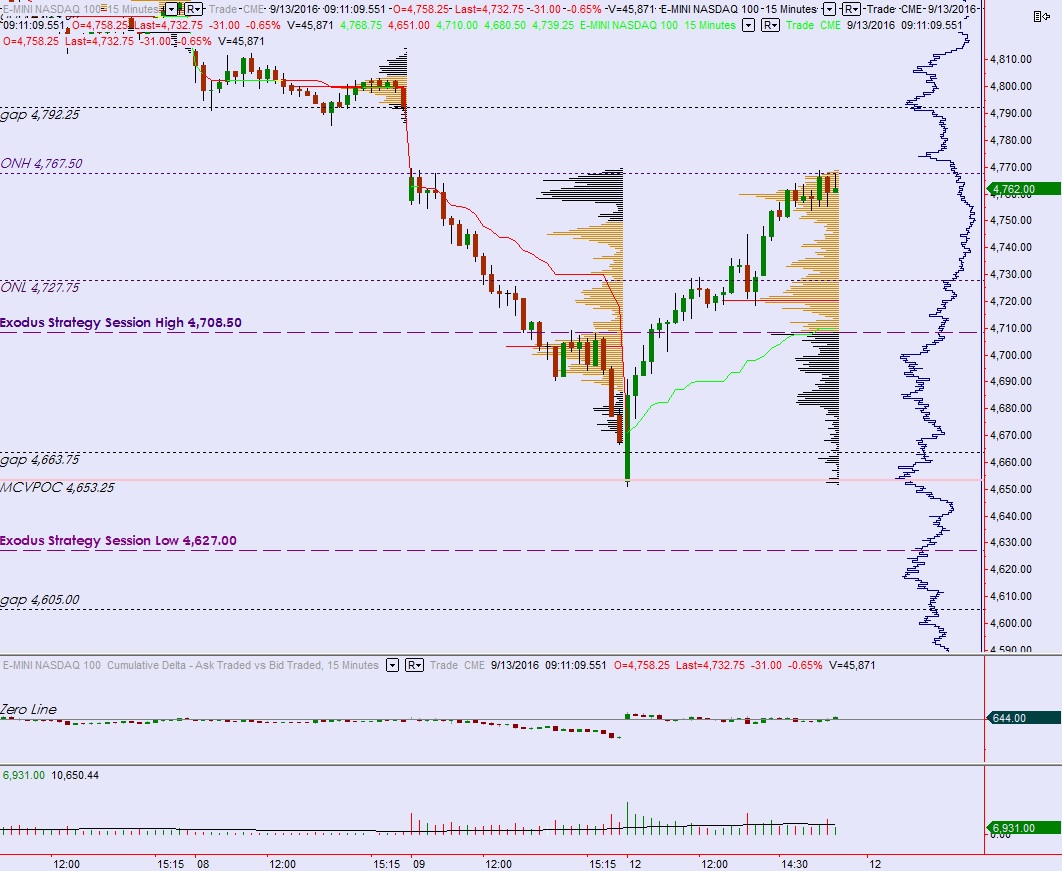

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring abnormal (2nd sigma) range and volume. Price worked lower overnight and erased the afternoon portion of yesterday’s trend day. Price also formed a weak low.

On the economic calendar today we have 4- and 52-week T-bills up for auction at 11:30am, a 30-year bond auction at 1pm, and the Monthly Budget Statement at 2pm.

Yesterday we printed a trend up. Price opened gap down to start the week, right on the MCVPOC from July at 4653.25. Buyers bought the dip and became initiative well before lunch. They continued initiating new risk for the resk of the session, ending the day up near the open print from last Friday’s trend down, effectively erasing Friday’s price action.

*Note – Friday was the 3rd biggest daily decline in the last 10 years.

Heading into today my primary expectation is for a push down through overnight low 4727.75 which opens the door for a test of 4702.25 before two way trade ensues.

Hypo 2 buyers press into overnight inventory, up to 4748 before finding responsive sellers who work back down to overnight low 4727.75. Look for buyers around 4713.75 and two way trade to ensue.

Hypo 3 buyers press up through all the overnight inventory to close the gap up to 4762 then set their sights on overnight high 4767.50. This sets up a continued move higher to 4792.25 before two way trade ensues.

Hypo 4 hard liquidation. Sellers sustain trade below 4700 setting up a move to test down to 4640.75 before two way trade ensues.

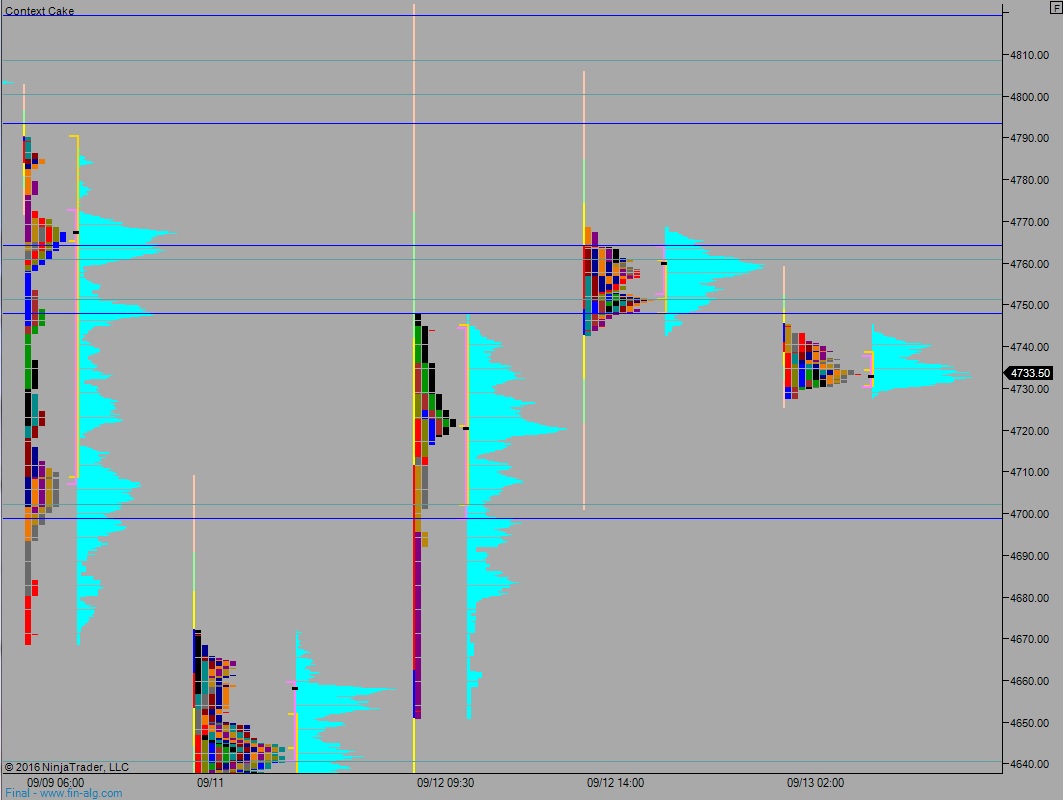

Levels:

Volume profiles, gaps, and measured moves: