NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range on normal volume. Price spiked higher Tuesday afternoon after Apple reported earnings well above analyst expectations.

Apple Reports Q3 EPS $1.67 vs $1.57 Est., Sales $45.4B vs $44.89B Est. at 16:30:24

At 8:15am ADP Employment change data came out below expectations.

USA ADP Employment Change for Jul 178.0K vs 185.0K Est; Prior 158.0K

Also on the economic agenda today we have crude oil inventories at 10:30am.

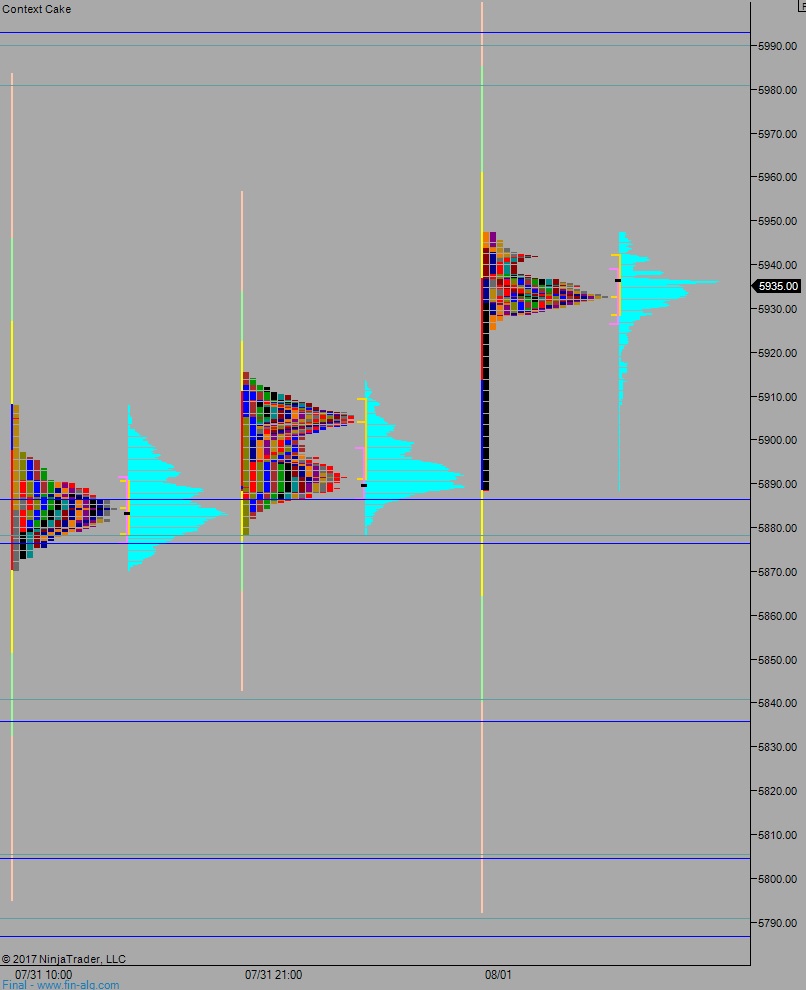

Yesterday we printed a normal variation down. The day began with a gap up and sellers quickly worked into the overnight inventory to close the gap. Then we spent the rest of the day marking time, waiting for Apple earnings.

Heading into today my primary expectation is for a gap-and-go higher. Look for buyers to work up through overnight high 5947.50 and tag 5962.75 before two way trade ensues.

Hypo 2 sellers press into the Apple earnings move and trade down through overnight low 5885.75. Look for buyers right around here and two way trade to ensue.

Hypo 3 stronger buyers sustain trade above 5962.75 setting up a move to target 5980.75.

Levels:

Volume profiles, gaps, and measured moves:

Note: Despite the IndexModel coming into the week with a bearish bias, we are back to a neutral stance after the stronger-than-expected Apple earnings. If sellers manifest Hypo 2, then we can consider returning to leaning bearish.

If you enjoy the content at iBankCoin, please follow us on Twitter