NASDAQ futures are coming into option expiration week gap down after an overnight session featuring extreme volume on an elevated range. Price worked lower Sunday night, working into the 07/20 range and below this week’s ATR band before finding a strong responsive bid. Since then the market has rallied about 30 points.

There are several Federal Reserve members speaking today, but everyone seems most concerned about Brainard talking economic outlook in Chicago at 1:15pm. Also on the docket today we have several bond auctions; at 11:30am both 3- and 6-month T-bills will be auctions, and the 3- and 10-year Note auctions are set for 1pm.

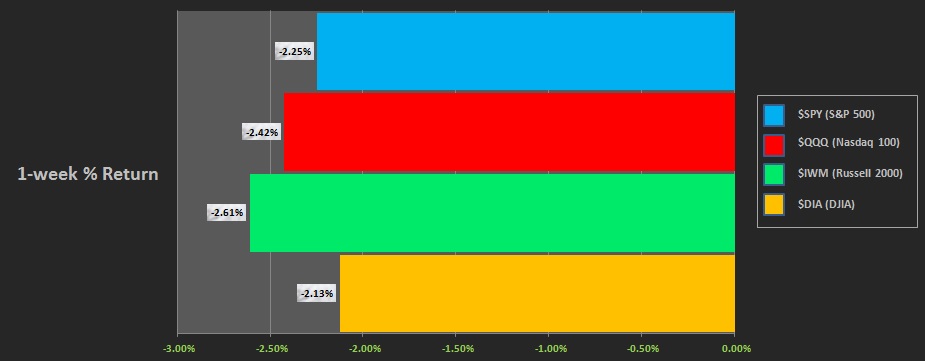

Last week was a holiday shortened week. On Monday the markets were closed in observation of Labor Day. The week began with a day-and-a-half of buying followed by a reversal just after making new highs. Thursday saw a gap down that never filled. Then Friday a gap down morphed into a trend day down.

Here’s the performance of each major index last week:

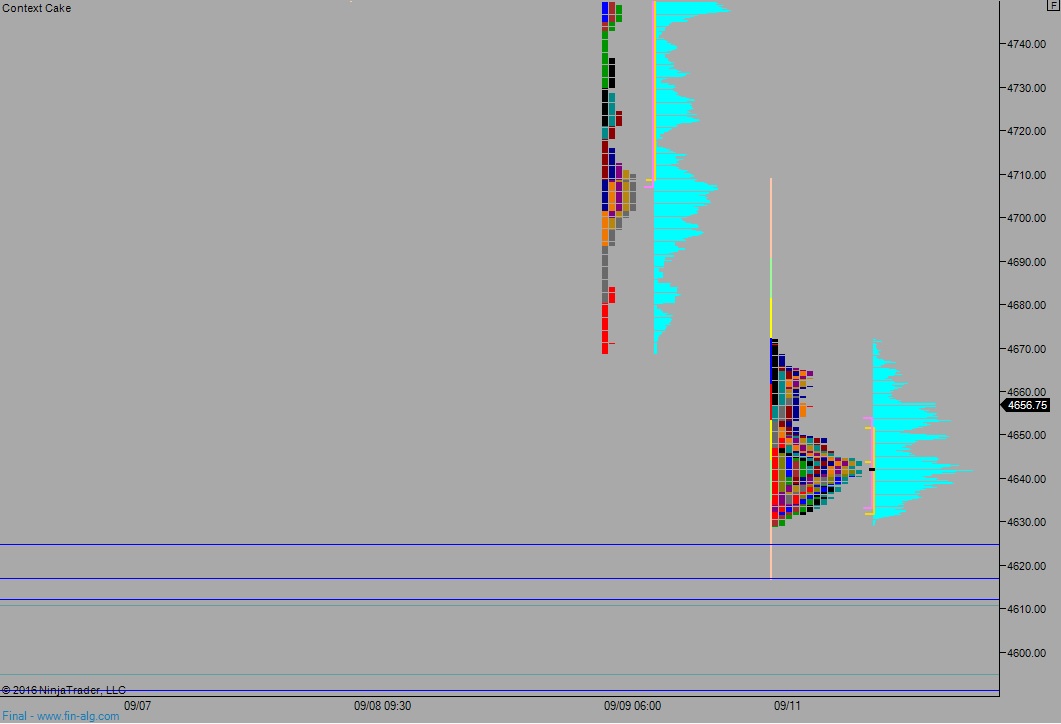

Heading into today my primary expectation is for buyers to push into the overnight inventory and attempt to reclaim Friday’s range. Look for sellers around 4685 who push the market down and out of Friday’s range, back down to the MCVPOC around 4653.25 before two way trade ensues.

Hypo 2 buyers reclaim Friday’s range and sustain trade above 4685 setting up a move to target 4708.50 before two way trade ensues.

Hypo 3 sellers push hard off the open and work back down to overnight low 4625.25 and continue lower to target the open gap down at 4605.

Levels:

Volume profiles, gaps, and measured moves:

what a rip rally we have here