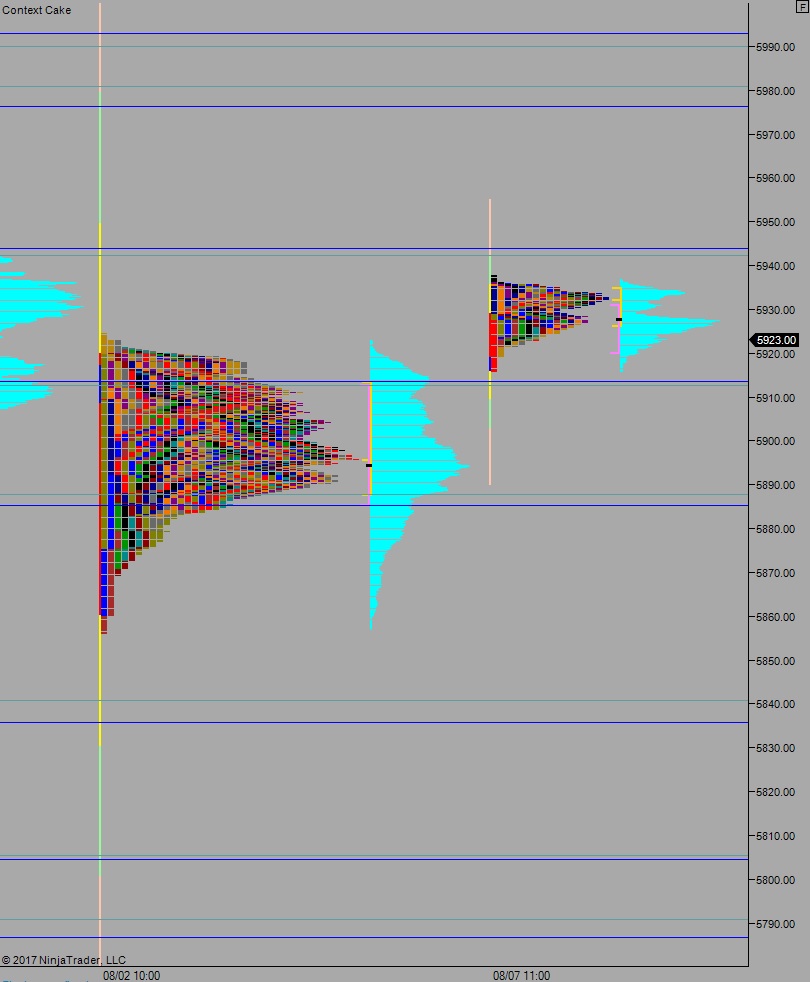

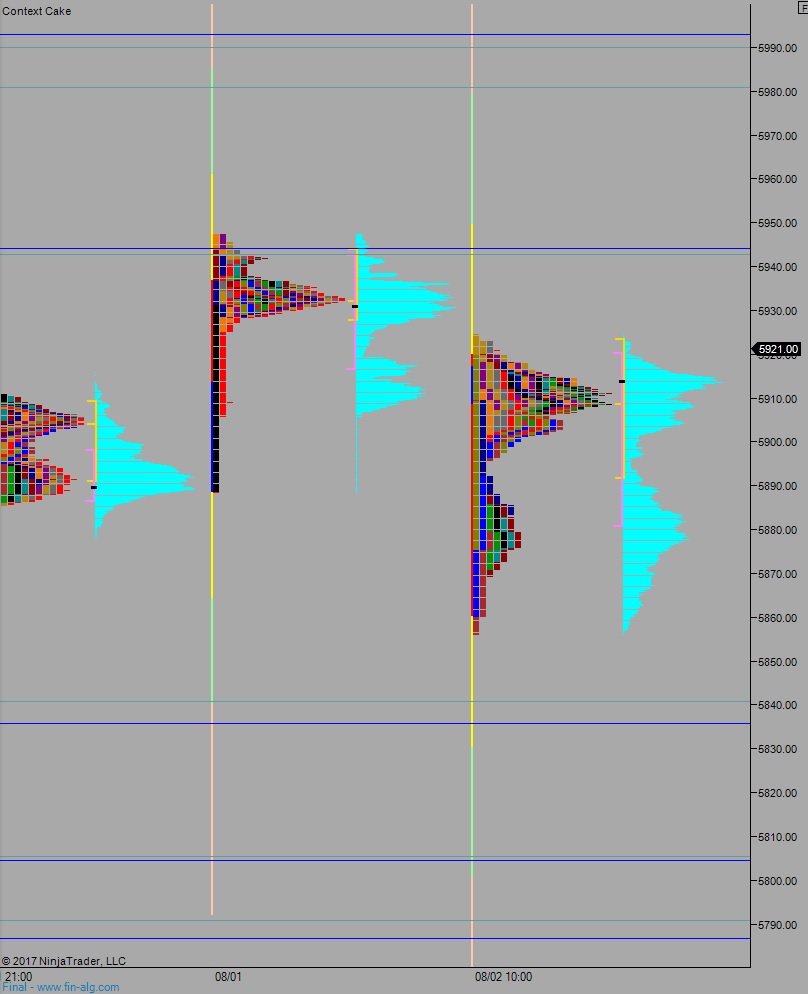

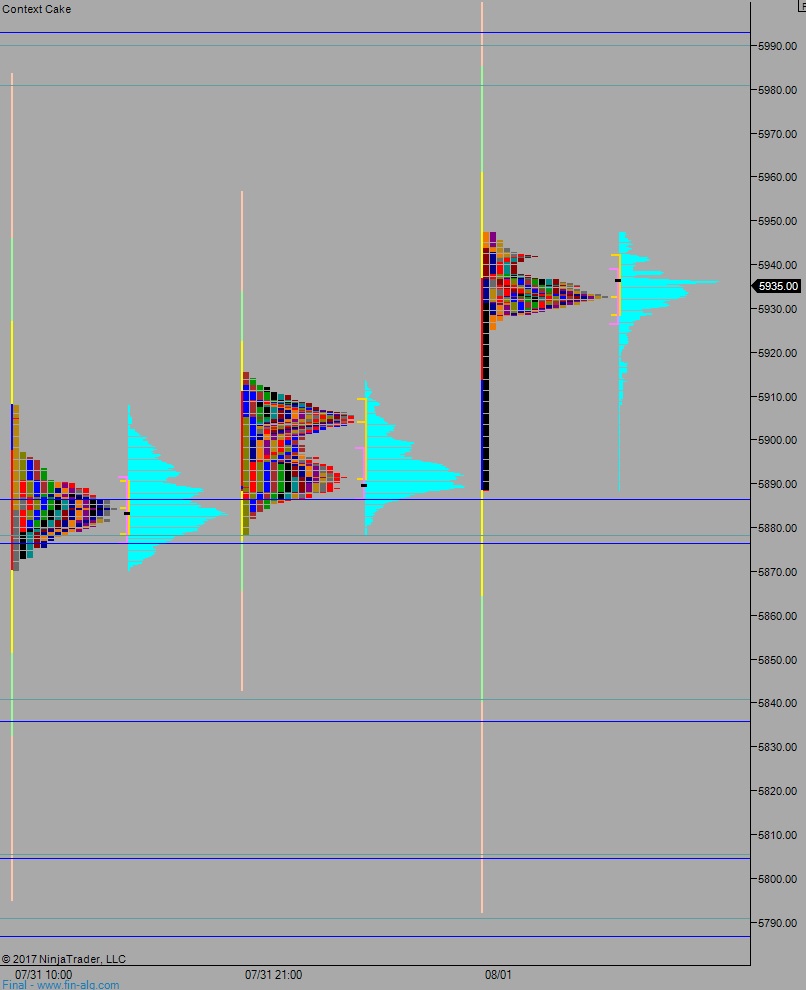

NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range on normal volume. Price worked higher overnight, eventually coming into balance inside last Wednesday’s range.

The economic calendar starts off slow this week. We only have a 3- and 6-mont T-bill auction to monitor at 11:30am.

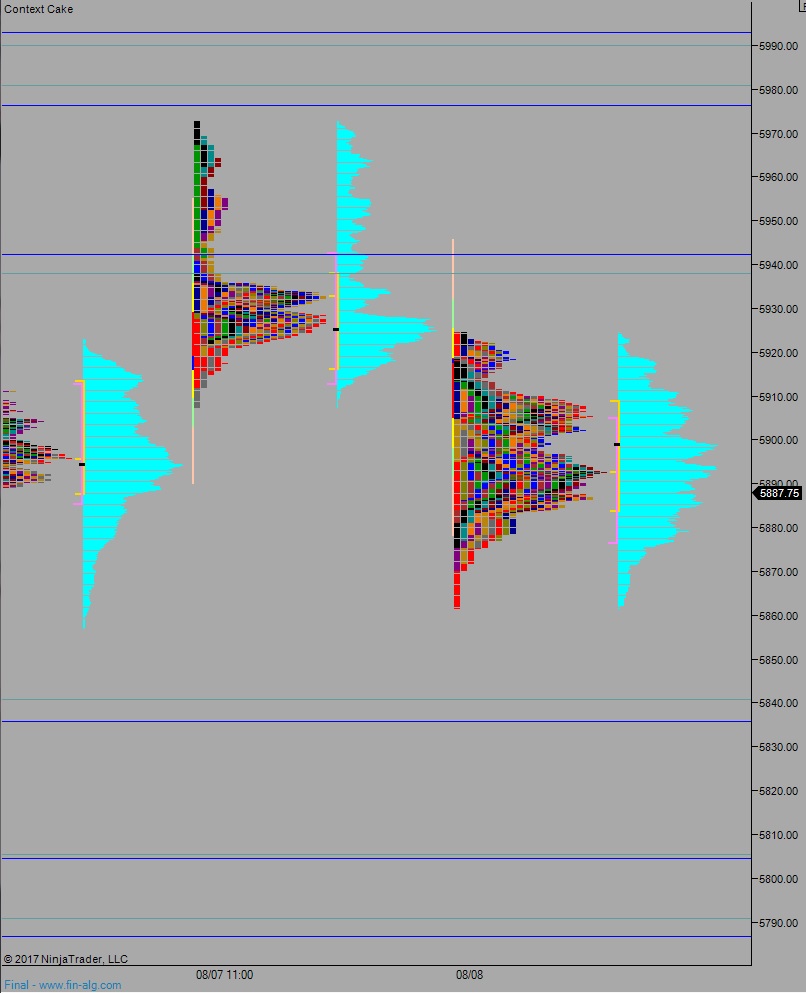

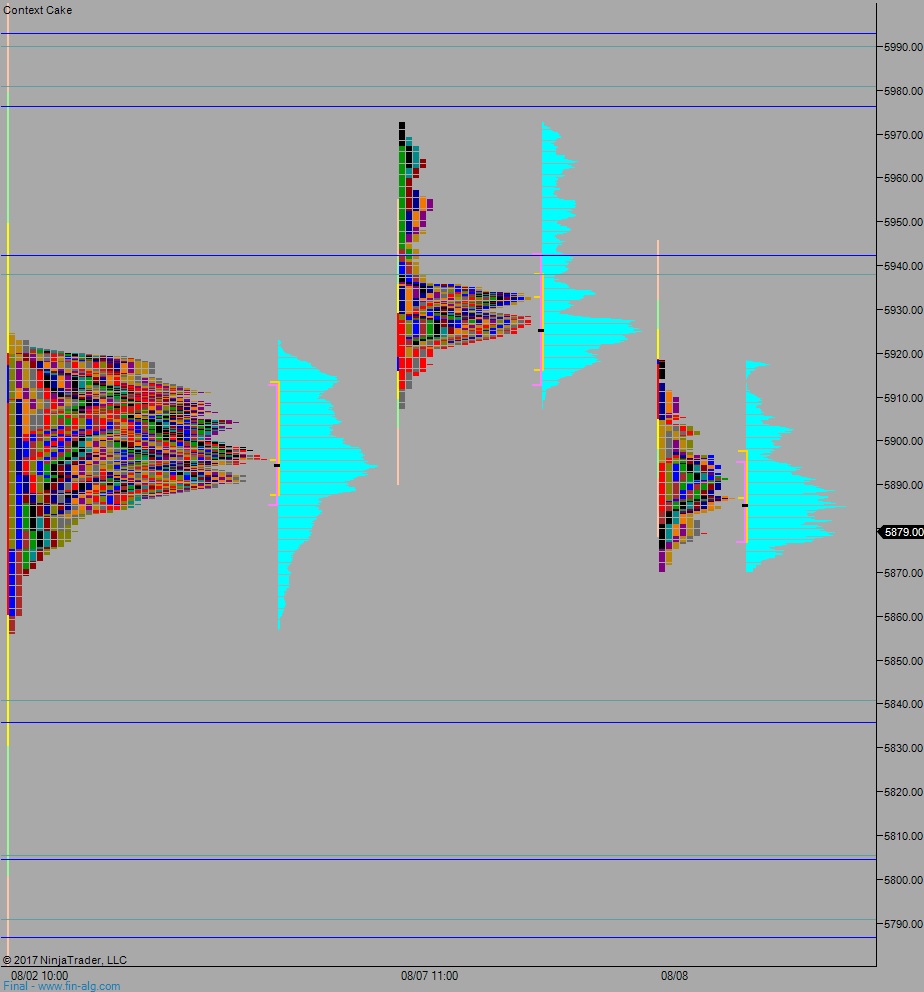

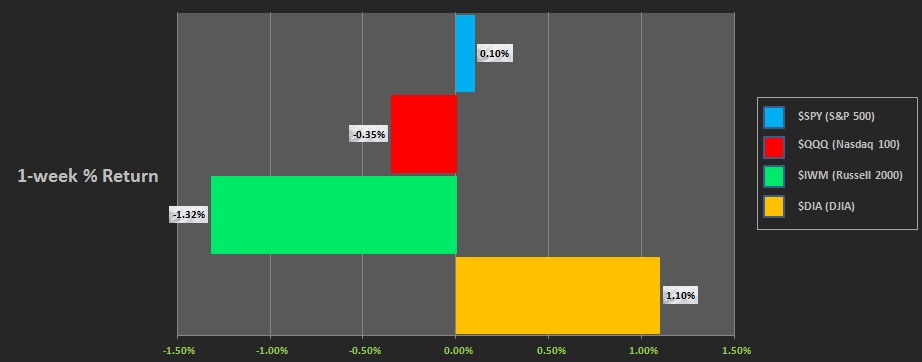

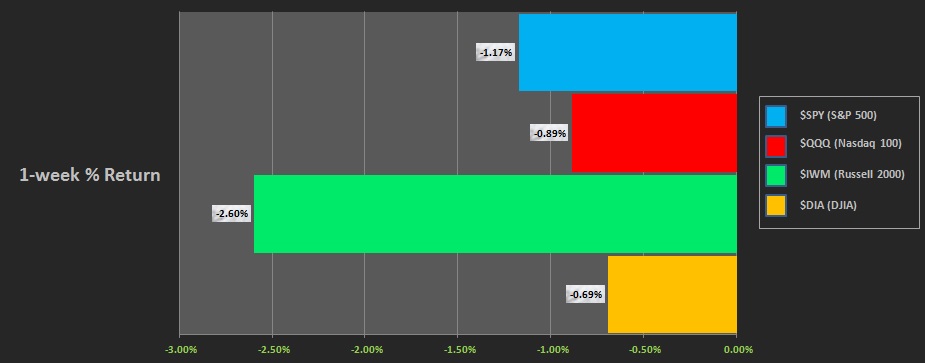

Last week began with a gap higher and one-and-a-half day rally. Then, after a sharp reversal Tuesday afternoon, there was a big gap down Wednesday. But buyers bought it up all day. Then Thursday was gap down again, and this time a trend down printed. However, much of the progress made by sellers on Thursday was retraced Friday. Below, the last week performance of each major index is shown:

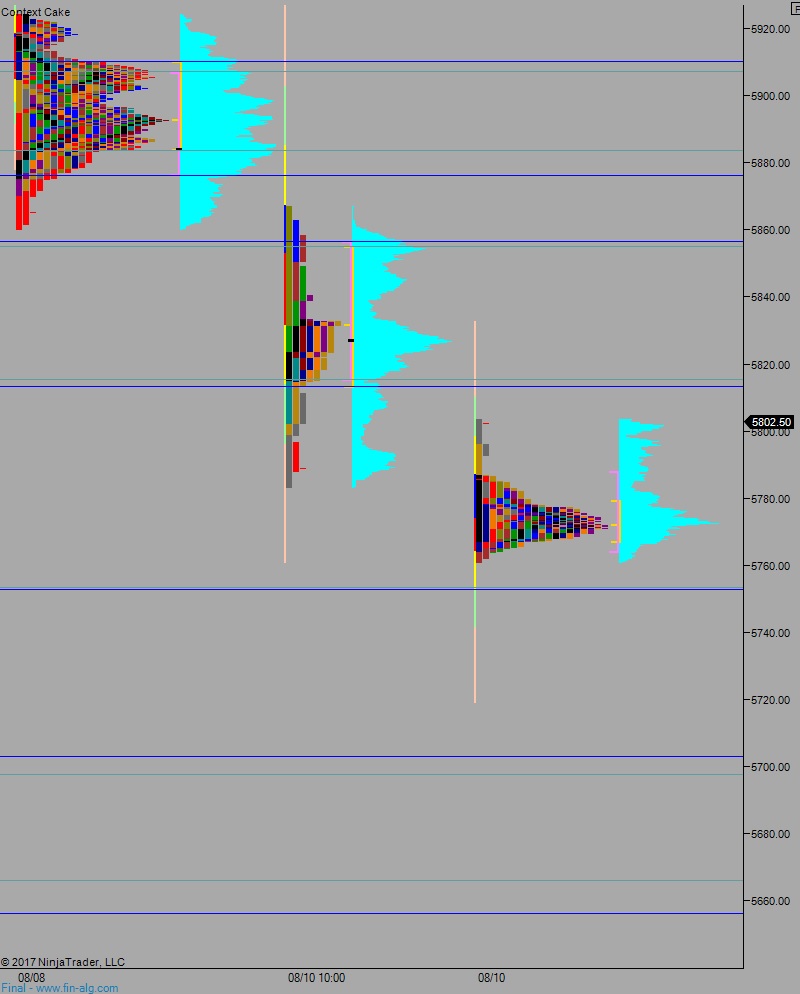

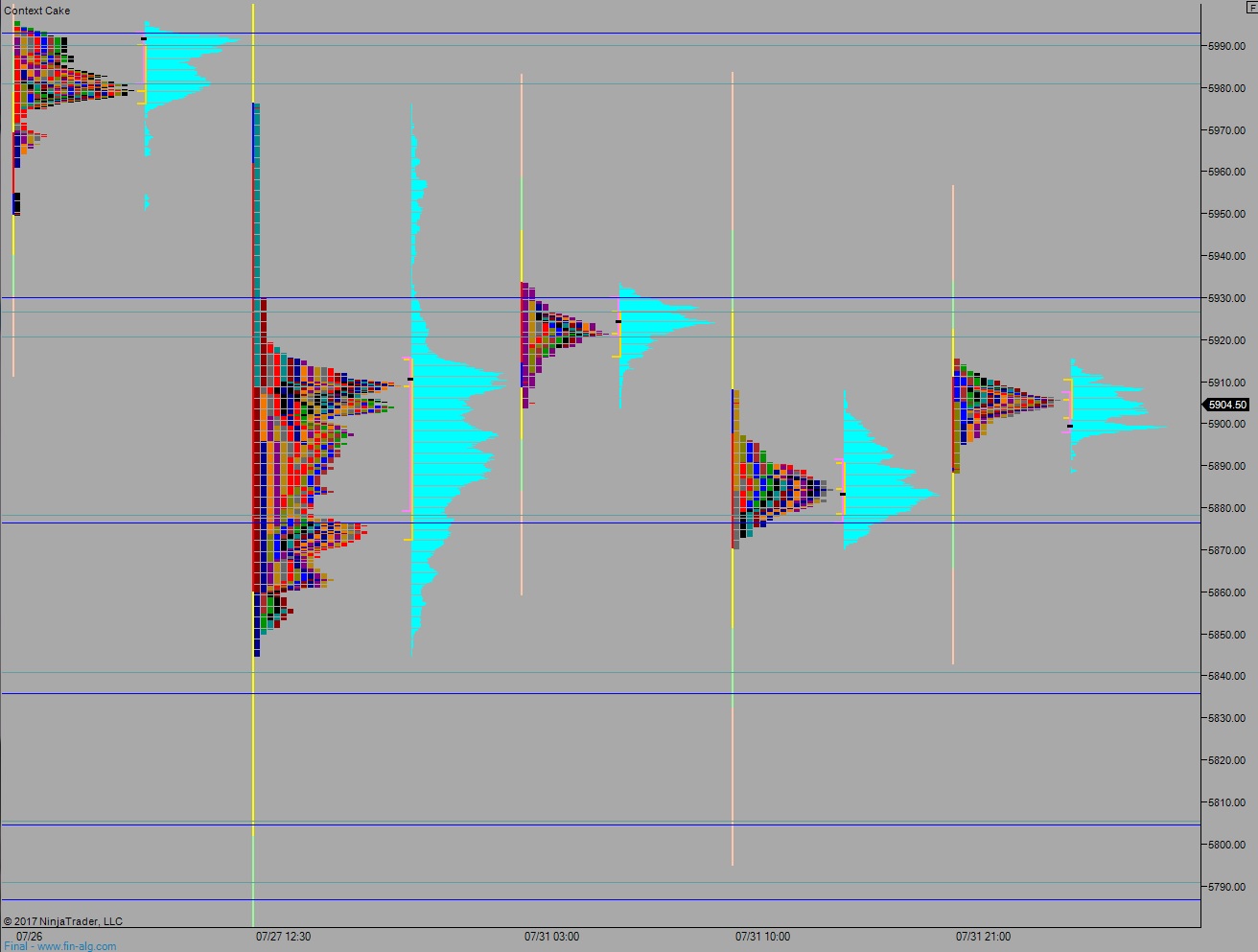

On Friday, the NASDAQ printed a double distribution trend up. When an early drive lower failed to take out the Thursday low, instead sharply reversing one tick ahead of the low, buyers reacted and stepped in. Then, in the afternoon they became initiative, eventually closing the day out near last Thursday’s midpoint.

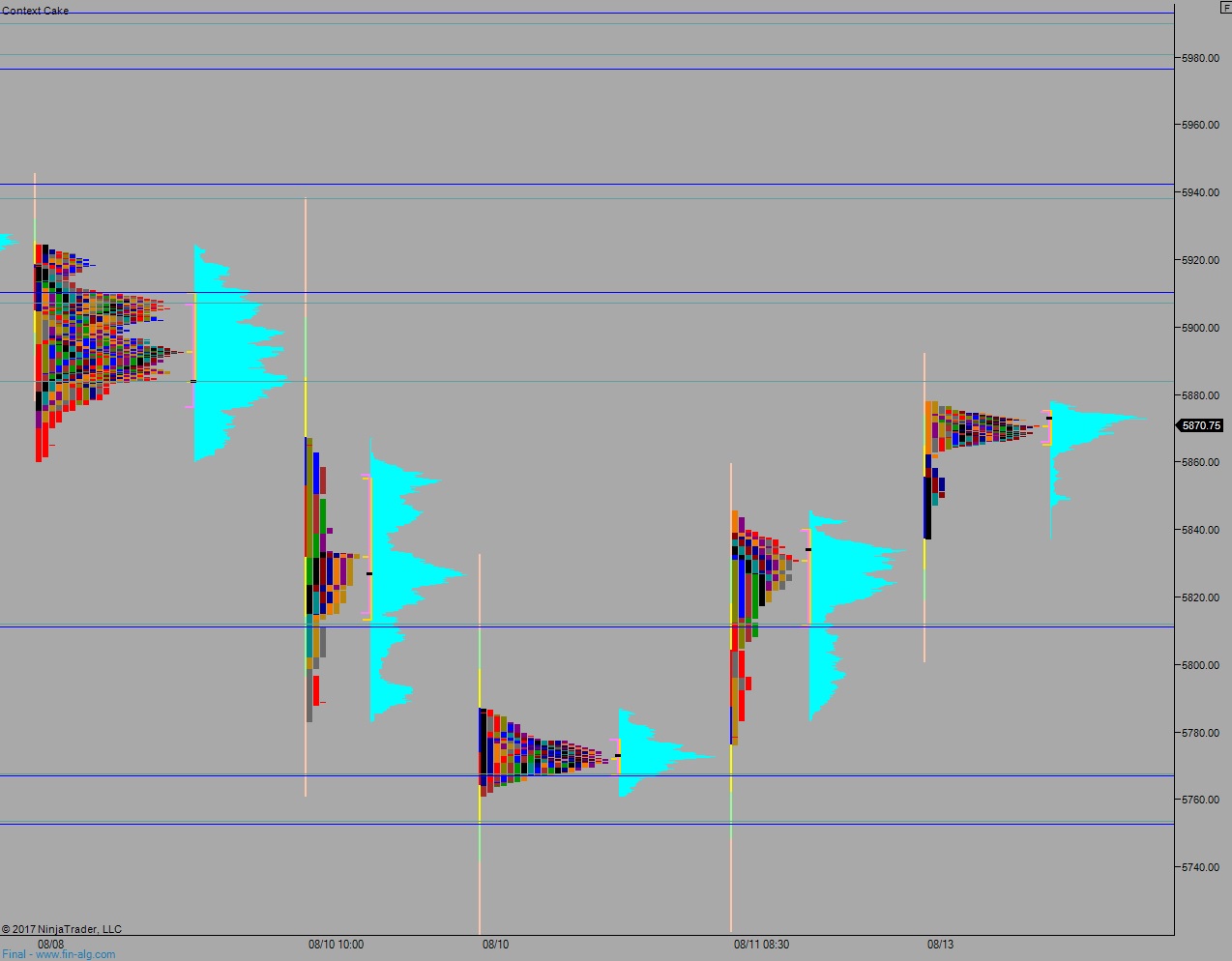

Heading into today my primary expectation is for sellers to push into the overnight inventory and close the gap down to 5837.75. Sellers continue lower, down through overnight low 5837.25, setting up a move to target 5831 before two way trade ensues.

Hypo 2 buyers lurch up through overnight high 5878, trading up to 5884 before two way trade ensues.

Hypo 3 gap-and-go higher. Buyers sustain price above 5884 setting up a move to target 5900.

Levels:

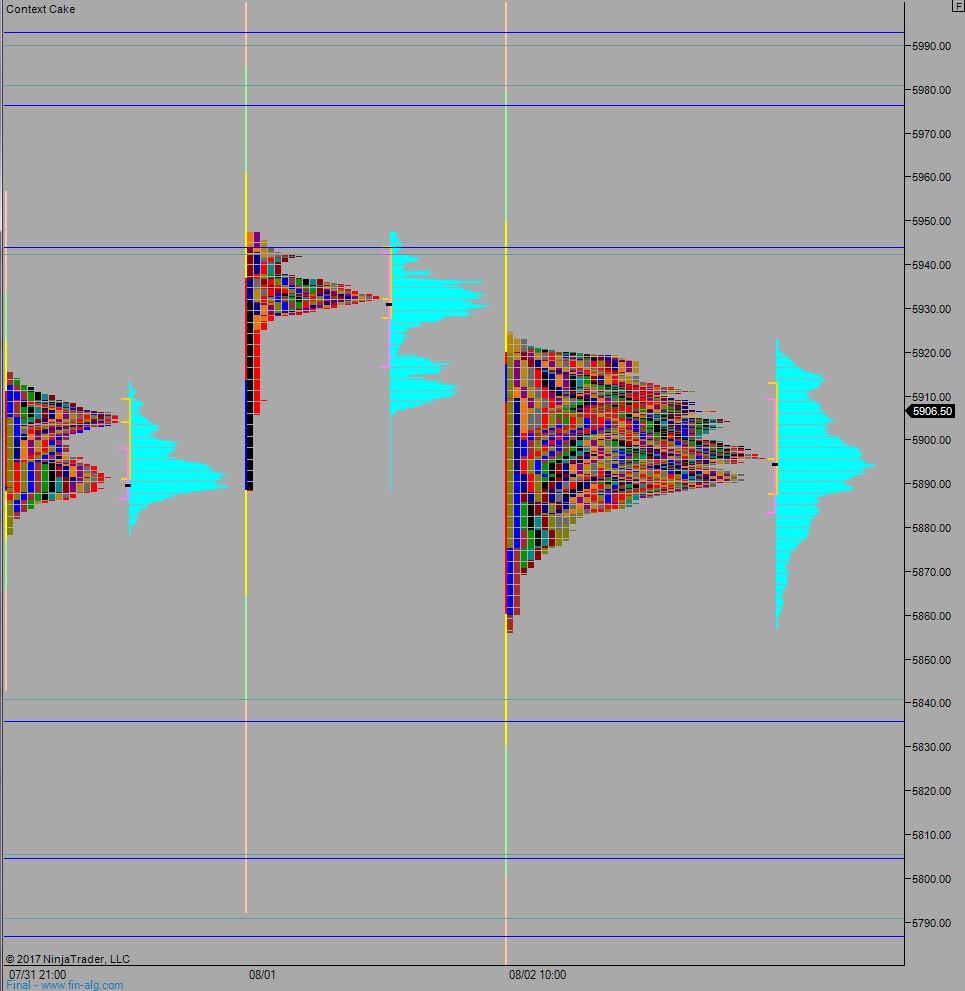

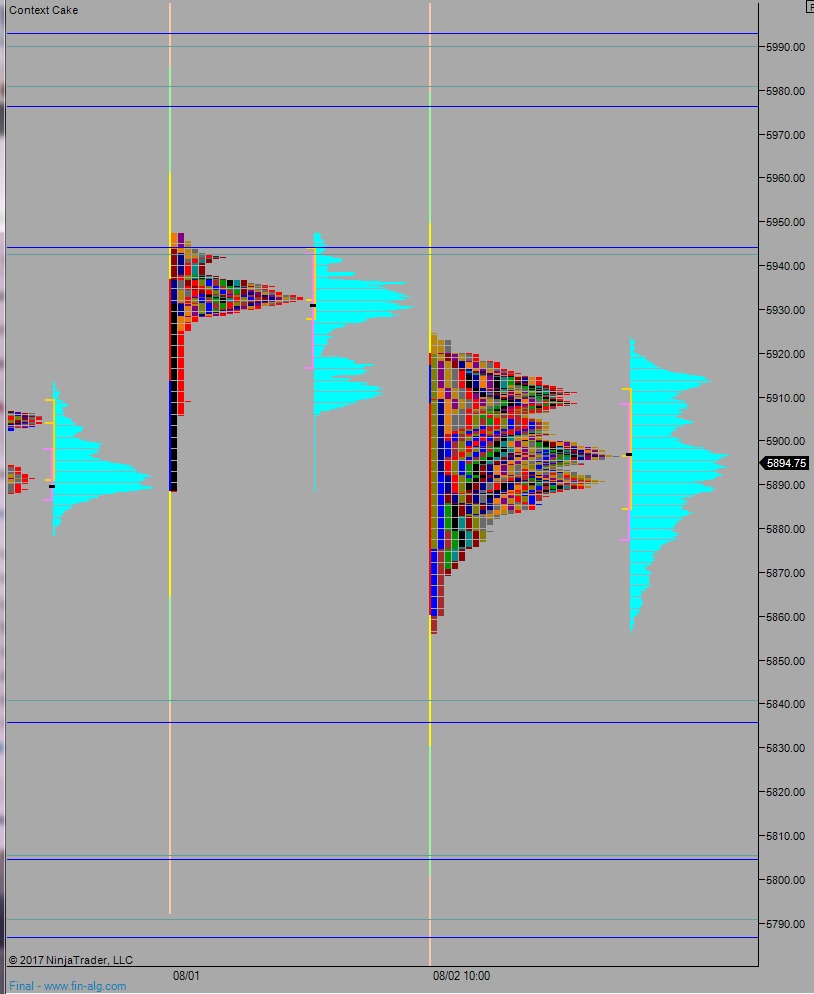

Volume profiles, gaps, and measured moves: