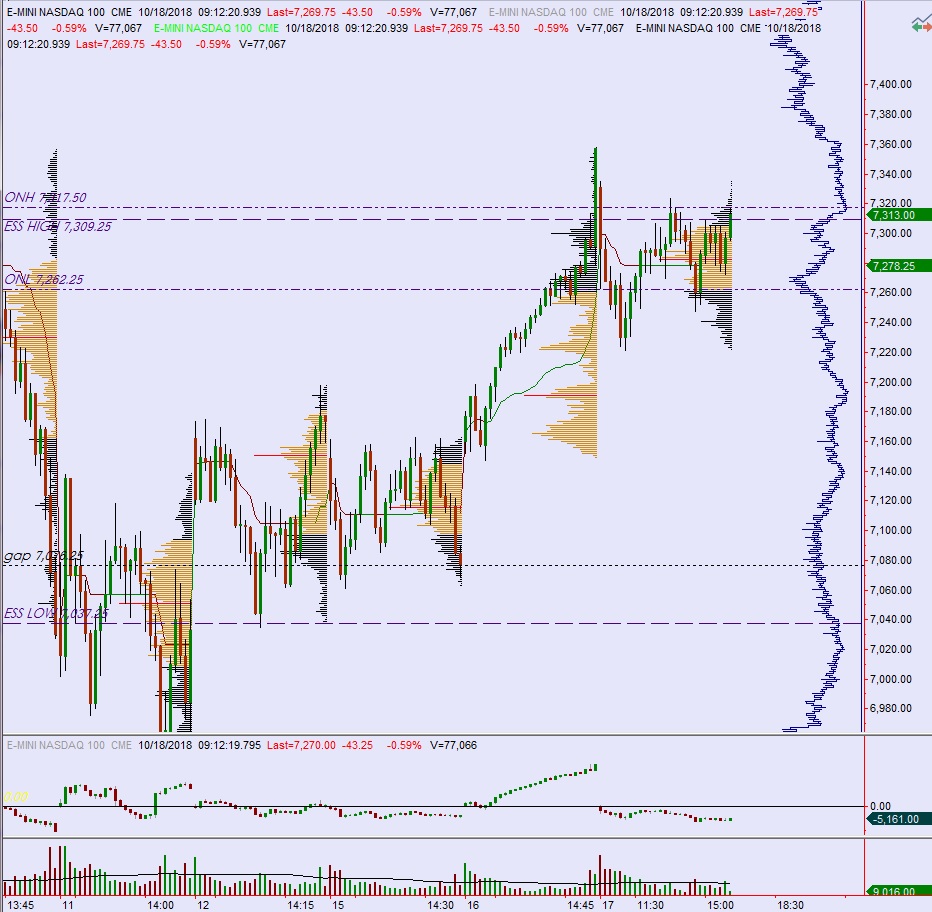

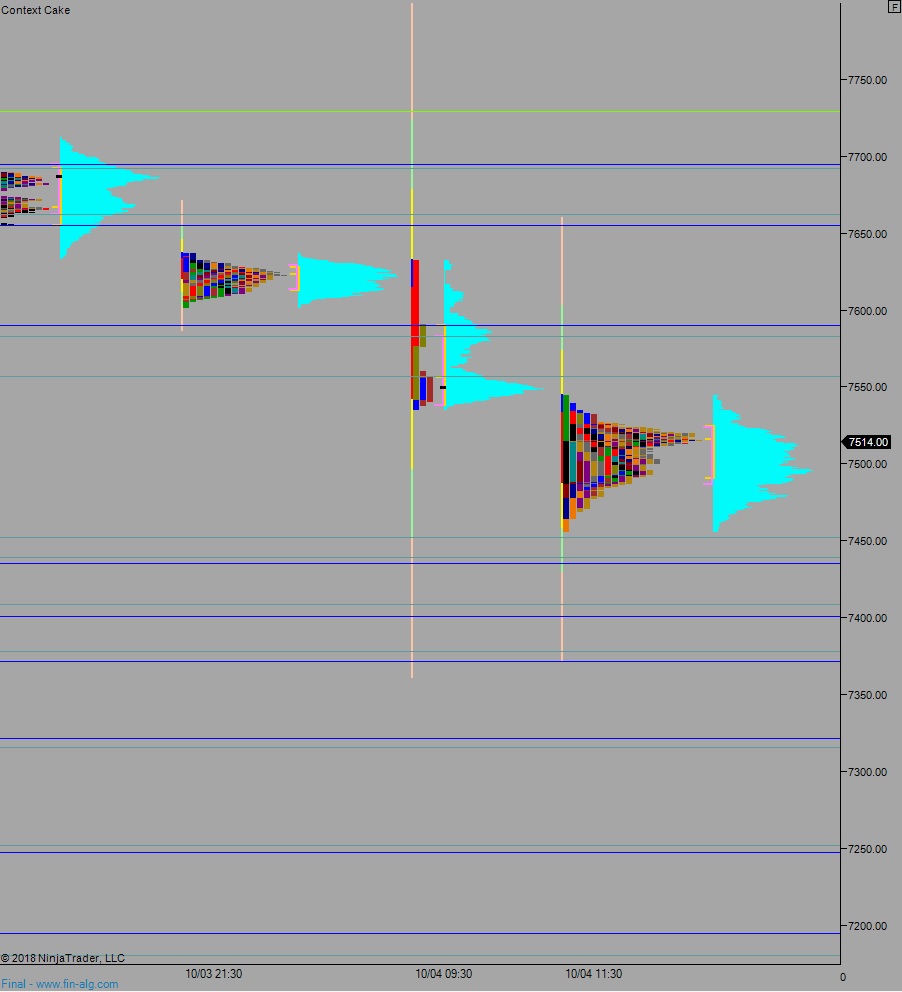

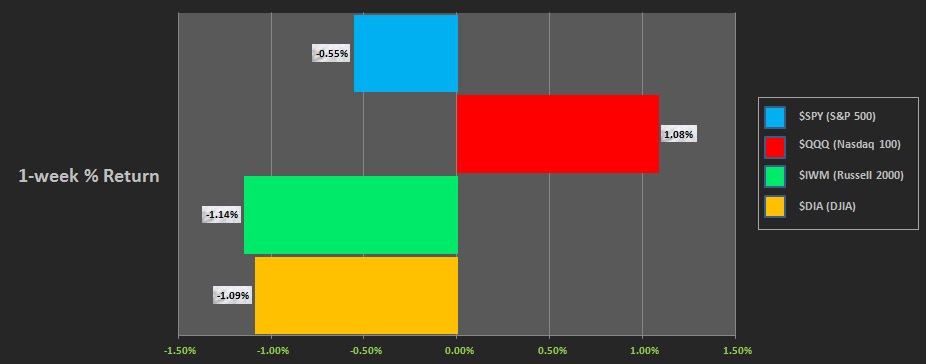

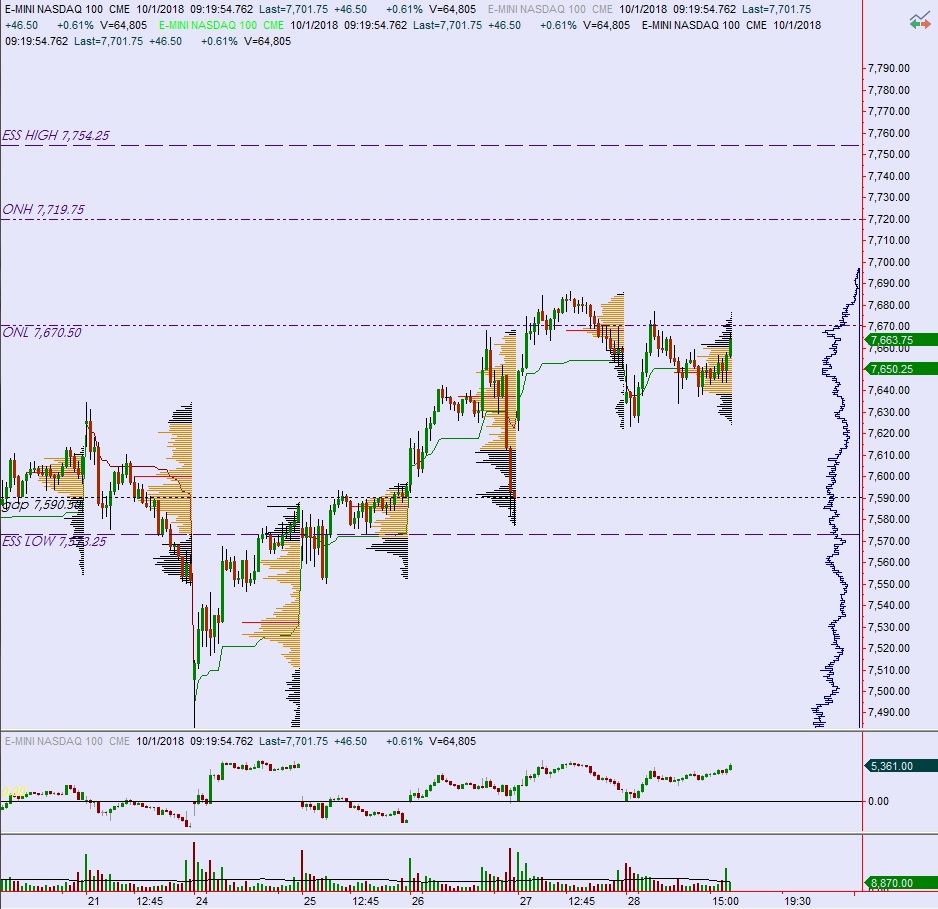

NASDAQ futures are coming into Thursday gap down after an overnight session featuring elevated range and extreme volume. Price worked sideways overnight in a balanced session. As we approach cash open prices are hovering along Wednesday’s midpoint. At 8:30am Philly Fed and Initial/Continuing jobless claims data came out all better-than-expected.

Also on the economic agenda today we have a 30-year TIPS auction at 1pm.

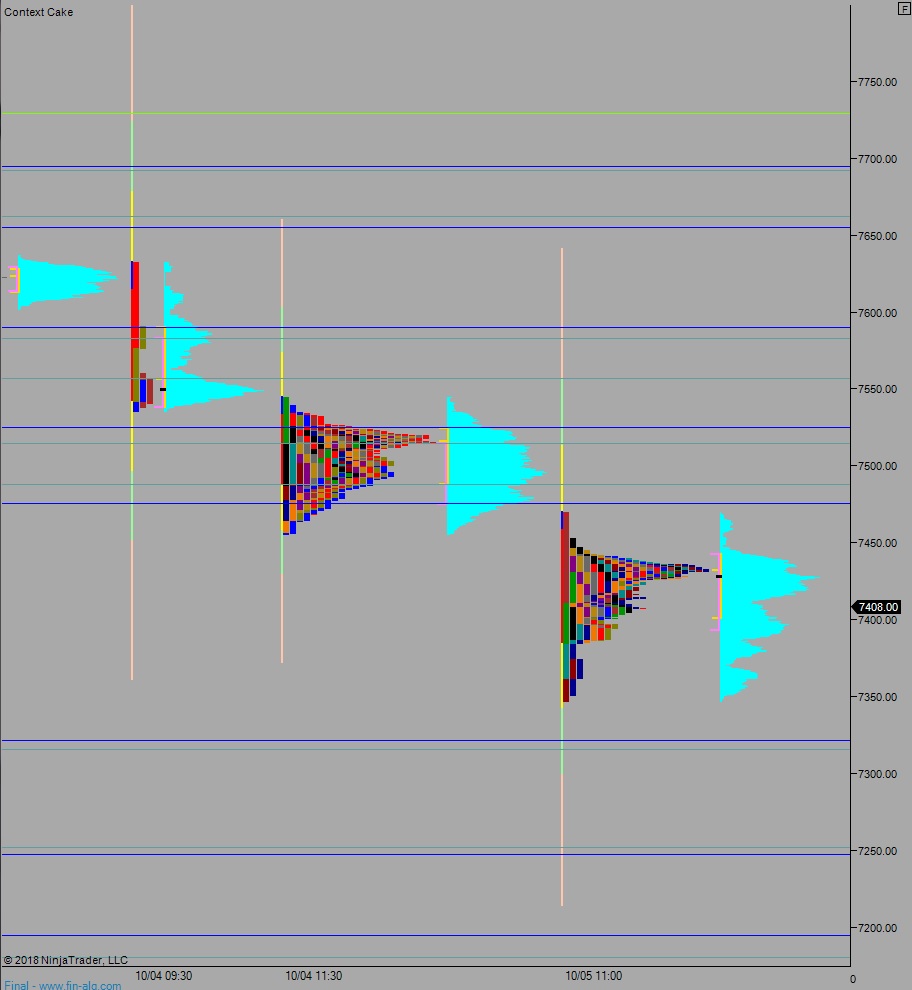

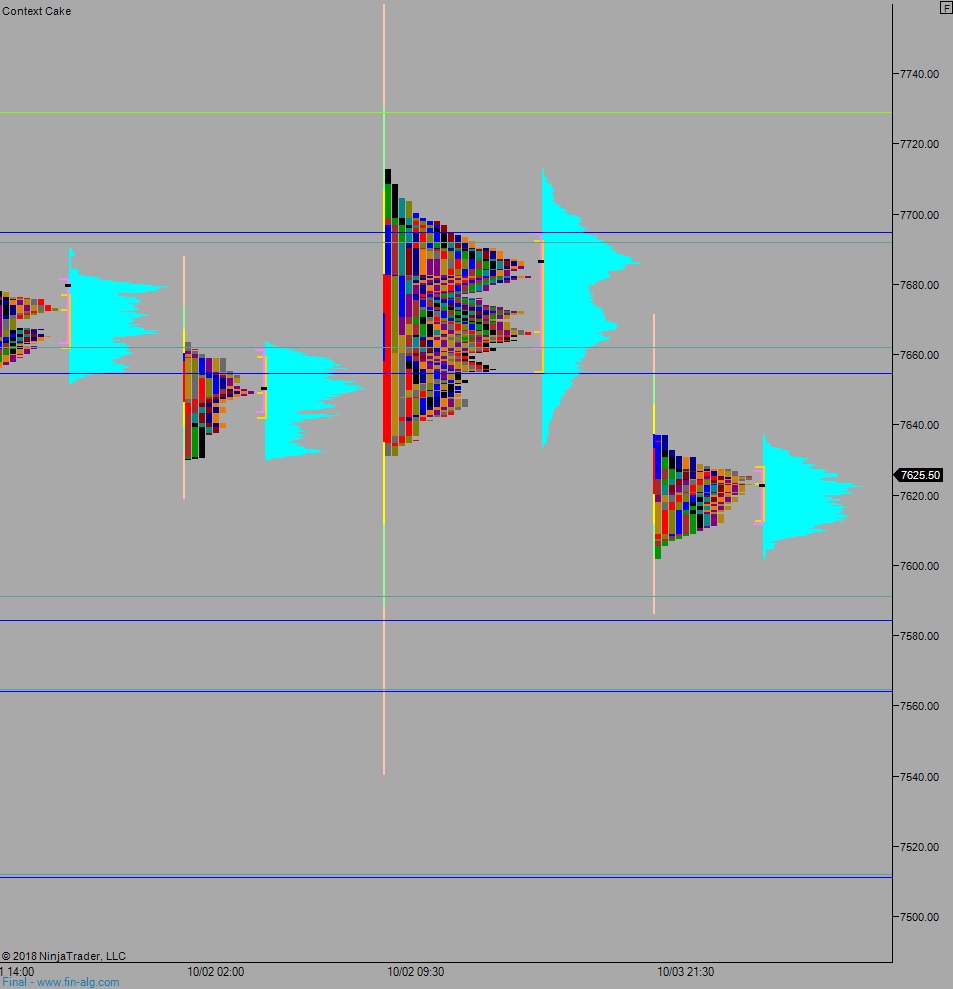

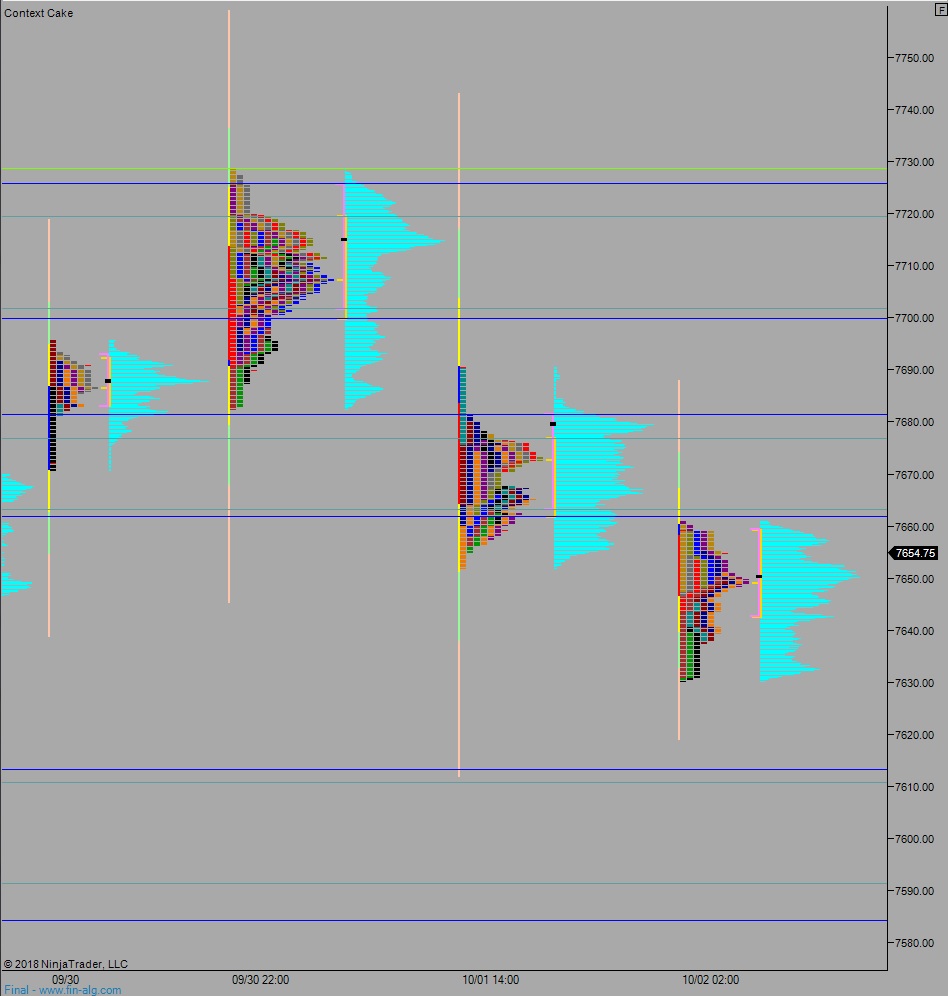

Yesterday we printed a normal variation down. The day began with a gap down and drive lower, with sellers pushing nearly to the Tuesday midpoint during the first hour of trade. Then, much like Tuesday, the market briefly went range extension down just after 10:30am before discovering a responsive bid. The rest of the session was spent working back up through the daily mid then chopping along it, eventually ramping higher near end-of-day but not pushing neutral extreme.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7313. From here we continue higher, up through overnight high 7317.50. Look for sellers up at 7348.25 and two way trade to ensue.

Hypo 2 stronger buyers trade us up to 7375.50 before two way trade ensues.

Hypo 3 sellers gap-and-go lower, trading up down through overnight low 7262.25. Look for buyers down at 7207 and two way trade to ensue.

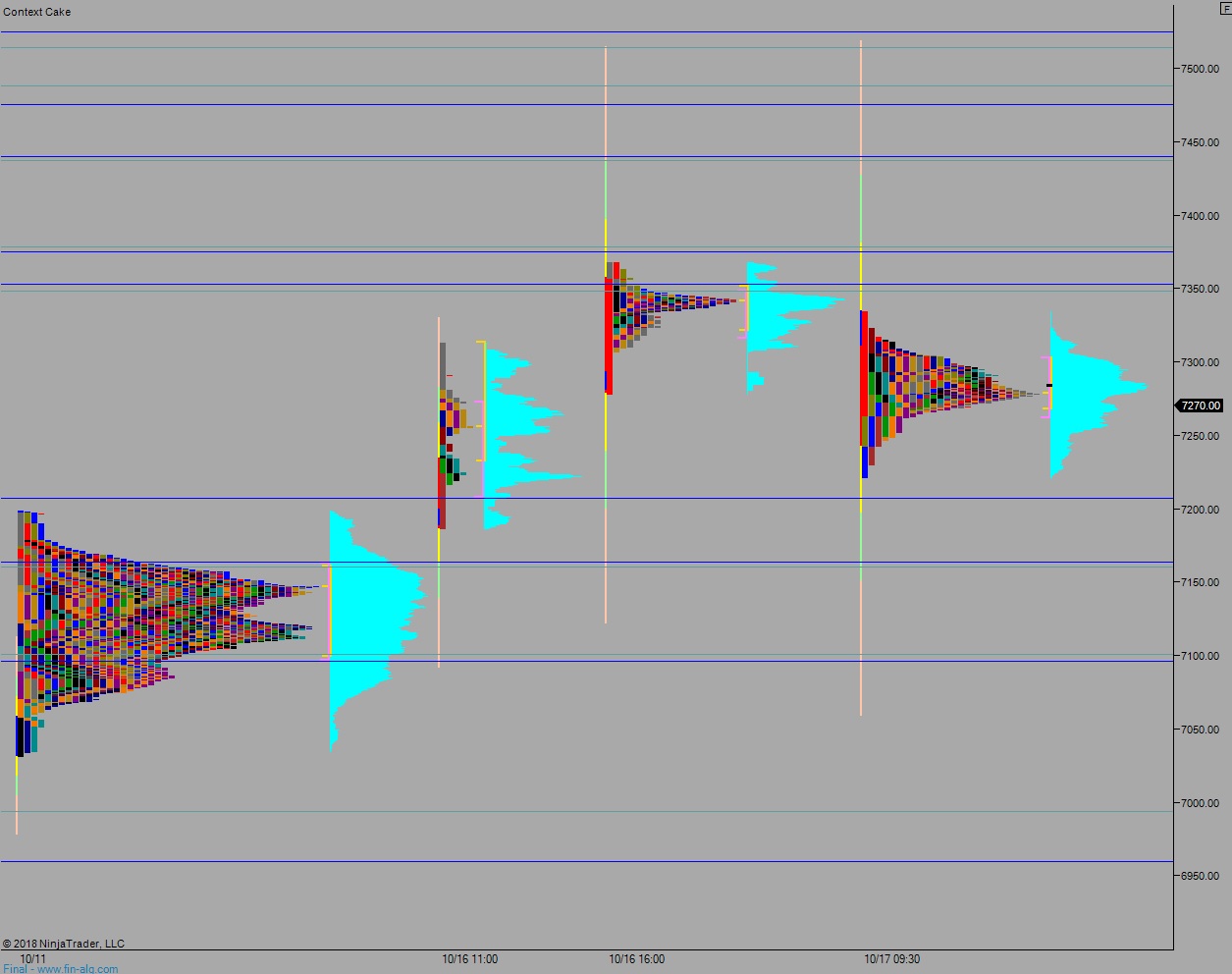

Levels:

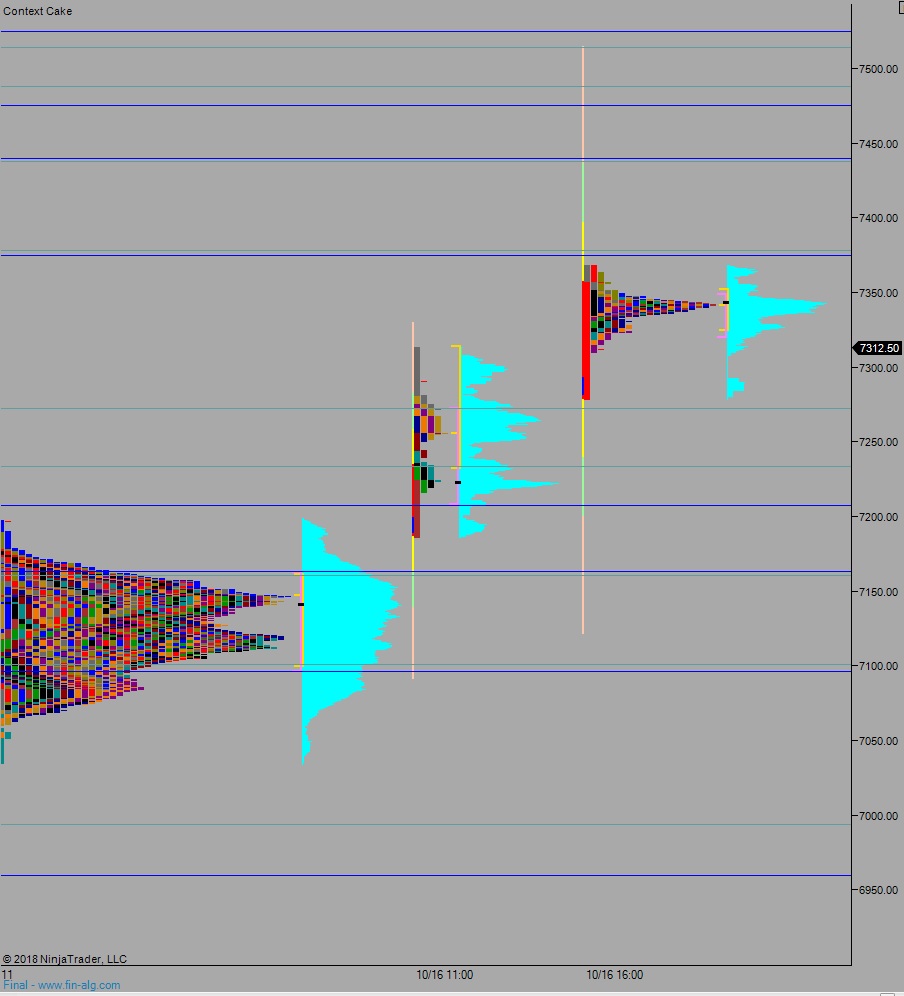

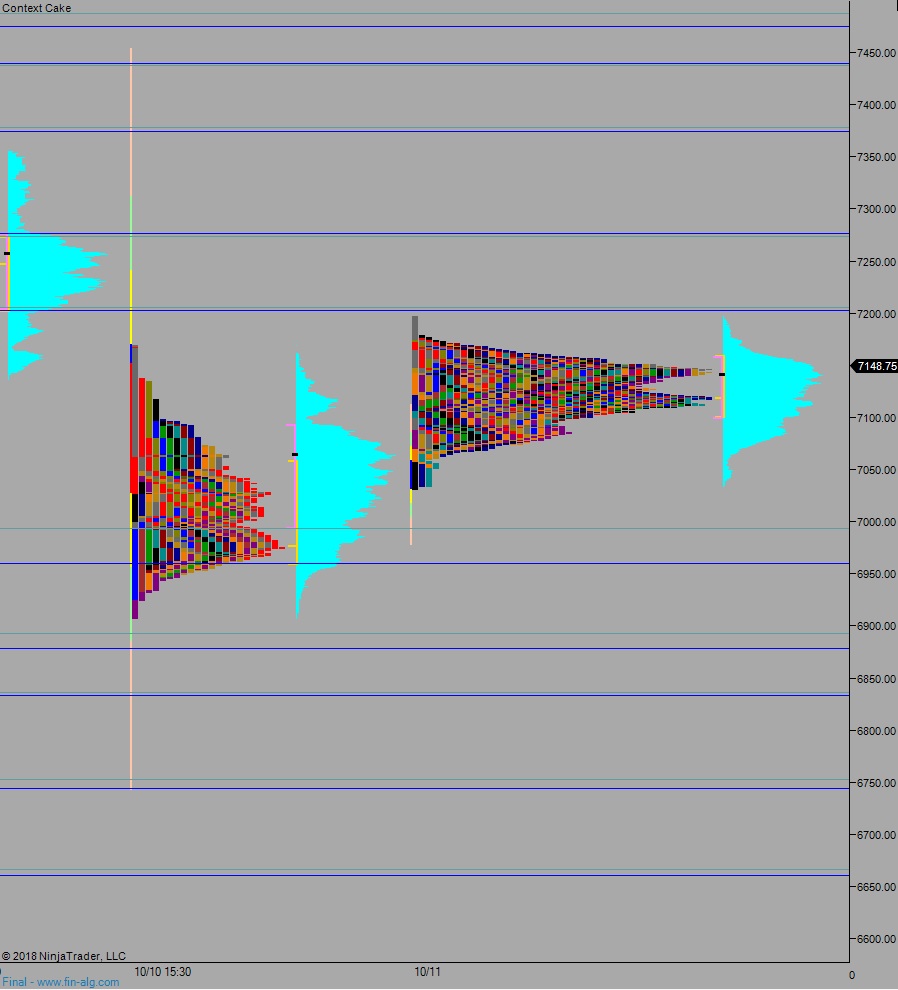

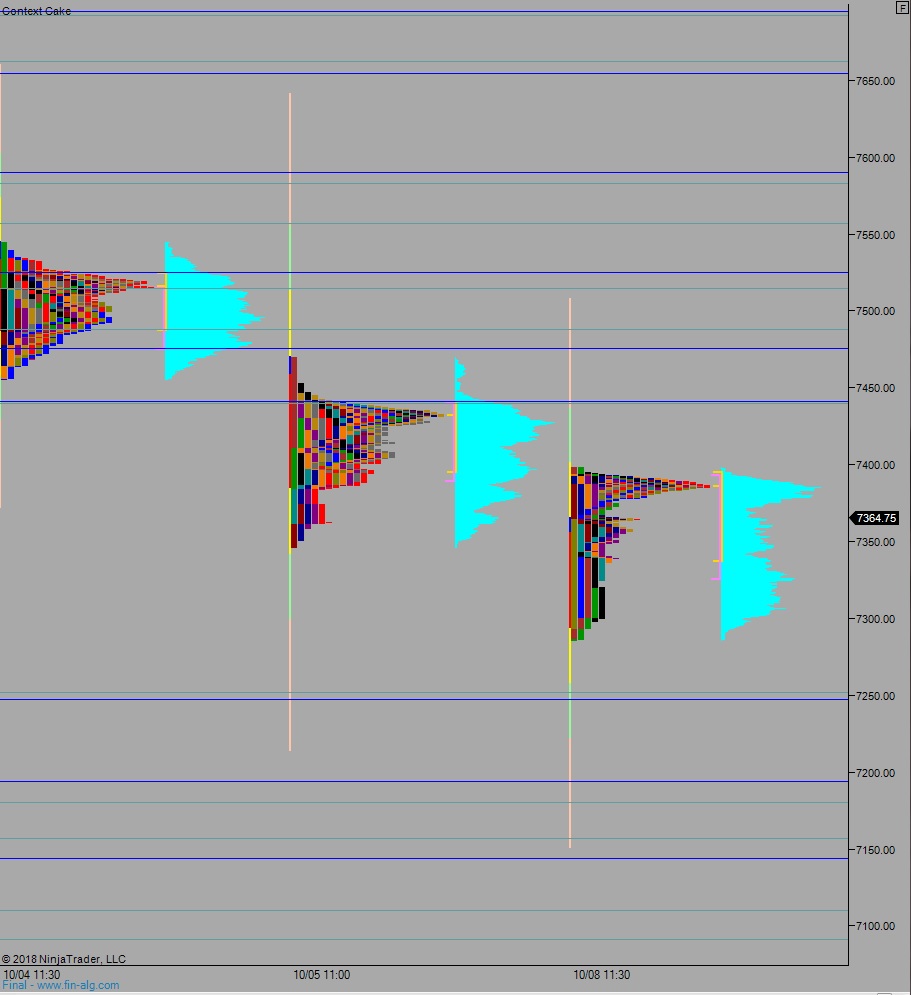

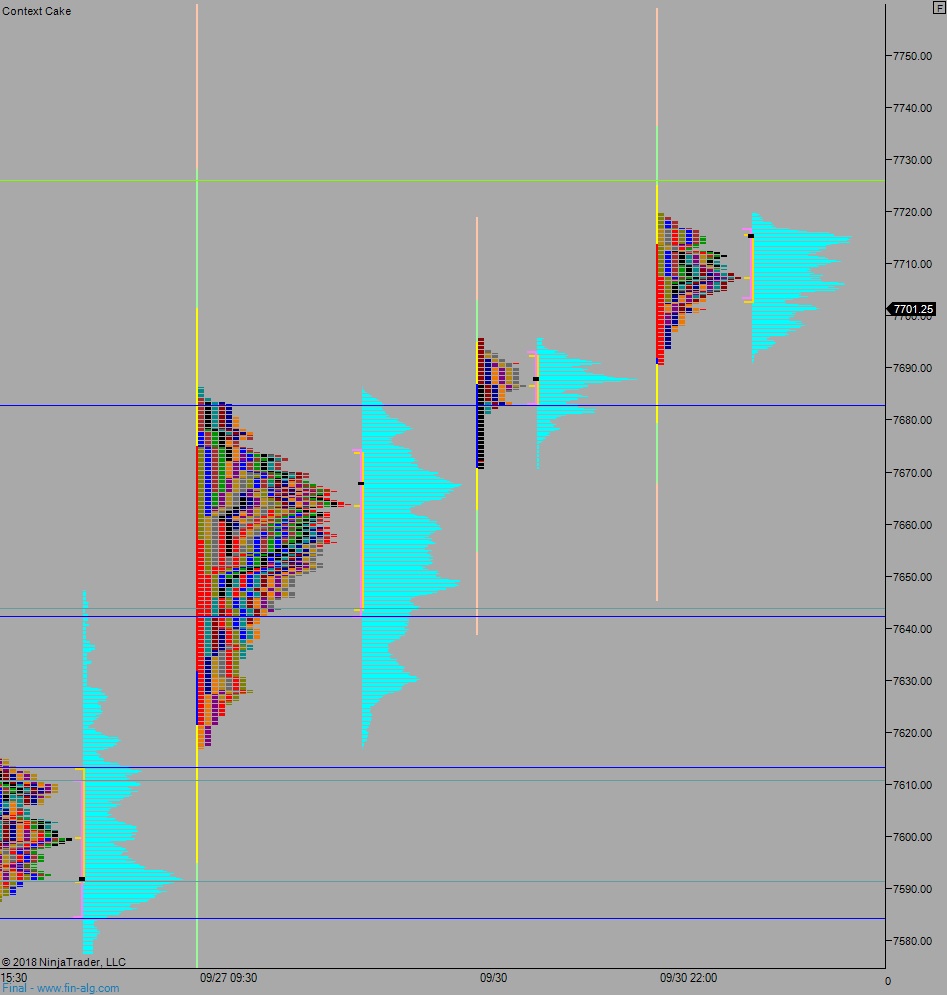

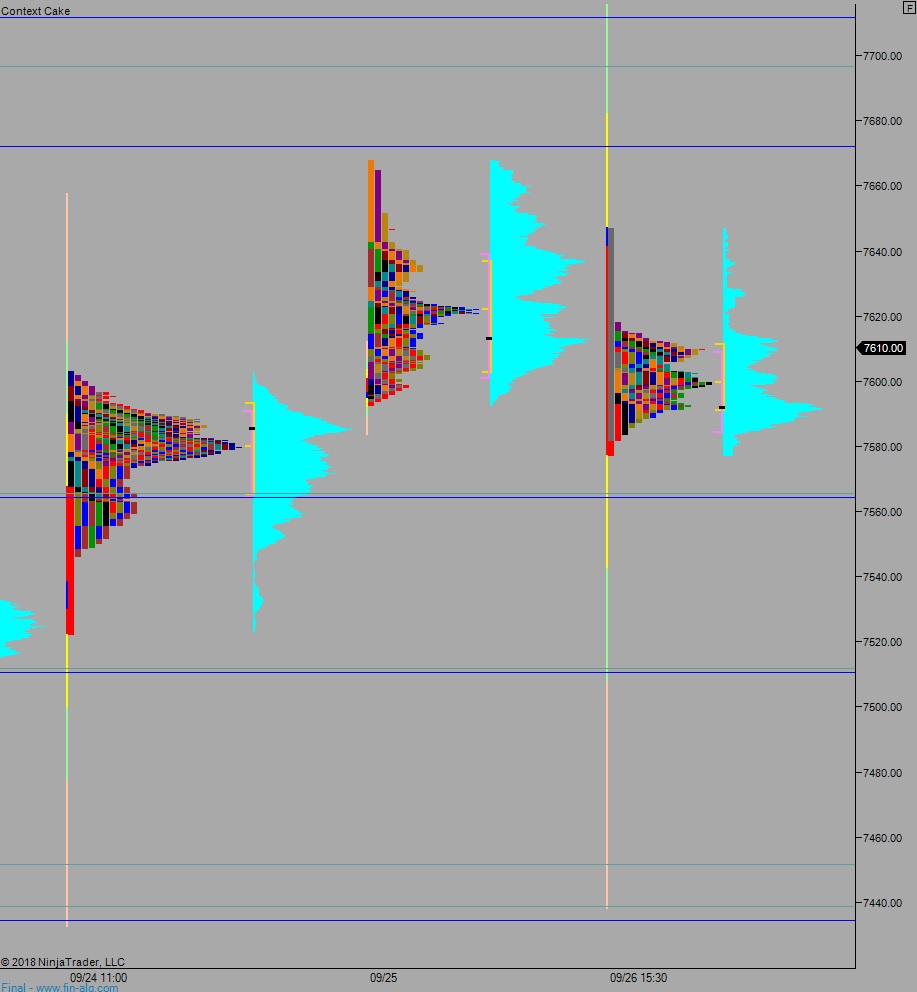

Volume profiles, gaps, and measured moves: