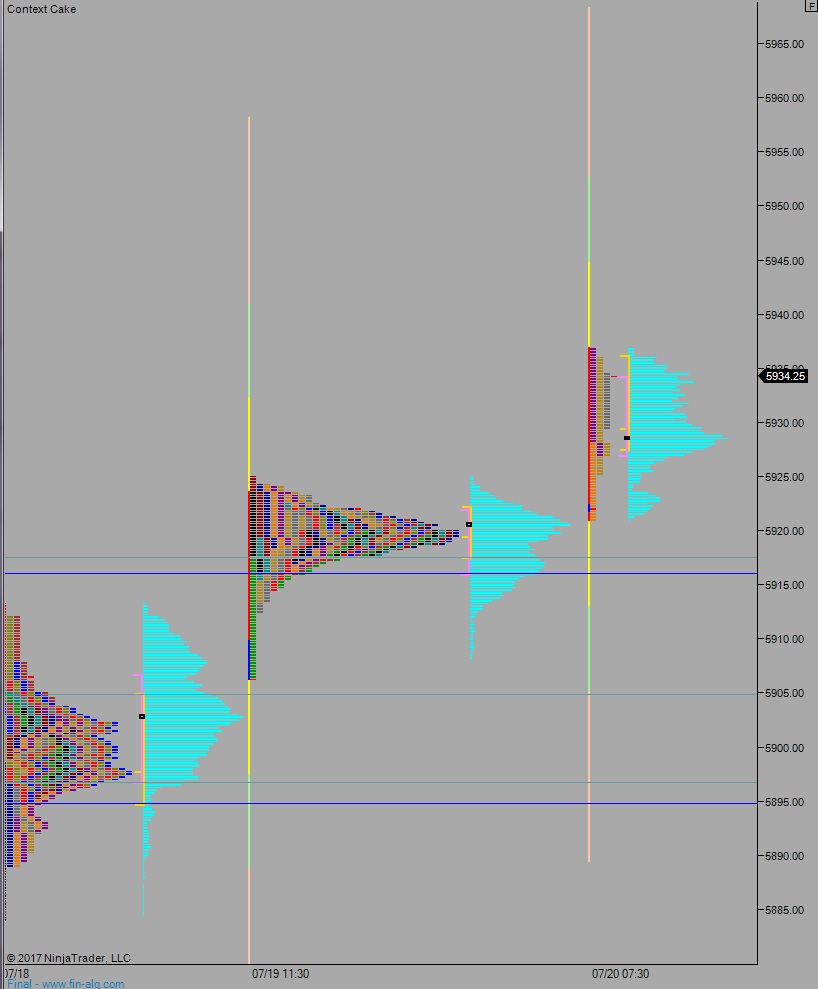

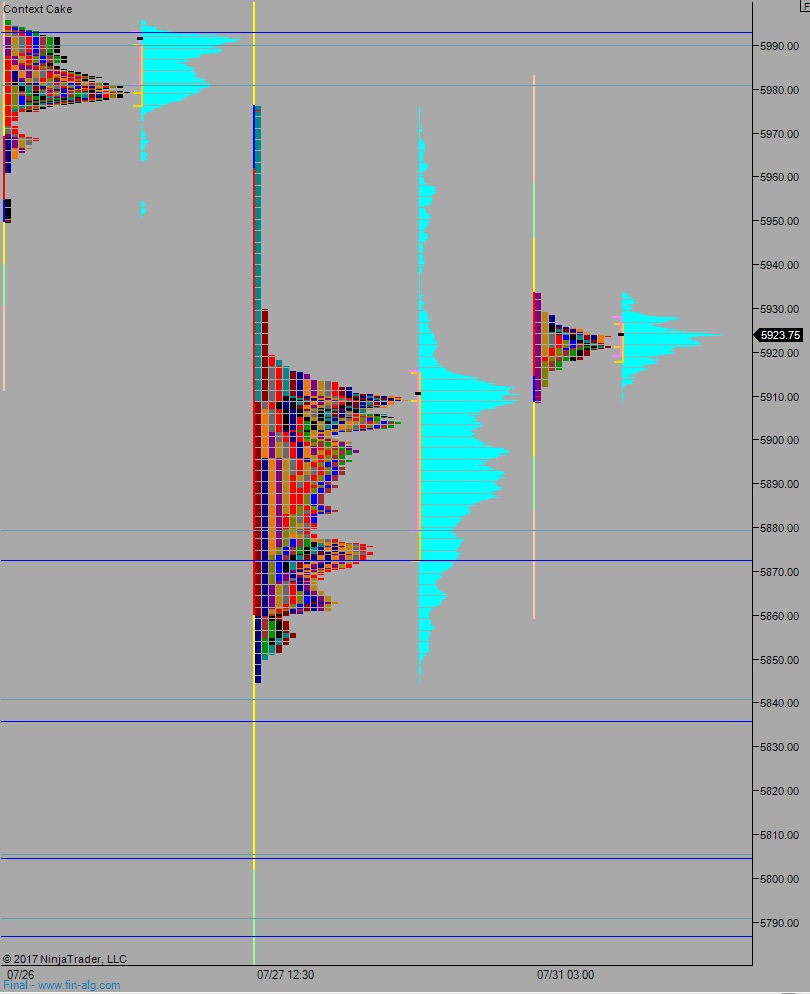

NASDAQ futures are coming into Monday gap up after an overnight session featuring normal range and volume. Price worked higher until about 3am New York time. Then we balanced out just above last Friday’s range.

The economic calendar is hot this week but it starts off slowly. Despacito. At 9:45am Chicago Purchasing Manager, 10am Pending Home Sales, and at 11:30am both a 3- and 6-month T-bill auction.

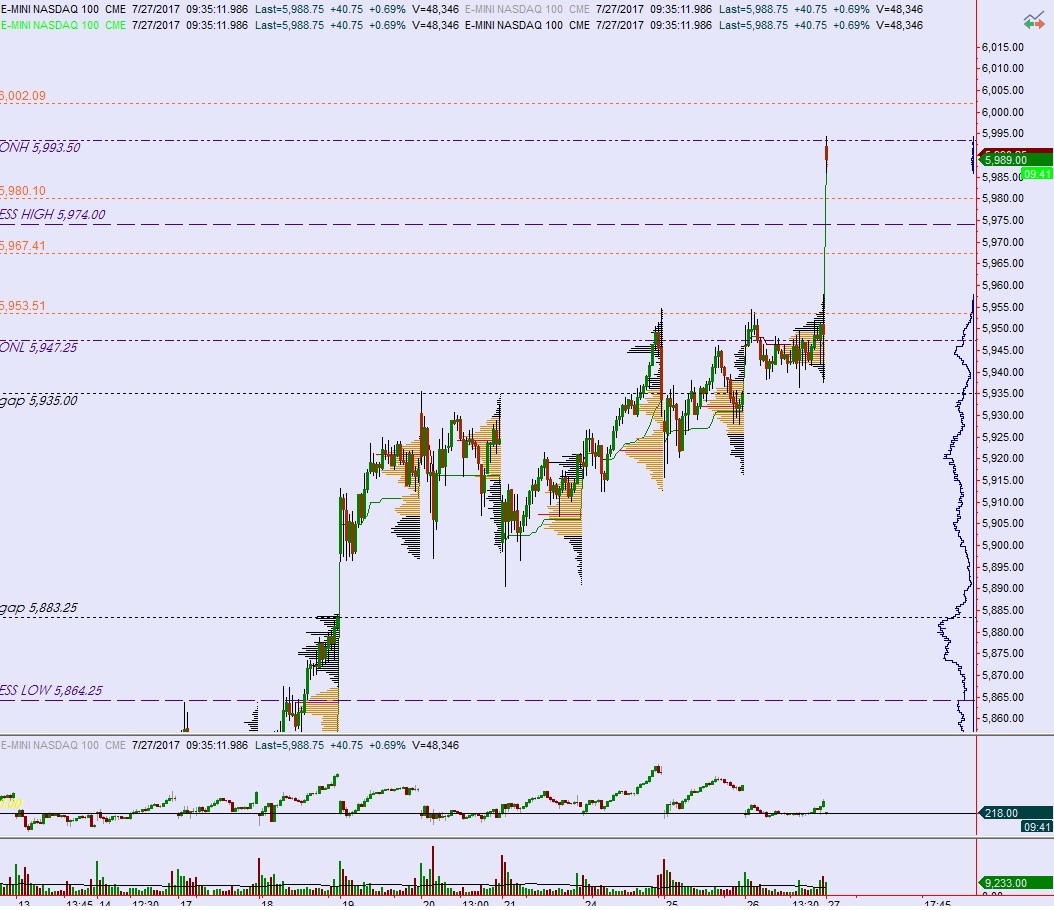

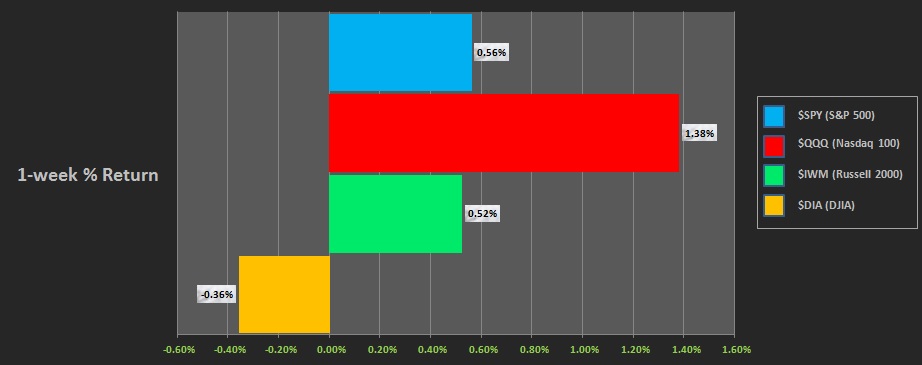

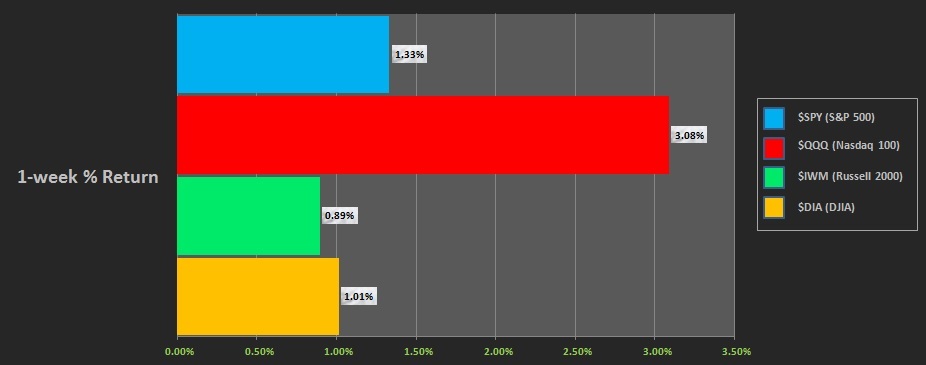

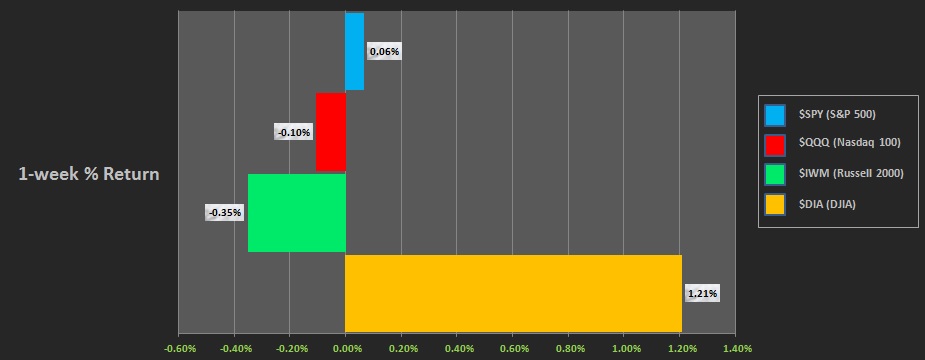

Last week we drifted higher through Thursday morning. The Dow was trend up all week. The Russell was under pressure. The NASDAQ and S&P made hard moves lower Thursday afternoon then stabilized into the weekend. The last week performance of each major index is shown below:

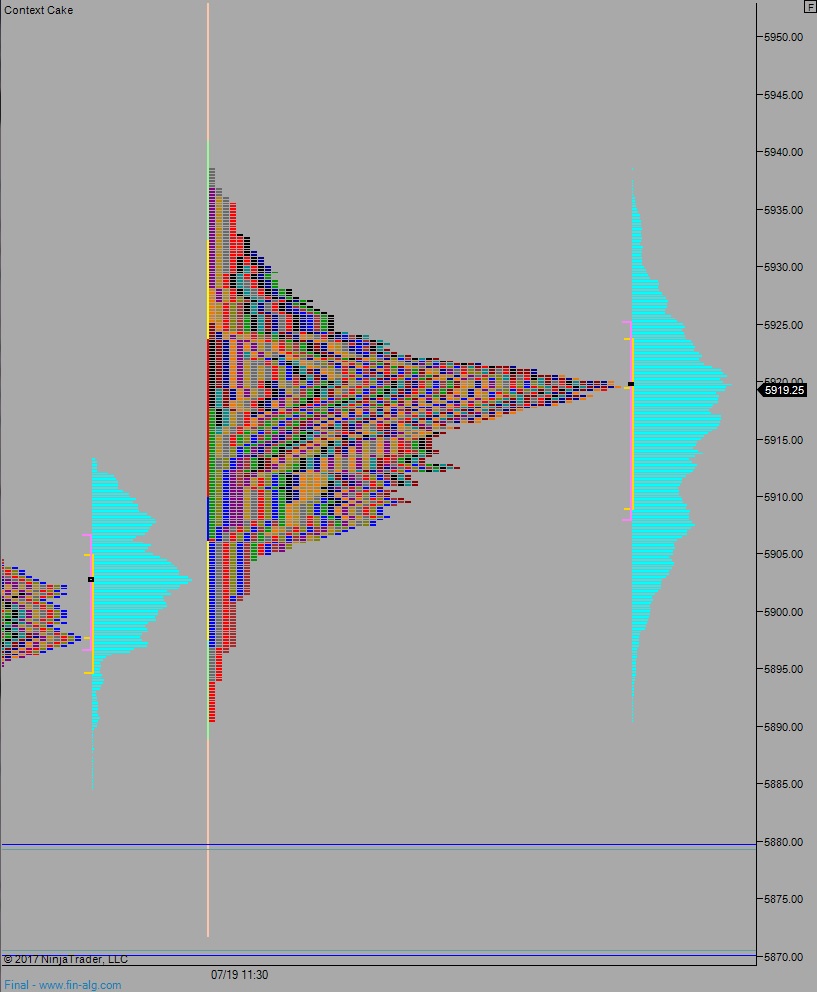

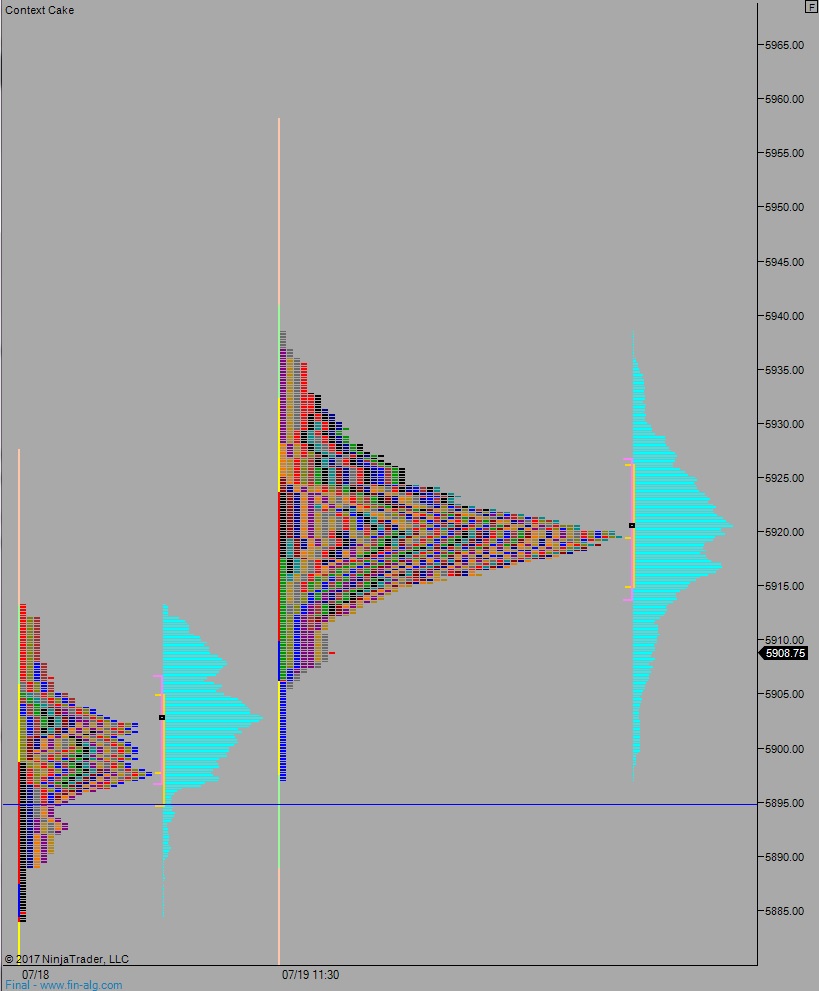

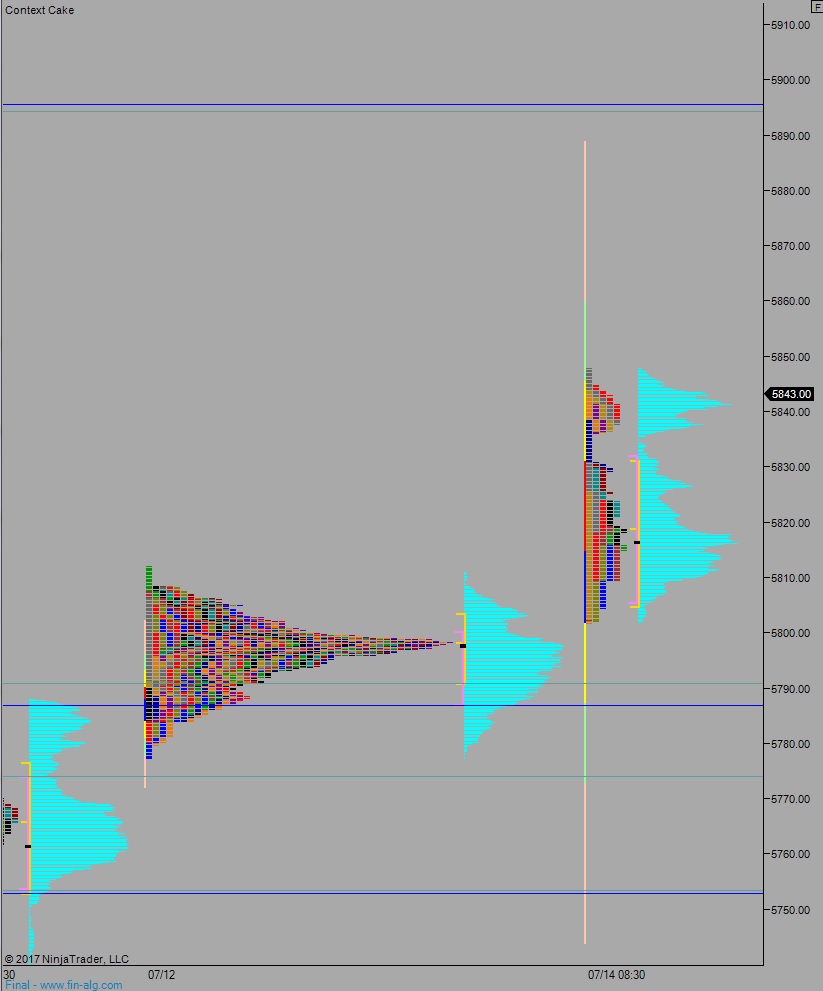

Last Friday the NASDAQ printed a normal variation up. Price opened gap down but inside the Thursday range. Then we spent the rest of the day slowly working higher, slowly working the gap fill.

Heading into today my primary expectation is for sellers to press into the overnight inventory and close the gap down to 5911.75. From here we continue lower, down through overnight low 5897.25. Look for buyers down at 5879.50 and two way trade to ensue.

Hypo 2 buyers press up through overnight high 5933.50 triggering a quick rally up to 5962.75 before two way trade ensues.

Hypo 3 strong sellers press down through 5872.50 and sustain trade below it, setting up a move to test last Thursday’s low 5844.75. Look for buyers down at 5841 and two way trade to ensue.

Levels:

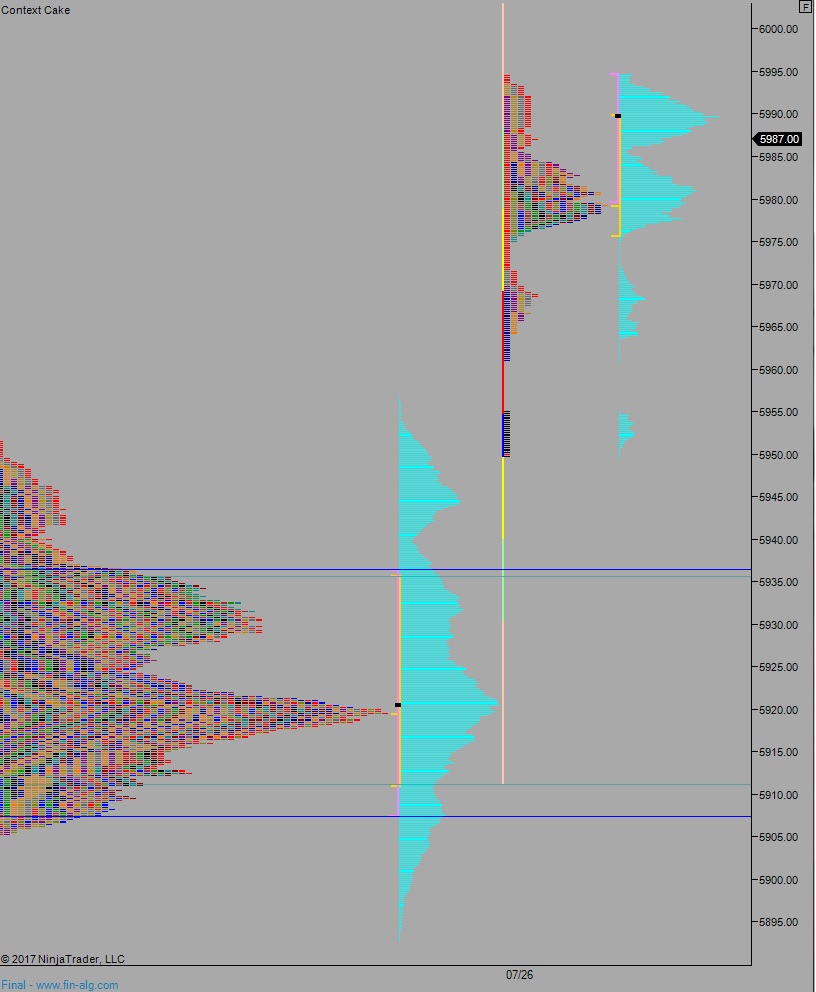

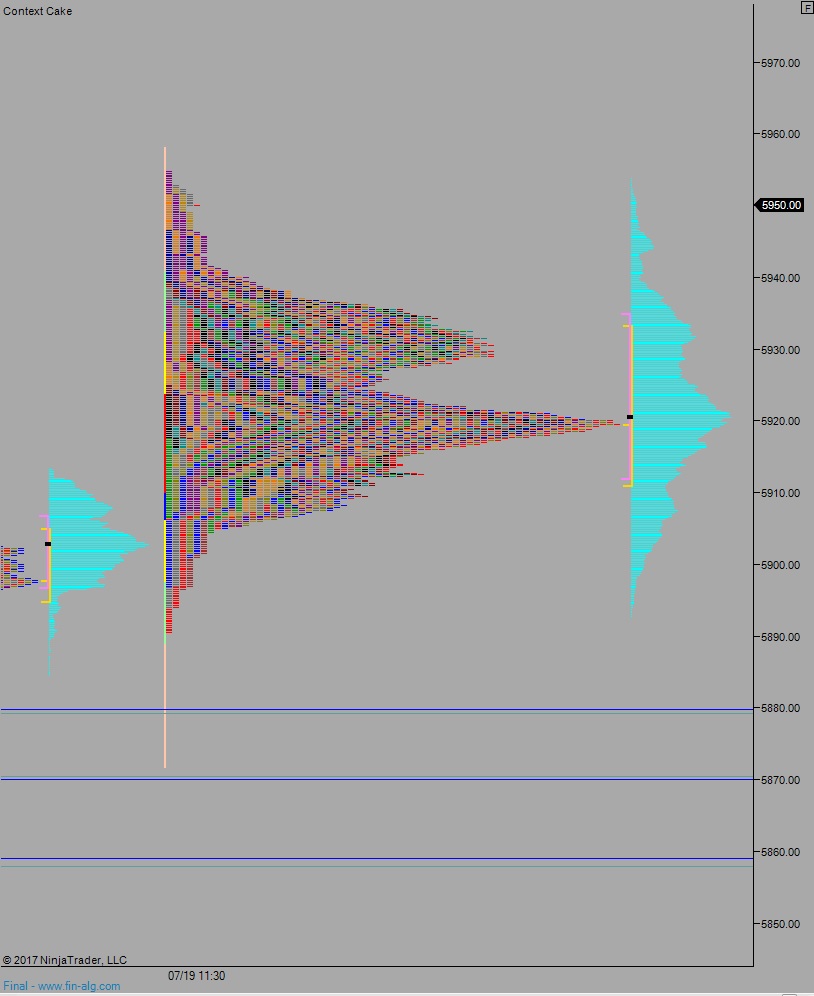

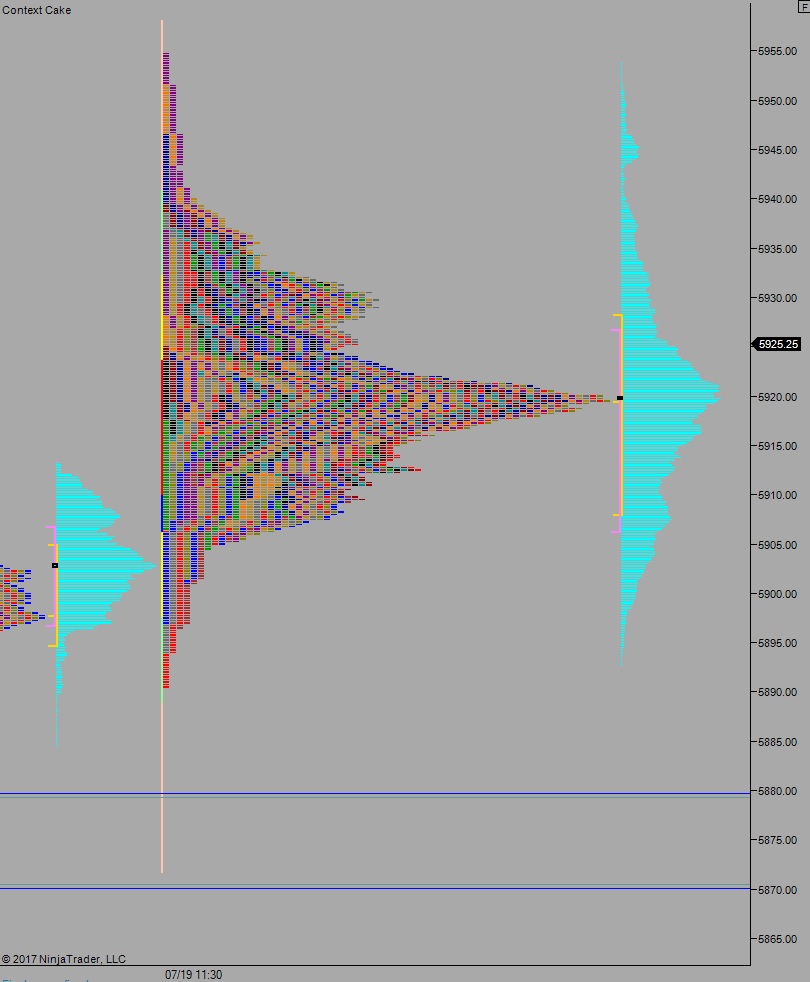

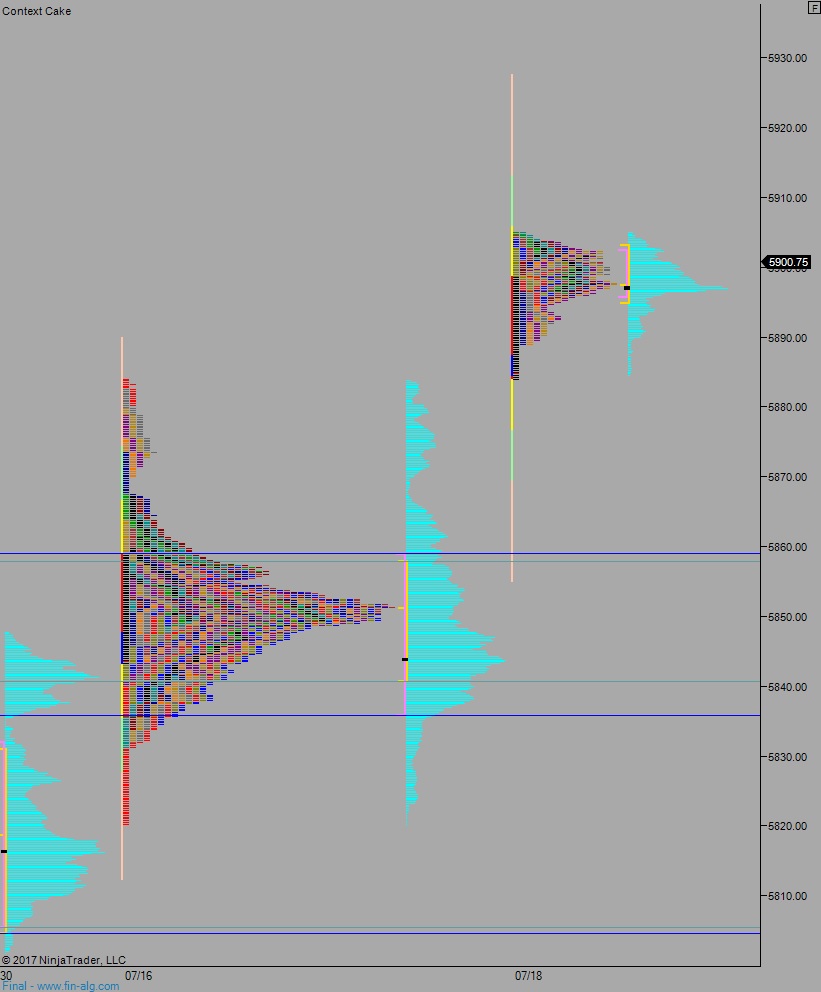

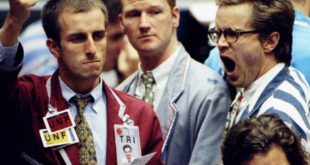

Volume profiles, gaps, and measured moves: