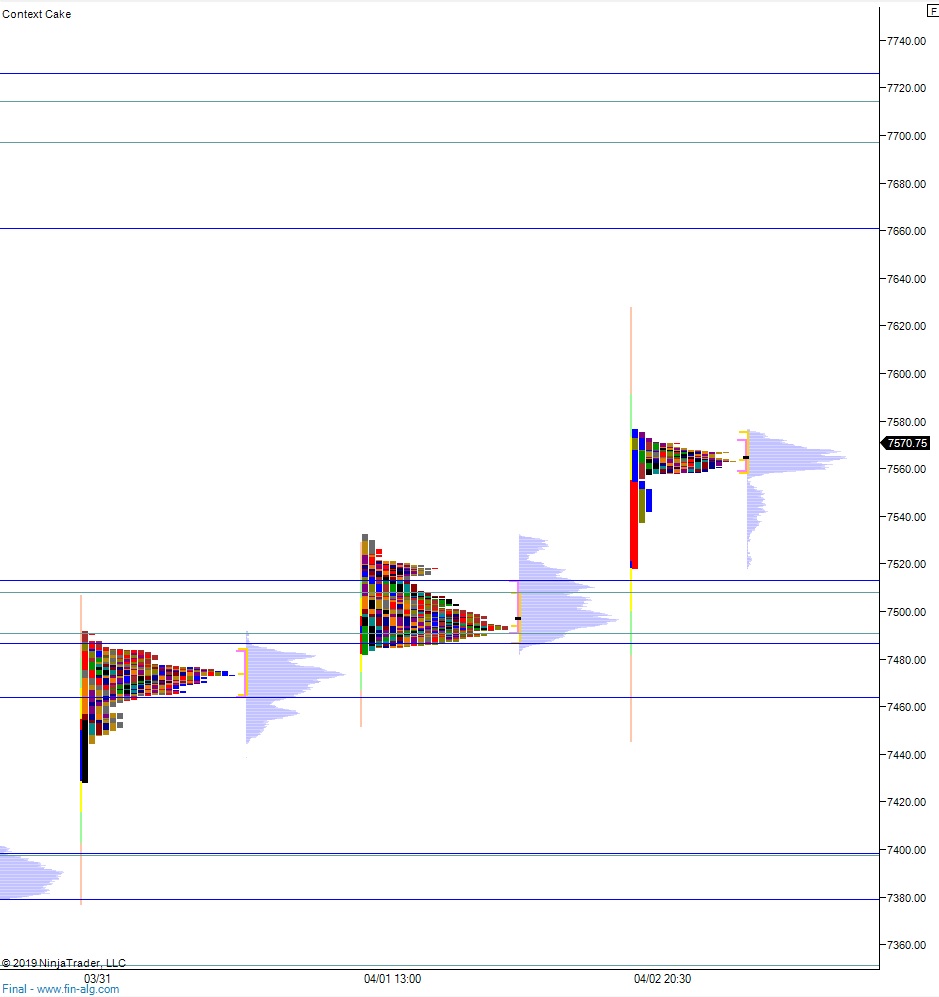

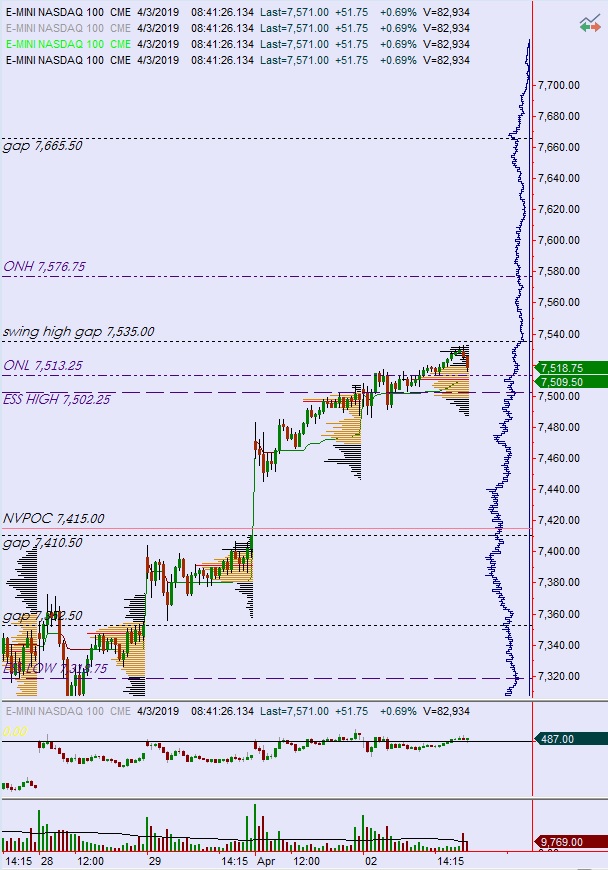

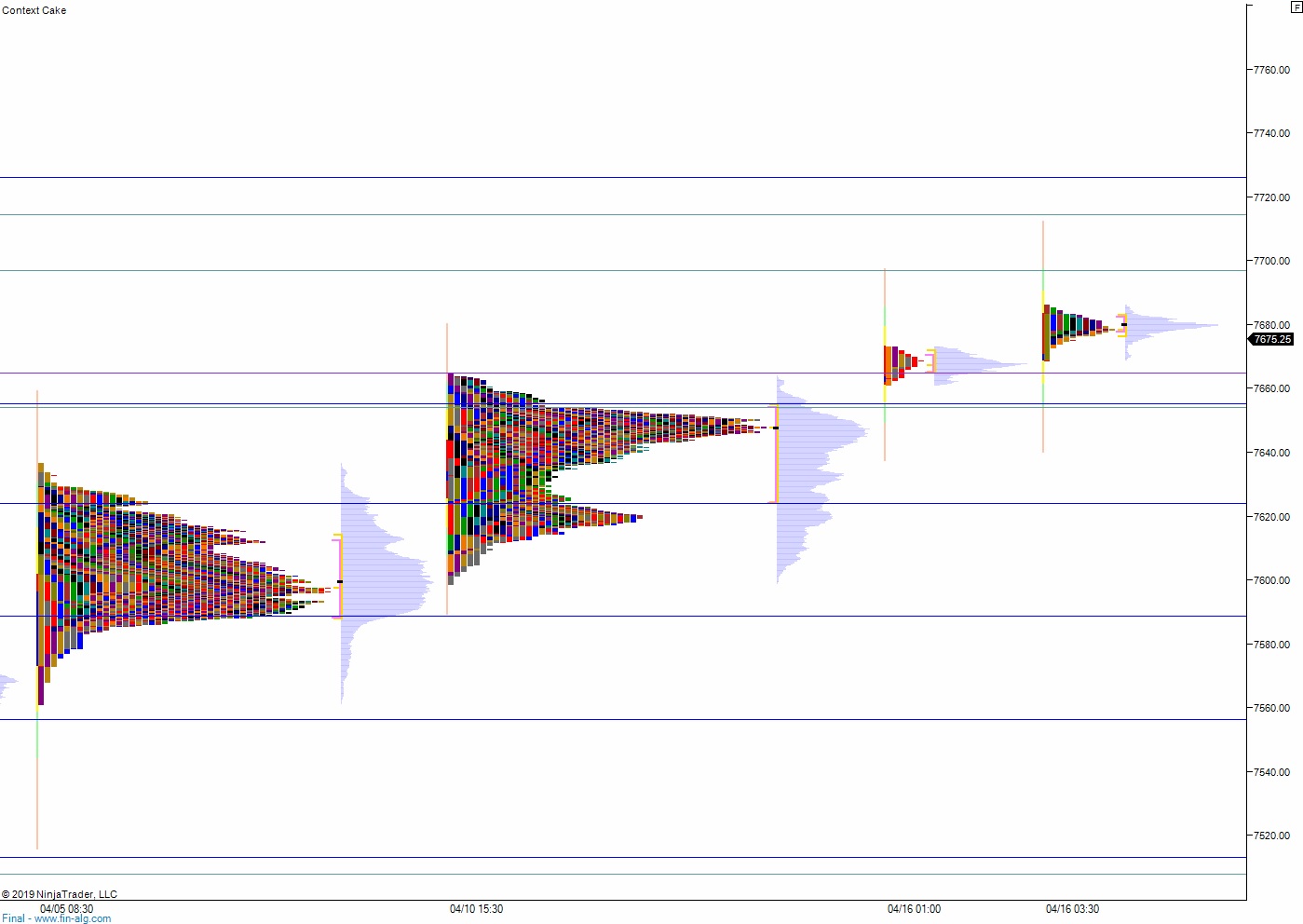

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring elevated volume and range. Price worked higher overnight, escaping a 5-day old value area by balancing for a bit along the Monday high then making another exploration higher. As we approach cash open, price is hovering at levels unseen since October 3rd of last year.

On the economic calendar today we have industrial/manufacturing production at 9:15am, NAHB housing market index at 10am, then API crude oil inventories at 4:30pm.

Earnings season officially gets started today after market close when both IBM and NFLX report earnings.

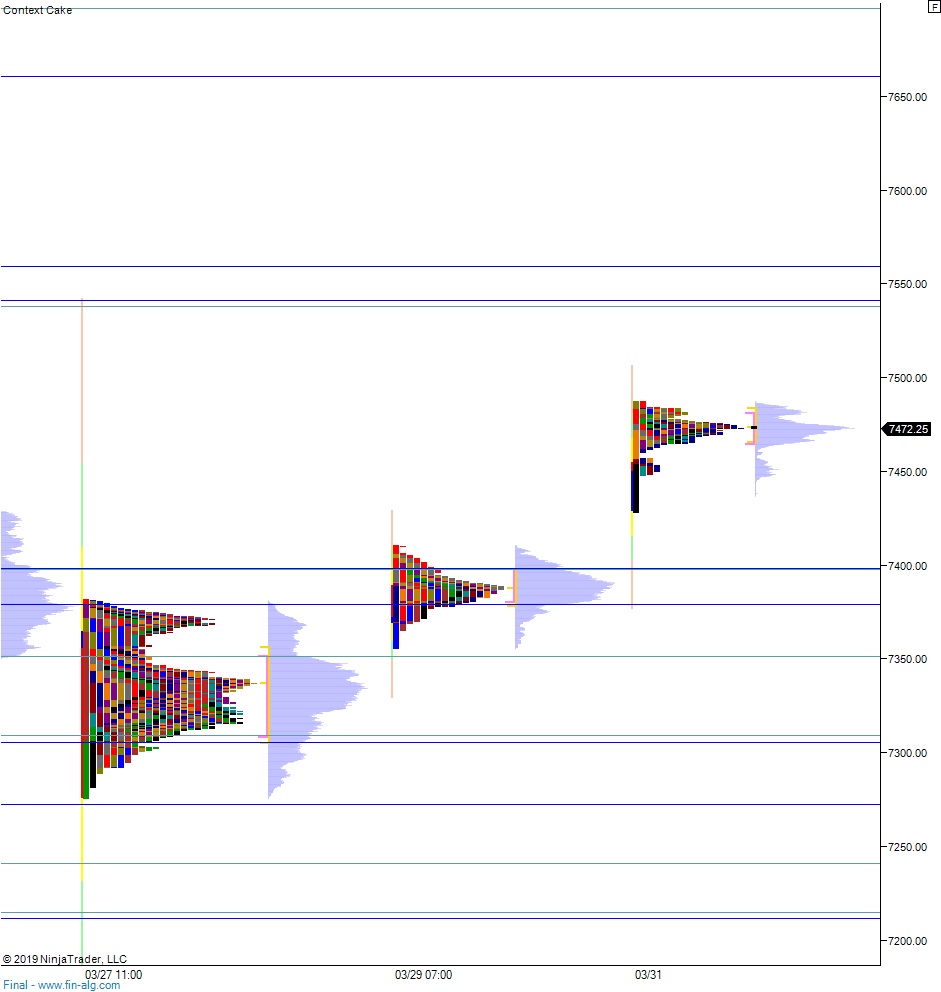

Yesterday we printed a normal variation down. The week began flat. After a brief 2-way auction at the open, price drove lower, trading down through the Thursday low before discovering a strong responsive bid. Buyers came to terms with the bottom-end of our daily mid for a few hours before continuing their campaign higher. We ended the day near session high, up a few point on the day.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 7700 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory to close the overnight gap down at 7648.50. Sellers cannot take out overnight low. Instead we work higher to 7700 before two way trade ensues.

Hypo 3 stronger sellers trade down through overnight low 7644.75 setting up a move to target 7624 before two way trade ensues.

Levels:

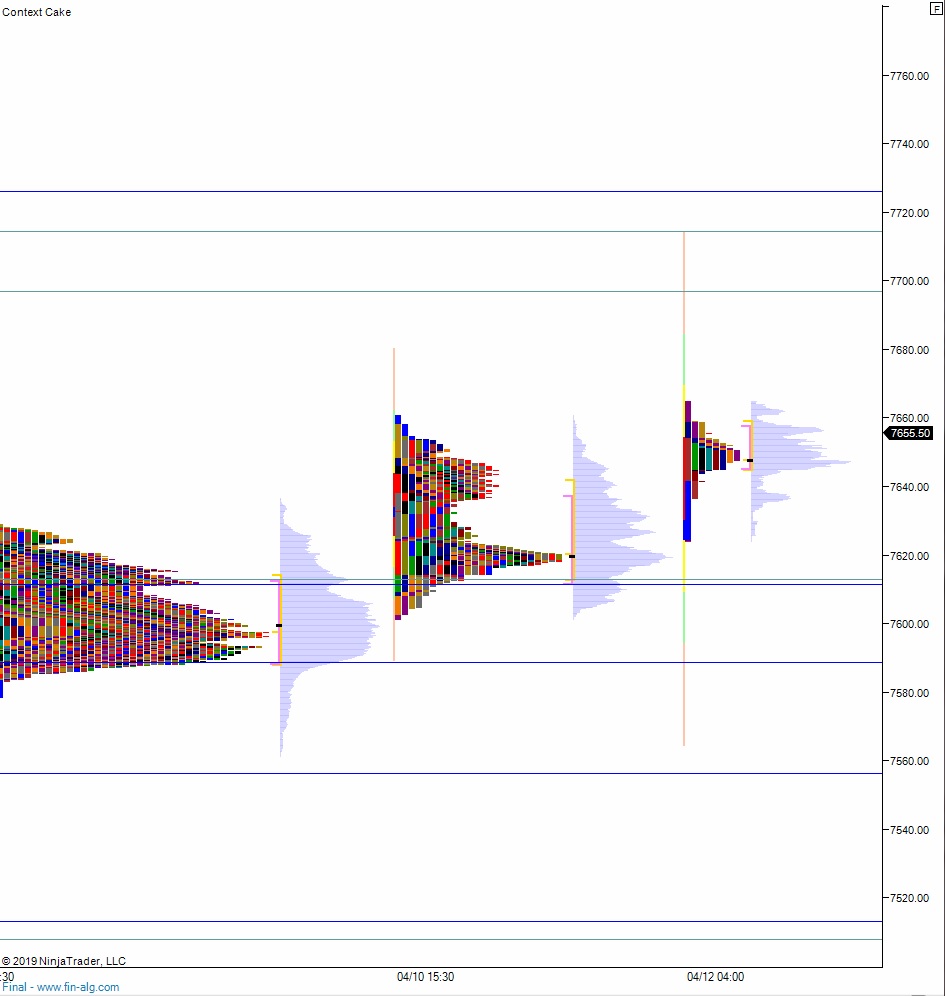

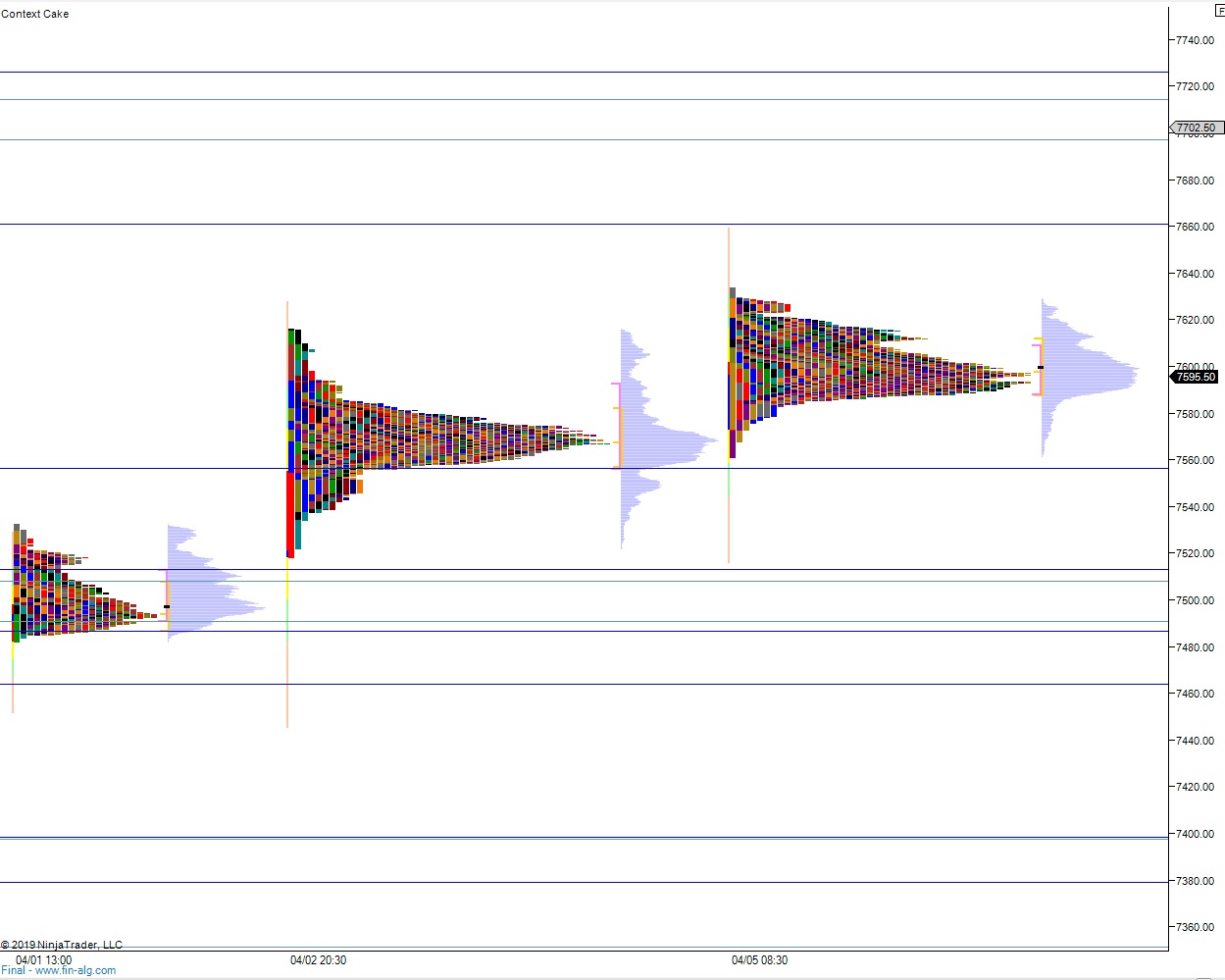

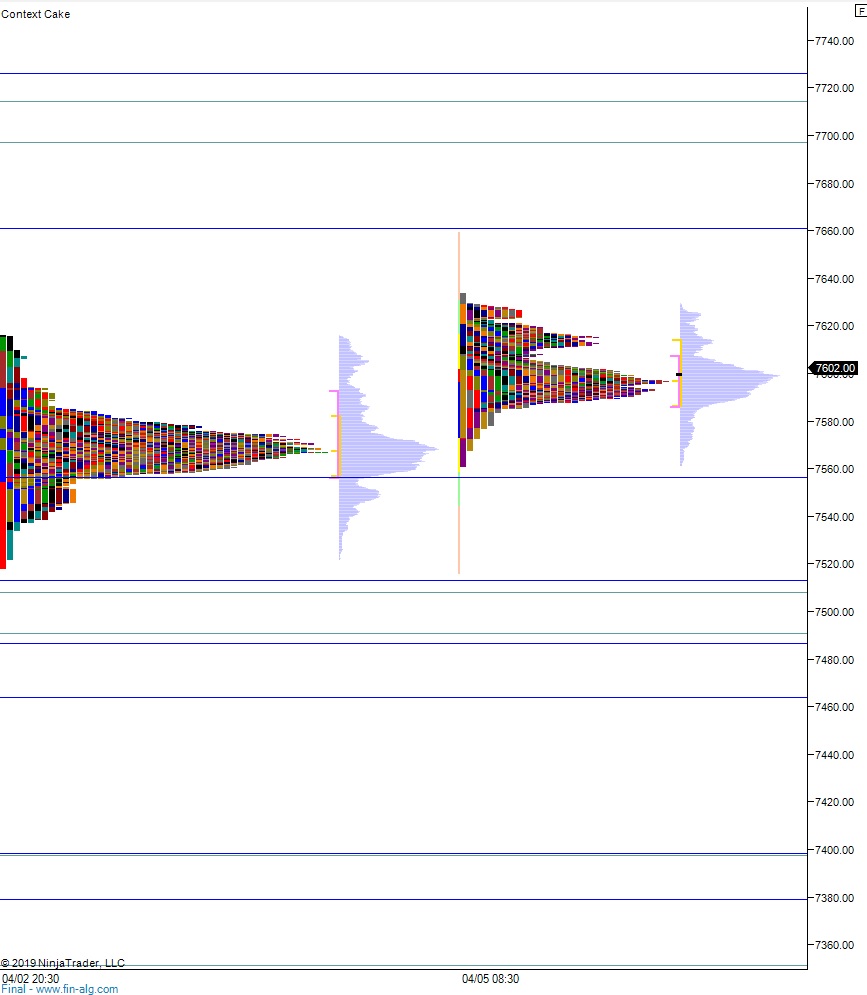

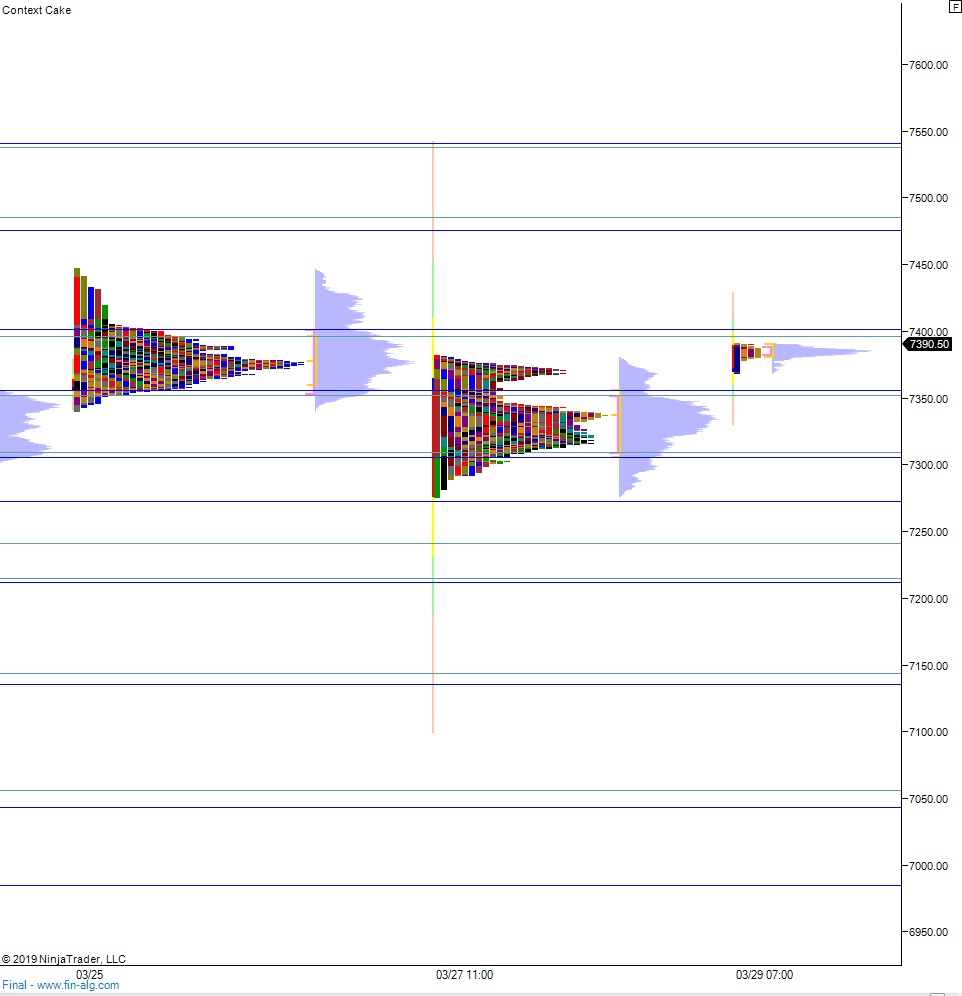

Volume profiles, gaps, and measured moves: