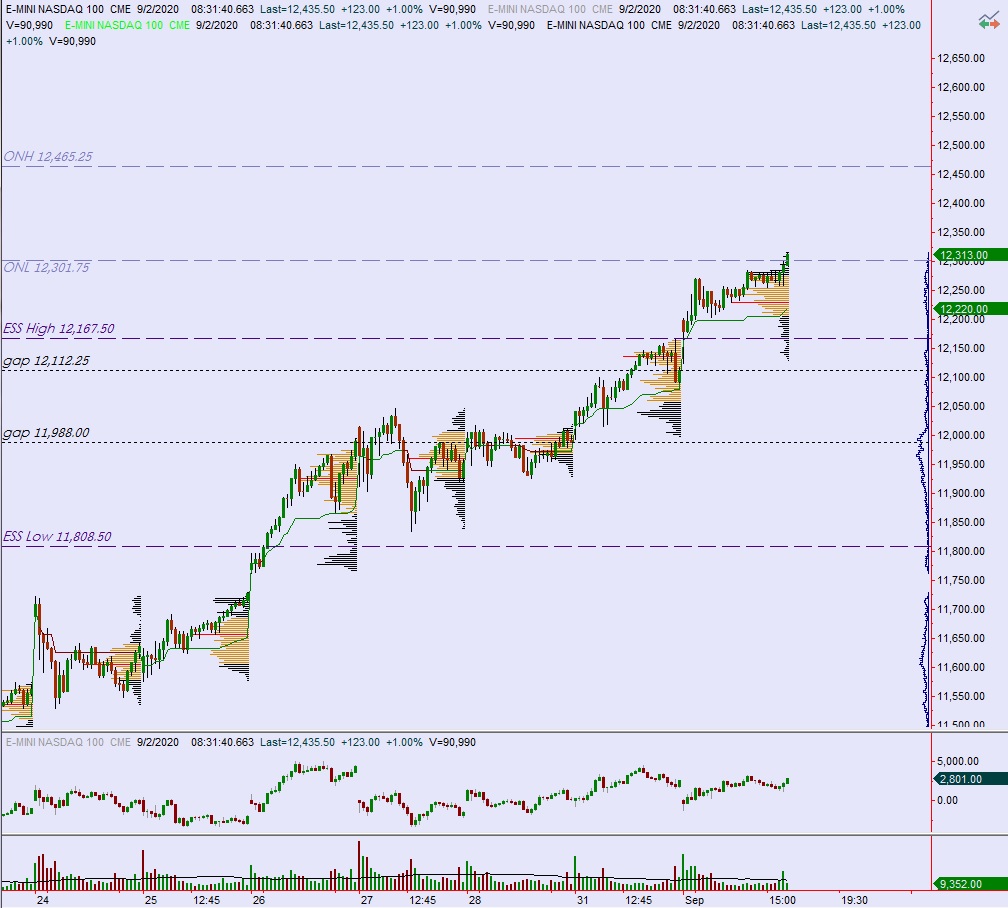

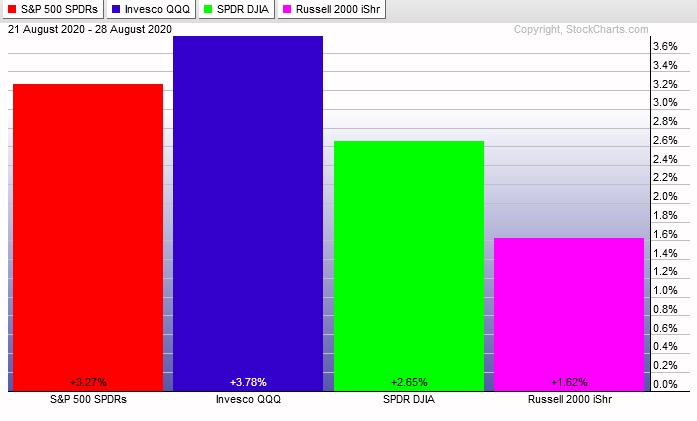

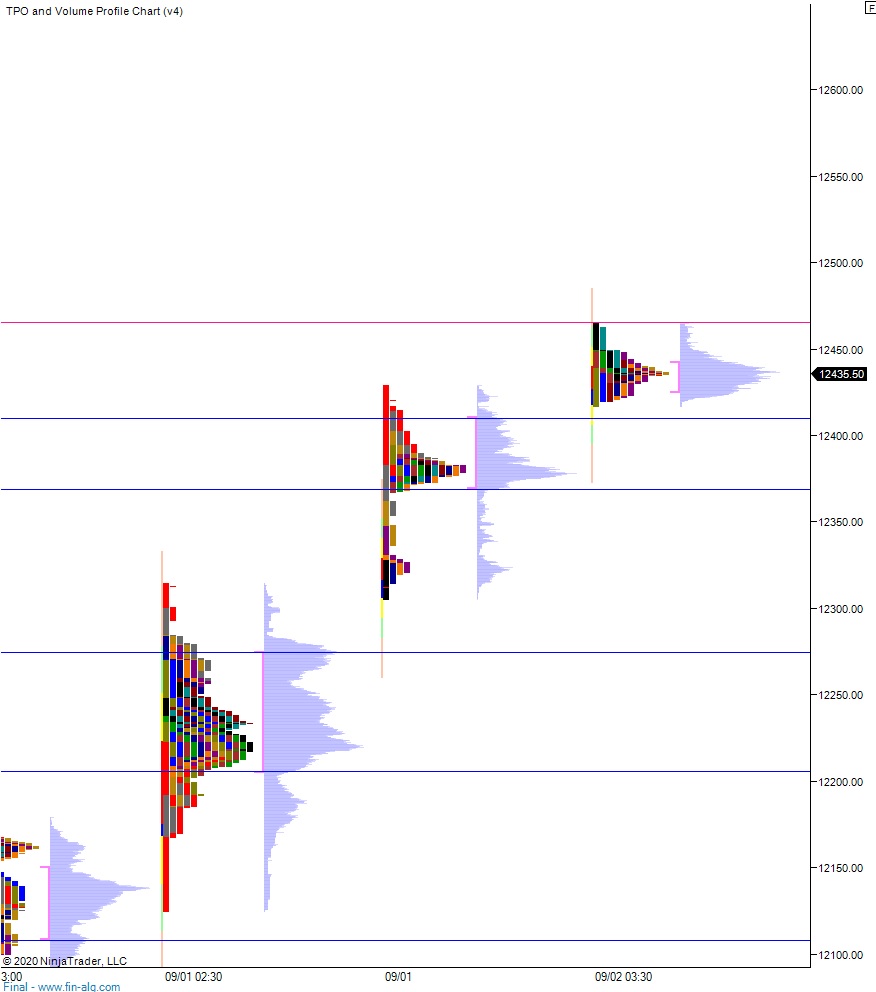

NASDAQ futures are coming into the second day of September pro gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, making a steady ascent higher via two rotations higher. At 8:15am the ADP employment report showed job growth, with private job growth at a steady 428,000 which many commentators are downplaying as not enough gains. As we approach cash open, price is hovering near 12,420.

Also on the economic calendar today we have factory orders at 10am, crude oil inventories at 10:30am and the Fed beige book at 2pm.

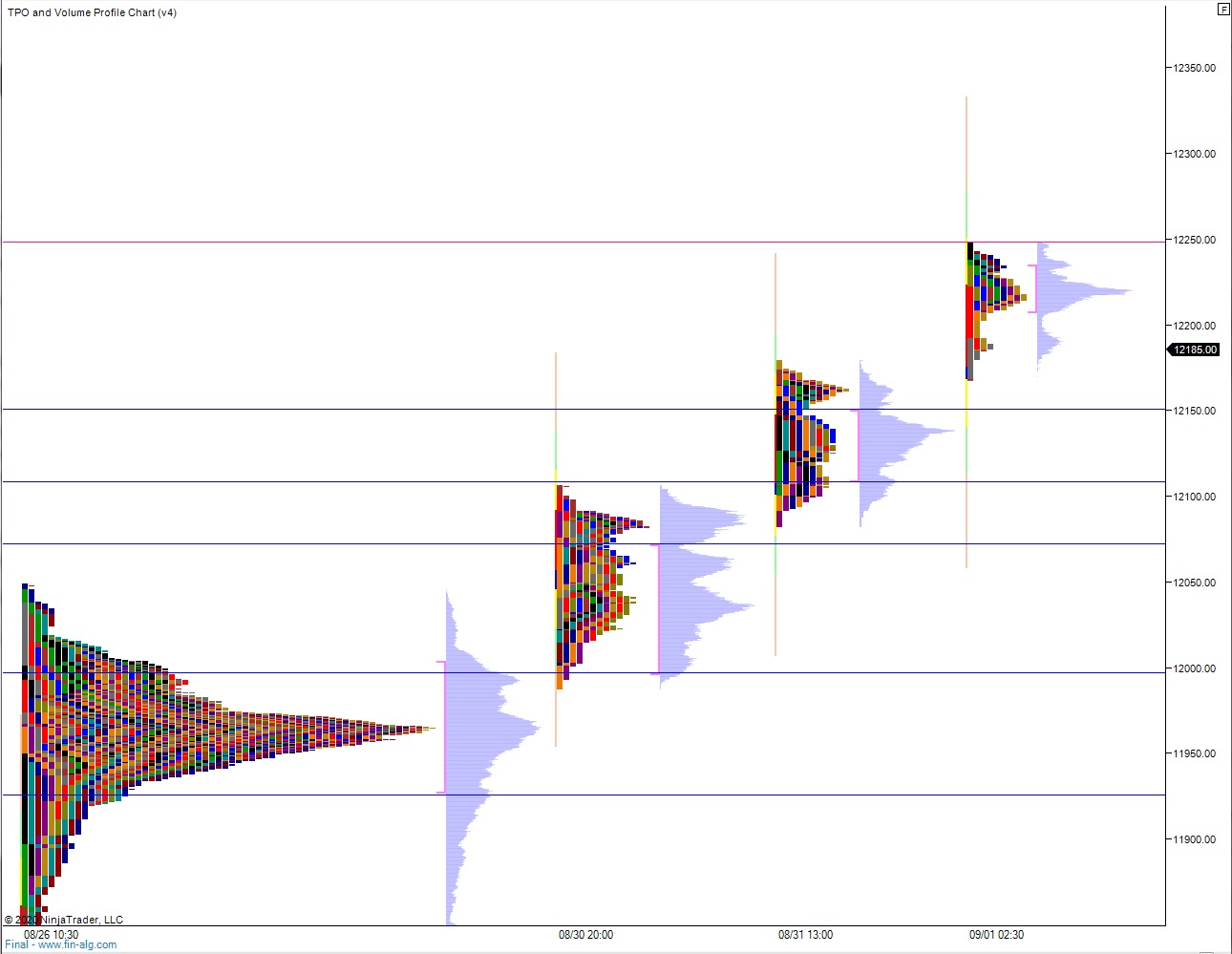

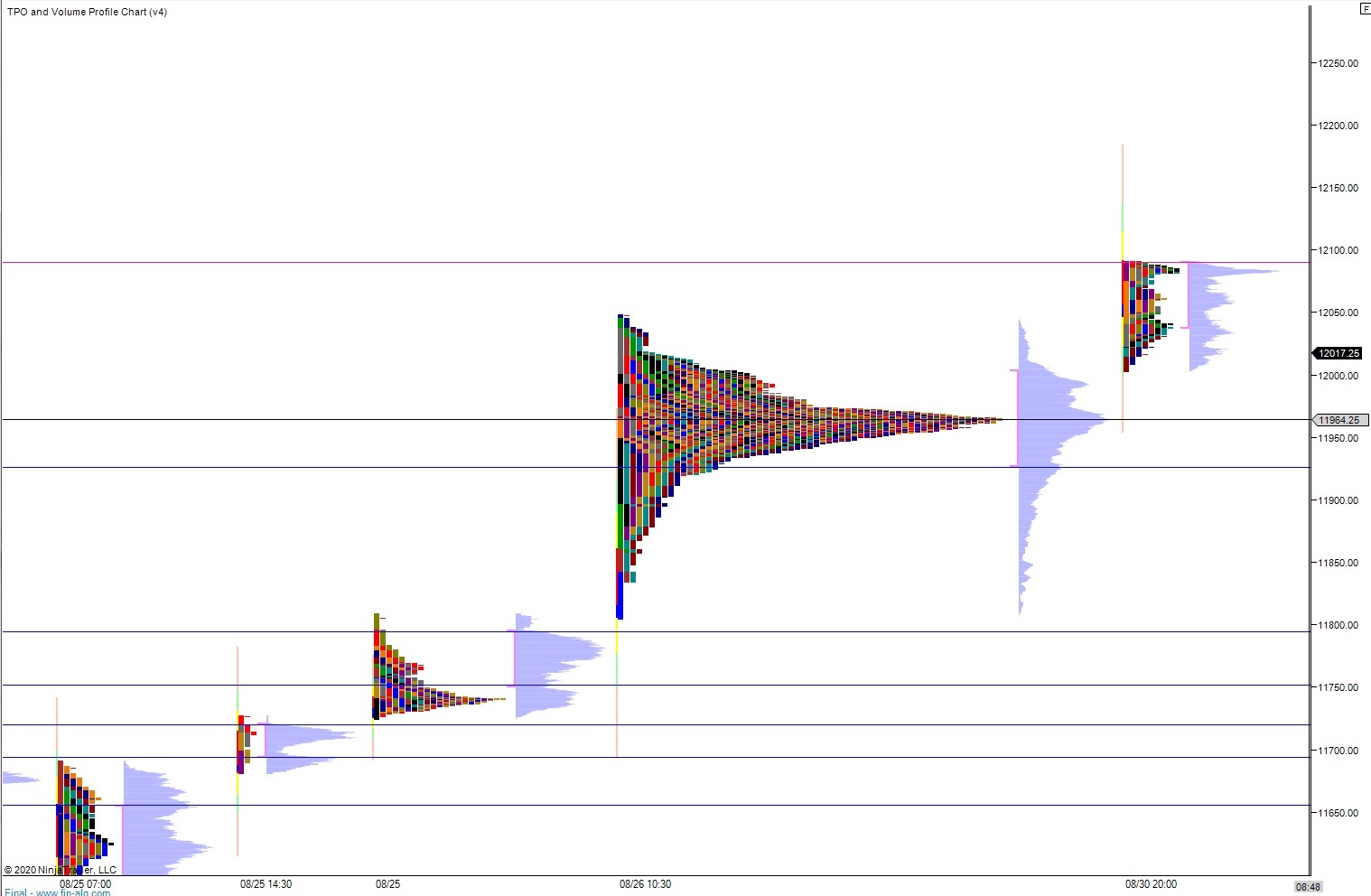

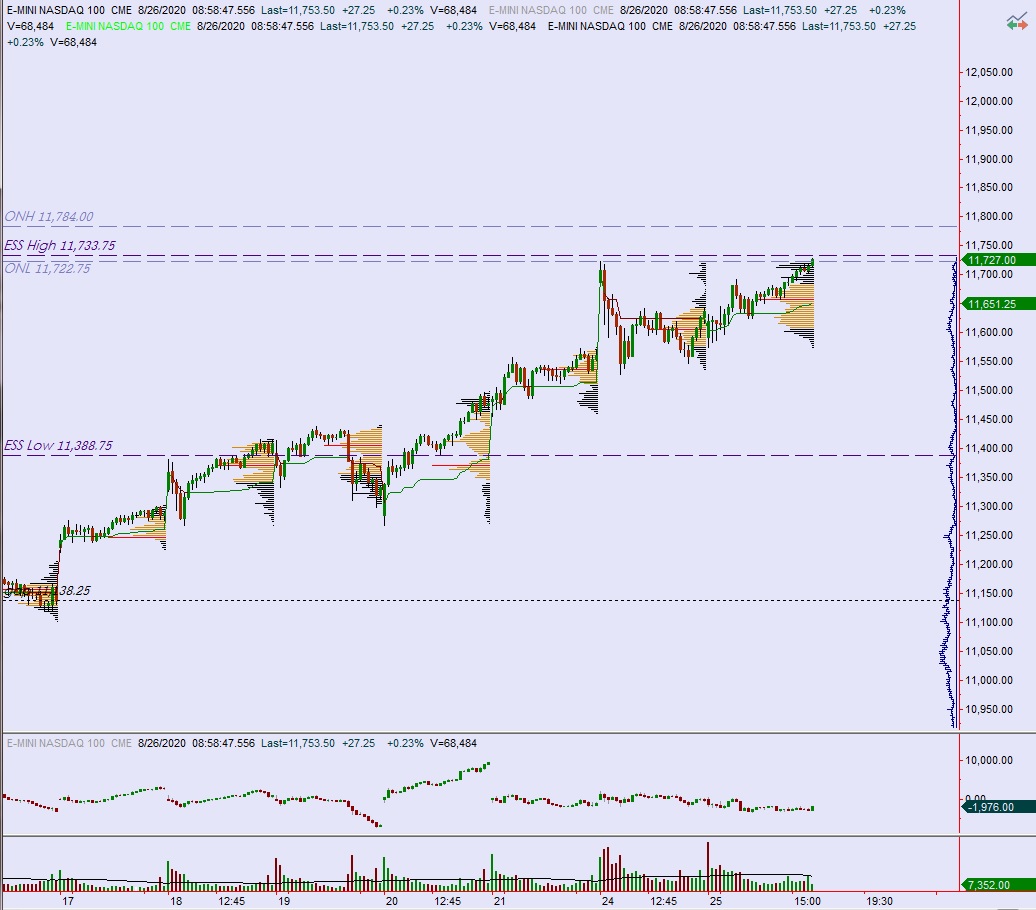

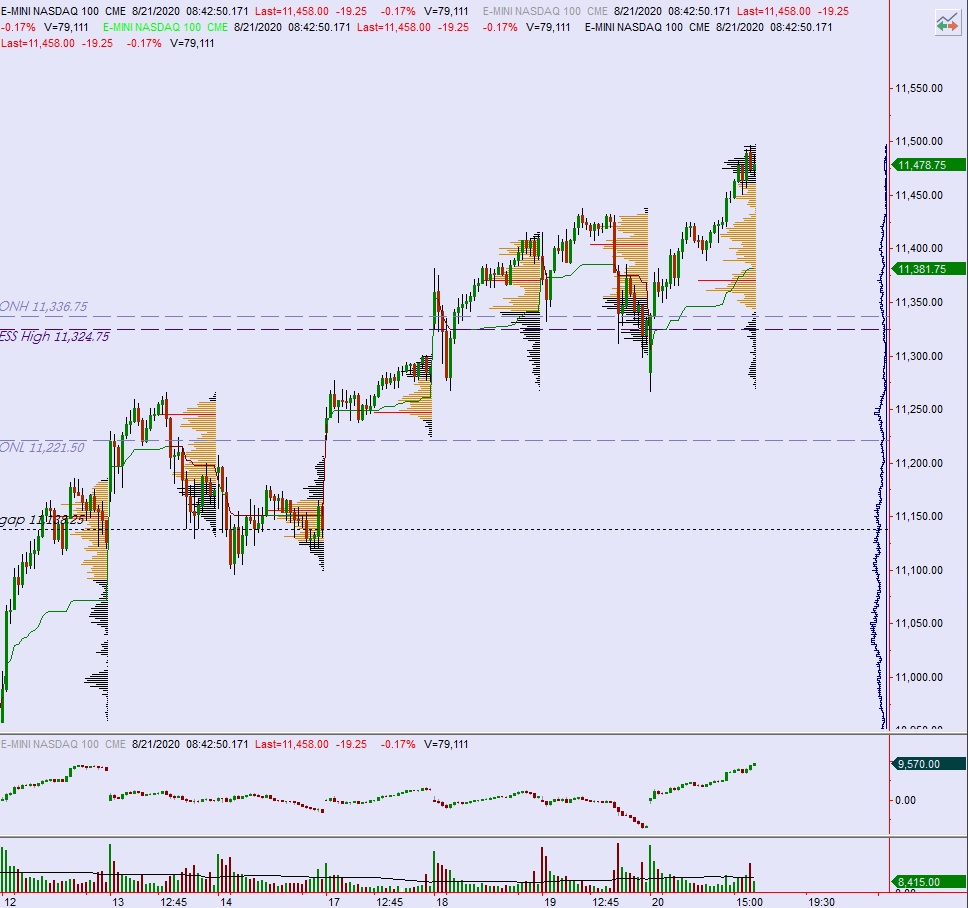

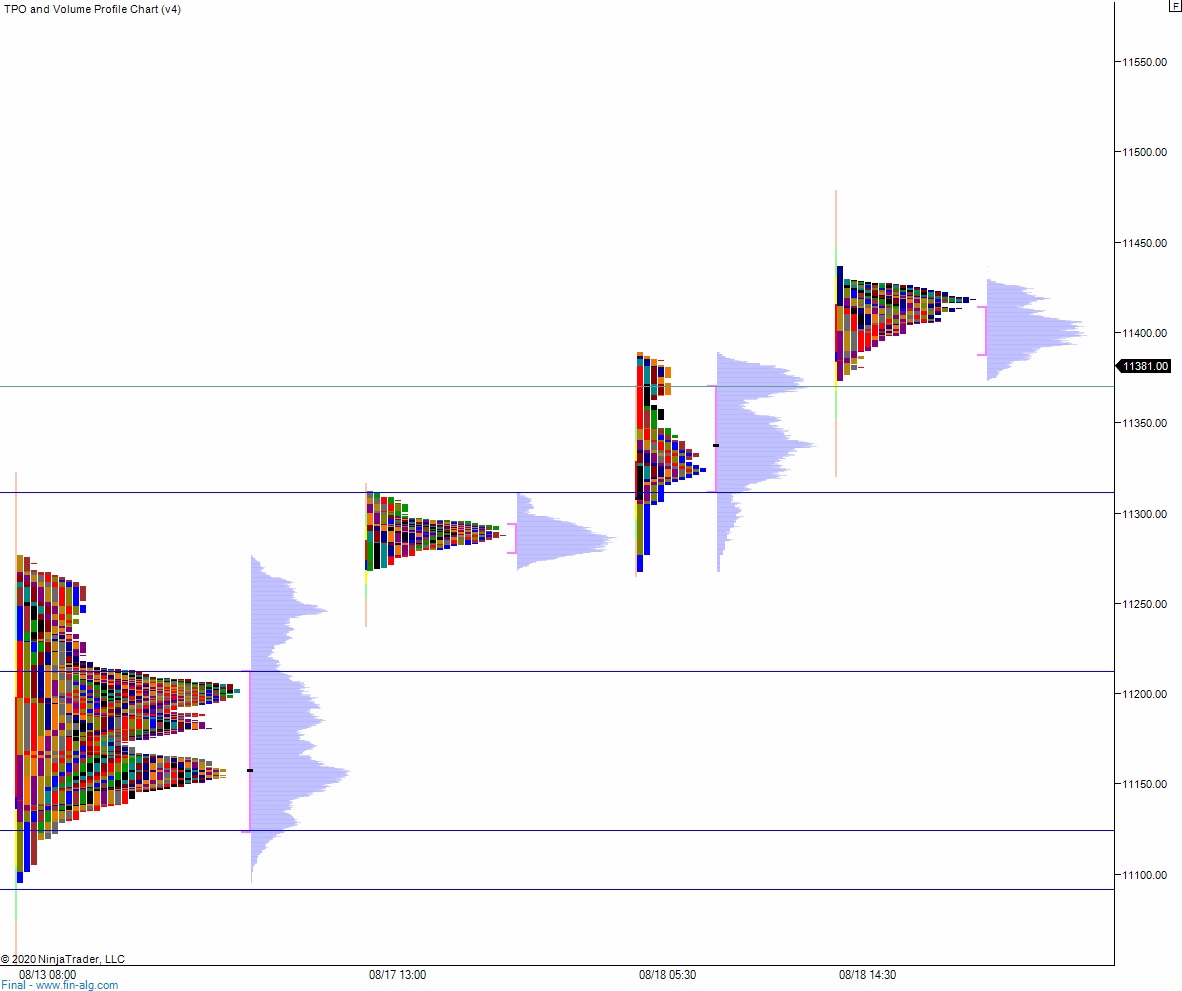

Yesterday we printed a normal variation up. The day began with a gap up beyond the Monday range. Sellers had a go at closing the gap during the opening swing but stalled after tagging Monday’s naked VPOC. Responsive buyers (responsive relative to Tuesday open, initiative relative to Monday close) stepped in and formed a sharp excess low then rallied price right up until 10:30am. Then we flagged in the upper quadrant for several hours, not making any range extension. Range extension up came around 1:45pm setting up another flag for about the rest of the session before we ramped into the bell and closed on the highs.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 12,465.25 on their way to tagging 12,500.

Hypo 2 sellers work a half gap down to 12,410 before two way trade ensues.

Hypo 3 stronger sellers work a full gap fill down to 12,313. Look for buyers down at 12,300 and two way trade to ensue.

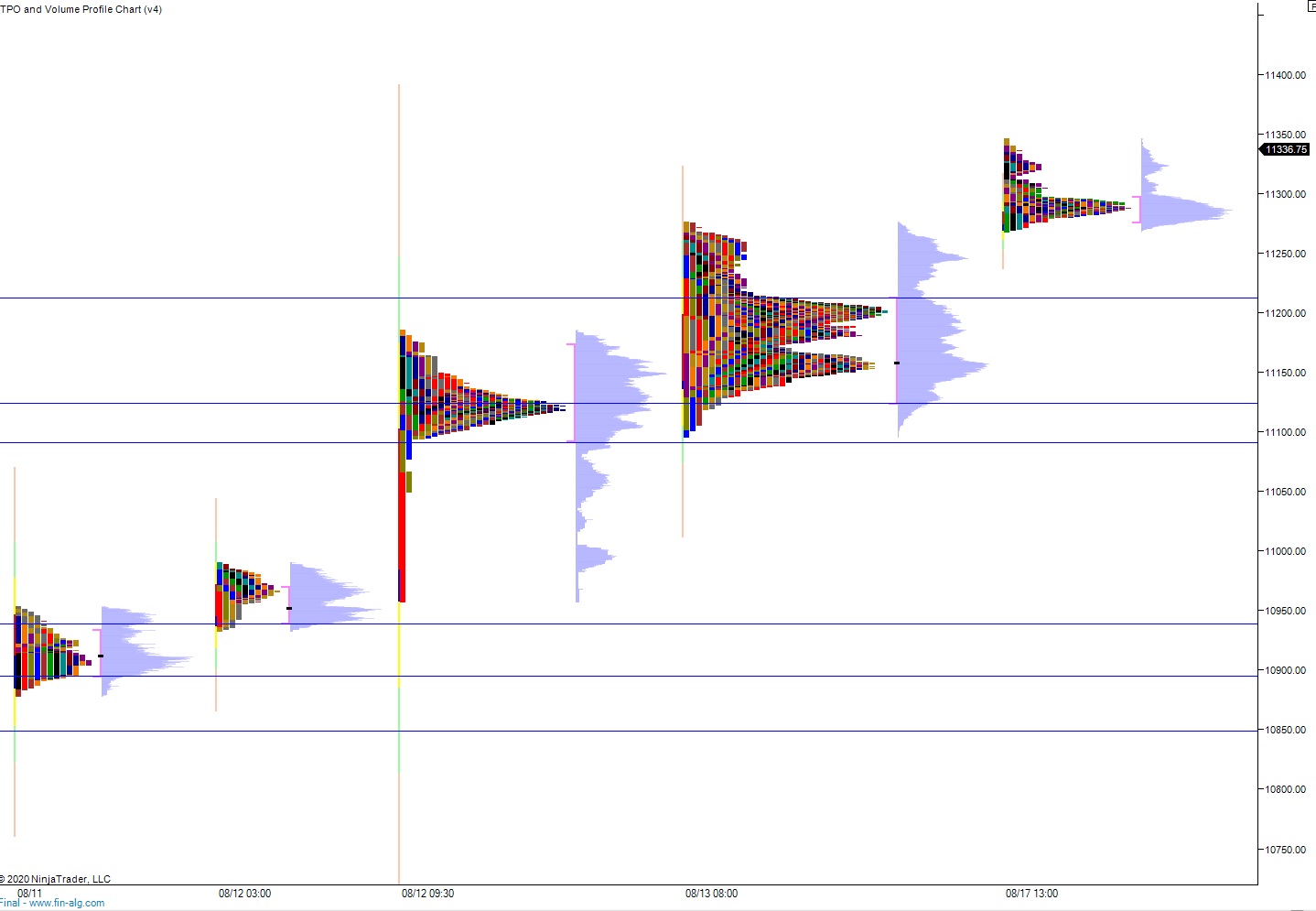

Levels:

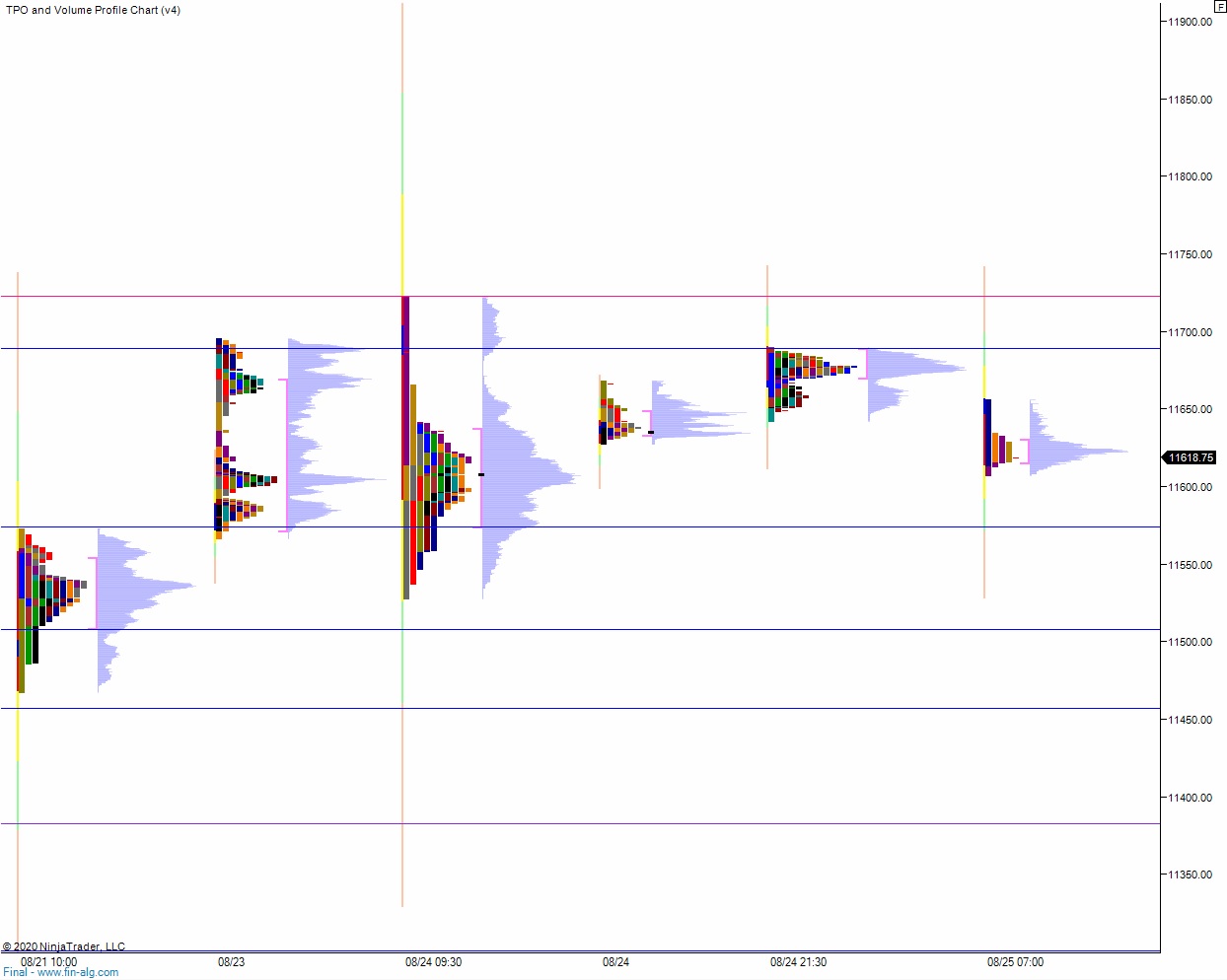

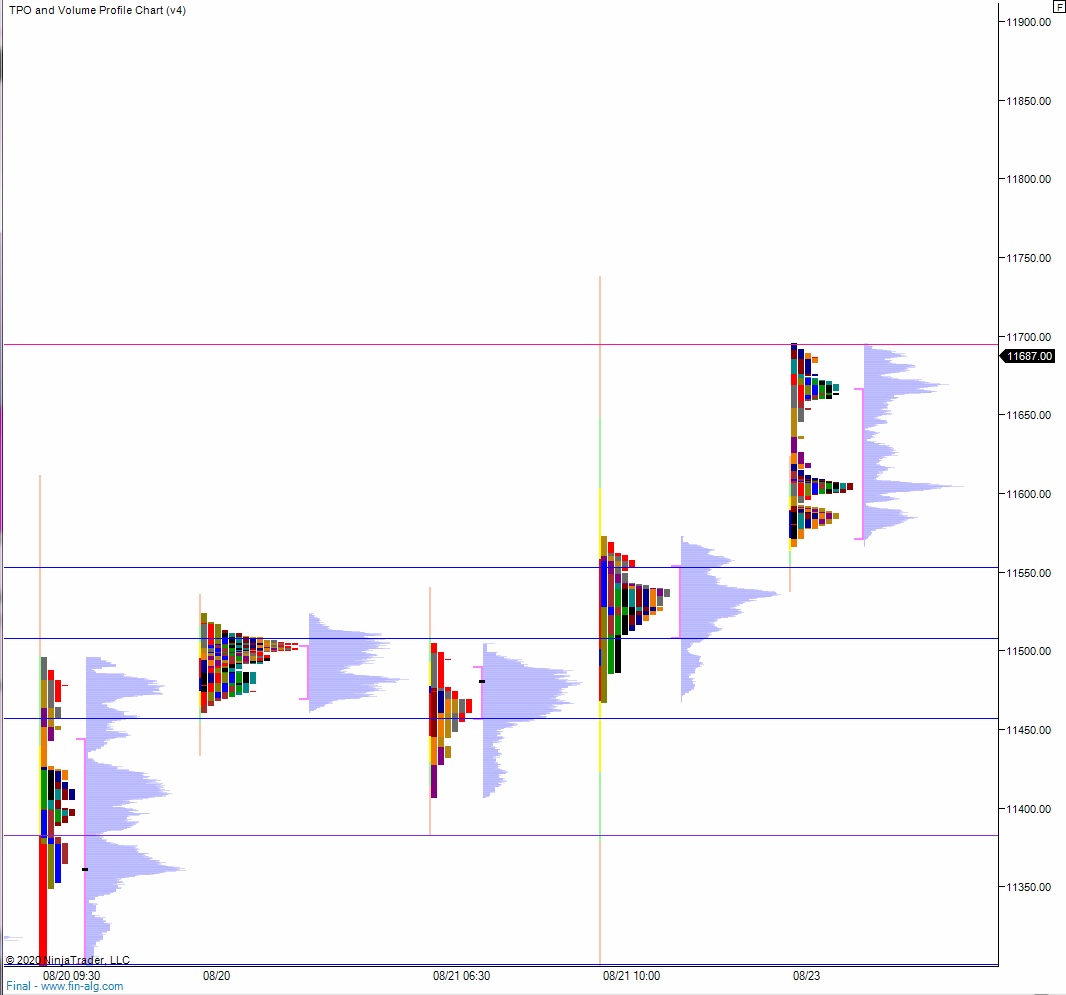

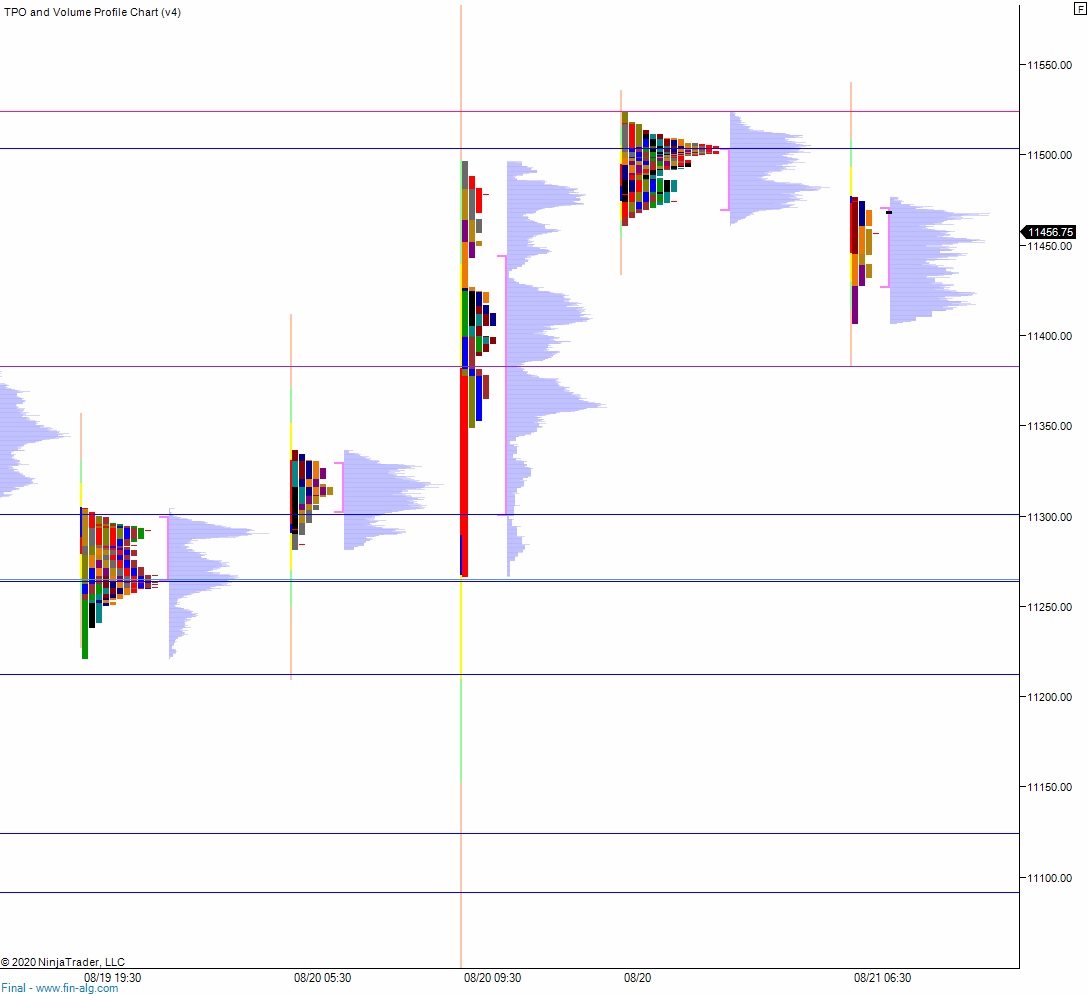

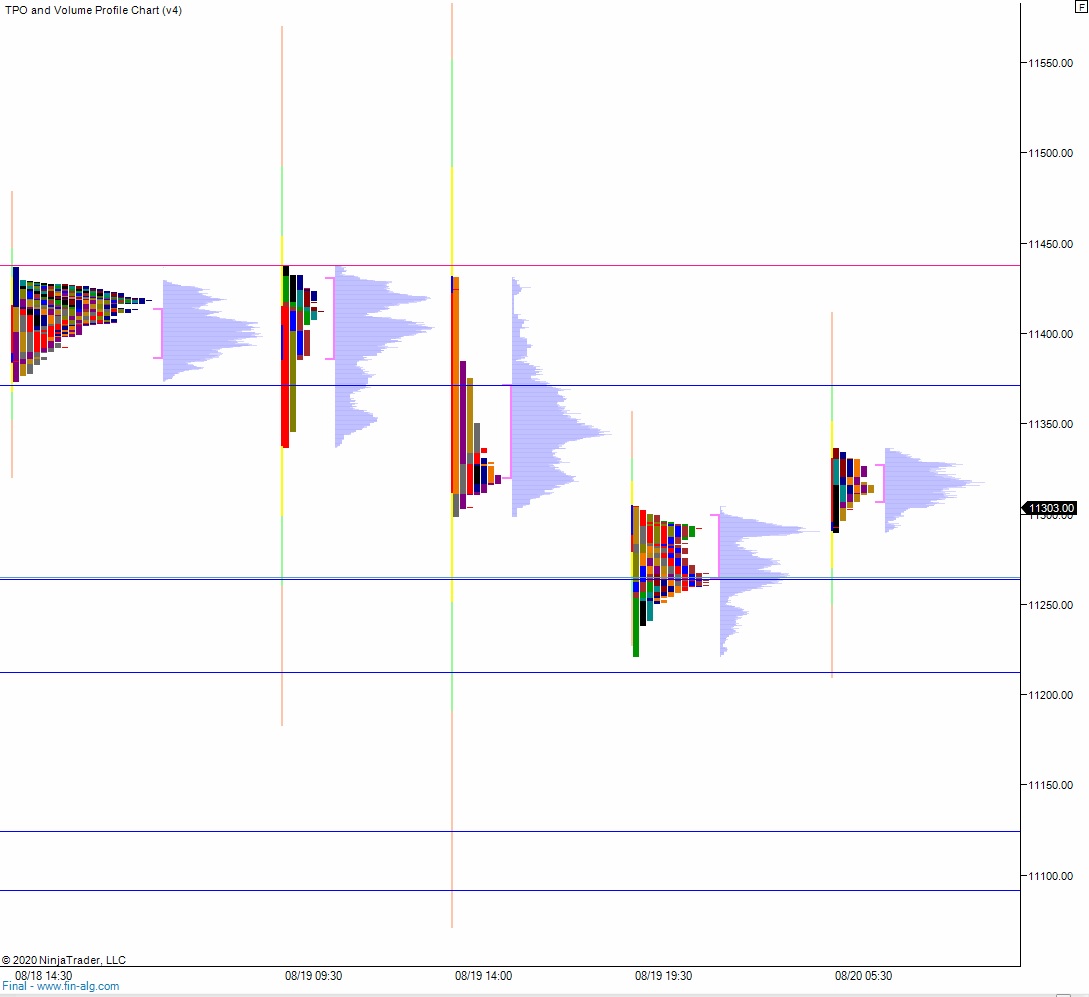

Volume profiles, gaps and measured moves: